Send this article to a friend:

November

08

2023

Send this article to a friend: November |

The Dark Side of Globalization: How You Pay the Price

Globalization is an economic miracle made possible by our technological achievements. Information, trade and capital circulate worldwide every second of every day. It’s easy to take this for granted! Stop for just a moment and reflect on the sheer number of miners, manufacturers and shipping companies that contributed to a single finished product – say the iPhone in your pocket. Each iPhone contains 60 different elements, from antimony to zinc. A total of 43 countries on all six populated continents provide raw materials and finished subcomponents, each of which has to be transported from its origin to its destination. Why am I going on about this? Because, for all the incredible benefits and wealth globalization has brought us, it also means unexpected events on the other side of the world can rattle the foundations of your financial stability. After experiencing the highest national gas prices in U.S. history during the Bidenomic inflationary heat-up in June last year, where average prices topped $5 a gallon, we could use a break from what seems like an endless conveyor belt of economic turmoil. The COVID panic, the Fed’s mishandling of the crisis, then the ongoing conflict in Ukraine… A lot keeps happening. Thanks to globalization, all of it affects you. What happens over there doesn’t stay over there Which leads us to the most recent flashpoint. The surprise attack on Israel and the war now raging in the Middle East has taken yet another dark turn, according to Reuters:

I think we can agree that this war is tragic. Like any war, it’s extremely complex, with a great deal of history and regional politics at play. I don’t want to ignore these factors – instead, I want to focus on the economic and financial consequences we can expect here in the United States. When a terrorist group attacks a sovereign nation, that’s one thing. When a terrorist group armed and supported by several sovereign nations attacks another nation, that’s a war. And wars are economically devastating for more than just those pulling triggers. For example, the World Bank reports that crude oil prices will likely skyrocket in the near-term, meaning higher gas prices for everyone:

Making matters worse, Russia also created a supply bottleneck:

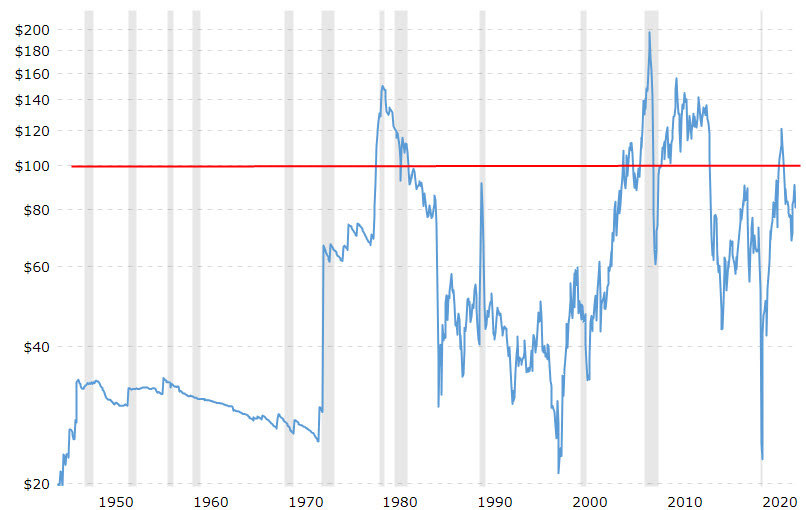

Now, we’ve seen crude oil prices over $100/barrel, but not very often – just five times in the last 80 years (see chart below, source):  70-year history of crude oil prices via MacroTrends, with red line indicating $100. Crude oil prices are incredibly important to the global economy. Think about it: Fossil fuels supply 84% of the world’s energy. Crude oil is 40% of the world’s energy, and the majority gets refined into the aviation fuel, diesel and gasoline required for transportation. Ultimately, when oil prices surge, so does everything else! Farmers paying more to fuel their tractors and harvesters? Food prices rise. Since virtually every plastic is made from petroleum, prices on manufactured goods rise. And, of course, since every finished product must be shipped from factory to warehouse, prices on everything rise… With this in mind, it shouldn’t surprise you that economic turmoil has historically followed massive surges in oil price… History’s “Oil Shocks” show us just how bad the next one might be One of the most famous oil price shocks started in 1973. Known as the Arab Oil Embargo, it started a chain of events that resulted in both the first time oil prices hit $50 a barrel and the first time oil topped $100 per barrel. Here’s a summary, via the Federal Reserve History website:

In a nutshell, then: The U.S. sent aid to Israel which had been surprise-attacked by a coalition of Arab nations led by Egypt and Syria. In retaliation, those nations stopped selling oil to the U.S. Oil prices quadrupled, and the resulting shock created not one but two major recessions. And major price surges not only at the gas station but on all transportation, from aviation to the U.S. Postal Service. The inflation lasted well into the 1980s, and savaged the purchasing power of the U.S. dollar permanently. Note: You may not think $11.65/barrel crude oil is a big deal. Adjusted for inflation, that $11.65 would be about $80 in today’s dollars. Remember, though, an “oil shock” isn’t just about price – it’s about the rapid surge in price. Think about your personal financial situation. How many of your bills could quadruple overnight without causing major economic stress? If my phone bill went up that much, I’d cancel my service in a heartbeat. If my mortgage went up that much, though, I’d be in real trouble… If one oil price shock wasn’t enough, another major one took place during the 2008 financial crisis, and resulted in oil rising over $100 per barrel for four years:

While we were distracted by the Federal Reserve’s bailouts of banks, the global energy market was going bananas. Regardless of who was ultimately responsible, there is no doubt that crude oil prices rose to historic levels during (and after) the 2008 financial crisis. So this leaves us with the more important question: What can we expect in the months ahead? The answer is: It depends on how the various geopolitical tensions work themselves out. The more parties who involve themselves, the more the conflict spreads, the greater an economic impact it will have. Even if you don’t follow the news about what’s happening over there, I hope I’ve explained to you why it matters over here. So what can we do about it? Bracing yourself for “retirement shock” Enduring the next oil price shock (or any unexpected economic development) boils down to this tactic: diversify your assets for safety as well as growth. That means during troubled times like these it might be best to consider historic safe haven assets that offer wealth protection. Physical precious metals like gold and silver historically acted as safe havens during both of the oil price shocks and the economic catastrophes of the 1970s and the 2008 financial crisis. Gold especially has historically outperformed inflation, and is more liquid might think (which can be helpful if geopolitical tensions escalate even further). Don’t wait, take back control of your financial future, and get all the information you need to consider precious metals in our free kit.

|

Send this article to a friend:

|

|

|