|

|

|

|---|

03.02.13- Life is not about how fast you run, or how high you climb, but how well you bounce.

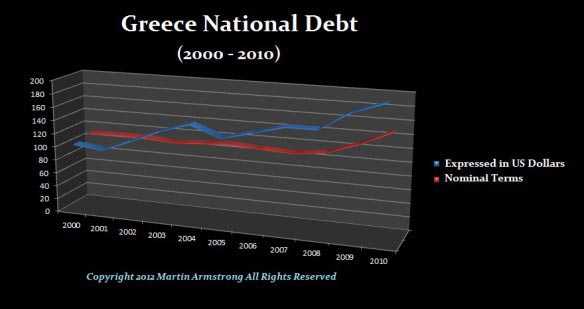

Johnny Silver Bear As the editor of the Silver Bear Cafe, I spend most of my time researching current events. I explore the markets, the economic war that is being waged on the middle class, precious metals, the Federal Reserve, energy, and how to go about surviving financially. In this weekly column I will attempt to condense the week's events and examine how the news might affect your pocketbook. JSB Financial Markets The consideration, by most Americans, that the turmoil growing in Europe could, in any way, affect their lives, has not yet occurred to many. But, the causes of the situations in Greece, Portugal, Spain and Italy are each a result of the same twisted paradigm that has been instigated in America as well. In one instance, the predatory lenders of Wall Street spent millions to bribe corruptible politicians and commissioners in Jefferson County Alabama in order to lend the county millions more for a new sewer system and water treatment plant. The original cost for the sewer project was estimated to be about $250 million. By the time the penalties and hidden fees and interest swaps came due, the debt had ballooned to over $5 billion. Because of the sewer debacle, the county was not only left with an unpayable debt on its sewer project, it also saw a downgrade in its overall credit rating, which left it paralyzed in its attempts to borrow money to pay for general expenditures. The people's sewers bills exploded by 400%! The county had to lay off many of its employees. They had to close one of their jails. This is also why Jefferson County had to file for bankruptcy last fall. The exact same thing happened in Greece, Portugal, Spain and Italy. The same predatory Wall Street lenders bribed corruptible European officials and left each country with an unpayable debt and in the same lurch. Tempting these folks to break the law is just as, if not more so, damning than the officials simply accepting a bribe. Accepting bribes has become "job one" for politicians, commissioners, and officials the world over. It's the "bribers", not the "bribees," that are the problem, although the world would be a better place without either. The insurrection in Greece, Spain and Italy is a result of "austerity measures" that the criminal banksters try to impose in order to continue to collect their "ill gotten gains"...

On the Economic War Front

For those of us that often find ourselves wondering why the Federal Government is doing things like purchasing hundreds of million of rounds of ammunition, stock piling millions of coffins, and have created, at least, one FEMA containment facility in every state in the union (a total of over 800, nationwide) these, and other unexplained mysteries tend to give us great pause. The fact that the Federal Government's Leviathan has become a corrupt, criminal, out-of-control rampaging menace goes without question:

Precious Metals In an ongoing attempt to maintain a handle on the precious metals/dollar relationship as well as to try and grasp the inflation/deflation event, we must seek to understand the influences which are proffered by the elitists, trying to maintain control of an increasingly dysfunctional world economy.

Energy Using ethanol to supplement gasoline is one of the most moronic ideas ever to come down the pike. Under the ruse of "energy independence" Archer Daniels Midland bribed half of congress to pass these insane laws. Well yes, of course, it enriches giant corporate corn farmers and Archer Daniels Midland, to the great detriment of the rest of the world. Ethanol degrades the performance of gasoline as a fuel. It damages the engine in your car, results in a severe reduction in mileage, and pretty much causes irreparable harm to any motor or engine you put it in. I am constantly having to repair my chain saws, mowers, and any other gas powered tools that I use. The ethanol causes the gas to separate into lacquer, gas and water. The lacquer gums up the works and requires expensive solvents to clean out the carburetors. It also has a devastating effect on the poor. The prices of corn have, and will continue to skyrocket. Proponents of ethanol subsidies are either idiots, or criminals, or both.

The Fed The Federal Reserve is a bought and paid for group of stooges that act as a tool of the most evil individuals to ever inhabit the Earth. The evil individuals are the illuminati. If you are not already aware of that fact, it is because you have not been paying attention. They already control the banking system and all facets of our government and, If not stopped, they will become the slave masters of your children and your children's children. It has become apparent that Bernanke is delusional and clueless. You can take everything he says and extract the absolute opposite meaning. The opposite of what he says is what will occur. I don't think he's lying, I think he's a moron. He has never, to date, done anything that has helped the economy. All he has ever accomplished was to enrich the top 1% elitist banksters. The man represents an institution that is an unconstitutional abomination and a parasitic scourge on America. On his own, he is a a misguided menace. Now let me tell you what I really think...

