|

03.04.26- The Iran War vs. Your Portfolio

And we have much to discuss this week. Today we’re going to examine several investment implications of this renewed conflict. Read More

|

|

03.02.26- What War With Iran Could Mean For Markets Monday

|

|

02.27.26- HALO: The Great Rotation Has Begun

Software is the poster boy here. The sector was attractive because once you build a software product, it doesn’t cost much to onboard new customers. There’s no physical cost to create a new software license. It’s all done in the cloud these days. Read More |

|

02.25.26- When Government Favors Big Business over Small Enterprise

|

|

02.23.26- Grinding the American Middle Class

That dream turned to a nightmare for many American families during the epic real estate bubble and subsequent bust in 2008-09. What’s more, in the near two decades that followed, federal monetary policies coupled with restrictive local development standards have huffed and puffed an even more perilous bubble than the last one. Read More |

|

02.20.26- The World’s Hottest Trade Is Built on Fake Money... And It’s About to Collapse

Since Chat-GPT was unveiled by OpenAI in November 2022, AI-related stocks have accounted for 75% of market gains, 80% of market profits, and 95% of capital expenditures. Read More |

|

02.18.26- "The Entire System is Gonna Collapse..."

|

|

02.16.26- Time to Start Hedging

Take a look at the chart below, which shows the S&P 500 CAPE P/E (price-to-earnings) ratio. The CAPE P/E ratio is one of the best measures of how expensive a stock or index is. It shows how pricey stocks are based on the last 10 years of earnings. Read More |

|

02.13.26- A Market Crash and Recession Are Bullish,

One of the most peculiar hyper-normalized hallucinations about "Capitalism" is that markets and the economy "should always go up" and if they don't, something is terribly wrong and somebody better do something to fix it. Read More |

|

02.11.26- One Glitch Away From Chaos

|

|

02.09.26- The Idiocracy That Is California Politics

|

|

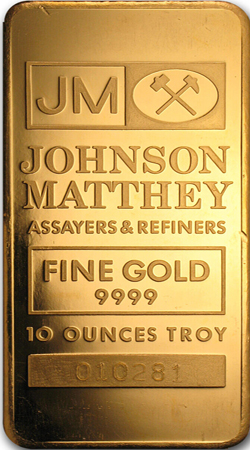

02.06.26- Gold’s $5,500 Week

|

|

02.04.26- From Inflation to Hyperinflation: The Gathering Monetary Hurricane

|

|

02.02.26- Mining Co. "Finds"

For those of you who don’t know Dr. Steve, he was one of the most successful newsletter writers and investors ever. He retired from Stansberry Research to surf, invest, and live the good life. Read More |

|

01.30.26- The Melt-Up Trap: Why Stocks Must Rise Until the Dollar Breaks

Each month, the university surveys households across the country, asking straightforward questions about personal finances, job prospects, inflation, and expectations for the future. Those responses are distilled into a single number that captures the public’s economic mood. Because it has been tracked for decades, the index offers a long-running reality check on confidence at the household level. Read More |

|

01.28.26- The Bullish And Bearish Case For 2026

|

|

01.26.26- Forget $5,000: Bank of America sees gold price hitting $6,000/oz by Spring 2026

|

|

01.23.26- The Stock Market Isn’t a Market Anymore — It’s a Political Control Mechanism

Its primary purpose was once straightforward: a venue where companies could raise capital by selling shares to the public, and where investors could freely buy and sell those shares among themslves. Read More |

|

01.21.26- Gold and Silver Explosion: Something Big Is Happening

In early 2020 at the beginning of the pandemic hysteria I noted that the covid panic seemed to perfectly coincide with the Federal Reserve's acceleration of interest rates and asset dumping. This trend, I argued, was a precursor to a Catch-22 scenario I have been warning about for some time. Read More |

|

01.19.26- And Now, for Something Entirely Different: What is left of America?

|

|

01.16.26- World on Fire? Be a Buyer!

You see, the Chicken Little Austrian School forgets to remind its adherents to gather ye rosebuds while ye may. That is, there’s a boom before the bust, and one has to make hay while the getting’s good, no matter how much you disagree with the prevailing fiscal or monetary policy. Read More |

|

01.14.26- Snouts at the Trough

It started with an independent journalist named Nick Shirley and his viral investigation into government-funded daycares. As I’m sure you all know by now, he visited a bunch of them on camera, and most were empty on a school day. Many had boarded-up windows, and no outdoor play areas. And the star of the show was the “Quality Learing Center”: Read More |

|

01.15.26- Cash Cut-Off Has

|

|

01.09.26- Three Monetary Riddles for the New Year

|

|

01.07.26- And Now, for Something Entirely Different: False Choice: Individualism Vs Collectivism

|

|

01.05.26- The Maths of a Debt Trap

But it’s not just the dollar. Economies in the Eurozone and the UK have insufficient growth to support their colossal mountains of government debt. In this article, I explain the mechanics of a debt trap. And how a combination of rising interest rates reflecting growing risk and stagnating economies bring on debt traps, leading to yet higher interest rates making the situation even worse. Read More |

|

01.02.26- Expect the Precious Metals Rally to Continue in 2026

Among AI stocks, only Palantir outperformed gold. Read More |

|

12.31.25- Michael 'Big Short' Burry Reveals He "Is Not Short" Tesla

Early Wednesday morning, Burry posted on X about a prior credit default swap trade he made with Bill Ackman. In response, an X user asked, "Would you short Tesla here?" Read More |

|

12.29.25- Gold Alert: Stormy Times Ahead

Assuming the markets close out the year without major volatility, gold holders can look forward to an approximate 70 percent increase in value within a single year. This is remarkable — not least because 2024 already ended with a 26 percent gain for the otherwise conservative asset class of precious metals. That amounts to a doubling of value in just two years — a surge usually seen in the tech sector rather than gold. Read More |

|

12.26.25- Trump Ignores Sound Economics at His Peril - And Ours

For almost twenty minutes, the president seemed to scold the American people for not appreciating how good they had it. He showed charts that made it appear, incorrectly, as if Trump has reversed the recent inflation surge and brought about deflation. At other points, he seemed to start yelling into the camera. Trump is clearly frustrated that the American people don’t believe him when he says the economy is excellent. Read More |

|

12.24.25- 2026: A Monetary Tsunami

When the devastating 2011 tsunami hit, Fudai was the only village in the area left intact. It wasn’t luck. This miracle was due to preparation. In the 1970s Fudai’s mayor, Kotoku Wamura, proposed a floodgate to stop tsunamis. Many called him crazy. They said it was a waste of money. Read More |

|

12.22.25- Seeking the Marlboro of Marijuana

Microsoft? Apple? NVIDIA? Ford? IBM? Nope, not even close. The answer might surprise you. Read More |

|

|

|

12.17.25- Here’s What Paradigm Editors Forecast for 2026

|

|

12.15.25- Birthing Pains for a Multipolar World

Europe, the USSR, and Japan were all devastated. The Soviet Union alone had 26 million deaths due to the war. The rest of Europe had approximately another 20 million. Japan lost around 3 million. Read More |

|

12.12.25- The Consumer Credit Conundrum

|

|

12.10.25- Denying the Affordability Crisis

Recent reporting shows rising public skepticism toward assertions that prices are stabilizing or falling. Donald Trump has repeatedly dismissed cost-of-living concerns as a “Democrat hoax” or a “con job,” yet consumer frustration over housing, energy, food, health care, and insurance remains widespread. Even as the administration insists that purchasing power has improved, most voters report that everyday necessities remain far more expensive than just a few years ago, undercutting the official narrative and widening the credibility gap between political messaging and lived reality. Prices have risen, broadly, since the 2024 election. Read More |

|

12.08.25- The Triumph of the UniParty: Debt, Decay, and Imminent Fiscal Breakdown

|

|

12.05.25- Model Collapse: The Entire Bubble Economy Is a Hallucination

Consider the data that the financial sector bases conclusions / decisions on(i.e. the data that the financial sector "trains" on) in a Bubble Economy like the present. The Bubble Economy's core goal is to inflate the valuation of assets not by increasing utility-value or productivity but by artificially expanding credit and leverage. Read More |

|

12.03.25- U.S. Businesses Are Going Bankrupt At An Absolutely Blistering Pace

|

|

12.01.25- Black Friday Has Taken Over The Calendar

He remembers when Black Friday meant one single day, the Friday after Thanksgiving, not a six-week marketing season stretching from early November into December. He admits nostalgia is part of it, but he still thinks we do not need to start the Christmas season the day after Halloween. Read More |

|

11.28.25- It’s Time to Believe Your Lying Eyes

On the one hand, the stock market keeps bouncing back, demonstrating nothing but resilience and strength. Up and to the right! On the other hand the real economy – the one that consists of the vast bulk of people working, shopping and living – is in miserable shape. Read More |

|

11.26.25- Google Drops a Nuke in the AI Wars

It’s been a valuable research assistant, and I also use it to make the images at the top of these letters. But suddenly ChatGPT has major competition. Google just released their latest model, Gemini 3. Gemini 3 has taken a lead on AI benchmarks, a set of tests which grade the performance of models. Read More |

|

11.24.25- Do Markets Ever Reach Equilibrium?

