The Changing World Order Is Approaching Stage 6 (The War Stage)

Ray Dalio

In this post, at the beginning I will show you how what is now happening is tracking the archetypical Big Cycle, and near the end I will show you how wars typically change how the systems work and how the markets and economies behave. In these 4,500 words, I will be packing in a lot to explain the mechanics of what is happening. While I tried to make it simple, if you find it too dense, just scan to the next section. I promise you that it will be worth it. In this post, at the beginning I will show you how what is now happening is tracking the archetypical Big Cycle, and near the end I will show you how wars typically change how the systems work and how the markets and economies behave. In these 4,500 words, I will be packing in a lot to explain the mechanics of what is happening. While I tried to make it simple, if you find it too dense, just scan to the next section. I promise you that it will be worth it.

The Big Cycle

History shows that the movements to civil and/or international wars that change the domestic and world orders take place via a progression of stages that transpire in big cycles that have occurred for logical reasons throughout history. I believe that reviewing how the typical Big Cycle works, what stage we are in, and what typically comes next is now especially important. That is because the evidence points to us being on the brink of civil and/or international war (in my book Principles for Dealing with the Changing World Order, I describe this as late Stage 5, on the brink of Stage 6) and because without understanding how these cycles transpire, we will simply observe events in the news without being adequately prepared for them or able to prevent them.

To be clear, when I say that I believe we are on the brink of civil and/or international war, I am not saying that we will necessarily go into them or that, if we do, it will happen very soon. What I am saying is that the different sides in domestic and international conflicts are preparing for war and if events are allowed to progress as they typically do, there is a dangerously high probability of us being in at least one of these wars if not both in about five years, give or take about three (with the highest risk point being in 2025-26).

While the part of the cycle we are now in has not occurred before in our lifetimes, it has occurred many times before, most recently in 1930-45. For that reason, I believe that now is the time to reflect on how the cyclical cause/effect relationships lead to the progression of events that makes up the Big Cycle, and what we should do individually and collectively to deal with these progressing realities.

The good thing is that the scary realities are now much more broadly recognized than they were a couple of years ago. The bad things are that a) conditions are deteriorating even faster than I expected, b) the cause/effect relationships and how they progress are not well understood, and c) nothing much is being done to halt their progressions.

Approximately two and a half years ago, I described the Big Cycle in a series of posts that would eventually become Principles for Dealing with the Changing World Order. At that time, many people thought the picture I painted—of a cycle that was leading us toward a financial and economic crisis, great internal conflicts bordering on a type of civil war, and great external conflicts that could lead to some form of international war—was implausible and exaggerated. Now that the financial and economic problems (most obviously the stagflations), the internal conflicts between populists of the left and populists of the right, and the international great power conflicts have intensified, most people see them. Still, most people look at each of these events in isolation rather than putting them in the context of the evolving Big Cycle. This is concerning because the cycle is progressing quickly, which has raised the odds of moving to Stage 6 (the civil war/war stage) to uncomfortably high levels.

How The Big Cycle Works and What’s Now Happening

To review, the Big Cycle is most importantly made up of three big cycles: 1) the long-term debt-money-economic cycle, 2) the internal order-disorder cycle, and 3) the external order-disorder cycle. Together, they determine the levels of financial stability, internal stability (within countries), and international stability (between countries). These levels change via intertwined cycles that reinforce each other, producing both improvements and deteriorations in conditions that together make up the Big Cycle. For example, when financial problems occur at the same time as large internal and external conflicts over wealth, power, and values, that produces a perfect storm. These three cycles and their confluence usually take people by surprise because they haven’t seen them before. That is because they typically last longer than a lifetime, so one typically experiences each phase only once a lifetime, or not at all.

While in today’s post I can only briefly summarize the Big Cycle, if you want a much more comprehensive explanation you can get it from my book Principles for Dealing with the Changing World Order. For those of you who have the book, in this post I will give you corresponding page numbers so you can refer to the more comprehensive versions of the points being made. Also, because different countries are in different stages of the Big Cycle, I shared the stats that convey that picture for where each of the 20 major countries is in its cycle here (link).

Where We Are in the Three Cycles That Make Up the Big Cycle

As far as where the world is in these three cycles:

1) The long-term debt-money-economic cycle.Most countries, most importantly the major reserve currency countries, are approaching the contraction/restructuring stage of this long-term cycle. Let’s review how this works.

