Send this article to a friend:

November

27

2023

Send this article to a friend: November |

Is Gold A Manipulated Market?

Some readers responded to last Wednesday’s post on gold’s trading pattern (Gold: Resistance Is … Finite) with shock that I didn’t know gold is a manipulated market where technicals don’t matter. This gives us a good jumping-off point for a look at several forms of gold manipulation that have been practiced over the years:

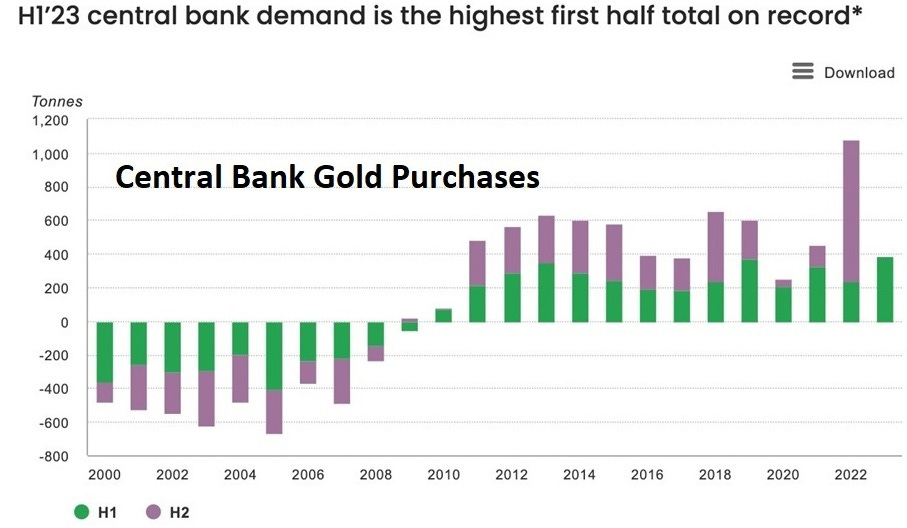

But those days are over now Europe, Canada, and the US dumping their gold definitely restrained the metal’s price, which would be $5000 or more in a truly free market. But this suppression was achieved by central banks that had a measure of control over the market, and that control ended in 2008 when other central banks started buying gold. The following chart shows that central banks were net sellers of gold prior to the Great Recession. But when the Fed, ECB, BoJ, and BoE met the housing crash with massive QE while using the dollar as a weapon against any country that threatened the Empire’s interests, other central banks started buying gold for protection. And lately, that buying has become a frenzy. The most recent data (not shown here) has 2023 coming in on par with 2022. 1,000 tons of gold in a single year is massive accumulation.  Now let’s consider gold’s trading action in this century. Does the following chart look like an artificially suppressed asset? Not really. Gold had a hell of a run when QE and negative interest rates first reared their ugly heads and then treaded water for a while to build a new base. Very normal free market trading behavior.

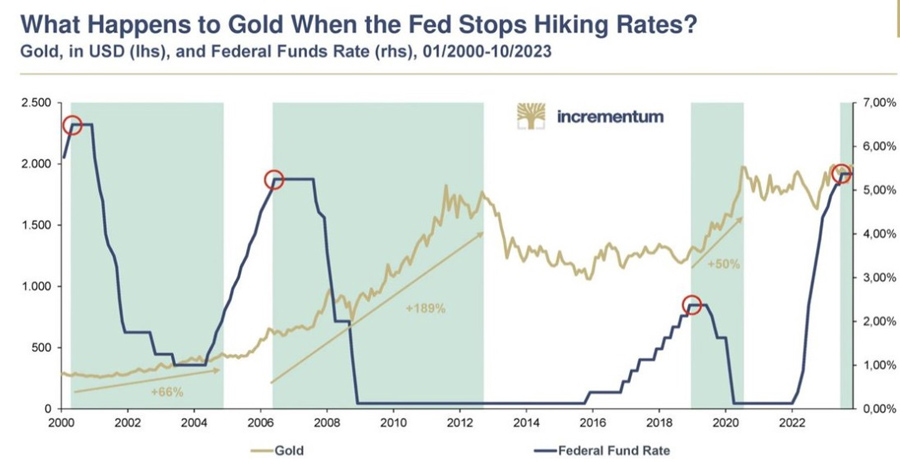

Good luck manipulating this market Today, the West can go ahead and sell as much gold as it wants. China, Russia, and India will happily take it, and then some. The impact of those sales on the price of gold is minimal in the short run (because it’s met with enthusiastic buying) and positive in the long run because the more gold the BRICS countries accumulate, the higher its likely future price becomes. Actually, the following chart is more important to gold’s near-term price action than any kind of manipulation. When the Fed stops tightening, gold goes up, easy peasy. And 2024 will almost certainly see the Fed stop tightening and stat easing, possibly in a panic.

Subscribe to John Rubino's SubstackThousands of paid subscribers Survive and Thrive in the Coming Crisis

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble(DollarCollapse Press, 2014) andÊThe Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

|

Send this article to a friend:

|

|

|