|

|

|

|---|

02.09.13- We May Be Lost, but we're making good time

As the editor of the Silver Bear Cafe, I spend most of my time researching current events. I explore the markets, the economic war that is being waged on the middle class, precious metals, the Federal Reserve, energy, and how to go about surviving financially. In this weekly column I will attempt to condense the week's events and examine how the news might affect your pocketbook. JSB Financial Markets I just finished a week in which I came in contact with several seemingly intelligent persons who simply, IMHO, did not get it. These folks are successful, upstanding citizens who prefer to believe that things economically, in America, couldn't be better. Now I realize that I am in Dallas, Texas and, because of the tax base provided by the Barnett Shale and contributing industry, things are not as dire here as they are in many parts of the country. The gentlemen that I was debating were also not part of the majority of Americans that are, in one way or another, on the Federal dole. It also had yet to occur to them that they were members of an endangered species which is, almost exclusively, made up of white, middle class men. They also refuse t realize how fragile their situations are being, almost entirely, dependent on the level of the stock market and the value of the dollar. Not one had any precious metals in their portfolios. I spend most of my time researching the markets and trying to "separate the bran from the chaff." The evidence of criminal misconduct by everyone from the Administration to the Security and Exchange Commission, is overwhelming. When searching for signs of honest politics, one generally come up empty handed. When searching for signs of honest banking, the results are even more dismal. And yet, the populace is intent on listening to elitest puppet Pollyannas who sing the recovery lullaby. Picking Your SideOffense

Defense

On the Economic War Front I finish each one of these Bear Track rants with a rule; you must first realize that there are, present in our lives, enemies. You must then know who those enemies are and act accordingly. By "act accordingly" I mean get prepared. Be aware of what is most likely to happen, given the circumstances. Be aware of who is responsible. Simply knowing what is about to happen will not be sufficient. Acting on that knowledge is paramount to your having a chance of maintaining an acceptable standard of life for you and your family.

Precious Metals The last thing that the powers that are engineering the devaluation of the dollar want to happen is for the world to wake up to the fact that precious metals represent un-inflatable money. Both gold and silver are rising in price. This rise is currently fueled mostly by the dollar's demise. When the resulting "demand panic" kicks in, and it will very soon, the value of precious metals will "go ballistic." It is my view, (and one that is shared by a great many others), that the failure of our current monetary system is imminent. From an economic standpoint, gold and silver will lend heartily to our salvation. Gold and silver will soon regain their positions as the anchors of an honest monetary system. The market will demand it, and the "powers that be" will have no choice but to let the market have its way. The presence of gold and silver in your portfolio will insure that you will emerge from the abyss with your capital intact. There is still time for you to reallocate a portion of your equity into the commodity sector, including gold and silver bullion, and gold and silver mining stocks. This move could well provide you with an unequaled measure of security. The gold standard is part of our Constitutional legacy. The subjugation of the Constitution is the root of all economic evils. If enough of us get together on this, we might be able to "Right the Republic".

