|

|

|

|

|---|

08.03.13- First things first - but not necessarily in that order.

Johnny Silver Bear As the editor of the Silver Bear Cafe, I spend most of my time researching current events. I explore the markets, the economic war that is being waged on the middle class, precious metals, the Federal Reserve, energy, and how to go about surviving financially. In this weekly column I will attempt to condense the week's events and examine how the news might affect your pocketbook. JSB Financial Markets

I have come to the conclusion, after having attempted to absorb the thoughts and prognostications of many highly intelligent people, that there are basically four groups that are involved in determining the future of the US Economy. Some of that determination is a result of either pushing or pulling, although most of it is a result of doing nothing, which is the collective contribution of the largest group. The largest group is made up of the sheeple, with the occasional good and bad clown popping up every now and then. The next biggest group is made up of politicians and bureaucrats, as well as a mish-mash of all other government employees including alphabet soup agencies, some of which have deemed themselves special agencies which allow them to provide us with special agents. This overall group also has its fair share of good and bad clowns. It also has an inordinate number of evil ones. The third largest group is made up of financiers; bankers, corporate management, muggers, thugs and thieves (an obscure reference to the banks of the River Charles). Consequently, here again, the group includes a number of good clowns but also bad clowns, and regretfully, a rather large contingent of evil clowns. The fourth and smallest group is made up of us! The conspiracy theorist, libertarian, constitutional backing, patriot freedom fighter, tin foil hat bunch who also have our share of clowns, but, for the most part, we call them bloggers. The way that these four groups interact has an all determining effect on the economy. The sheeple mindlessly provide the politicians with an unserved constituency so that they, the politicians, can covertly serve their donors while pretending to be dutifully serving the people. All this, they do, while clumsily providing their moronic best to keep the party going. Consequently, the party has become a big problem. Keeping the party going any longer will proove to be extremely detrimental to the short term well being of the whole country. An explanation of how the groups interact in a perverse concert is the something I have chosen to explore. Please stay tuned for another epic rant based on the theme: Clowns: the good, the bad, and the evil - All the King's horses and all the King's men...Meanwhile, Michael Snyder schools us again on the warning signs of collapse.

On the Economic War Front

Of the 308 companies in the Standard and Poor's 500 Index that have pension plans, 94% are underfunded. The government projects that as many as 150 private pension plans are underfunded to the extent that they face insolvency. Meanwhile, the Pension Benefit Guaranty Corporation (PBGC), the independent government agency that takes over private pension plans that become insolvent, isn't all that healthy itself. The PBGC already has a deficit of $34 billion. Its own estimates indicate the agency has a 91% chance of becoming insolvent itself by 2032. The PBGC estimates pension insolvencies could double over the next decade, forcing it to take on as much as $295 billion in underfunded pension plan liabilities. Perhaps the sheeple have been sufficiently dumbed down and placated to take this lying down. After all they will have social security (or some semblance of it) to fall back on. So what, if rather than receiving the $5000 per month they were promised, they only receive $2500. Spam instead of steak. Diet soda instead of wine. What if the pension shortfall is a result of slimey politics rather than simply fiscal stupidity?

Precious Metals

Most of these folks, that I am aware of, lean heavily on recommending the possession of precious metals as a blanket panacea. Holding a commodity that the Central Bankers can't invent will help protect us from the vile and inherent evil of greed which comes from a lust for power. There is much to fear from the Darkside. Through the disassemblage of the fabric of society they are effectively dismantling, not just the country, but the entire world. As a result, safe havens are becoming scarce. It is hard to get away from a world wide scourge. There is, however, an inherent flaw in their plan, and it may prove to be their undoing. That flaw, I suspect, may lie in the unrealized risk of the massive amount of leverage that has been employed in the creation of $800 trillion in derivatives.

Energy

There is an ever increasing group of realists that, apparently, believes that the quantity of carbon base fossil fuels, recently discovered in the Dakotas, South Texas and Colorado, has been greatly over estimated and over stated. To hear so much positive MSM spin, one is led to believe that the United States' reliance on foreign oil and natural gas has been, essentially, alleviated. The politicians, forever in bed with big oil and gas, refuses to heed the tell-tale signs of depletion and would, rather, maintain a delusional hope that all is well. The politicians are not, in all cases, guilty of the perpetration of fraud, but are just as ignorant of the facts as the sheeple. After all, they were all sheeple once. They are, in some cases, more dumbed down than the constituents they pretend to represent.