The contraction/restructuring phase occurs when the levels and growth rates of debt are unsustainable in ways and amounts that are analogous to the 1930-45 period (and many periods before then, which are shown in my book). More specifically they occur when debt assets and debt liabilities have both risen to such high levels that the interest rates that are high enough to incentivize creditors to hold them are intolerably high for debtors to meet their debt payment obligations. When this is the case, these assets will be dumped either because the assets are not providing high enough returns to hold them or because there is a greater risk of default. That puts the central bank in the difficult position of having either to allow interest rates to rise (due to the selling of debt), which is depressing to asset prices and the economy, or to print a lot of money and buy the debt assets, which depreciates the value of the money. If you are interested in seeing a more complete explanation and many historical cases, you can get that in Principles for Dealing with Big Debt Crises,which is available for free here. This is also covered in Chapters 3 and 4 of Principles for Dealing with the Changing World Order.

We are now seeing this dynamic occur in most countries with their central banks varying how they are dealing with it. For example, it was most obviously shown in the UK borrowing debacle and less obviously shown in Japan’s money printing and devaluation of the yen. In both of these cases—in fact in all countries’ cases—the holders of financial assets experienced big depreciations in asset values through some mix of price declines and declines in the value of money. In those cases in which central bankers are moving more aggressively to raise interest rates and tighten liquidity, that is hurting financial asset prices and starting to hurt the interest-rate-sensitive parts of the economy, whereas in those cases where the central banks are printing a lot of money, we are now seeing more rapid depreciations in the value of their currencies.

Looking ahead, most governments’ fiscal spending will remain much greater than the tax money taken in, which will require governments to sell a lot of debt (e.g., in the US, the amount to be sold will be about 5% of GDP), which will be met with inadequate demand. The demand will be inadequate because investors are losing their taste for owning debt assets that are paying interest rates that are rising (causing their assets to fall in price), yet still failing to compensate them for inflation. Also, in the United States the Fed will be selling a significant amount of debt (equal to about 5% of GDP). So, the government (i.e., the Treasury and the Fed) will have to sell about 10% of GDP in additional debt, which worsens the imbalance between the amount of debt to be sold and the demand for it. Since the amount sold has to equal the amount bought, it seems most likely that will happen via a big contraction in private credit, which will lead to a lot less buying of goods, services, and financial assets, and hence price declines in financial assets and an economic contraction.

Now that the inflation problem is so obvious, some central banks, most importantly the Fed, are making the classic move of tightening credit and raising interest rates, while some are doing virtually none of that (e.g., Japan’s central bank) or relatively little of that (e.g., Europe’s central bank). In either case, these policies are leading to declines in the values of debt assets through declines in the prices of these assets and/or through declines in the values of currencies relative to the costs of goods and services. These debt-money-economic contractions are coming at the same time as the other two main cycles are also in their late stages. That is creating an especially dangerous confluence of events. Let’s look at the other two big influences.

...2) the long-term internal order-disorder cycle.Most countries in varying degrees, especially most Western democracies and most especially the United States, are now approaching the dangerous internal conflict part of the cycle. This is primarily due to the largest wealth, values, and political differences since the 1930-45 period. In the US people are fighting over just about everything: who gets what money and where they get it from, how children should be taught in schools, whether the police should deal with crime strongly or leniently, who rightfully wins elections, what to do about gun ownership (in a country that is becoming increasingly violent), what to do about abortion…drugs…budget deficits…etc. And our leaders show no prospect of figuring these things out intelligently and in a way that will satisfy most Americans.

We are now seeing this manifest in increasing populism of the right and of the left and intensifying conflicts between these populists. Populists are people who will fight to win at all costs, not people who will work with the other side to compromise by following the rules to govern in the way democracy has worked for the many years it has worked. The media adds fuel to the fire, having abandoned the pursuit of truth through objective reporting because distorted sensationalism is more exciting, sells better, and is a vehicle for them to fight for their side. This is leading good leaders, most importantly those who could be most helpful, to opt out. For example, the most sensible senators, House representatives, and governors who are inclined to work across party lines to intelligently figure out what’s best for most people are resigning and being replaced by extremists. Said differently, the US is clearly in late Stage 5 of the cycle (when there is disorder and intense conflict), which I will describe more completely later.