|

|

11.21.25- Don’t Fall in the China Trap

We’ll begin the analysis with the latest official economic releases from China. These releases showed some of the weakest performance by the Chinese economy since the 2020 pandemic collapse. Read More |

|

11.19.25- Breakthroughs, Manias,

Fisher was a raging bull, and his portfolio was leveraged to the hilt. The crash wiped out his entire fortune, and he was forced to borrow from wealthy relatives to pay his IRS bill. Read More |

|

11.17.25- Warning: Stocks are on

Regarding #1, the bull run begun in early April has been ludicrous in its strength. It is NOT normal for stocks to go straight up. The mere fact the S&P 500 had gone 130 sessions without touching its 50-DMA moving average indicated that stocks were due for a correction. Read More |

|

11.14.25- The Great Rotation Approaches

|

|

11.12.25- And Now, for Something Entirely Different: What FDR Did to Our Money

|

|

11.10.25- The Terrible Truth About The U.S. Economy Can No Longer Be Denied

|

|

11.07.25- NVIDIA CEO: ‘China is Going to Win’

Via FT.com:

|

|

11.05.25- One Little "K"... And The End of America

|

|

11.03.25- The Astonishing AI Boom

|

|

10.31.25- Laptop Class on Notice

The reduction in force (RIF) is expected to spread across several departments, including Human Resources, Cloud Computing (AWS), and Advertising. Moreover, this is Amazon’s largest RIF since 2022, which eliminated around 27,000 jobs. Read More |

|

10.29.25- The Debt Crisis Has No Escape

|

|

10.27.25- Fringe Theories for a Faulty Financial System

|

|

10.24.25- Following the Golden Path

On Tuesday gold plunged 5.7%, its biggest daily fall since 2013. Silver fell a whopping 8%, slipping back under the key $50 level. Miners fell harder, with the GDX gold miner ETF stumbling from $84 to $73 over the past week. The SILJ silver miner ETF fell from around $26 to $23 over the same period. Read More |

|

10.22.25- About That Trifling Little $300 Trillion Klepto-Currency Error...

|

|

10.20.25- Stocks Are Always the Last Asset to “Get It”

|

|

10.17.25- Dotcom Deja Vu

This is the wiring the internet runs on. The arteries and veins of the data world. Corning (NYSE: GLW) was the darling of fiber optics in the 1990s and into 2000. This classic American company had been a leader in specialized glass and ceramic materials for more than a century. Read More |

|

10.15.25- Looking for Taylor Swift Returns

|

|

10.13.25- Inflection Point: US Government Shutdown And Strange Economic Signals

In my article “Trump’s Return: Get Ready For Chaos To Be Unleashed And Blamed On You”, published in July of 2024, I predicted that Biden would step out of the presidential race and that Trump would win the election. I noted that: Read More |

|

10.10.25- Storm Clouds

He was putting plywood over the window openings…and battening down the hatches. Read More |

|

10.08.25- The "Premier Anomaly"

The speaker – usually quoting Eugene Fama, father of the Efficient Market Hypothesis – smiles and says: “Sorry, but research shows you can’t.” Read More |

|

10.06.25- Keep Your Eyes on the Road

Several decades ago, the stock market was viewed as a forward-looking animal. A place where investors considered expectations about future earnings and performance to make decisions affecting share prices. Those days are long gone. Read More |

|

10.03.25- Will AI Crash The Economy?

|

|

10.01.25- Pure, Concentrated Risk

But the tech-heavy Nasdaq 100 would have turned every $10,000 into $58,866 over the same period. That’s based on the QQQ ETF and also assumes dividends are reinvested. Read More |

|

09.29.25- When Monetary and Fiscal Policies Blur

|

|

09.26.25- When Monetary and Fiscal Policies Blur

|

|

09.24.25- Why Warren Buffett is Wrong About Gold

Warren Buffett once famously stated that gold doesn’t do anything but “look at you.” What Buffett meant was that unlike corporations, gold doesn’t have earnings, pay a dividend, or grow revenues. It’s simply a hard asset. In this sense, its value is determined by circumstance (economic growth, inflation, etc.) as opposed to the future value of its cash flows. Read More |

|

09.22.25- Market outlook

|

|

09.19.25- On Black Swans and White Lies

Facing the UnexpectedThere was an old European belief that persisted for centuries. People were convinced that all swans were white. Their reasoning was founded in logic and supported by empirical evidence.Read More |

|

09.17.25- And Now, for Something Entirely Different: The American Dilemma

The Republicans represent Israel’s interest. The reason for this is that Republicans tend to be more conservative, more religious, and more patriotic than Democrats and are often seen by their opponents as jingoistic. The Republican mentality toward Israel comes from the “Judeo-Christian ethic” and the long Cold War against the Soviet Union. Read More |

|

09.15.25- Dollar Downfall – ‘This Is as Big as When We Closed the Gold Window’

|

|

09.12.25- And Now, for Something Entirely Different: Men Of The West, We Are At War

|

|

09.10.25- Marginal Utility Theory

Mainstream economics explains the law of diminishing marginal utility in terms of the satisfaction that one derives from consuming a particular good. For instance, an individual may derive vast satisfaction from consuming one cone of ice cream. However, the satisfaction he will derive from consuming a second cone might also be great but not as great as the satisfaction derived from the first cone. The satisfaction from the consumption of a third cone is likely to diminish further, and so on. Read More |

|

09.08.25- Perfect Competition Will

Without a course correction, the U.S. economy faces a self-inflicted bust. In the mid-2000s, Wall Street’s best and brightest were packaging subprime loans into complex securities and assuring the world they were safe. Regulators nodded. Rating agencies blessed them. Investors snapped them up. Read More |

|

09.05.25-A Lot Of Upcoming Action On The Horizon, And, Of Course, It Will Not All Happen Right Away Or At Once, But It Will

Yellowed leaves were already dropping here in August with the lack of rain and tomatoes won’t turn red when the air hits the mid-forties at dawn. Summer is trying hard to end, though technically there’s almost a month left. This is the real new year, of course, not the noisy one in January with all the drunken commotion and confetti. Read More |

|

09.03.25- China’s Economic

|

|

09.01.25- Elon Musk Reveals What's Really Coming in September

|

|

08.29.25- America’s Debt-Fueled Economy Is Cracking at the Seams

In our modern day and age of economics, the health of the economy is usually measured by consumption. How much is being spent. So, governments and large companies look at measures such as gross domestic product as the single most important metric to track. Read More |

|

08.27.25- Home Prices Are Starting To Crash – Is That Really Good News Or Really Bad News?

Zero Hedge is reporting that home prices in the 20 biggest cities in the United States declined for a 4th consecutive month in June… Read More |

|

08.25.25- Excessive Money Supply Growth Creates Secular Stagnation.

|

|

08.22.25- And Now, for Something Entirely Different: Why Do We Live in a Two-Faced World?

The answer is yes, because there is no one to hold the government accountable. By its nature as a state, it is above accountability. As Rothbard elaborately explained, the state is a criminal gang writ large, an organization not subject to its laws because of its monopoly of violence. Jefferson’s notion of binding men down by the chains of the Constitution was easily broken by government intrigue. Read More |

|

08.20.25- Housing Market Cracks Widen: Top Siding Company Suffers Worst Stock Collapse

|

|

08.18.25- Trump vs. Putin: Rickards on the Ukraine Endgame

The summit will take place in Anchorage, Alaska, as covered in detail by our friend Byron King earlier this week. Read More |

|

08.15.25- Complete Financial Collapse Is Unavoidable

Today, multiple warning signs point to the inevitability of a comprehensive collapse of global financial markets. Equities (stocks), bonds, real estate, and commodities will all be affected. This forecast isn’t based on fear or speculation. Read More |

|

08.13.25- Coffee Analyst Warns Brazil Frost Could Deliver "Death Blow" To 2026 Harvest

Wallengren warned that this "frost damage" event could be the "death blow" to the 2026 harvest, with production estimates now around 54 to 58 million bags versus prior estimates near 70% of capacity. Read More |

|

"The Housing Market Is Going to EXPLODE - Here's Why!"

|

|

08.08.25- 120 Million Square Feet: Store Closings In The United States Are On Pace To Set A New Record High In 2025

|

|

Doug Casey: Well, it’s not that I’ve researched them. They are things that I’ve absorbed almost by osmosis. News items float like a layer of scum on the cesspool of media. However, a couple of things have risen to the top and were drawn to my attention. Read More |

|

08.05.25- The Infinite Credit Card Glitch

Let’s be honest: Most people don’t understand how monetary systems work. It’s not exactly a staple of public education – which makes it easy for bad ideas to take hold. Read More |

|

08.04.25- Market Update: Are the Lows In Already… or Will Stocks Drop Even Further?

