Send this article to a friend:

November

24

2023

Send this article to a friend: November |

Gold: Resistance Is...Finite

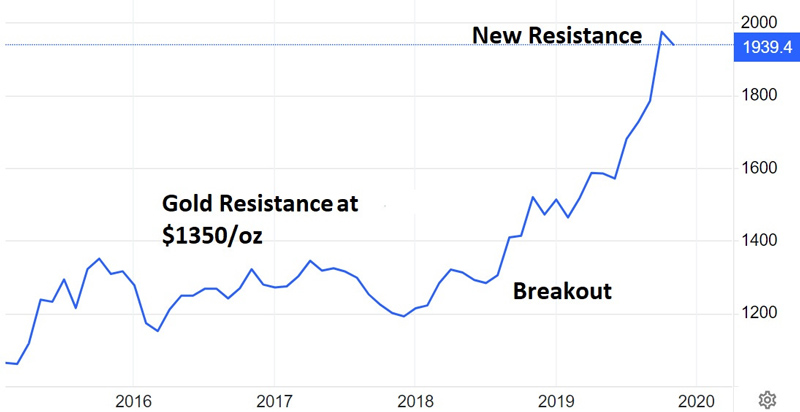

Today’s gold chart is a classic example. Since July 2020, gold has repeatedly threatened $2000/oz, only to be smacked back down by all the people who bought at $1000 and see $2000 as a psychologically comforting place to take profits.

Resistance is finite Selling interest at a given price is not unlimited. So one way that this might resolve is for gold to keep threatening $2000 until the number of sellers diminishes to irrelevance. It will then be free to rise with little new resistance until the next big round number — say $2500. How close is gold to penetrating resistance? Well, $2000 has held for 3+ years, which means a lot (most?) of the potential selling has already happened. For a sense of how this might look, check out gold’s last resistance battle. Between 2015 and 2019 its price bounced off ~ $1350 four times, until gold bugs began to wonder if $1400 was forever out of reach. But the same repetition that demoralized the longs eventually exhausted the sellers, and when gold finally pierced $1350 it was off to the races until 2020, when it hit the current $2000 resistance.  There’s no guarantee that this pattern will repeat. But both recent history and human psychology say it’s definitely possible. Subscribe to John Rubino's SubstackThousands of paid subscribers Survive and Thrive in the Coming Crisis .

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble(DollarCollapse Press, 2014) andÊThe Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

|

Send this article to a friend:

|

|

|