U.S. Caught in Death Trap

Brian Maher

Imagine a fellow… Imagine a fellow…

This is a wastrel sunk impossibly in debt — credit card debt.

Spiraling interest payments begin to swamp him.

He must take on an additional credit card in order to satisfy interest payments on the original.

Yet he must soon take on another credit card… to service the interest on the card he previously took on… which he took on to service the interest on the first.

That is, he must borrow money to service previously borrowed money. Reduce the thing to its essentials and you will find:

The money he borrows is dead money. It lacks all productive purpose.

He is merely shoveling it into a roaring fire.

Yet Pelion goes heaping upon Ossa.

That is, his situation deteriorates further yet…

Rising Interest Rates

To his fantastic alarm, interest rates begin to gallop on him. That means he must pay more and more money to service his debt.

Before he knows what has struck him… he is undone… bankrupt.

Well friend, here you have the government of the United States.

It is the reckless and improvident fellow just described — who opens new credit cards to service the interest on existing ones — who is the slave of nonproductive debt.

Projected interest payments on the nation’s debt presently exceed $1 trillion annually.

And the cost to service that debt has doubled in the past 19 months alone — doubled!

The nation is far along the ruinous path. How far down the ruinous path has the United States wandered?

The Day of Reckoning Is in Sight

Mr. Alasdair Macleod, economist:

The day of reckoning for unproductive credit is in sight… Malinvestments of the last 50 years are being exposed by the rise in interest rates, increases which are driven by a combination of declining faith in the value of major currencies and contracting bank credit. The rise in interest rates is becoming unstoppable…

The interest bill is already growing exponentially. We can see that the funding requirement for new debt will be $2 trillion in excess spending, plus at least another $1.3 trillion of interest (allowing for the $7.6 trillion of debt to be refinanced), totaling over $3.3 trillion in total. Clearly, it won’t take much more of a credit squeeze and the increasing likelihood of a buyers’ strike to push the interest bill to over $1.5 trillion…

Irrespective of central bank policy, the shortage of credit is driving borrowing rates higher, and the cost of novating maturing debt is rising, if the credit is actually available — which increasingly is rarely the case.

It is an old-fashioned credit crunch, not really seen since the 1970s. And it has only just started… The big picture is of an asset bubble which has come to an end. And by any standards, this one was the largest in recorded history.

It is our sincere hope that you are wrong. It is our profound fear that you are correct.

Yet cannot the Federal Reserve and its brother central banks reach into the deep trick bag into which they reached last decade — interest rate suppression, quantitative easing and the rest?

Will not these magic tricks prove adequate next time?

No says Mr. Macleod…

The Black Hole of Extinction

Thus we are informed:

The era of interest rate suppression is over. G7 central banks are all deeply in negative equity, in other words technically bankrupt, a situation which can only be addressed by issuing yet more unproductive credit. These are the institutions tasked with ensuring the integrity of the entire system of bank credit.

This is not a good background for a dollar-based global credit system that is staring into the black hole of its own extinction.

Just so. Yet with the highest respect, sir, we have heard this “doom and gloom” before.

In fact, we have heard it issue from an orifice upon our very face, the one directly beneath the nasal bas.

For three decades — at least — these cries have come issuing.

And for three decades it has been a cry of wolf.

In each instance the financial system has been knocked horizontal… it has shortly regained the vertical.

Whether under its own steam or assistance from the financial authorities, it has gotten up.

Why should next time prove different?

Why This Time Is Different

Here Mr. Macleod inform us why “this time is different”:

This time, the Global South, the nations standing to one side of all this but finding their currencies badly damaged by unfavorable comparisons with a failing dollar, a dollar forced into higher interest rates in a world that knows of nowhere else to go — this non-financial world is on the edge of abandoning American hegemony for a new model emerging from Asia.

The Global South’s rise is different you say. Do you care to elaborate, sir?

That the U.S. government is ensnared in a debt trap and is being forced to borrow exponentially increasing amounts just to pay the interest on its mountainous debt is not the fault of other nations. But many of them in turn are being forced to pay even higher interest rates, irrespective of their budgetary positions, and irrespective of their balance of trade. Yet their currencies continue to weaken even against a declining dollar.

A conundrum! They are chained to the dollar. It is a liability. They are prisoner to it. What can they do?

The Global South, which is the new name for those either in the Asian hegemons’ camp or considering joining it will need to find an alternative… The pressure for a whole new monetary system for the emerging nations is increasing… There is only one answer, and that is to abandon the dollar.

Perhaps the potential BRICS currency of which Jim Rickards so often speaks represents an omen — a straw swaying in the wind.

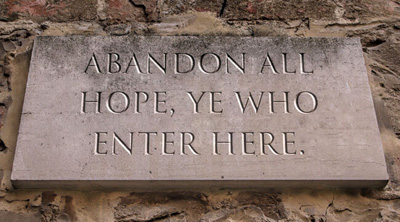

The Wages of Sin

Thus the United States confronts the wages of its monetary and fiscal sins.

It has cast all restraint to the scattering winds. It has sacrificed the morrow upon the altar of the present.

And it has made its dollar headache the world’s migraine.

A private concern would confront bankruptcy under Chapter 11 of United States Bankruptcy Code.

The United States government will not confront bankruptcy proceedings of course.

It does — after all — maintain access to a press that prints money.

It can make all its shortages good… in nominal terms at least.

The debtees will get their money. In reality they will get sawdust…

The Wicked

“I borrowed $100 from you, good sir? Well, here is your $100 back, as promised. I hereby discharge my fiduciary responsibility to you. I have fulfilled my contractual obligations.”

“But the $100 I loaned you is now only worth $22.08, because of the vicious inflation you caused” comes the bitter reply. “You’ve robbed me blind! You’re a goddarned crook, that’s what you are.”

“Your problem, not my problem,” answers the deadbeat.

That is Uncle Samuel for you.

“The wicked borroweth, and payeth not again,” Psalms informs us.

This uncle of ours is a cad. He is a bounder. He is a scoundrel.

He is wicked…

Brian Maher is the Daily Reckoning’s Managing Editor. Before signing on to Agora Financial, he was an independent researcher and writer who covered economics, politics and international affairs. His work has appeared in the Asia Times and other news outlets around the world. He holds a Master’s degree in Defense & Strategic Studies.

dailyreckoning.com

|