The signals were all there. Market leading metrics were rolling over. Multiple asset classes were signaling that a “risk off” move was coming. And stocks were entering a period that has historically been weak. Read More |

|

08.02.25- The Correction is Finally Here!

Over the last week, I’ve been warning that stocks were due for a pullback, if not a correction. Some of the red flags I noted were:

|

|

08.01.25- The Information Problem

We look back. As the 21st century gestated, the US stock market became more and more absurd. Companies with no earnings, no business plans, no employees, and no real hope were suddenly worth millions of dollars. Read More |

|

|

|

07.25.25- How the Epstein Scandal Is Shaking the Foundations of Power

Doug Casey: Although I lived in DC for almost half my life, since my father’s side of the family has been there since the 1850s, I’m now out of touch with Mordor and its denizens. Therefore, I can’t retail any fresh scuttlebutt to you. The fact is that all any of us really know—or rather think we know—is what we hear, read, or see on the news. And most of that is propaganda, lies, half-truths, conjectures, psy-ops, or just plain stupidity. Read More |

|

07.15.25- 1 Birthright Gold Stock, 1 Pure Silver Play

It was a bonanza for natural resource bulls. Especially us gold and silver bugs. We heard from and spoke with some of the best mining companies in the world. From early-stage exploration stocks to giants like Agnico Eagle Mines (AEM). And everything in between. Read More |

|

07.14.25- Trump’s Epstein Problem

|

|

07.12.25- What Passive Investing Has Done To Our Retirement

It goes like this: “When a measure becomes a target, it ceases to be a good measure.” It’s called Goodhart’s Law, named after British economist Charles Goodhart. He meant it as a warning to policymakers. Read More |

|

07.11.25- The Homeownership Rate Is Lower Now than it Was 45 Years Ago

It’s debatable whether or not such reforms have ever actually worked to increase the homeownership rate, though. In 1930, at the very beginning of the Great Depression, the homeownership rate was 44 percent. During the thirties, the federal government adopted policies that created Fannie Mae and ushered in the era of the 30-year fixed mortgage. Read More |

|

07.10.25- The Root of America’s Problems [Podcast]

You might think it’s overspending, or the Federal Reserve, or career politicians. But what if it’s something even more fundamental… like letting just anyone vote? Read More |

|

|

|

07.08.25- Are Markets Marching Toward A ‘Wile E. Coyote Moment’? To the old line — never bet against the US consumer — might be added a new twist. Never bet against the US retail investor.” Read More |

|

07.07.25- And Now, for Something Entirely Different: Cage Match

|

|

07.05.25- Tokenization Begins: A New Way to Buy Private Shares

How about owning shares of other real-world innovators shaping the future? As of today, buying shares in these private companies outright isn’t possible for most investors. Read More |

|

07.04.25- What is True Freedom & Liberty? Where Does it Come From?

I am asking readers to really examine just how free are Americans today after all those lives that have been given in the quest for Liberty and Freedom. We hear so much about the sacrifices that the Founding Fathers and the American soldiers sacrificed on our behalf. In spite of all those lives – American falls deeper into Slavery and loss of Liberty than ever before. Read More |

|

07.03.25- After 50 Years of US-Government-Sponsored Housing Finance: Why Are Houses So Unaffordable?

|

|

07.02.25- What should Investors expect from declining US residential Property & Stock Prices?

|

|

07.01.25- THE DEEPER DIVE: The Bull is Strong, but the Economy is Weak

|

|

06.30.25- Trust Lost In Banking System

|

|

06.28.25- Why Gold Based International

|

|

06.27.25- And Now, for Something Entirely Different: Why Too Much Optimism

|

|

06.26.25- Buying as the World Burns

…They’re up. In Israel, for example, the stock market has soared to all-time highs. The iShares Israel ETF (EIS) is up a whopping 53% over the past year. Read More |

|

06.25.25- The Great Bond Scam: Wall Street’s Biggest Myth Exposed

|

|

06.24.25- The Real Estate Recession

The housing market is a massive portion (about 1/6th!) of the entire U.S. economy. About two-thirds of American families own their home – and for most, it’s their single biggest financial asset (as well as where they sleep). Home equity represents a tremendous share of household net worth – about half for the typical family! More of our national wealth is tied up in housing than any other single asset class. Read More |

|

06.23.25- Closing The Strait Of Hormuz Will Be A Nightmare Scenario For The Global Economy

|

|

06.21.25- Basel III Changes the Rules. The Rio Reset Changes the Game

Next month, the global financial system will see two very different updates. Now, this is probably just a coincidence. But still, it's a useful coincidence. Because it showcases two very different approaches to problem-solving. Read More |

|

06.20.25- Central-Banking Myths that Fed Critics Believe

For example, one will often see Fed critics attacking the Fed for not lowering interest rates enough or soon enough. This is just one variation of the idea that the Fed is not doing things “correctly.” Read More |

|

06.18.25- Strait Of Hormuz Disruption Fears Surge After Former Iranian Minister

|

|

06.17.25- WW3 Is… Bullish?

Oil refineries ablaze. Ammo depots bursting into mini-mushroom clouds. Air defense systems exploding spectacularly. The world has never seen war footage like this. Read More |

|

06.16.25- $100? $200? $300? – How Catastrophically High Will The Price Of Oil Go When Iran Closes The Strait Of Hormuz?

|

|

Long, a Republican who served in Congress from 2011 to 2023, once sponsored a bill to eliminate the IRS entirely. Read More |

|

06.13.25- The CAPE Crusader Unveils a Bubble

Goldman’s optimism was based on reduced U.S.-China tariff anxieties, and better than expected economic growth forecasts. The bank’s economists put the chance of a U.S. recession at 35 percent over the coming 12 months, with GDP to expand by 1.6 percent. Read More |

|

06.12.25- AI is Going to Generate a MASSIVE Boom in Hard Assets

As I’ve laid out in the last few articles, the AI revolution is moving into its next phase: physical AI. This is the phase in which AI software is integrated with physical hardware (robots, appliances, automobiles, etc.). Some recent developments:

|

|

|

|

06.10.25- THE DEEPER DIVE: The Numbers Are Breaking down, but What they Mean and Where They Are Heading Looks Worse

|

|

06.09.25- The Truth About

You’ll recall the buzz from earlier this year. Trump and Musk loudly announced they were going to visit the U.S. bullion depository at Fort Knox, Kentucky to make sure the U.S. gold was actually there. The press was invited to tag along. Musk claimed that his DOGE team was ready to “audit” the gold bars to see that there were none missing. I had my own views on the announcement (described below) but I certainly agreed this would be the mother of all photo ops. Read More |

|

06.07.25- And Now. for Something Entirely Different: The DogeFather in Exile

The task for DOGE was simple enough. Musk would apply the disruptive magic of Silicon Valley to the grim halls of Washington. He’d shutter all the useless agencies that specialize in pointless minutia and archaic laws and regulations. He’d eliminate waste and make the government more efficient. Why not? Read More |

|

06.06.25- ‘Something to Behold’: Silver Miners Explode

The moment we’ve been waiting for approaches. Poor man’s gold broke out to a 13-year high over $36 per ounce, up more than 4% as of 9:30 am. And the miners? Oh boy… Read More |

|

06.05.25- Demand in the Housing Market Just Got Even Worse, as Supply Piles Up

|

|

06.04.25- Americans Are Dangerously Vulnerable To A Stock Market Correction

|

|

06.03.25- Space Is The Most Undervalued Industry

The science fiction author Arthur C. Clarke wrote back in 1977: “The impact of satellites on the entire human race will be at least the same impact as the advent of the telephone in so-called developed societies”. And he was right. Satellite mega-constellations such as Starlink, Qianfan, Kuiper, and Sat Net will ensure that the third of the world’s population that does not currently have access to the internet will soon be connected. Read More |

|

06.02.25- Ray Dalio Is Predicting

|

|

|

|

05.30.25- The Gold Bull Market Has Just Begun

Every day is a circadian cycle for us all. Our bodies move through phases based on our exposure to light or darkness. Markets are also remarkably cyclical, responding to the environment around them. Interest rates, regulation, monetary policy and investor psychology all play important roles. Read More |

|

05.29.25- Trump’s Monetary Reset: Is a Gold-Backed Dollar on the Horizon?

