|

|

|

|---|

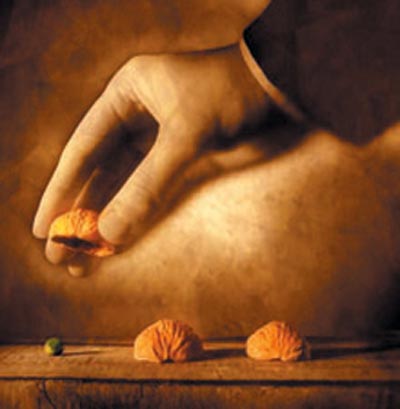

04.13.13- There are no dangerous weapons; there are only dangerous men

As the editor of the Silver Bear Cafe, I spend most of my time researching current events. I explore the markets, the economic war that is being waged on the middle class, precious metals, the Federal Reserve, energy, and how to go about surviving financially. In this weekly column I will attempt to condense the week's events and examine how the news might affect your pocketbook. JSB Financial Markets

Given that our country's leading (most popular) economist is Paul Krugman, whose accolades include a Nobel Prize, and given that Mr. Krugman is a Keynesian, we can confidently surmise that, generally speaking, the current state of the practice of economics in our country (and the world, for that matter) is dismal. It was comforting to have Mr. Kaletsky provide the basic questions of economics distilled into a single paragraph:

By attempting to answer the seven questions he raises in the first paragraph of his article, I found that the questions, and my answers, provided me with a clearer understanding of how I felt about the general state of the global economy, and the causes for its apparent disintegration. For the sake of the communication of my take on economics I will try and answer his questions, one by one.

I believe that the Federal Government has no place in running any deficits, ever. They do not have a Constitutional right to do so. Given that the Federal Government was originally set up to protect the shores and deliver the mail, and, based on our ongoing problems with immigration and the fact that the post office is about to go bankrupt, that they can't even handle those tasks, they obviously lack the aptitude, even if they had the mandate, which they don't, and thereby have no business attempting to manage the national trust in any other respect. Budgets deficits have always contributed to a weakened, and thus a recessionary/depressionary economic environment.

Zero percent interest rates provide no return for lenders. Whether those lenders be Mom and Pop savers lending their capital to banks, in the form of CDs, or other countries investing in Treasury Notes and Bonds, no interest provides little incentive for investment. The Federal Reserve has adopted the task of supporting the government by buying $85 billion of treasuries each month with money it creates out of nothing. Even a seven year old could tell you that eventually, the money will lose all its value. That day, in my opinion, is rapidly approaching. With it will come the decimation of the lives of millions through economic ruination. So many banksters...so few lamp posts.

Welfare benefits have greatly contributed to the economic ruination of the whole world. Welfare has aided and abetted the creation of a group that now constitutes the majority. It has, irreparably, contributed to the prevalence of Socialism, globally, whose only benefits are enjoyed by those elitists who are in control, and the ease with which they can enslave and control the masses, whose energies can then be effectively harvested. Charity, rather than rule of law, is the only way to successfully provide for the poor.

So long as there is no rule of law, and regulators do not constrain banks from nefarious investments (read in derivatives) some, if not most of these institutions are destined to become insolvent. Many, if not most of the large banks, in the world, are currently insolvent, zombified, and continuing to exist only with the aid of smoke and mirrors. We could play the blame game and prosecute bank management, whose shoulders the blame should fall on. We could take it a step further and prosecute the lobbyists, whose criminal machinations have criminally tempted our rapacitic congressional representatives to accept bribes, kickbacks and contributions. The next step would be to jail all the congressmen who have become so embroiled in this criminality that it has become "business as usual". Finally, we could step back and see that the real responsibility lies on the shoulders of the voting public who have allowed this den of vipers and money changers to take over the whole system, in which case everyone involved should be, and deserves to be, subject to big losses.