The Fed

It's one thing to not know what you're talking about. I like to pose the question, how much of this do you not know. Having a clue about how much you don't know is an incredibly important step that we must all make on the road to enlightenment. Ben Shalom Bernanke, apparently hasn't got a clue when it comes to defining what he doesn't know. When it comes to economics, what he doesn't know makes up, at least, 99% of the subject. He is a sycophant, kissing the asses of his Bilderburger masters. His biggest, and therefore most dangerous shortcoming is the fact that, along with not even beginning to comprehend what it is that he doesn't know, he believes his own bullshit. As Mark Twain so famously quipped, its not what you don't know that will screw you up, it's what you think you know that is wrong. He is beginning to realize that his actions, mandated by his puppet masters, have created the biggest and most dangerous threat to truth, justice and the American way that has ever come down the pike. From Michael Kosares, an inkling of the most likely outcome of the chairman's misguided ignorance...

Financial Survival

All I can say is "make like a boy scout and be prepared" Step out of the collective. Be the individual God meant for you to be and start assuming the responsibility that comes with the tenets of liberty and freedom. Most of what your neighbor thinks is a result of a massive misinformation campaign. Friends of mine who have gone through the "waking up process" compare it to becoming "born again". Waking up usually results in the gradual development of healthy defense mechanisms. I believe that, as a result of the misinformation campaign, members of our society are devolving and becoming less capable of defending themselves. It is our societal responsibility to both health and home to wake up. James Howard Kunstler, a perennial favorite of mine, is capable of such eloquence, it is hard not to understand what he is talking about.

You must first realize that there are, present in our lives, enemies. You must then know who those enemies are and act accordingly. Eliminate as much debt as possible, especially “variable rate” debt, such as credit cards and lines of credit. Interest rates will be rising, so the elimination of debt offers a “real return” of escaping rising rates by creditors. Get some control over some fresh water. If you are depending on Social Security, stop. Follow the course opposite to custom and you will almost always do well...

More next week... May the Great Spirit be with you always,

Johnny

Silver Bear Disclaimer All statements and expressions are the sole opinions of the editor and are subject to change without notice. A profile, description, or other mention of a company in the newsletter is neither an offer nor solicitation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable, in no way do we represent or guarantee the accuracy thereof, nor the statements made herein. The staff of Silver Bear Cafe are not registered investment advisors and do not purport to offer personalized investment related advice. The publisher, editor, staff, or anyone associated with, or associated to the Silver Bear Cafe may own securities mentioned in this newsletter and may buy or sell securities without notice. |

|---|

Send this article to a friend:

Archives

08.03.13- First things first - but not necessarily in that order.

07.27.13- If God is watching us, the least we can do is be entertaining.

07.20.13- Debt is normal. Be weird.

07.13.13- My problem lies in reconciling my gross habits with my net income.

07.06.13- I can't believe that cop put me in the backseat after I clearly called shotgun.

06.29.13- People who think they know everything are a great annoyance to those of us who do.

06.15.13- How Can I Miss You if You Won't Go Away?

06.08.13- If the Good Lord's Willing and the Creek Don't Rise...

06.01.13- Just cause you got the monkey off your back doesn't mean the circus has left town.

05.25.13- Even if you're on the right track, you'll get run over if you just sit there.

05.18.13- House Guarded By Shotgun 3 Days A Week. Guess Which Days.

05.11.13- Beware of false knowledge; it is more dangerous than ignorance.

04.27.13- A dyslexic man walks into a bra...

04.20.13- "The economy is so bad the Mafia is laying off judges."

04.13.13- "There are no dangerous weapons; there are only dangerous men."

04.06.13- A government that robs Peter to pay Paul can always depend on Paul's Support.

03.30.13- A word to the wise isn't necessary - it's the stupid ones that need the advice.

03.09.13- Yield to temptation. It may not pass your way again.

03.02.13- Life is not about how fast you run, or how high you climb, but how well you bounce.

02.23.13- Don't be afraid to take a big step;you can't cross a chasm in two hops.

02.16.13- The difference between genius and stupidity is that genius has its limits

02.09.13- We May Be Lost, but we're making good time

02.02.13- If we don't change course, we may end up where we are heading

01.26.13- Opportunities always look bigger going than coming

01.19.13- There's too much youth; how about a fountain of smart

01.12.13- Sixty-five-year-old, one owner, needs parts ...Make offer.

01.05.13- Lead me not into temptation, I can find it by myself

12.29.12- Never Underestimate the Power of Stupid People in Large Groups

The more things change, the more they stay the same. For those of us who have developed the bad habit of prognostication, the more they stay the same.