Two powerful catalysts are driving the coming monetary reset. Read More |

|

05.28.25- The Multi-Trillion Dollar Question Investors Need to Answer

As I outlined in my best-selling book The Everything Bubble: The Endgame For Central Bank Policy the bond bubble is THE definitive bubble of our lifetimes. Every other bubble whether it be the Tech Bubble, Housing Bubble, etc. has been a derivative of the almighty bond bubble that was generated during the super cycle bull market in bonds that went from 1982 to 2020. Read More |

|

05.27.25- A Dying Man Will Try Any Medicine

Now we have craziness at the international trade level. At its core, it’s all politics. The now dead George Carlin had a skit where he told us why he doesn’t vote. To quote: Read More |

|

05.26.25- I Sold Almost All My Stocks – “I’ve Seen This Party Before”

|

|

05.24.25- The Rio Reset's New Architecture Rests on an Old Foundation

If you're familiar with my original Rio Reset article, then you already know what's going on, If you're not, here's a brief recap: Read More |

|

05.23.25- America's Dire Fiscal Condition

The National debt rose from less than $6 trillion in 2000 to over $37 trillion today. Our debt is now 720% greater than our annual revenue. The Nation's annual deficit for fiscal 2025 is projected to be $1.9 trillion, or 6.2% of GDP. The US Government now spends more on interest payments on the National Debt ($1.11 Trillion) than National Defense ($1.10 Trillion). The CATO Institute projects that the US government will pay $2 trillion in interest payments on all this debt in the next 10 years. Read More |

|

05.22.25- Economic Growth vs. the Stock Market

Most financial commentators are of the view that increases in the stock market translate to an increase in economic growth. The reason is because the increase in stock prices lifts consumer and business optimism, which, in turn, boosts consumer and business demand for goods and services. This, in turn, strengthens the economy. But is it valid to hold that what drives the economy is the demand for goods and services? Read More |

|

05.21.25- Is Japan’s Financial System On The Verge Of Collapsing?

|

|

05.20.25- And Now, for Something Entirely Different: Donald of Arabia

“This is a bar for British officers,” replied the diminutive man behind the marble counter. “That’s alright,” said Trump. “We are not particular.” After a short, sharp, shouting match, a senior officer walked up and officiously demanded to know, “What’s going on?” Read More |

|

They're Moving the Markets With Lies...

One of the more challenging aspects of today’s stock market is that it is being driven by headlines. And the headlines are not always correct (or honest). Case in point, throughout the month of April China claimed it was NOT in trade negotiations with the Trump administration. They even claimed this AFTER Chinese officials were seen entering the U.S. Treasury on April 25th 2025. Read More |

|

05.17.25- Yikes. The “ONE BIG BEAUTIFUL” tax bill is the opposite of what America needs.

It was expensive and highly unpopular among investors. And wealthy Athenians simply stopped investing in local businesses to avoid the tax. |

|

05.16.25- From Strategic Retreat to Full Retreat

On Monday, in a joint statement from Geneva, it was announced that the United States and?China had agreed to a 90-day pause on the?tariffs they had put in place over the last month. In the interim, they are, “Moving forward in the spirit of mutual opening, continued communication, cooperation, and mutual respect.” Read More |

|

05.15.25- Doug Casey on DOGE, Deficits, and the Coming Financial Earthquake

Doug Casey: I hate to sound pessimistic, because the idea of DOGE was excellent, but it’s not making much in the way of progress. Musk first thought he could cut $2 trillion from the budget. I see how he could say that; it’s a very reasonable estimate. But as he discovered the depth of the resistance, he reduced it to $1 trillion. And now it’s $150 billion—and he’s probably not even going to be able to do that. Read More |

|

05.14.25- The Russell 2000: An Earnings Illusion

But once you learn the truth about the Russell 2000 small cap index, you just might hate it too. Today we’re going to explore why the Russell 2000 makes a bad foundation for any investment vehicle. Read More |

|

05.13.25- Wealth Generation and the Market Economy

|

|

05.12.25- And Now, for Something Entirely Different: The OKC Bombing Sting Operation and the Ford Bronco

|

|

05.10.25- Why We Can Forget About

Buffett famously quipped, “Be fearful when others are greedy, and greedy when others are fearful,” which was ultimately a nod to the cyclical nature of markets and the economy. Read More |

|

05.09.25- Debt Spiral, Treasury Market Stress, and a New Financial Order

Doug Casey: It’s only important because it exists—but it shouldn’t exist. People think that the Treasury market is part of the cosmic firmament, but there once was a time when the US government had little or no debt outstanding, and the world got by fine without it.Read More |

|

05.08.25- And Now, for Something Entirely Different: Will America Survive?

American aggression toward the world is hidden under a euphemism: “national defense.” In past years before euphemisms took over from reality, the Secretary of Defense was known as the Secretary of War. Read More |

|

05.07.25- Trade in your Big Ships for a Little Junk from China

Tariff news out of Trump’s mouth was not what stocks wanted to hear, so their nonsense rally ended today.Read More |

|

05.06.25- Trump-Led Agency Warns America Is Heading for an Economic Hurricane

|

|

05.05.25- "Resistance Is Futile" -

|

|

05.03.25- Cracked Shells:

|

|

05.02.25- Apollo's Torsten Slok Unveils Timeline For Trade War Fallout

For those tracking trade developments in recent weeks, this freight downturn was entirely predictable: Read More |

|

05.01.25- The Recession Begins! GDP Subsides, Inflation Heats up, Jobs Fall into a Pit.

|

|

04.30.25- American Capitalism’s Worst Nightmare

And we do mean wrong—as in completely, unequivocally and with no if, ands or buts. Indeed, Trump thinks large trade deficits are prima facie evidence of cheating by our trading partners, yet the evidence debunks that primitive axiom with such alacrity as to literally shutdown the argument. Read More |

|

04.29.30- Supply Chain Crisis Looms: Shortages Set to Slam Markets!

|

|

04.28.25- Did Someone Call The COMEX Bluff?

The data below looks at contract delivery where the ownership of physical metal changes hands within CME vaults. It also shows data that details the movement of metal in and out of CME vaults. It is very possible that if there is a run on the dollar, and a flight into gold, this is the data that will show early warning signs. Read More |

|

04.26.25- Sorting Through The Chaos

|

|

04.25.25- Make Depressions Great Again

Are extreme tariff policies one of President Trump’s ‘art of the deal’ tactics? Or is the ground shifting beneath the feet of the global economy and financial markets? Read More |

|

04.24.25- Marching Toward a Liquidity Cliff

In short, Piepenburg places tariff headlines, seismic geopolitical shifts, de-dollarization trends, extreme market volatility and recessionary reality into a simple lens: It all boils down to an unprecedented national and global debt crisis. Read More |

|

|

|

04.22.25- A Crisis Was Ordered Long Ago

“Wall Street got drunk,” President Bush said in 2008, to which Peter Schiff replied, “They did. And the Fed provided the liquor!” Schiff—who credits his understanding of markets and Austrian economics to his father’s teachings growing up—is renowned for his prediction of the Financial Crisis of 2008, years before the housing market nosedived. His position earned him the scorn and ridicule of almost every other commentator, as seen in this collection of videos, but he never blinked. The market was in trouble, not because of a lack of regulations, but because the government and the Fed were on a fiat money high. Read More |

|

Consequences of the AI Disruption

To prepare, I’ve been brushing up on past industrial revolutions, starting with the first one, which took place from around 1750 to 1830. A few of the more disruptive inventions from this period include: Read More |

|

04.19.25- Trump vs Powell - New Gold-Backed Sound Money Plan Revealed

|

|

04.18.25- Potential for War With Iran—and the Financial Shockwaves That Could Follow

How likely is it that this long-simmering standoff erupts into a full-scale war? Read More |

|

04.17.25- The Catastrophic Consequences of Under-Competence

Author Charles Perrow studied organizational weaknesses that generate flawed responses to what he calls "normal accidents," responses that made the situation far worse. In other words, the system itself increases the risks of normal accidents becoming catastrophic accidents. Read More |

|

04.16.25- These Amps Go Up to Eleven

|

|

04.15.25- Can Trump Really Bring Back Manufacturing To The U.S.?

