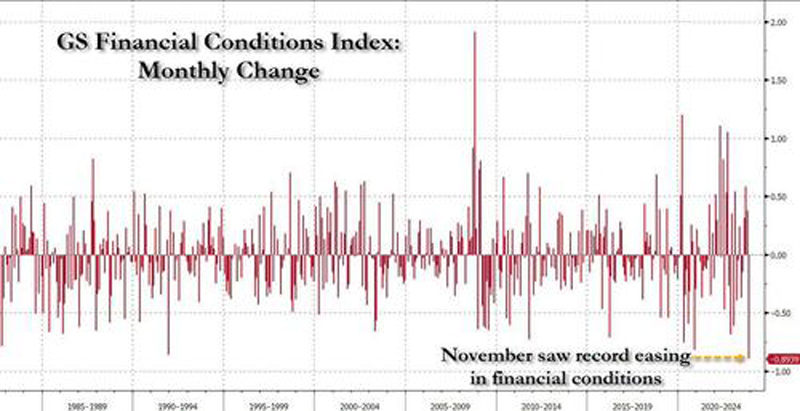

Will Fed Chair Crash The Party After Biggest Easing

In Financial Conditions On Record

Tyler Durden

As noted earlier, November was a scorching blockbuster month for markets after a run of three fairly weak ones, which has led to a big turnaround in some of the YTD numbers for 2023. In fact, it was the best month for global bonds since December 2008, the best month for US bonds since May 1985, as well as the strongest month for the S&P 500 this year and the second best November for US stocks since 1980 (only the insane 2020 was better). As noted earlier, November was a scorching blockbuster month for markets after a run of three fairly weak ones, which has led to a big turnaround in some of the YTD numbers for 2023. In fact, it was the best month for global bonds since December 2008, the best month for US bonds since May 1985, as well as the strongest month for the S&P 500 this year and the second best November for US stocks since 1980 (only the insane 2020 was better).

There is a reason for that: as the chart below shows, November saws the biggest easing in financial conditions in history.

This is how Goldman's Tony Pasquariello described the action:

- Beneath the hood, it was a clean sweep, and of significant magnitude: stocks up, rates down, dollar weaker, credit tighter.

- While there’s always a chicken-or-egg dynamic here -- and, perhaps the Fed chair will temper some of this impulse -- the fact is this: the markets have moved a lot, and they have done so in a way that is supportive of US growth.

- To put a line under the piece of the FCI equation that is comprised by equities, November was a ripper by any measure.

- To illustrate the point: S&P was up in 16 of 21 trading days and had its best month of the year (to say nothing of -- ahem -- the 11% rally in NDX).

- In many ways, it was one of those rolls where what could have gone right ... mostly went right.

Ok that was November, what now? Well, according to DB's Jim Reid, whether the trends of November continue into year-end will in part depend on Powell’s speech later today, or rather two speechs, which take place just before the FOMC blackout (ahead of the Dec 13 FOMC statement).

According to Reid, "market moves have been so great since he suggested that tight financial conditions were doing some of the Fed's job for them (November 1st) that you have to think he will address the subsequent moves and either push back or endorse." On balance the DB strategist thinks he may take a similar tone to Williams yesterday and push back a little while acknowledging the progress that has seemingly been made.

On that theme, NY Fed President Williams' remarks yesterday helped the month end on a soggier tone, especially for bonds. He said he expects “it will be appropriate to maintain a restrictive stance for quite some time to fully restore balance and to bring inflation back to our 2% longer-run goal on a sustained basis .” Separately, San Francisco President Daly said that “I’m not thinking about rate cuts at all right now”.

So going back to Powell's not one but two appearances today, first, at 11am ET, the Fed Chair is scheduled to sit down for a fireside chat with Helene D. Gayle, the president of Spelman College in Atlanta, in which they address the challenges of our post-COVID economy.

Then, three hours later, at 2pm ET, Powell and Federal Reserve Board Governor Lisa Cook will participate in roundtable to hear from local leaders in the tech innovation and entrepreneurship community during visit to Spelman College. It is less likely that he will discuss monetary policy here although one never knows what questions may be lobbed his way.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|