Warning: Stocks Are On the Edge of a Cliff!

Graham Summers, MBA

Stocks are breaking down because: Stocks are breaking down because:

1) The bull run begun in April is more than overdue for a correction.

2) The Fed has signaled that it might not cut rates again in December.

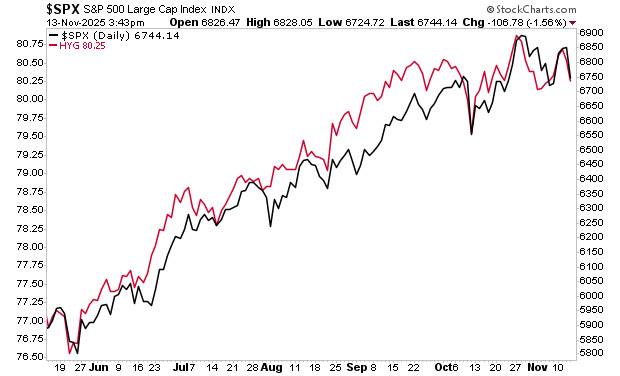

Regarding #1, the bull run begun in early April has been ludicrous in its strength. It is NOT normal for stocks to go straight up. The mere fact the S&P 500 had gone 130 sessions without touching its 50-DMA moving average indicated that stocks were due for a significant correction.

Moreover, both high yield credit and breadth had signaled that the S&P 500 had more downside to go. This downdraft was signaled well in advance to those who were paying attention.

Which brings us to #2.

Multiple Fed officials have signaled that they are not on board with another rate cut at the Fed’s December meeting (December 9th-10th). This, combined with stocks being overbought and overextended above key moving averages, has resulted in the market struggling to rally.

Stocks are on the ledge of a cliff. What happens next is critical!

In this context, the #1 question for investors is whether the bull market has ended and it’s time to “sell the farm.”

To answer this, I rely on a proprietary indicator that has triggered before every major meltdown in the last 50 years. This signal caught the 1987 crash, the Tech Crash, the Great Financial Crisis and more.

We detail this trigger, how it works, and what it’s saying about the markets today in How to Predict a Crash.

Normally we’d sell this report for $499, but in light of its recent warning, we’re making 99 copies available to the investing public.

To pick up one of the last copies…

CLICK HERE NOW!

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research

Graham Summers, MBA is Chief Market Strategist for Phoenix Capital Research, an investment research firm based in the Washington DC-metro area.

Graham’s sterling track record and history of major predictions has made him one of the most sought after investment analysts in the world. He is one of only 20 experts in the world who are on record as predicting the 2008 Crash. Since then he has accurately predicted the EU Meltdown of 2011-2012 (locking in 73 consecutive winners during this period), Gold’s rise to $2,000 per ounce (and subsequent collapse), China’s market crash and more.

His views on business and investing has been featured in RollingStone magazine, The New York Post, CNN Money, Crain’s New York Business, the National Review, Thomson Reuters, the Fox Business, and more. His commentary is regularly featured on ZeroHedge and other online investment outlets.

gainspainscapital.com

|