One of Donald Trump’s big campaign promises had to do with bringing back manufacturing jobs to the U.S., and for a big portion of the working aged population, maybe especially in the rust belt, that is hugely important. We all saw steel, auto, and other manufacturing and related industries struggling over the last few decades. Read More |

|

04.14.25- Dead Bull Walking

But no one’s told your portfolio yet. Volatility is flaring. Headlines are swinging from panic to euphoria. One day it’s a crash, the next it’s a 10% rally. Every move feels like a trap. Read More |

|

Some of the world’s most highly respected cancer experts are sounding the alarm over concerns of the looming health crisis. Read More |

|

04.11.25- China Escalates With 125% Tariff On US Imports, Signals Will "Ignore" Future Retaliation

As the week concludes, the U.S. and China are locked in a heated, once-in-a-century trade war. Earlier, President Trump announced a 90-day suspension of additional country-specific tariffs for countries that have refrained from taking retaliatory measures—an apparent attempt to isolate China and use tariffs to get Beijing to strike a trade deal. Read More |

|

04.10.25- Trump Triples Down:

Most are working out well. Gold, silver, tobacco. Even Brazil is holding up pretty well compared to the rest of the market. We’ve recommended raising cash and limiting exposure to U.S. stocks. However, there is one investment idea I proposed which needs an update due to recent developments. Read More |

|

04.09.25- China Has An Insidious 6 Point Plan To Defeat Donald Trump And Win The Economic War

|

|

04.08.25- It's a Total Global Bloodbath Today!

|

|

04.07.25- Forget about AI: America is about to be the world leader in socks and underwear

In today’s podcast, we dig into the many, many unforeseen consequences of the new tariff policies. For example: Read More |

|

04.05.25- Humpty Dumpty Was Pushed

|

|

04.04.25- When Bank of Mom and Dad

The Federal Reserve’s preferred inflation indicator, the personal consumption expenditures (PCE) price index, recently showed consumer prices increased at an annual rate of 2.5 percent in February. If you exclude food and energy, the PCE price index increased at an annual rate of 2.8 percent. Read More |

|

04.03.25- Tariff Rift

As of April 5, a universal 10% baseline tariff on all imports into the United States will go into effect. Days later, a raft of reciprocal tariffs—as high as 49% on Cambodia and 54% on China—will begin rolling out country by country. Read More |

|

04.02.25- The Rio Reset: Inside the BRICS Scheme to Hotwire the Global Economy

BRICS+ leaders are meeting in Rio de Janiero this summer. Their dedollarization drive has made huge progress over the last two years. Here’s what they’ve accomplished so far – and why the Rio Reset will stun the world…Read More |

|

04.01.25- 30% Market Correction + Recession 'Baked In The Cake'?

|

|

03.31.25- Warren Buffett Gets It Wrong

|

|

03.29.25- The Dumbest Investment in the World

Well, you never know, do you? Recall that the Argentines introduced a “century bond’ in 2017. At the time, we were not alone in considering it the ‘dumbest investment in the world.’ Read More |

|

03.28.25- Trump Tariffs Gone Wild

|

|

03.27.25- Global Markets Slide Spooked By Trump Auto Tariffs

|

|

03.26.25- Total (Trade) War

When preparing for financial warfare, nations aim to become as self-reliant as possible. In agriculture, manufacturing, refining, mining, drilling, and more. The stronger a nation is in these areas, the stronger its negotiating position will be. Read More |

|

03.25.25- Will US Debt Cause

This way of thinking originates in the writings of Irving Fisher who held that a major risk factor is the debt liquidation. According to Fisher, this can occur on account of a shock such as a decline in the stock market. As a result, this is likely to generate a decline in money supply Read More |

|

03.24.25- Commercial Real Estate Is in

Putting a number to the percentage, “The 1.57 percent delinquency percentage means more than $47.1B of loans would have been delinquent at the end of the year,” writes Billy Wadsack for Bisnow’s Dallas-Fort Worth bureau. That’s an 88 percent increase from a decade ago. Read More |

|

03.22.25- Trump’s MAGA Policies

|

|

03.21.25- Peace in Ukraine: Investor Implications

This week Presidents Trump and Putin had a 2+ hour phone call which apparently went well. Both leaders expressed a strong desire to end the war, and more than that, expand bilateral relations. Read More |

|

03.20.25- And Now, for Something Entirely Different: 10 Signs That A Significant Portion Of Our Population Has Gone Nuts

|

|

03.19.25- Tesla’s Existential Threat

In the midst of this market chaos, yesterday a friend texted me, saying, “I’m thinking about buying more Tesla here.” Historically, big pullbacks in Tesla have turned out to be excellent buying opportunities. But I had to tell him that I don’t believe the risk/reward is favorable here. Read More |

|

03.18.25- Here Are 7 Astonishing Economic Charts That Will Absolutely Blow Your Mind

|

|

03.17.25- Globalist Games: They Play, We Pay

He only recently became a politician, but already he’s sitting at the head of the class! No worries, though. He has the kind of résumé all globalists in good standing with Klaus Schwab’s World Economic Forum would envy. He ran not only the Bank of Canada, but also the Bank of England. He’s a central banker extraordinaire! He loves printing funny money and manipulating markets. Artificially created inflation is his jam, man! Read More |

|

03.15.25- We Just Got A Big Red

As Lenin put it, “There are decades where nothing happens, and there are weeks where decades happen.” Under that philosophy, this has been at least a six-decade week. Things sure are “interesting” right now, and are likely to become even more so… Read More |

|

03.14.25- President Trump's Tariffs: A New Golden Age For American Aluminum Workers

|

|

03.13.25- The Walmart Bubble

On Monday, JPMorgan economists raised their risk of recession to 40%. Big banks are typically bullish to a fault, so this is noteworthy. Meanwhile, a recent poll revealed that more than half of Americans have less than $500 in savings. Read More |

|

03.12.25- Trade Wars

Oh, OK, it’s not ancient and it’s not Chinese, but it’s a good curse, nonetheless. And it’s hard to think of a more apt description of 2025 than “interesting.” It seems like every day this year there’s been a new, blockbuster story to displace yesterday’s blockbuster story from the 24/7 doomscroll feed. Israel is preparing a “Hell Plan” for Gaza. Read More |

|

03.11.25- “Shipbuilding, Shipbuilding, Shipbuilding” – Half a $Trillion Is in Play

Through his contracts and spending power, this guy buys steel by the tens of thousands of tons. Along the way, he moves aluminum and copper markets. Beyond basic metals, he procures train cars filled with machinery, electrical equipment and much else. Read More |

|

03.10.25- Futures Slide As Recession Fears Mount, Trump Warns Of Looming "Disruption"

|

|

03.08.25- The Pain Begins

Scott Bessent, Trump’s Treasury Secretary, has made a flurry of recent media appearances. And he’s setting expectations low. Bessent recently admitted to CNBC that America has “become addicted to government spending, and there’s going to be a detox period”. A detox period, you say? Hmmm. Read More |

|

03.07.25- New US Tariffs on Canada, China and Mexico Take Effect

|

|

03.06.25- Brace for Economic Turbulence

But the promised change never arrived. Until now. Today the bloated federal government is being deflated by President Trump’s Department of Government Efficiency (DOGE). Read More |

|

03.05.25- This Might Actually Work: America’s Golden Visa

The island had lost about 10% of its population— mostly young, educated professionals, i.e., the most lucrative members of its tax base. Read More |

|

03.04.25- The Weirdest, Saddest Recession Indicator I Ever Heard Of

There’s a common lapse in memory that I see regularly among many people that like to get into the numbers in economics and finance (like me), and that is to forget the human side of the issue. Read More |

|

03.03.25- And Now, for Something Entirely DifferentThe Original Matrix - What They Don't Teach You About Money

|

|

03.01.25- Stock Market Trembles with Deep Fear over Inflation and Job News

|

|

02.28.25- Federal Workers Sing the Blues

Suppose you were an average student in high school without any real academic focus. Your guidance counselor told you that college graduates earn more over their working lives than their peers who only graduated high school. Read More |

|

02.27.25- Weirdest Housing Bubble Ever

Real estate is cyclical, which means it has its booms and busts, each of which differs slightly from the last. But today’s US housing market is so outside the norm that its strangeness has become the story’s main theme. Consider: Numerically speaking, housing used to be driven by young families buying starter houses. But today, the median age of homebuyers is 56. Read More |