The dissolution of the middle class in the world is a devolutionary reaction to the application of an agenda that has been put forth by a group of megalomaniacal miscreants whose only goal is to rule the world. Their agenda does no involve any improvements or the altruistic provision of a better standard of life for any but themselves. Consequently, the pitiful lack of any ability to build or make positive contributions to the implementation of remedy, rather than the ongoing havoc the are wreaking in the exploitation of resources and the destruction of the planet's ability to "recharge" itself, has brought us to the precipice of disaster. Their "buying off of governmental administrations throughout the world have allowed for a blatant breakdown in the rule of law, which, in turn, has allowed for the feudalistic violation of property rights which are integral in the the right to life, liberty and the pursuit of property, These (some would say, God given) rights were won originally at the Battle of Hastings in 1066, and further cemented by signing the Magna Carta in 1215. The Magna Carta ("Great Charter") was intended to limit the powers of the monarch and proclaimed certain liberties for "freemen". That occurrence was an evolutionary event for humanity. Evolution is natural and a sign of health. Devolution is a sign of sickness. The infringement of these rights, along with tyrannical taxation is the cause of income inequality. The world is currently being run by a group of very sick individuals.

This seems to be a bit of a rhetorical question in that it should be obvious to all those who have retained any sense of critical thought that criminally unconstrained market forces have, and will continue to create environmental disasters. Take, for instance the BP debacle on the Gulf of Mexico. It has been evidenced, repeatedly, that both Haliburton and BP were criminally complicit in the disaster, and yet no criminal charges were ever brought against either company. Instead, the US Coast Guard was brought in, by the President, to exponentially exacerbate the problem by dropping millions of gallons of Corexit on the surfacing oil to make it sink. "Out of sight, out of mind". As a result of the introduction of the Corexit, the fisheries, that are the life blood of the Gulf Coast residents, have been irreparably contaminated, and will result in the death of millions of fish and people in the coming years. Unfettered market forces would have provided for the prosecution (and in many cases execution) of the participants. As a result of manipulated market forces, many members of our current administration are culpable and have, for the time being, escaped justice. The same diatribe could be applied to the Fukushima disaster, whose effects have now rendered Tokyo to be currently as irradiated as Fukushima was a year ago. Fukushima is currently suffering from continually increasing levels of radioactivity which will also kill millions, both in Japan and the US, far into the future.

Government support for anything does not stem from, and is not a result of, the application of any form of intellect. Technological progress is an intellectual pursuit. Any time the government gets involved in anything, it turns to dung. As a result of government action, the standard of life for every man, woman and child on the earth has been, and will continue to be stifled, stymied, crushed and curtailed. If the natural instinct for self preservation hadn't already been bred out of the population, the government would be far less intrusive, if it continued to exist at all.

On the Economic War Front

Precious Metals

Over the next nine years, as the Hunt's predicted inflation accelerated and racked the economy, Bunker and Herbert continued to use silver to hedge their assets with a vengeance. By the accumulation of more and more silver, they effectively protected their family's property and, single-handedly remonetized the white metal. Throughout the world people began to remember that real wealth consists of real assets, not paper money, and that real assets include gold and silver. This fact holds true more today than ever. Start purchasing silver bullion. Then buy some more. Community members, increase your holdings. Rather than just two brothers from Texas doing all the work, and consequently being an easy target, let's all become involved. Besides enriching ourselves through the exercise of buying and owning silver, we can passively wrest the control of the silver market out of the hands of the "Dark Side" and back into the hands of the people. This can bring about some very important changes, in one way, that will really make a difference. As the price of bullion subsequently rises, more and more people will begin to see Federal Reserve Notes for what they really are; fake money, and recognize and appreciate precious metals for what the really are; real money. If nothing else, it might make wars more expensive to fight. The downside risk is minimal compared to the upside potential. Oh, and by the way, for all you "Joe Six Packs" out there, a $10 bill you got in 2002 currently has the buying power of $3.50, (a loss of $6.50), while an ounce of silver you could have procured, at the same time, for $5.00, is currently worth $26.00, (a gain of $21.00). But the real deal is the two ounces of silver that you could have purchased for that 2002 $10 bill that would currently worth $52.00. That's a 520% increase on the original $10 but a whopping 1485% profit when you compare holding the FRN to holding the silver. Hey, it's a no brainer, (and that's a good thing considering the level of brain power utilized by the average brain dead American.) Most importantly, the price of silver, IMO, is about to "go to the moon."

Energy

So many politicians, so few lamposts...