...3) the long-term order-disorder external cycle.The world’s leading powers are clearly in late Stage 5 (i.e., having intense conflicts between rival powers) and are on the brink of Stage 6 (military war). This is classically due to comparably powerful rival countries fighting over existential wealth and power differences in ways that are analogous to the 1930-45 period and many times before then. It is also due to these countries being in the hands of populists/nationalists who are more inclined to fight than to try to work things out. This is now most obvious in 1) Russia’s conflict with Ukraine and NATO countries, 2) the US’s conflict with China, 3) North Korea’s threats to its neighbors, and 4) Iran’s conflicts with Israel and Saudi Arabia. Less obviously, many other countries are having conflicts (e.g., Turkey in conflict with Greece, India in conflict with Pakistan and China, Yemen in conflict with the UAE and Saudi Arabia, and Palestine in conflict with Israel). In most countries there are also either great increases in internal conflict or strong suppression of internal opposition.

The sides are now more clearly lining up in these conflicts. As is usual in these cycles, when conflicts intensify there is a lot of pressure on all parties to pick a side and fight for it. This dynamic is becoming increasingly risky because there are many ways these countries can badly hurt each other. For example, several countries now have nuclear weapons and other weapons of mass destruction so it is not inconceivable, though it is still improbable, that a chain-reaction war, like that which occurred in the world wars, could occur.

While the great powers are on the brink of classic military war (Stage 6) they have not yet crossed the brink. As explained in greater detail in my book, the transition into Stage 6 is signaled by attacks on each other’s lands and people and significant losses of life that take the conflict into all-out war that can only be resolved by one of the sides surrendering to the other. Though Russians are attacking and killing Ukrainians and Ukrainians are killing Russians in Ukraine, the US and NATO countries are not fighting Russians militarily on each other’s lands and are not killing each other’s people, and the war is so far constrained to conventional weapons. Between the US and China, there has not been any military conflict though there has been plenty of saber-rattling and preparation for war.

At the same time, we are seeing all the classic signs of being on the brink of military war, such as using economic warfare that is existentially threatening. For example, the recently passed US bill that could cut off needed semiconductor chips to China and Russia cutting off natural gas to Europe are analogous to the US cutting off oil to Japan in 1941, which led to the Japanese bombing of Pearl Harbor. There are also the classic big increases in military spending that typically come just before wars. If you are interested in seeing how analogous what is happening now with what happened immediately prior to World War II, I suggest that you read Chapter 6 in Principles for Dealing with the Changing World Order.

How the Big Cycle Transpires in Stages

In my book I described in greater detail than I can describe here how the archetypical Big Cycle transpires in stages. I will now paraphrase and condense my descriptions that are in the book.

In brief, whether it is an internal or external order cycle, the progression from each order to the next typically progresses in the following sequence of steps:

- Stage 1 is when a) the new order begins after a war, b) the new leadership consolidates power, c) debts are restructured or monetized so debt burdens are reduced, and d) wealth gaps and conflicts over them are reduced, which leads to…

- Stage 2, which is when there is a further consolidation of power and the building of resource allocation systems, which leads to…

- Stage 3, which is when there is peace and prosperity, which leads to…

- Stage 4, which is when there are great excesses in spending and debt and a widening of the wealth and political gaps, which leads to…

- Stage 5, which is when there are bad financial/economic crises and intense conflicts between comparably powerful parties within countries and between countries, which leads to…

- Stage 6, which is when there are wars, which leads to…

- Stage 1, Stage 2, etc.

These six stages are described much more completely in Chapter 5, which is on the internal order-disorder cycle, and in Chapter 6, which is on the external order-disorder cycle. They cover the cycle of war and peace both within and between countries (see page 77 and pages 99-102 for this “Big Balance of Power Cycle”), which I describe as “the timeless and universal dynamic of allies and enemies working to gain wealth and power. It drives virtually all struggles for power, from office politics to local politics, and from national politics to geopolitics.” What these struggles have in common, in addition to being conflicts over wealth, power, and ideologies by rivals, is that the relative strengths between these rivals are good indicators of what’s to come. For example, one could look at the relative economic and military powers of two sides (e.g., we could use my quantitative measures of these) and pretty well know which side will win (e.g., that Russia would lose the war with Ukraine and NATO countries) if neither side backs down. What is happening both internally and externally—though most importantly internally—affects the relative strengths of the competing parties. The internal and external cycles operate similarly, except that the impact of the rule of law tends to be greater internally than externally, though when the rule of law breaks down internally there isn’t much difference. For a much more complete description the progression of internal conflicts see Pages 167-191 and external conflicts see Pages 193-201 and 209-216.

