|

|

|

|---|

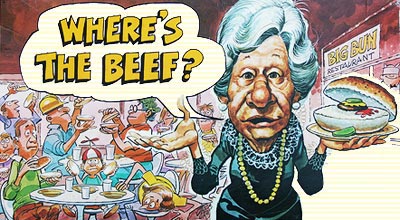

03.16.13- Inflation is when you pay fifteen dollars for the five-dollar haircut you used to get for two dollars when you had hair.

Johnny Silver Bear As the editor of the Silver Bear Cafe, I spend most of my time researching current events. I explore the markets, the economic war that is being waged on the middle class, precious metals, the Federal Reserve, energy, and how to go about surviving financially. In this weekly column I will attempt to condense the week's events and examine how the news might affect your pocketbook. JSB Financial Markets The country is currently mired in, and vexed by, a criminal administration which is, brazenly, fronting for a criminal banking cartel. The banks, through the use of lobbyists, toddies, shills and go betweens, have, effectively, through the elimination of regulation, unbridled the wanton greed so common in the world of finance. Attorney General Eric Holder, during testimony before Congress last week, admitted that he was aware long before the bank's admission in court, that HSBC had been laundering billions of dollars in drug money profits for both the Columbian and Mexican drug cartels. This admission, coming on the heels of the "Fast and Furious" scandal which was the realization that, for years, the U.S. government through the BATF, has been running elaborate "gunwalking" operations on the Mexican border, only to end up providing over 2000 fully automatic weapons to the cartels. Holder's testimony brought to light what had been widely suspected, and that was that HSBC had bought off Washington to such a degree that their prosecution was a non issue and would never occur. Meanwhile, in the realm of correctional services, the private prison industry thrives on the incarceration of thousands for the victimless crime of possession. The incarceration of these minions is billed to the 30% of Americans who pay taxes. There is certainly a glaring and disparaging chasm between the criminal elite and the "unwashed masses".

On the Economic War Front

Precious Metals In the last week, my wife and I have dined out twice, which has been, more often than usual. We are in Dallas and, as a result, privy to some very good Mexican food. Wednesday we went to an very nice, but not formal restaurant called Mi Cocina. We shared a guacamole appetizer, and then enjoyed chicken and cheese enchiladas. I had a Margarita, she had tea. The bill was $49.00 plus tip. Friday she wanted fish. The Fish City Grill provided a special on Sea Bass which my wife opted for. I had a dozen oysters. Again I had a cocktail, she had tea. Again, the dinner was $48.00 plus tip. Her comment was to the effect that it seemed like everyone had raised their prices substantially. It seemed like we have been eating at the same restaurants and others of a similar ilk, for half as much. Actually, the value of the fare had remained consistent. The value of the medium with which we were paying, however, had diminished dramatically. As I have been railing about for years, inflation is theft. The criminal manipulation of the precious metals markets is simply an attempt to keep the spotlight off inflation. Ten years ago, we could have had the same dinners, at the same restaurants, for two ounces of silver for two of us. Today, we could have gotten them for an ounce and a half. In spite of the manipulation, the cost of our meals had, in real terms, gotten cheaper, not more expensive. If it wasn't for the criminal manipulation (which I believe is just about to come to an end) we could have spent one ounce of silver for both nights including tips.

Energy I have always enjoyed our Energy Forum because it allows the documentation of the crimes being perpetrated by the Darkside, against the American Middle Class, to face the light of day in a completely different perspective. Lat week we discussed the technology of Nikoli Tesla and his application of harvesting static electricity which could provide free electricity for all.. This week we examined other old technologies that, out of "a need for greed" have been quashed in order for TPTB to continue to extract their pound of flesh... The following is a video of the Hemp Car prototype made by Henry Ford in 1941. In the video, Ford is seen striking the trunk of the car WITH AN AXE, and leaving no dents whatsoever. The "Hemplastic" seen is about 60% of the weight of steel, and ten (10) times more durable.