The Fed

Fortunately, the Founders did not think like the majority. If the majority had ruled, we would have never had a revolution. The Founders were part of the minority and did not establish our government as a democracy. In fact, the only references to democracy in the founding documents of our nation were purveyed in a very negative light. Liberty is the concept on which our county was founded. Liberty is the only thing that insures our freedom. The Constitution and its first ten Amendments, (the Bill of Rights), provided for our liberties and therefore our freedom. Attempts by "the Dark Side" to subjugate the Constitution, (i.e..., the Federal Reserve Act, the Patriot Acts I and II, and any other legislation that tends to abort Constitutional mandates), have been veiled attempts to strip our liberties and therefore our freedom. Consider that in the past, we had Liberty coins, not Democracy coins. We have the Statue of Liberty, not the Statue of Democracy. We pledge allegiance to the flag, and to the Republic for which it stands, not the democracy for which it stands. Patrick Henry said: "Give me Liberty or give me death!", not "Give me democracy or give me death". The ideology of Liberty suggests and implies that people should choose to be benevolent and productive, as part of God's moral code. That society will create for itself non-governmental organizations to deal with social needs, that government is established by society to sustain and defend the unalienable (God given) rights of the individual, and limited only to this function. Political power was to remain within the individual and his society. So you may ask, if we live in a Republic founded upon the principles of Liberty and limited government, why do so many of our politicians and teachers keep trying to shove this concept of democracy down our throats, as if freedom naturally followed? That is a very good question! Perhaps puppet politicians and their masters don't like the limits on the powers that have been granted them by our state and federal constitutions. Maybe it's because majority rule sounds legitimate and moral on its face. The majority of "We the People" have apparently gone for their hooey. If we don't watch out, we may end up where we are heading. Only the knowledge of our heritage will enable us to anticipate such schemes and act accordingly to right the direction of our Republic. If we are to successfully alter the course of America, we must familiarize ourselves with our Constitutional tenets, and share them with everyone we meet. We must "Defend to the Death" the Constitution of the United States of America. Otherwise, we will be forced to take whatever "the Dark Side" decides to dole out. Making money use to be the highest and most meaningful contribution a free man in a free market could make to the economic vibrancy of our society. The Constitution originally contained the words: "Life, Liberty and the Pursuit of Property". Through the application of each individual's energies, in the "Pursuit of Property", the standard of life in our country was progressively raised for everyone. Unfortunately, through an insidious misinformation campaign, we have been duped by those whose wealth and position have allowed them to be tempted by, and then to succumb to, the lure of avarice and greed. They have decided that anything less than everything is not enough. "The Dark Side" has thwarted the essence of capitalism by engineering the demise of the Gold Standard. Through their incipient use of "political puppets" they have, over the course of the last two hundred years, finally succeeded in channeling the wealth, which comes as a result of human toil, into their coffers. The producers and savers of our county, it's life blood, are being methodically fleeced. Soon, the last meaningful productive job in America will be exported to China. On that day American society will become a zoo, and we, as citizens, will be reduced to the station of animals in a cage, totally dependent on the zoo-keepers for our food and shelter. All this has been promulgated by a collectivist mind-set. Central banking is the vehicle through which the most heinous rip off ever conceived in the history of the world has been perpetrated. The U.S. Federal Reserve is the most successful of all central banks in history. Since 1971 it's unfettered issuance of money has continued to debase our currency and as a result adulterated our living standard at an ever increasing rate.

Financial Survival History reveals nations can be conquered by the use of one or more of three methods. The most common is conquest by war. In time, though, this method usually fails, because the captives hate the captors and rise up and drive them out if they can. Much force is needed to maintain control, making it expensive for the conquering nation. A second method is by religion, where men are convinced they must give their captors part of their earnings as "obedience to God." Such a captivity is vulnerable to philosophical exposure or by overthrow by armed force, since religion by its nature lacks military force to regain control, once its captives become disillusioned. The third method can be called economic conquest. It takes place when nations are placed under "tribute" without the use of visible force or coercion, so that the victims do not realize they have been conquered. "Tribute" is collected from them in the form of "legal" debts and taxes, and they believe they are paying it for their own good, for the good of others, or to protect all from some enemy. Their captors become their "benefactors" and "protectors. Although this is the slowest to impose. It is often quite long lasting, as the captives do not see any military force arrayed against them, their religion is left more or less intact, they have freedom to speak and travel, and they participate in "elections" for their rulers. Without realizing it, they are conquered, and the instruments of their own society are used to transfer their wealth to their captors and make the conquest complete. Today, as we stand before the dawn of a New World Order run by internationalist financiers, most of the revenue collected by the Federal government in the form of individual income taxes will go straight to paying the interest on the debt alone. At the rate the debt is increasing, eventually we'll reach a point where, even if the government takes every penny of its citizens' income via taxation, it will still not collect enough to keep up with the interest payments. The government will own nothing, the people will own nothing, and the banks will own everything. The New World Order will foreclose on America." - Ammended from Sheldon Emery's "Billions for the Bankers, Debts for the People.