|

02.26.25- Brazilian Stocks Offer 8% Yields at 8x Earnings

My biggest weakness is that I hate owning overvalued stocks. I look at the S&P 500 today and simply cannot pull the trigger. It’s too expensive. Read More |

|

02.25.25- When Markets Misbehave

When Benoit Mandelbrot's book The (Mis)behavior of Markets was published in 2004, it was a revelation for many of us. I remember sitting in my car in a parking lot, unwilling to tear myself away from reading it. Read More |

|

02.24.25- Using Dow Jones’ Daily Volatility to Time the Market

|

|

02.22.25- Time For a Mercy Killing – The House GOP’s Budget Resolution Hides a

The whole point of the 1974 budget act and its mechanism of budget resolutions and reconciliation instructions was to enable elected politician to curb their propensity to spend and borrow, and to thereby put an effective lid on the public debt. A half century latter, however, the House Republicans are making a sheer mockery of the act with a resolution which actually instructs four leading House Committees to do theopposite. That is, to RAISE the deficit by $6 trillion over the next decade! Read More |

|

02.21.25- The Coming Monetary Reset And Trump's Impact On Gold & The Dollar

Meanwhile, long-term interest rates are climbing, even as the Fed lowers short-term rates. Can the US government keep kicking the can down the road? Or will Trump have to reset the system? Read More |

|

02.20.25- This Is Why The Bitter Feud Between President Trump And “President Z” Has Just Brought Us Even Closer To Nuclear War

Needless to say, the moment the Russians start conducting military strikes inside the UK, the U.S. would be forced to intervene and we would be right on the brink of nuclear war. Read More |

|

02.19.25- Conspiracy Theorists Were Right About Everything – Now What?

|

|

02.18.25- A Game of Chicken

The only way to prevent it is to make dramatic policy changes now — not just to ‘improper payments’ to federal bureaucrats, but also serious cuts to the firepower industry. Read More |

|

Bureaucracy Is One Of The Central Pillars Of Our Economy, And It Is Starting To Crumble (Jobless Claims In D.C. Up 36% In 1 Week!)

|

|

02.15.25- Darkness Dying

The exorcism of the USA just keeps revving up. You can tell by the number of revolutions-per-minute Elizabeth Warren’s head spins while she spews pea soup at the cameras. Who knew what a demon-infested slough USA Management Central was? And yes, I would like some insight as to how humble civil servants like Liz Warren accrue a $12-million fortune . . . and $30-million for Samantha Power (ex-USAID-chief) . . . and more than $150-million for Nancy Pelosi. Could it be as simple as just good stock-picking? (Is that how they spend their time?) Read More |

|

02.14.25- 2025 Economic Predictions already Coming true on Schedule

|

|

02.13.25- Trump’s Microcap Renaissance

It was about to go bankrupt. And… the government swooped in to save it. All at the taxpayer’s expense. Fast forward to October 1, 2024… Read More |

|

02.12.25- Futures, Rates Flat Ahead Of High-Stakes CPI Report

|

|

02.11.25- Hostile Takeover of Canada

Donald Trump, with his absurd megalomaniac claims to Greenland, Canada, Panama and now Gaza, has managed to do what no one else has done. He has made the United States hated across Canada, even in usually pro-American Alberta. Read More |

|

02.10.25- How China’s DeepSeek Could Disrupt Financial Markets and Global Stability

What’s your take on this development? Doug Casey: Technology—all technologies—inevitably become better and cheaper over time. That trend has been in motion, at an accelerating rate, since at least the end of the last Ice Age about 12,000 years ago. Since the start of the Industrial Revolution about 200 years ago the hyperbolic curve has gone vertical. Read More |

|

02.08.25- The Crises Yet to Come

That the Trump Reformation / Counter-Reformation is disrupting various nodes of the status quo is viewed as an existential crisis by many. The choice between Reformation / Counter-Reformation seems to cleave on this basic perception: the status quo in its 2024 configuration was ably serving the common good, or the the status quo in its 2024 configuration had veered from the basics of accountability, efficiency and transparency into self-serving self-righteousness, defending its sclerosis and inefficiency via political correctness and narrative control. Read More |

|

02.07.25- How China’s DeepSeek Could Disrupt Financial Markets and Global Stability

What’s your take on this development? Doug Casey:Technology—all technologies—inevitably become better and cheaper over time. That trend has been in motion, at an accelerating rate, since at least the end of the last Ice Age about 12,000 years ago. Since the start of the Industrial Revolution about 200 years ago the hyperbolic curve has gone vertical. Read More |

|

02.06.25- Trade Wars Bring Pain… And Opportunity

After months of threatening tariffs on U.S. trading partners during his 2024 presidential campaign, Trump has now taken definitive action on that front. On Saturday, February 1, Trump announced that the U.S. was imposing 25% tariffs on all goods imported to the U.S. from Mexico and Canada (with the exception of Canadian energy, which was tariffed at 10%) and additional 10% tariffs on all goods imported from China. Read More |

|

02.05.25- Ferris Bueller’s “Crisis Bubble”

Ferris Bueller wasn’t a trader (forgive me for adapting the iconic movie quote). But if Ferris ever had the urge to dip his toes into the markets, he’d probably have the perfect mindset to deal with this noisy, volatile news cycle. For the past two weeks, we’ve watched the same situation play out. Here’s how it goes: Read More |

|

02.04.25- This trade war might be the straw that breaks the US dollar’s back.

The Byzantine Empire was still a vast and powerful state by the late 12th century. But it was becoming obvious to anyone paying attention that they were in serious decline. Read More |

|

02.03.25- Are They Positioning Themselves

|

|

02.01.25- Rickards: A U.S. Recession is Coming

|

|

01.31.25- The End of America’s Financial Contract

America was the undisputed King of the World. I watched Lawrence Taylor beat up opposing quarterbacks every autumnal Sunday of my youth. Joe Montana won four Super Bowls. Some guy named Bo Jackson was an All-Star in both football and baseball. Nolan Ryan, Roger Clemens, and Donnie Baseball were the diamond’s elite. Wayne Gretzky rewrote the record books in ice hockey. Magic and Larry dominated the NBA, soon to hand it over to Michael Jordan. Mike Tyson was a 22-year-old heavyweight champion. Ayrton Senna and Mario Andretti were racing royalty. Read More |

|

01.30.25- The Release of DeepSeek AI Humiliates Western Companies and Forces Americans to See the Superiority of China

|

|

01.28.25- The U.S. Empire Is Entering

|

|

01.27.25- DeepSeek Pulls Rug Out On Nvidia, ASML

|

|

01.25.25- The Health Sector Is in a Panic

|

|

01.24.25- Mastering the Art of Speculation and Today’s Top Opportunities

Doug Casey: The word “speculator” is generally misused and poorly defined. Let’s put it in context, along with some related terms that it’s usually confused with. First, what is a speculator? A speculator is someone who capitalizes on distortions in the market. These distortions are mostly caused by the actions of government, so most are political in nature. But distortions can also be caused by natural disasters or aberrations of public psychology.Read More |

|

01.23.25- How to Stop the BRICS Nations from Abandoning the Dollar

|

|

01.22.25- Welcome to The Trump Crypto Era

On Friday night around 9pm EST President Trump launched a new cryptocurrency. When Trump first posted the news on Truth Social and X.com, people thought his accounts must have been hacked. But somehow, it was real. Read More |

|

01.21.25- The Competency Crisis Proliferating The West

Aurelien highlights the strange lack of realism by which the West has approached the crisis — Read More |

|

01.20.25- Druckenmiller Declares: U.S. Going From 'The Most Anti-Business Administration In History To The Opposite'

|

|

01.18.25- Zen And The Art Of Market Crash Fear Porn

|

|

01.17.25- December CPI: The Good, the Bad, and the Expensive

That’s how I felt reading the December Consumer Price Index (CPI) report. I mean, it wasn’t awful. But it wasn’t good either. Read More |

|

01.16.25- What If Tech, the Market and the State Are No Longer Solutions?

