Are There Too Many People Or Too Few?

John Rubino

With financial collapse and global war inching closer every day, you’d have to be an anxiety junkie to worry about distant things like demographic trends. With financial collapse and global war inching closer every day, you’d have to be an anxiety junkie to worry about distant things like demographic trends.

Still, the population debate is interesting, with economists, statisticians, and techies disagreeing over whether the world of 2100 will have too many people, too few, or just the right number. To summarize the three scenarios:

Too many people. We already exceed the Earth’s carrying capacity and developing country populations will continue to increase for at least the next half-century, leading to mass extinctions, degradation of farmland and aquifers, and widespread famine. Meanwhile, automation will eliminate millions of jobs, causing mass unemployment, civil unrest, and bankrupt governments. This is “negative feedback loop” all the way down.

Too few people. Birth rates are plunging and by mid-century there won’t be enough young workers to support a growing number of retirees, resulting in a global inflationary depression and/or massive cuts in social programs that leave millions of retirees destitute.

Just the right number. Theworkforce shrinks while automation eliminates jobs, keeping labor markets more or less in balance. Productive capacity expands, retirees are supported, and the environment starts to heal.

It really does matter which of these actually happens.

How we got here

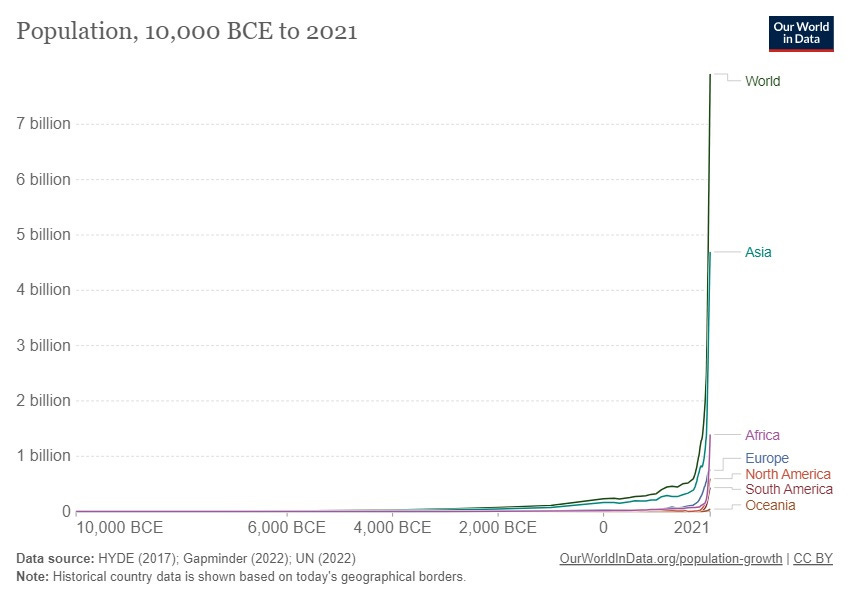

The human population has exploded thanks to industrialization, fossil fuels, and better public health:

But now birth rates are plunging. A population is stable when the typical woman has 2.1 kids. During the past few millennia, that number was obviously a lot higher (see above). But lately, birth rates have plunged, with the “replacement rate” threshold just a few years off.

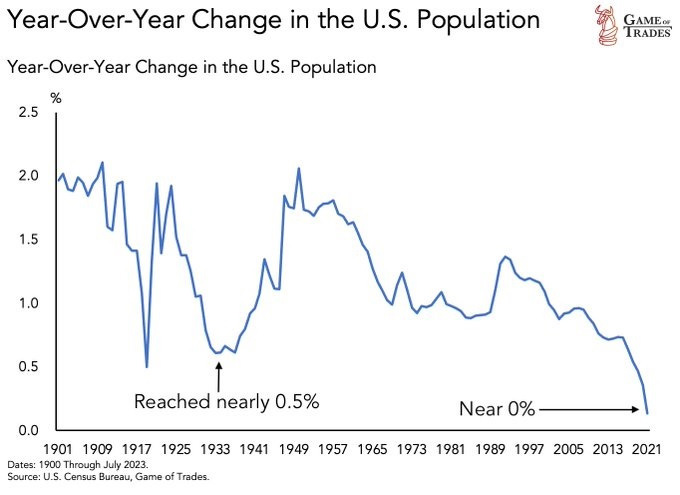

Here in the US, we’re tracking the global rate pretty closely:

Why the sudden fertility collapse?

The short answer is urbanization. In agricultural societies, children are free labor so people have lots of them. When people move from farms to cramped apartments in crowded cities, kids are more trouble than they’re worth, so families shrink. Today’s world is rapidly urbanizing, so fertility rates are plunging.

Some populations, including big ones like Germany and China, are already declining. But Italy is leading the way in Europe. From Reuters:

Births in Italy dropped to a new historic low below 400,000 in 2022, national statistics bureau ISTAT said on Friday, as the population continued to shrink.

Italy’s dearth of babies is considered a national emergency, and fixing the problem was a prominent policy pledge by Giorgia Meloni ahead of last year’s election which saw her become the country’s first woman prime minister.

Last year Italy recorded more than 12 deaths for every seven births and the resident population fell by 179,000 to 58.85 million, ISTAT said in its annual demographic report.

Italy recorded 392,600 births in 2022, down from 400,249 the previous year, ISTAT said, the 14th consecutive fall and the lowest number since the country’s unification in 1861.