Financial Survival I would have normally posted this article in the "Precious Metals Forum" but I opted for "Financial Survival" instead. This web site was founded on the belief that the "Dark Side" would eventually screw everything up so bad that a global financial meltdown would ensue. At the time of this posting, the criminal banksters, at the behest of their demonic puppet masters, have feloniously mashed the price of silver to below $30.00. When silver was at $4.10 an ounce, Ted Butler called it one of the great buying opportunities of a lifetime. Mr. Butler is suggesting that this might be your last chance to acquire silver at such a depressed price. You may find that a 10% - 15% commission is tacked on (for years I bought and sold silver bullion for less than a 5% markup) but I wouldn't let that stand in my way. Presently silver might just offer the best investment value of any issue available anywhere. For your financial survival you would be remiss to let this opportunity pass you by. There is a very good chance that silver is about to liftoff.

You must first realize that there are, present in our lives, enemies. You must then know who those enemies are and act accordingly. Eliminate as much debt as possible, especially “variable rate” debt, such as credit cards and lines of credit. Interest rates will be rising, so the elimination of debt offers a “real return” of escaping rising rates by creditors. Get some control over some fresh water. If you are depending on Social Security, stop. Follow the course opposite to custom and you will almost always do well...

More next week... May the Great Spirit be with you always,

Johnny

Silver Bear Disclaimer All statements and expressions are the sole opinions of the editor and are subject to change without notice. A profile, description, or other mention of a company in the newsletter is neither an offer nor solicitation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable, in no way do we represent or guarantee the accuracy thereof, nor the statements made herein. The staff of Silver Bear Cafe are not registered investment advisors and do not purport to offer personalized investment related advice. The publisher, editor, staff, or anyone associated with, or associated to the Silver Bear Cafe may own securities mentioned in this newsletter and may buy or sell securities without notice. |

|---|

Archives

03.02.13- Life is not about how fast you run, or how high you climb, but how well you bounce.

02.23.13- Don't be afraid to take a big step;you can't cross a chasm in two hops.

02.16.13- The difference between genius and stupidity is that genius has its limits

02.09.13- We May Be Lost, but we're making good time

02.02.13- If we don't change course, we may end up where we are heading

01.26.13- Opportunities always look bigger going than coming

01.19.13- There's too much youth; how about a fountain of smart

01.12.13- Sixty-five-year-old, one owner, needs parts ...Make offer.

01.05.13- Lead me not into temptation, I can find it by myself

12.29.12- Never Underestimate the Power of Stupid People in Large Groups

One of the greatest frauds today, is that ethanol reduces carbon dioxide (C02) emissions, and in doing so, saves the earth from global climate change. Responsible scientists say that CO2 plays no role in climate change, and shows up well after any increase or decrease of temperatures. Ethanol is bad science. It is bad for the engines of cars that must use such a gasoline blend. It increases the cost of gasoline, and all other corn based products. It actually increases the amount of CO2 in the atmosphere. It reduces the fuel mileage a car would get with pure gasoline. An authority on the U.S. oil industry, is Sei Graham, the author of "Why Your Gasoline Prices Are High." He is a man with more than fifty years experience. First, as a petroleum reservoir engineer, and later as an oil and gas attorney. He is also a graduate of West Point. Here is what he has to say about the current gas prices:

One of the greatest frauds today, is that ethanol reduces carbon dioxide (C02) emissions, and in doing so, saves the earth from global climate change. Responsible scientists say that CO2 plays no role in climate change, and shows up well after any increase or decrease of temperatures. Ethanol is bad science. It is bad for the engines of cars that must use such a gasoline blend. It increases the cost of gasoline, and all other corn based products. It actually increases the amount of CO2 in the atmosphere. It reduces the fuel mileage a car would get with pure gasoline. An authority on the U.S. oil industry, is Sei Graham, the author of "Why Your Gasoline Prices Are High." He is a man with more than fifty years experience. First, as a petroleum reservoir engineer, and later as an oil and gas attorney. He is also a graduate of West Point. Here is what he has to say about the current gas prices: By 1789, a lot of French people were starving. Their economy had long since deteriorated into a weak, pitiful shell. Decades of unsustainable spending had left the French treasury depleted. The currency was being rapidly debased. Food was scarce, and expensive.

By 1789, a lot of French people were starving. Their economy had long since deteriorated into a weak, pitiful shell. Decades of unsustainable spending had left the French treasury depleted. The currency was being rapidly debased. Food was scarce, and expensive. Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.

Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.