The more things change, the more they stay the same. For those of us who have developed the bad habit of prognostication, the more they stay the same. There is one vitally important number that everyone needs to be watching right now, and it doesn't have anything to do with unemployment, inflation or housing. If this number gets too high, it will collapse the entire U.S. financial system. The number that I am talking about is the yield on 10 year U.S. Treasuries. When that number goes up, long-term interest rates all across the financial system start increasing.

There is one vitally important number that everyone needs to be watching right now, and it doesn't have anything to do with unemployment, inflation or housing. If this number gets too high, it will collapse the entire U.S. financial system. The number that I am talking about is the yield on 10 year U.S. Treasuries. When that number goes up, long-term interest rates all across the financial system start increasing. What do you think the general working class population will do when they are deprived of their pensions?

What do you think the general working class population will do when they are deprived of their pensions? It should be obvious to economists, but apparently is not, that Walmart-type jobs of the "New Economy" do not pay sufficiently to support a consumer-dependent economy. As Obamacare is phased in, consumer purchasing power will suffer another blow. Even the subsidized premiums are expensive, and the cost of using the policies in terms of deductions and co-pays will be prohibitive for most. As employer-provided benefits and Medicare are cut back, the health care crisis will worsen in the midst of an economic crisis.

It should be obvious to economists, but apparently is not, that Walmart-type jobs of the "New Economy" do not pay sufficiently to support a consumer-dependent economy. As Obamacare is phased in, consumer purchasing power will suffer another blow. Even the subsidized premiums are expensive, and the cost of using the policies in terms of deductions and co-pays will be prohibitive for most. As employer-provided benefits and Medicare are cut back, the health care crisis will worsen in the midst of an economic crisis. In the realm of alternative media, there resides a group of prophets, poets, pundants, and prognosticators that expend varying degrees of energy on a daily/weekly basis attempting to communicate their take on the state of the world. This usually differs greatly from the main stream media's observations. Hence, the tag: "alternative".

In the realm of alternative media, there resides a group of prophets, poets, pundants, and prognosticators that expend varying degrees of energy on a daily/weekly basis attempting to communicate their take on the state of the world. This usually differs greatly from the main stream media's observations. Hence, the tag: "alternative".

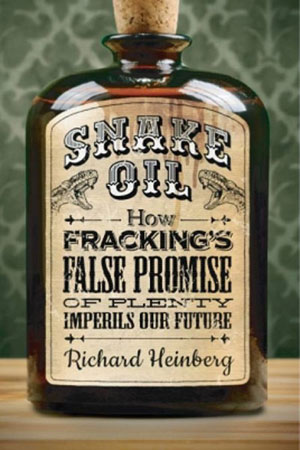

The rapid spread of hydraulic fracturing ("fracking") has temporarily boosted US natural gas and oil production... and sparked a massive environmental backlash in communities across the country. The fossil fuel industry is trying to sell fracking as the biggest energy development of the century, with slick promises of American energy independence and benefits to local economies.

The rapid spread of hydraulic fracturing ("fracking") has temporarily boosted US natural gas and oil production... and sparked a massive environmental backlash in communities across the country. The fossil fuel industry is trying to sell fracking as the biggest energy development of the century, with slick promises of American energy independence and benefits to local economies.

The Federal Reserve on Wednesday slightly downgraded its economic outlook but gave no hint about its plans for its $85 billion-a-month asset purchase program. The statement released after a meeting of the Fed's policy making committee said that the economy was expanding at a "modest" pace, a change from the "moderate" pace seen in June. The Fed also noted that the rise in mortgage rates was a concern. It also said that persistently low inflation was a risk. There was only one dissent, by Kansas City Fed President Esther George.

The Federal Reserve on Wednesday slightly downgraded its economic outlook but gave no hint about its plans for its $85 billion-a-month asset purchase program. The statement released after a meeting of the Fed's policy making committee said that the economy was expanding at a "modest" pace, a change from the "moderate" pace seen in June. The Fed also noted that the rise in mortgage rates was a concern. It also said that persistently low inflation was a risk. There was only one dissent, by Kansas City Fed President Esther George. What are we going to do? Where are we going to go? In spite of what your neighbor thinks, you're beginning to get a little antsy. Well okay, a lot antsy.

What are we going to do? Where are we going to go? In spite of what your neighbor thinks, you're beginning to get a little antsy. Well okay, a lot antsy.

Its

not what you don't know that will screw you up, it's

what you think you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.

Its

not what you don't know that will screw you up, it's

what you think you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.