The fertility rate edged down to 1.24 children per woman from 1.25 in 2021. Italy’s overall population has been falling steadily since 2014, with a cumulative loss since then of more than 1.36 million people, equivalent to the residents of Milan, the country’s second biggest city.

ISTAT predicted in September that Italy could lose almost a fifth of its residents, with the population set to decline, under a baseline scenario, to 54.2 million in 2050 and 47.7 million in 2070.

Japan, meanwhile, offers a glimpse of Asia’s future:

(Nippon) – Japan’s population, which stood at 126.2 million in 2020, will drop below 100 million by 2056 and to 87 million or around two-thirds of the current figure by 2070, according to reported projections by the National Institute of Population and Social Security Research.

Japan’s population grew continuously after World War II, surpassing 100 million for the first time in 1967, during a period of rapid economic growth. After peaking at 128.1 million in 2008, however, the figure has been falling ever since. The 87-million projected population for 2070 is almost the same level as it was in 1953 when the country was still recovering from the aftermath of the war.

A breakdown of the population composition in 2070 shows 33.7 million people or 38.7% are predicted to be seniors aged 65 or over. In contrast, the working-age population (aged 15 to 64) will be 45.4 million, meaning that the number of workers supporting each senior will decrease from 2.1 to 1.3. The working generation, who normally drive both production and consumption, may become overwhelmed by the extra burden of social security. The population of children, aged 0 to 14, is predicted to fall to 8.0 million by 2070, representing less than 10% of the total population, leading to concern that Japanese society will not be sustainable.

Can a single worker support both themself and a retiree? That doesn’t seem mathematically possible, hence the financial doomsday predictions.

Immigration to the rescue?

Fertility stats for individual countries don’t include the several billion poor, desperate people who would happily move to Europe, the US, or Japan. From the previously quoted Reuters article on Italy:

[Italy’s falling births were] offset by immigration, with immigrants exceeding emigrants by 229,000 last year compared with a net inflow of 160,000 in 2021. Foreigners made up 8.6% of the country’s population in 2022, for a total of 5.05 million.

So shrinking countries can, if necessary, just import new workers to maintain their population. But this risks the replacement of their culture with an alien one, thus defeating the purpose of the program. Better, perhaps, to stay Japanese or Italian to the bitter end than commit cultural suicide half a century early. For developed countries, this might be the central political debate of the next few decades.

Automation: savior or existential threat?

Goldman Sachs predicts that AI will automate 46% of administrative jobs, 44% of legal jobs, and 37% of architecture and engineering. In developed countries, this would mean 28% of workers being replaced by machines. In a sign of things to come, IBM recently announced plans to replace almost 8,000 jobs with AI, with human resources professionals being the first to go.

But Goldman notes that emerging technologies also create new jobs, so the net impact isn’t clear.

Then there’s Elon Musk

(Yahoo) – While speaking at the U.K.’s inaugural A.I. Safety Summit last week, serial founder, investor, and CEO Elon Musk predicted that AI would inevitably remove the need for all jobs.

“It’s hard to say exactly what that moment is, but there will come a point where no job is needed,” Musk told U.K. Prime Minister Rishi Sunak. “You can have a job if you want to have a job, or sort of personal satisfaction, but the AI will be able to do everything.”

That may sound alarming to many, and even Musk joked that he wasn’t sure “if that makes people comfortable or uncomfortable.” But Musk’s perspective was apparently more positive, describing his vision as a “protopian” future with AI.

“I think everyone will have access to this magic genie, and you’re able to ask any question. It’ll be certainly bigger for education. It’ll be the best tutor,” he said. “And there will be no shortage of goods and services. It will be an age of abundance.”

He also suggested AI will lead to a “universal high income,” an apparent superior to universal basic income, which other Silicon Valley figures like Sam Altman and Mark Zuckerberg have advocated for. “We won’t have universal basic income. We’ll have universal high income,” Musk said, without clarifying how the two differ. “In some sense, it’ll be somewhat of a leveler, an equalizer.”

Totally manageable transition

The deeper one digs into the population issue, the less scary it becomes. For every demographic threat, there’s a solution. But since the (always preferable) laissez-faire approach won’t work in cultures where free individuals are choosing not to reproduce, this might be an issue where even libertarians will have to hold their noses and accept major government interventions. Some examples:

- Low birth rate countries can create immigration programs that actively recruit adults with useful skills, and/or young people from compatible cultures (emphasis on “compatible”). Then eschew multiculturalism and encourage/demand assimilation. The work gets done and the culture survives.

- Low birth rate countries can also just pay people to breed. As with most other things, there’s a number that gets results, and a coordinated policy of tax breaks, direct cash payments, and subsidies for daycare, education, housing, etc., might make parenting an attractive job. Ideally, the extra kids thus produced would more than cover their cost by working and paying taxes.

- If automation is eliminating too many jobs, tax the robots’ owners and use the proceeds to finance new private sector opportunities, institute mandatory national service, and/or beef up the social safety net. This is a version of Elon Musk’s “post-scarcity” techno-utopia, and the sudden emergence of AI brings it into sight.

Assuming we get through this decade’s immediate threats, it might be a relief to confront some problems that have actual solutions.

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble(DollarCollapse Press, 2014) andÊThe Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

rubino.substack.com

|