This Big Cycle is made up of several shorter-term versions of the same cycles that add up to the Big Cycle. They, like the Big Cycle, tend to have influences on each other. For example, 1) there is a short-term debt-money-economic cycle (that typically lasts about seven years give or take about three) that is manifest in what is commonly called the business cycle that consists of recessions that lead central banks to create easy money and credit that eventually leads to booms that overheat that lead to inflations and bubbles that lead to central banks tightening money and credit that leads to recessions and busts, 2) there is a short-term political cycle that shifts power between the left and the right in elections that are influenced by the short-term debt-money-economic cycle, and 3) there are short-term external order-disorder geopolitical cycles that are manifest in more minor shifts between peace and war that grow in intensity when two or more opposing great powers exist. None of these cycles transpires in any exact way because they are influenced by many other things.

My examination of history showed two other big things that affect what happens in a big way but aren’t as clearly cyclical:

Footnote: Of course, there are many other forces at play, the most important of which are covered in my book (e.g., changes in thinking that arise from generation to generation due to their experiences, the technologies that exist, etc.) but I can’t and don’t need to describe them here.

4) acts of nature, most importantly droughts, floods, and pandemics, which are clearly relevant today and are likely to be more harmfully relevant in the future

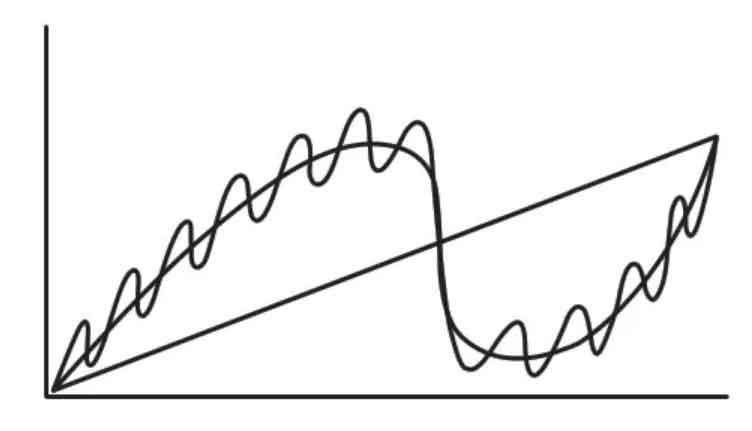

5) humanity’s adaptability and inventiveness,which is the greatest force for improvement and is evolutionary rather than cyclical. It is now more powerful than ever before because of humanity’s inventions of tools that improve our thinking/inventiveness capabilities. It will certainly produce amazing advances that will produce bright spots in the lives and places of those who are having them, which will differentiate them greatly from those that are not having them. Together this dynamic conceptually looks like this to me.

Let’s now focus on the movement toward war both internally and externally because that’s most relevant now. To be clear, I am not saying that civil war or external war will happen. I am saying that whether or not these wars happen is now too close to call, that we are headed toward them, and that a lot depends on how the leaders and people behave.

The Wars

“There are five major kinds of fights between countries: trade/economic wars, technology wars, capital wars, geopolitical wars, and military wars” (Page 194). The first ones on this list tend to come before the last ones and they all tend to become increasingly intense.

Right before there is a shooting war there is usually an intense economic war in which the sides try to disable each other. They have been and still are 1) asset freezes/seizures, 2) blocking capital markets access, and 3) embargoes/blockades. (See Page 209) Sanctions, such as those the United States now commonly uses, are classic throughout history. (The United States cutting off China’s ability to import semiconductor chips and Russia cutting off natural gas to Europe I discussed above are examples.) Also, big increases in military expenditures, such as those that are planned in China and to lesser extents in Europe and the US, are classic early warning signs of a military war ahead. For an explanation of the remarkable similarities between the economic warfare that is going on now and that which occurred immediately before World War II see the case study that begins on Page 201 of Principles for Dealing with the Changing World Order.

