Send this article to a friend:

December

30

2023

Send this article to a friend: December |

Why 2024 Is the Most Important Year for Wealth Preservation

During times of economic turmoil, investors generally tend to become more conservative, more risk-averse. As we close the books on 2023 and look ahead to 2024, we expect there will be a major shift in focus to investing for wealth preservation. Here are three major factors that will play a role… Cash: A “necessary evil” that’s terrible at wealth preservation It’s always a good idea to have an emergency stash of cash for short-term use. Anyone who suggests otherwise isn’t following common sense. You’ll want some on-hand (under the proverbial mattress, perhaps?) and the rest somewhere safe like a savings account. But when it comes to anything beyond the short term, cash isn’t enough. Inflation erodes its purchasing power day by day – especially during times when official CPI reports don’t capture the actual cost-of-living increases we see every day. Adam Hetts, global head of multi-asset investments at Janus, explains when to consider alternatives to cash:

Longer term, there are a number of inflation-resistant investment options to consider. Only physical precious metals combine the benefits of inflation resistance and high liquidity that you’d want in a cash alternative. Remember, in 2024, the Federal Reserve is already anticipating a series of interest rate cuts. The banked embers of inflation will very likely burst aflame once again. In other words, it’s not a bad idea to consider inflation’s effects on your saving! One incredibly popular form of wealth preservation that’s also said to be inflation-resistant: Real estate. That isn’t looking particularly attractive right now, though… Real estate: Excessive prices and unaffordable mortgages Home prices nationwide are at or near all-time highs – on average, 70% more expensive than at the peak of the mid-2000s housing bubble. That alone might convince you real estate isn’t exactly an attractive proposition these days. The Fed’s attempts to fight inflation by raising interest rates has made mortgages a lot more expensive. That combination of high prices and costly credit has stalled the housing market in many areas. We know how supply and demand works – higher mortgage rates reduce affordability, which reduces demand. Eventually, prices compensate. If you’re one of the fortunate homeowners who locked in a 3% or lower mortgage, congratulations! I’m sure it would take an incredibly generous offer on your home to convince you to sell. If, on the other hand, you’re shopping for real estate? Unless you can pay in cash, your budget is going to be constrained by mortgage rates. Now, real estate is a local phenomenon. Depending on where you live, you may be seeing prices decline a smidge – or not. As Wolf Richter tells us in a recent article, the numbers are all over the place:

Some places, prices are still rising. Does that mean it’s a good idea to buy? Other locations, prices are falling – a better buy there? I don’t know! What I can say with certainty is, today’s real estate market is unstable. We’ll have to look elsewhere for wealth preservation. Banking crisis to enter “Stage 2”? Remember the bank crisis from back in March? It could happen again, and soon. In fact, one of Jim Rickards’ forecasts for 2024 calls for “stage 2” of the first banking crisis to take place after what he called the “quiet period”:

It’s a fairly easy forecast for Rickards to make, considering the fact that ratings agencies like Moody’s were asking “What if the banking crisis isn’t over?” earlier this year:

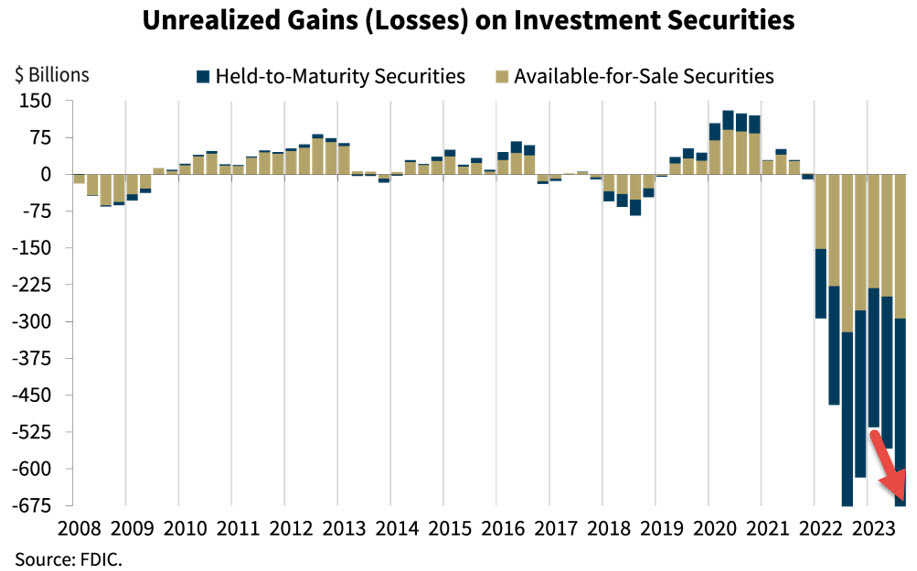

It’s fairly easy to see why Moody’s was asking this question, when you consider losses on bank reserves have actually increased 50% since March:

Original via FDIC. Marked to indicate decline in bank capitalization since March 2023. I‘ve said it before, and I’ll say it again: Banks need your trust because they don’t have your money. The Fed’s emergency Bank Term Funding Program (BTFP) is set to expire in a few months. And it’s worrisome to see the Fed’s lending has nearly doubled since Chairman Powell assured us that:

How does $675 billion in unrealized losses and $135 billion in emergency loans add up to a “sound and resilient” banking system? If it’s one thing history teaches us, it’s that banking crises wreak widespread economic havoc. Perhaps now is a good time to consider devoting less focus to growth, and putting more focus on wealth preservation in your retirement planning? Pivoting to wealth preservation If you want to consider preserving your wealth as a viable strategy for your retirement planning, then one way you can do that is to diversify your savings. When you’re properly diversified, you don’t have to choose between growth and preservation – you can have a little (or a lot) of both. Physical precious metals (especially gold and silver) have historically served as safe-haven stores of value, preserving wealth during even the most troubled economic times. That’s because precious metals have intrinsic value (based on both their inherent utility) as well as supply and demand. In fact, while inflation robs the wealth of everyday Americans, the price of gold has grown almost 13% overall (handily beating inflation). Both gold and silver have been historically proven to help preserve purchasing power. They’re both incredibly liquid assets, easily converted to cash when you need it. So don’t wait too long. Want to learn more about wealth preservation with physical precious metals? You can get the information you need to consider precious metals in our free kit.

|

Send this article to a friend:

|

|

|