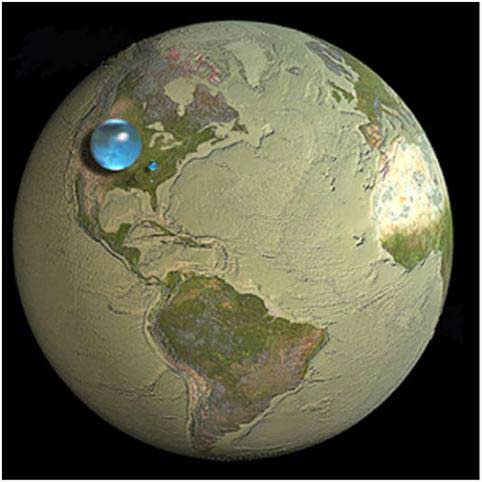

Energy In 1998, the World Bank refused to guarantee a $25 million loan to refinance water services in Cochabamba, Bolivia, unless the government sold the public water system to the private sector and passed the costs on to consumers. Bolivia, one of the poorest countries in the world, finally acquiesced. Only one bid was considered, and the company was turned over to Aguas del Tunari, a subsidiary of a conglomerate led by Bechtel, the giant San Francisco engineering and construction company. In December 1999, before making any infrastructure investments, the private water company, Aguas del Tunari, announced the doubling of water prices. For most Bolivians, this meant that water would now cost more than food; for those on minimum wage or unemployed, water bills suddenly accounted for close to half their monthly budgets, and for many, water was shut off completely. To add to the problem, the Bolivian government, prompted by the World Bank, granted absolute monopolies to private water concessionaires, announced its support for full-cost water pricing, pegged the cost of water to the American dollar and declared that none of the World Bank loan could be used to subsidize water services for the poor. All water, even from community wells, required permits to access, and even peasants and small farmers had to buy permits to gather rainwater on their property. The selling-off of public enterprises such as transportation, electrical utilities and education to foreign corporations has been a heated economic debate in Bolivia. But this was different; polls showed that 90 percent of the public wanted Bechtel out. Debate turned to protest and one of the world's first "water wars" was launched. The people of Bolivia revolted against the government over the privatization of water. A broad-based movement of workers, peasants, farmers and others created the Coalition in Defense of Water and Life to "de-privatize" the local water system. Between January and early February, 2000, hundreds of thousands of Bolivians marched to Cochabamba in a showdown with the government, and a general strike and transportation stoppage brought the city to a standstill. Police reacted with violence and arrests and the army killed six people and injured more than 100 when it opened fire on demonstrators. In early April 2000, the government declared martial law. Could this happen here? Is it possible that you could someday be charged for collecting rainwater off your roof? You would be surprised at how many trans-national companies already have stakes in water delivery in this country. Globally, we have already entered water scarcity. The Middle East will run out of fresh water within the next ten years. Sub-Saharan Africa will run out in the next 5 years. China is considering moving the capital to another location because there is no more water in Beijing. Closer to home, the mighty Colorado river no longer makes it to the Sea of Cortez. It trickles out somewhere in the Mexican desert south of the Arizona border. The Rio Grand, which use to flow into the Gulf of Mexico now stops some 20 miles short of Brownsville, Texas. Aquifers all over the country are being depleted far more rapidly than they can recharge themselves. We are on the verge of a national water crisis right here in America. In the next two decades, the struggle for water will tear apart communities, exacerbate differences between social classes, and challenge governments and private organizations to change how they perceive their roles.

The Fed The Federal Reserve is a bought and paid for group of stooges that act as a tool of the most evil individuals to ever inhabit the Earth. If there is one recurring theme on this web site that I highlight when ever the chance arises, it is to make sure that every warm bodied person that ever peruses the pages of the Bear comes away with the knowledge that the Federal Reserve is the root of all evil in the universe. I have found that no matter how many times or how many ways it is stated, it is never too many. If we all did or level best to rid the world of the Federal Reserve in particular and central banking in general, the world would be a much better place for all of humanity.

Financial Survival The term "currency wars" defines a measure of economic competition between Central Bankers. Almost every sovereign nation has a central bank. In the last week, Switzerland devalued the Franc in order to remain competitive when it comes to exports. The less your currency is worth, the less your exportable goods and services cost in relation to other currencies. On the downside the purchasing power of your average swiss citizen eroded, overnight. This matters not to the host of insiders that either knowingly converted their money into another currency or into gold and silver. Those not on the inside got screwed. Yesterday the same thing happened in Venezuela of a bit more extreme nature. A 46% devaluation! Almost half of the purchasing power of the savings of non insider Venezuelan citizens was stolen from them by their government. For those of you (or your friends that just don't get it) that believe that this couldn't happen here, get ready, 'cause here it comes.

You must first realize that there are, present in our lives, enemies. You must then know who those enemies are and act accordingly. Eliminate as much debt as possible, especially “variable rate” debt, such as credit cards and lines of credit. Interest rates will be rising, so the elimination of debt offers a “real return” of escaping rising rates by creditors. Get some control over some fresh water. If you are depending on Social Security, stop. Follow the course opposite to custom and you will almost always do well...

More next week... May the Great Spirit be with you always,

Johnny

Silver Bear Disclaimer All statements and expressions are the sole opinions of the editor and are subject to change without notice. A profile, description, or other mention of a company in the newsletter is neither an offer nor solicitation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable, in no way do we represent or guarantee the accuracy thereof, nor the statements made herein. The staff of Silver Bear Cafe are not registered investment advisors and do not purport to offer personalized investment related advice. The publisher, editor, staff, or anyone associated with, or associated to the Silver Bear Cafe may own securities mentioned in this newsletter and may buy or sell securities without notice. |

|---|

Archives

02.09.13- We May Be Lost, but we're making good time

02.02.13- If we don't change course, we may end up where we are heading

01.26.13- Opportunities always look bigger going than coming

01.19.13- There's too much youth; how about a fountain of smart

01.12.13- Sixty-five-year-old, one owner, needs parts ...Make offer.

01.05.13- Lead me not into temptation, I can find it by myself

12.29.12- Never Underestimate the Power of Stupid People in Large Groups

Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.

Its

not what you don't know that will screw you up, it's

what you know that is wrong. The spin you hear from the

mainstream media is intended to mislead you. Open your

eyes and face the future. If you leave your head in the

sand and ignore it, you are only leaving your butt exposed

for the world to kick. This all may sound like gloom

and doom, but when you get a handle on what is going

to happen, you will have a future filled with opportunity.

Fortune favors the Informed.