Send this article to a friend:

November

03

2025

Send this article to a friend: November |

Family Arguments Over Inflation? It’s a New Trend

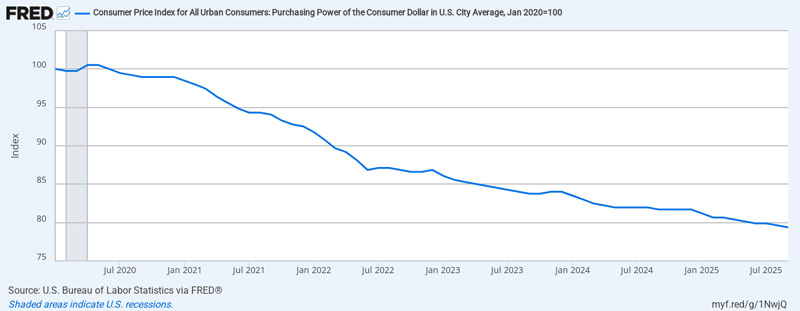

Let me start with a question you’ve probably never asked yourself: What if the story of the prodigal son ended differently? Stay with me – this is a financial discussion, not a theological one. In this version, the son still demands his inheritance early. But when the money’s gone, he doesn’t return home in humility. He turns his back for good – leaving his father not just heartbroken, but broke. It sounds like a dark twist on a familiar parable. Yet stories like this are playing out quietly across America today, with far more tragic endings than any sermon ever warned about. How does the prodigal son’s story play out in modern times? Too often, in our current day and age, the story of the prodigal son starts off the same as in Jesus’s parable. The son goes to his parents and says, “Give me my inheritance now!” And he gets it. This scene is playing out across the U.S. today. Swati Pandey and Amy Bainbridge with Bloomberg call it “inheritance impatience.” As you might guess, inheritance impatience is when an heir needs, asks for, or even demands to receive an inheritance now. Not “someday,” but now. An elderly lady in Australia named Joan gave savings of $70,000 of her savings to a relative to build a small apartment in their backyard for her to live in during her retirement years. The idea was that Joan would be able to live out her retirement years comfortably without having to pay rent or mortgage payments, saving her money during retirement. Then, the relative would have the apartment free and clear after Joan died, giving them a type of inheritance from Joan. The problem? They didn’t finish the apartment, and when the relative remarried, Joan was told to, basically, get lost. All of those funds were gone. Things like this happen more often than you’d think. Jilenne Gunther with the AARP tells us that people 60 and older lose nearly $30 billion a year from financial exploitation. The vast majority, nearly three-quarters of this financial abuse comes from family members. Now, it’s easy to climb on my soapbox and rail at these young spendthrifts impatient for their ancestors to die so they can start living large. But this isn’t a black-and-white story. "I want it now!" Inflation and inheritance expectationsYou’re probably feeling pretty outraged right now. I know I am. How could anyone behave like this? The answer, in many cases, comes down to necessity. The last five years have raised the cost of living out of reach for millions of Americans. Officially, our dollars have lost 20% of their purchasing power since 2020:

Unofficially, though? Since January 2020:

This kind of financial pressure is corrosive – mentally exhausting, physically stressful. When we can’t seem to get ahead no matter how hard we work, no matter how much we save? Well, it’s easy to see how people get pushed to the very brink. And sometimes over it. See, inflation doesn’t just take our purchasing power. It goes farther than that, straining the very fabric of relationships. Between employers and employees, between governments and citizens and between heirs and their benefactors. That’s one thing I wish the easy-money advocates and the MMT-enthusiasts could understand. The devastation caused by excessive debt, unconstrained spending and interest-rate repression. The real lives ruined by this relentless rise in the cost of living. Financial anxiety leads to another type of elder abuse, one slightly less reprehensible than inheritance impatience – but still dangerous. “Inheritance preservation” puts money before family In emergencies, we often find we need to convert savings into liquidity. Unexpected medical bills, a roof damaged by a severe thunderstorm, maybe a bad traffic accident. We don’t plan for something like this to happen – instead, we save, set aside a rainy-day or emergency fund. But to prospective heirs? They want your assets intact. To keep appreciating so they’ll eventually inherit more. This can cause friction. (It’s difficult to enjoy your golden years if you feel like every meal you eat is one your grandchildren won’t…) Family members oppose the decision – in cases with joint custody of assets, they may even block the transaction. Putting you in a financial bind. Prioritizing the future value of their inheritance over the person who earned and saved that money in the first place. It’s an ugly, ugly situation, however it plays out. If there’s one thing I want you to remember from these stories, it’s this: Inflation damages more than our purchasing power. Once you understand that, at least you can prepare for it. These challenges aren’t going away As bad as these stories are, the fact of the matter is that they will almost certainly become more common and get worse. We live in a world that values right now over right. Yes, that’s partially human nature. Inflation makes it worse. And we see it not just from individuals but from governments (which are made up of people), too. Politicians make promises to get elected and to stay in office (“Vote for me to get free healthcare forever!”). Congress, after all, was granted “the power of the purse.” And when all you have is a hammer, every problem looks like a nail. We all know the federal spending hasn’t slowed down (another $1 trillion in just 79 days!). We can’t realistically expect it to slow. Promises of taxation or spending less just doesn’t win elections. So those bills get paid through inflation – the tax nobody voted for, yet everybody pays. Inflation protection is one of the greatest benefits of diversifying with physical precious metals. There’s also the peace of mind that comes from knowing you own tangible assets that can’t be hacked – that are more than numbers on a banker’s spreadsheet. Somehow, for those of us who own real gold and silver, their very existence is comforting. (There even more benefits of owning precious metals.) Is diversifying with gold and silver right for you? You can start your due diligence by finding out more about the benefits of owning precious metals. Sources

|

Send this article to a friend:

|

|

|