The status quo rests on a foundational belief that all problems, regardless of their nature, can be solved by technology, the market or the government (i.e. the state), or some combination of these three. Read More |

|

01.15.25- The Big Bipolar Breakout

Trump had just won the election. Bullish momentum thrusts were popping up left and right. Small-caps and the major averages were breaking out. Everywhere you looked, stocks were posting new highs.Read More |

|

01.14.25- Full Speed Ahead

|

|

01.13.25- THE DEEPER DIVE: Will the Stock Market Dive in '25?

|

|

01.11.25- Rational Despair

President-elect Trump wants to keep both the stock market and economic levitation going. Asset prices and low unemployment provide a superficial appearance of good health. Trump’s a reality TV guy. He wants things to look good. He wants to have rising stock indexes and low unemployment to point to as validation of his policies. Read More |

|

01.10.25- Positioned For a Historic Crash

Kamala Harris presided over the ceremony as president of the Senate and faced the awkward task as she formally certified Trump’s victory and her own loss. Read More |

|

01.09.25- “Curb Your Enthusiasm” In 2025

|

|

01.08.25- Pressing for Yet More

Reliable valuation measures are enormously informative about both long-term investment returns and the potential depth of market losses over the completion of any given market cycle. At the same time, valuations are of strikingly little use in projecting market outcomes over shorter segments of the market cycle. Investor psychology – the desire to speculate, or the aversion to risk – has a much stronger impact, which is why we also have to attend to factors including market internals, sentiment, short-term overextension / compression, and monetary policy (while unfavorable market internals dominate monetary easing, favorable internals amplify it). Read More |

|

It started almost exactly a year ago. It was January 2, 2024, and we wrote to you about a new law that had just taken effect called the Corporate Transparency Act, or the CTA. Read More |

|

01.06.25- Doug Casey’s Top Prediction for 2025

What major event or trend should people prepare for that most are currently overlooking? Doug Casey: The trends that appeared, seemingly against all odds, in 2024 are going to accelerate. Read More |

|

01.04.25- Trump’s Plan to End Currency War 3.0

Trump badly bungled his transition after first being elected president in 2016. He was not ready with a long list of loyal appointees. Many of his senior appointments such as Rex Tillerson as Secretary of State, James Mattis as Secretary of Defense, and John Kelly as Chief of Staff secretly disliked Trump but accepted their roles as so-called “adult supervision” around the supposedly reckless Trump. Read More |

|

01.03.25- 10 Stock Market Predictions for 2025

Stepping into a new year, investors have a lot to be thankful for. In 2024, the iconic Dow Jones Industrial Average (^DJI 0.11%), benchmark S&P 500 (^GSPC 0.43%), and technology-driven Nasdaq Composite (^IXIC 0.68%) all reached multiple record-closing highs. Read More |

|

01.02.25- Recession Watch: Broke Consumers, Tanking Houses

Credit card debt set to hit record levels as consumer holiday spending rises(CNBC) - Heading into the holidays, many Americans were already saddled with record-breaking credit card debt. And yet, consumer spending is set to reach a fresh high this season. Read More |

|

01.01.25- My Predictions for 2025? You Don’t Want to Know.

|

|

|

|

12.30.24- Stock Market Crash in 2025! Stocks Have NEVER Been as Precarious as they Are Now

|

|

12.28.24- The World Order Is Dangerously In Flux

I would guess that you’re feeling as if anything might happen now. It’s hard to rule out even the possibility that we could all be vaporized before moving onto the next mundane chore of the day. The world order is dangerously in flux. Read More |

|

12.27.24- US Stock Futures Drop As 10Y Yield Trades Near 2024 High

|

|

12.26.24- Will Russia Collapse in 2025?

I raise this question not only because Putin has been fighting in his gentlemanly way a war on Russian territory in Ukraine for six months longer without yet winning than it took Stalin’s Red Army to defeat the formidable German Wehrmacht in World War II, and still Putin has not cleared Ukrainian troops from the small Donbas area or from the Ukrainian invasion of Russian Kursk. Does anyone remember when Putin declared that Russia would never again fight a war on its own territory? Putin has been fighting a war on Russia’s own territory for longer than the Soviet offensive took to drive the German invaders out of Russia. Moreover, Putin and Lavrov seem to be relying on Trump, not the Russian military, to bring the conflict in Ukraine to an end by agreeing to a mutual security treaty. Read More |

|

12.25.24- It's A Wonderful Life and A Political One

Such general encouragement may seem more needed than ever these days; indeed, this may be, sadly, the cause of the film’s popularity. But “It’s a Wonderful Life” may be more important still for its overlooked lesson in democratic economics, a lesson arising from the struggle for survival of a combination credit union and savings bank, the Bailey Building & Loan in the Everytown of Bedford Falls.Read More |

|

12.24.24- Big Money

Forbes:

|

|

12.23.24- National Self-Perception

Bill Shakespeare had a talent for phrasing basic truths well, and this quote is no exception. (Even if you lie to others, don’t lie to yourself, or you’re in real trouble.) Much has been said about the American self-image, going back to its inception as an upstart nation that imagined it could succeed as a republic, as Athens had failed to do. Read More |

|

12.21.24- The Correction Is Not Over Yet

When it comes to the Fed, words speak louder than actions. As expected, the Fed cut rates by 25 basis points. However, Fed Chair Powell said that the number of rate cuts in 2025 would be just two, down from four in September. This is hawkish, obviously. The markets responded accordingly Read More |

|

12.20.24- Microsoft's $200 Billion Bitcoin Moment

That’s the amount of cash Microsoft is sitting on – money that could have made history a few weeks ago. The crypto world watched with bated breath as Microsoft shareholders faced a decision that would ripple through Wall Street: whether to turn some of that mountain of cash into Bitcoin. Read More |

|

12.19.24- Trump’s Economic Plans

His core economic team is already announced including Russell Vought as Director of the Office of Management and Budget, Jamieson Greer as U.S. Trade Representative, Kevin Hassett as Director of the National Economic Council, Scott Bessent as U.S. Treasury Secretary, and Howard Lutnick as Secretary of Commerce. Read More |

|

12.18.24- Will the New Tariff Coming to Town Put Stocks in the Stockade or Shoot up Inflation?

|

|

12.17.24- Trade Wars Accelerate

As a result, China’s share of the U.S. trade deficit dropped from 47% to 26%. However, it’s worth noting that America’s trade imbalance continued to rise, as production shifted to low-tariff countries such as Vietnam, Canada, and Mexico. Read More |

|

12.16.24- Legendary Investor Sold His US Stocks, Here's Why

|

|

12.14.24- A "Spectacular Implosion" In Stocks Is Due Once The Euphoria Ends

Excited in part by the pro-business policies of the incoming Trump administration, stocks are back to trading at record highs and investor and business confidence is rising. But that said, the average American household is still struggling under a high cost of living, and a labor market that does not seem as robust as we've been told. Read More |

|

12.13.24- The Hardest Retirement Math

And it seems like nobody knows exactly how to figure out how much today’s dollars will be worth tomorrow…Everyone agrees (if they’ve thought about it) that retirement planning is a good idea. Read More |

|

12.12.24- The mother of all bubbles

The writer is chair of Rockefeller International. His latest book is ‘What Went Wrong With Capitalism’ The idea of America as an exceptional nation, superior to its rivals and therefore destined to lead the world, seems passé to most observers. In political, diplomatic and military circles, the talk is of a dysfunctional superpower, isolationist abroad and polarised at home. But in the investing world, the term “American exceptionalism” is hotter than ever. Read More |

|

12.11.24- East Vs. West: A Global Dollar Dump Is Inevitable And The US Must Prepare

|

|

12.10.24- The Ultimate Hustle Economy

Its cash reserves were dwindling rapidly. Its losses were mounting. And the once mighty company was just 90 days away from failing. Read More |

|

12.09.24- The Deeper Dive: Some Predict a Major, MAJOR Stock Blow-off is Imminent

As promised, this weekend’s Deeper Dive will pull together the best bits from a few videos published in The Daily Doom headlines this week about the prospects for an imminent major stock market crash. I’ll include each video and bullet-point the reasons given for believing a major crash is imminent as I go from video to video on what turned out to be a common theme to all of them. Read More |

|

12.07.24- The Peasants’ Revolt 2.0

|

|

12.06.24- A Critical Time for America

|

|

12.05.24- The Looming Debt Crisis: Is America Following the Path of Collapsed Empires?