You must first realize that there are, present in our lives, enemies. You must then know who those enemies are and act accordingly. Eliminate as much debt as possible, especially “variable rate” debt, such as credit cards and lines of credit. Interest rates will be rising, so the elimination of debt offers a “real return” of escaping rising rates by creditors. Get some control over some fresh water. If you are depending on Social Security, stop. Follow the course opposite to custom and you will almost always do well...

More next week... May the Great Spirit be with you always,

Johnny

Silver Bear Disclaimer All statements and expressions are the sole opinions of the editor and are subject to change without notice. A profile, description, or other mention of a company in the newsletter is neither an offer nor solicitation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable, in no way do we represent or guarantee the accuracy thereof, nor the statements made herein. The staff of Silver Bear Cafe are not registered investment advisors and do not purport to offer personalized investment related advice. The publisher, editor, staff, or anyone associated with, or associated to the Silver Bear Cafe may own securities mentioned in this newsletter and may buy or sell securities without notice. |

|---|

Archives

04.13.13- "There are no dangerous weapons; there are only dangerous men."

04.06.13- A government that robs Peter to pay Paul can always depend on Paul's Support.

03.30.13- A word to the wise isn't necessary - it's the stupid ones that need the advice.

03.09.13- Yield to temptation. It may not pass your way again.

03.02.13- Life is not about how fast you run, or how high you climb, but how well you bounce.

02.23.13- Don't be afraid to take a big step;you can't cross a chasm in two hops.

02.16.13- The difference between genius and stupidity is that genius has its limits

02.09.13- We May Be Lost, but we're making good time

02.02.13- If we don't change course, we may end up where we are heading

01.26.13- Opportunities always look bigger going than coming

01.19.13- There's too much youth; how about a fountain of smart

01.12.13- Sixty-five-year-old, one owner, needs parts ...Make offer.

01.05.13- Lead me not into temptation, I can find it by myself

12.29.12- Never Underestimate the Power of Stupid People in Large Groups

Most of the travails of societies internationally, are a result of the pandemic apathy and passivity of large groups when it come to dealing with their so-called leadership. I can certainly understand the general reaction to "the point of a gun" and to the never ending urge of the ruling class' naturally desire to disarm the masses. Since the Second Amendment was included in the Bill of Rights as a remedy to tyranny, it only stands to reason that tyrants would prefer that we were unarmed. Those championing gun control are either dumbed-down morons, or tyrants. If the people did not fear the governments, politicians, worldwide, would be better behaved.

Most of the travails of societies internationally, are a result of the pandemic apathy and passivity of large groups when it come to dealing with their so-called leadership. I can certainly understand the general reaction to "the point of a gun" and to the never ending urge of the ruling class' naturally desire to disarm the masses. Since the Second Amendment was included in the Bill of Rights as a remedy to tyranny, it only stands to reason that tyrants would prefer that we were unarmed. Those championing gun control are either dumbed-down morons, or tyrants. If the people did not fear the governments, politicians, worldwide, would be better behaved. In 1970

the price of silver was at $1.50/oz. The Hunt brothers, Bunker and

Herbert, of Texas oil fame, were both acutely

aware of the wholesale theft of the Nation's silver stockpile that

had been taking place through the actions of the

In 1970

the price of silver was at $1.50/oz. The Hunt brothers, Bunker and

Herbert, of Texas oil fame, were both acutely

aware of the wholesale theft of the Nation's silver stockpile that

had been taking place through the actions of the  The following report reminds me of the everlasting Beatles' hit, Taxman:

The following report reminds me of the everlasting Beatles' hit, Taxman:

From

From  Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.

Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.