The Fed It has always been well known amongst intelligent politicians, (who have, apparently, remained in the minority), that the gold standard protected citizens against the controlling tendencies of the government by offering an absolute hedge against the depreciation or devaluation of the currency. Gold has provided an agent of maintenance and liquidity within and beyond national borders. Above all, it has raised a mighty barrier against authoritarian interferences through the manipulation of the economic markets. Within the constraints imposed by the gold standard, America's economy remained relatively healthy until 1913. On December 23, 1913, the U.S. Congress passed the Federal Reserve Act, placing control of this nation's money into the hands of a private corporation. This corporation was made up entirely of bankers. Calling itself the Federal Reserve, so as to seem official, it replaced the national bank system. Treasury notes were recalled and Federal Reserve notes were issued with a promise to redeem them in gold on demand. The forces behind the Federal Reserve, (American and Western European banking interests), remained tethered by the limits imposed by the gold standard, but this would soon change. In 1920, the 66th Congress passed the Independent Treasury Act. In 1921, the United States Congress abolished the U.S. Treasury, and, as a result, all of our country's bullion and all other instruments of value, ( i.e...moneys in trust funds and other special funds that had been kept in U.S. Treasury offices and vaults), were systematically transferred to the coffers of a private corporation! From 1913, until 1933, under the authority of the U.S. Congress, the Federal Reserve held control of all of our country's gold. They then proceeded to loan us back our gold, at interest. We paid interest for the use of our own gold! What's wrong with this picture? What could have incited our Senators and Representatives to allow that to happen? In order to keep up with the ever rising debt service, we borrowed more of our own gold. We kept borrowing more and more of our own gold to pay more and more interest, until all the gold was gone. At that point, the country went bankrupt. Guess what happened next. The bankers foreclosed on America. I know what you're thinking. Me too. (An excerpt from one of my essays: The Nature of Money and Our Monetary System)

Financial Survival

I have been honored by the SPLC by being listed as a patriot organization on a page called "Active 'Patriot' Groups in the United States in 2011". As I explored all the categories on "Who Controls America?" I could not help but realize that a conspiracy is afoot, and, perhaps, the conspiracy to end all conspiracies. I would appear that America is being run by members of a club that we don't belong to. Please take the time to follow the links to confirm what I mean. You must first realize that there are, present in our lives, enemies. You must then know who those enemies are and act accordingly. Eliminate as much debt as possible, especially “variable rate” debt, such as credit cards and lines of credit. Interest rates will be rising, so the elimination of debt offers a “real return” of escaping rising rates by creditors. Get some control over some fresh water. If you are depending on Social Security, stop. Follow the course opposite to custom and you will almost always do well...

More next week... May the Great Spirit be with you always,

Johnny

Silver Bear Disclaimer All statements and expressions are the sole opinions of the editor and are subject to change without notice. A profile, description, or other mention of a company in the newsletter is neither an offer nor solicitation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable, in no way do we represent or guarantee the accuracy thereof, nor the statements made herein. The staff of Silver Bear Cafe are not registered investment advisors and do not purport to offer personalized investment related advice. The publisher, editor, staff, or anyone associated with, or associated to the Silver Bear Cafe may own securities mentioned in this newsletter and may buy or sell securities without notice. |

|---|

Archives

03.09.13- Yield to temptation. It may not pass your way again.

03.02.13- Life is not about how fast you run, or how high you climb, but how well you bounce.

02.23.13- Don't be afraid to take a big step;you can't cross a chasm in two hops.

02.16.13- The difference between genius and stupidity is that genius has its limits

02.09.13- We May Be Lost, but we're making good time

02.02.13- If we don't change course, we may end up where we are heading

01.26.13- Opportunities always look bigger going than coming

01.19.13- There's too much youth; how about a fountain of smart

01.12.13- Sixty-five-year-old, one owner, needs parts ...Make offer.

01.05.13- Lead me not into temptation, I can find it by myself

12.29.12- Never Underestimate the Power of Stupid People in Large Groups

The ever continuing movement of vast amounts of gold and silver to the East in particular begs the question of how physical demand is being satisfied elsewhere.

The ever continuing movement of vast amounts of gold and silver to the East in particular begs the question of how physical demand is being satisfied elsewhere.  The

The  The Southern Poverty Law Center was recently, again, brought to my attention when I received a link to a web site entitled "

The Southern Poverty Law Center was recently, again, brought to my attention when I received a link to a web site entitled " Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.

Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.