Debt can topple even the most powerful empires. Whether it’s Rome, Spain, France, Britain, or the Soviet Union, excessive debt has played a critical role in their decline. The typical pattern in these examples of collapsing empires is: Read More |

|

12.04.24- The Debt Monster and the Big Men

|

|

12.03.24- Are We Headed For A Economic Collapse?! Silver Prices Will GO PARABOLIC!

|

|

Yahoo is using AI to generate takeaways from this article. This means the info may not always match what's in the article. Reporting mistakes helps us improve the experience. Read More |

|

11.30.24- The end of globalization:

The first great wave of globalization ended with World War I, and was followed by trade wars and deep depressions throughout the interwar period. Although trade integration resumed after World War II – facilitating the reconstruction of Western Europe and Japan – its scope remained limited. It was not until the late 1980s and early 1990s that the next great wave of globalization began.(Project Syndicate, ‘The Dangerous Retreat Into Protectionism’, May 21, 2024) Read More |

|

11.29.24- The Zealous Pursuit of Retail Therapy

The stock market is in full melt up. The Trump bump is powering share prices higher. Investors and speculators expect a bright future. And their intentions are to exploit it for personal profit. Read More |

|

11.28.24- Seven Key Indicators to Watch as the Dollar Declines

But is the dollar really in trouble? Investment guru Nick Giambruno thinks it is. In fact, he believes the dollar will ultimately collapse. Read More |

|

11.27.24- About that “Government Efficiency”

It was the culmination of weak, incompetent leadership combined with massive government spending throughout the stagflation of the 1970s— an entire decade of high unemployment, little growth, and a rising cost of goods and services. Read More |

|

Turkey, Touchdowns, and Trading

This is easily my favorite holiday. I get a midweek break in the market action filled with food, family, and football — without the added stress of exchanging gifts and all the cleanup that comes after a busy Christmas morning with the kids… Read More |

|

11.25.24- Americans Need $5.3 Million Net Worth To Be Considered Financially Successful: Survey

An annual salary in excess of $270,000 is needed for a person to be considered successful in the United States, the Nov. 22 survey found. In terms of net worth, the threshold is at $5.3 million. Read More |

|

11.23.24- Three Unusual Inflation Hedges

Today we’ll examine the benefits of owning firearms, farmland, and fixed-rate mortgages during inflationary periods. Let’s get started. Read More |

|

11.22.24- Elon Musk’s Wrecking Ball and Your Financial Future

One of Donald Trump's big campaign promises when he won both in 2016 and this year was to reduce the size of the Federal government and radically reduce government spending. Read More |

|

11.21.24- Investors Are Increasingly Reluctant To Buy US Treasuries Even At These Yields

|

|

11.20.24- How to Stick The Market Melt-Up

The sharp election rally has given way to some volatility as investors digest the moves, fill some gaps, and nervously wait to see what stocks and sectors bounce first. Read More |

|

11.19.24- A Watched Market Crash Pot Never Boils

|

|

11.18.24- Regional Banks To Go Bust? Massive Bailouts Coming

|

|

11.16.24- The US Economy Will Collapse: How Trump Should Handle It

|

|

11.15.24- How The Trade War Ends

The point is that free trade not only increases the wealth of different societies, but it may also be essential for peaceful relations. The breakdown of free trade has often coincided with wars. These wars start as currency and trade wars and then escalate into shooting wars. This is something to be mindful of as President-elect Trump amps up forthcoming import tariffs. Read More |

|

11.14.24- Trump’s Second Term: What It Means for America and Investors

How do you expect it to differ from his first term? Doug Casey:Thank heavens Kamala lost. If she’d won, the Jacobins would have cemented their hold on the country, and it would have been “game over.” We would have seen an acceleration of cultural decline, vastly higher taxes and regulations, and a serious push to shut down free speech. Read More |

|

11.13.24- American Economy Bleaker

More voices are harmonizing with mine by saying that the recession already began this year. (Which is not to say they are saying it with any awareness of what I’ve been saying, as I don’t suppose they are.) Today, Ed Dowd says that Donald Trump is inheriting “a turd of an economy” because the facts have been concealed (read “stealth recession)” behind “such blatant manipulation of government statistics.” Read More |

|

11.12.24- Hold Your Nose and Buy!

This is not one of those times. Stocks have exploded higher since the election, with some of the market’s most speculative areas taking on leadership roles. If you’re looking for a melt-up, you’ve come to the right place. Read More |

|

11.11.24- Global Credit Collapse Is Deflationary

Bond prices collapsed nearly 3% post-election and are down 12% since mid-September. Whatever that tells us did not change because of election results. Read More |

|

11.09.24- Judy Shelton Returns With A Bold Plan To Restore Gold

In her newest work, former Trump administration advisor Judy Shelton argues that a return to sound money requires going back to gold. Read More |

|

11.08.24- The Road to America’s Golden Age

Make a toast or say a prayer. It all depends on your political and spiritual preferences. There are times to kiss the bottle. So, too, there are times to kneel in church. Perhaps now is the time for both. “This will truly be the golden age of America,” remarked Trump. Read More |

|

11.07.24- The Recession Of 2025 Will Be Backdated

That’s a lot to consider so let’s unpack this a bit. Read More |

|

11.06.24- Trump Wins, Sends 'Trumpquake' Through Washington

|

|

11.05.24- The Great Blunder In Public Finance

|

|

|

|

11.02.24- Why the DOLLAR will collapse, GOLD will rule, and America will FRACTURE

|

|

11.01.24- The Brics Version of Globaloney

|

|

10.31.24- US Treasury: Funny Money

|

|

10.30.24- BRICS will not kill Dollar – War Will

|

|

10.29.24- Government Can Fix

Recently RFK, Jr. gave his recipe but in general, it’s yet another request for government intervention in these fields (pun intended). Capping drug prices, prohibiting research grants from going to people with conflicts of interest, and reforming crop subsidies to incentivize healthier alternatives all sound nice. Eliminating SNAP (formerly food stamps) from being spent on high fructose corn syrup drinks ($9 billion annually) sounds good too. Read More |

|

10.28.24- On The Wrong Track: This Is What An Imploding Economy Looks Like

|

|

10.26.24- Do We Face a "Minsky Moment"?

|

|

10.25.24- "Consumers Running Out Of Money": Former Target Exec Offers Dire Warning Ahead Of Christmas

|

|

10.24.24- Economy Slowly Ebbing in Rising Tide of Inflation

|

|

10.23.24- The Point of No Return(s)

The short answer is yes but the full explanation requires a financial history lesson. Read More |

|

10.22.14- Two Weeks Before

|

|

10.21.24- You Can’t Get Blood Out Of A Stone: U.S. Consumers Have Been Squeezed Bone Dry As The U.S. Economy Falters

|

|

10.19.24- How Federal “Bans”, “Freezes”, and “Price Controls” Spread Economic Chaos

|

|

10.18.24- Retail Bad News Adjusted into Great News Just in Time for the Election

In keeping with the analysis I did in recent Deeper Dives about how all the good news in economics these days appears to be adjusted into place, we have another clear example today that I'll share with all. Read More |

|

10.17.24- Top 3 Predictions

What do you expect to happen in the 2024 election in this regard? Do you think the outcome will be disputed? Doug Casey: Election disputes are not unique to the current era. In the 1960 election, Chicago’s Mayor Daley stuffed ballot boxes, allowing Kennedy to win over Nixon in an extremely close election. Read More |

|

10.16.24- The Biggest Credit Bubble in History

Many still insist ours is a capitalist system. Yet Mr. Duncan tells them to have another guess. He argues that the capitalist system went into the grave when the gold standard went into the grave. Read More |

|

10.15.24- 10 Signs That The Economy Is A Giant Mess As The Election Approaches

|

|

|

|

10.12.24- Prepare for False Flag

|

|

10.11.24- BRICS working on own payment system – Russian finance minister

The BRICS countries are working to create their own international payments system as platforms which operate using Western infrastructure are becoming increasingly politicized, Russian Finance Minister Anton Siluanov told RT Arabic in an exclusive interview on Wednesday. The unprecedented sanctions campaign against Moscow spearheaded by the US has forced Russia and other members of the geopolitical bloc to look for ways to pursue trade despite the restrictions. Read More |

|

10.10.24- Why I Want My Kids to Grow Up to be Union Bosses

My parents were pretty traditional so they hoped I would grow up to become a doctor. This is pretty typical; after all, parents just want their kids to be financially secure. I think about this a lot with my kids— both of whom are extremely young. I give a lot of thought to what their world will look like in 20 years given the seismic geopolitical and macroeconomic shifts taking place. Read More |

|

10.09.24- Projected Supply Deficits For Key Energy Transition Metals

Supply, however, is not on track to keep up with this surging demand. Visual Capitalist partnered with Appian Capital Advisory to visualize what these supply gaps may look like by 2030 and the mining investment needed to balance these deficits. Read More |

|

10.08.24- Can America Survive Global De-Dollarization?

|

|

We have had the technology to create, control, and steer hurricanes for decades. “Project Cirrus is the first Official attempt to modify a hurricane. It was run by General Electric with the support of the US military. The official theory was that by changing the temperature outside the eye-wall of a hurricane, which they did by seeding the clouds with various compounds such as silver iodide, a decrease in strong winds will result. Read More |

|

10.05.24- America’s “Quiet Coup”

|

|

10.04.24- Mideast Tinderbox Set to Explode