The following principles are worth paying attention to when trying to anticipate the outbreak of war:

“The greatest risk of military war is when both parties have 1) military powers that are roughly comparable and 2) irreconcilable and existential differences” (Page 197). “All-out wars typically occur when existential issues (ones that are so essential to the country’s existence that people are willing to fight and die for them) are at stake and they cannot be resolved by peaceful means” (Page 195). “The choice that opposing countries face—either fighting or backing down—is very hard to make. Both are costly—fighting in terms of lives and money, and backing down in terms of the loss of status, since it shows weakness, which leads to reduced support” (Pages 197-198). “The two things about war that one can be most confident in are 1) that it won’t go as planned and 2) that it will be far worse than imagined” (Page 196).

We can see these principles playing out in what is happening in the Russia-Ukraine-NATO war, in the US-China-Taiwan conflict, and internal and external conflicts in Iran, tensions with North Korea, and several less significant conflicts. For example, in the Russia-Ukraine-NATO war, we can see the principles that it won’t go as planned and that it will be far worse than imagined at play. This should be a reminder to all countries’ policy makers when they think about what their next moves should be now that they are so close to Stage 6.

What Do Military Wars Look Like?

They are terrible. While a lot more happens than I can describe here, I will show five tables that convey what happened in the major countries in World War II. Once again, I’m not saying these things will happen today; I am saying that they might happen because they happen for good reasons that are explained on Pages 212-214 and 224-232 and summarized below.

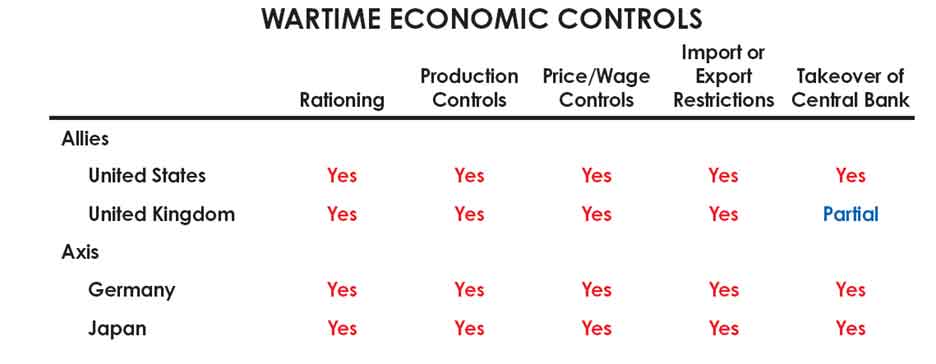

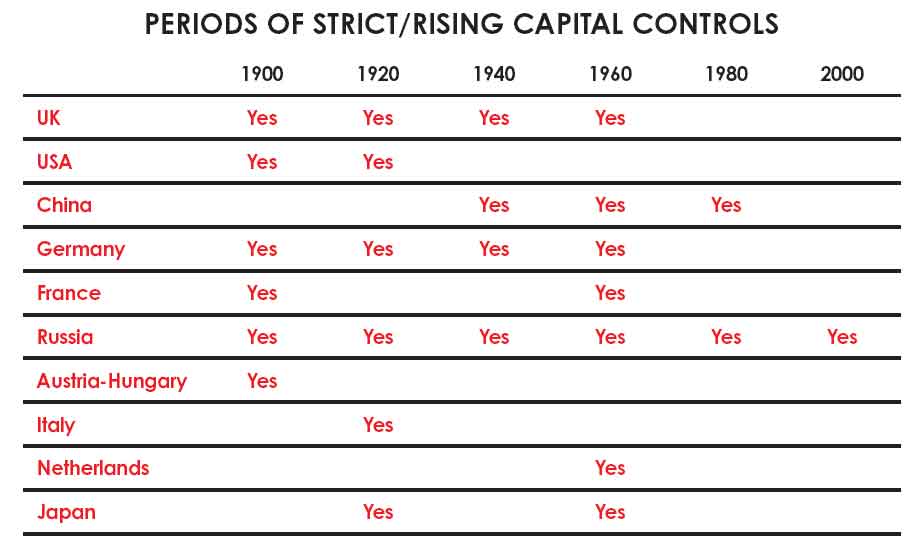

The first table below shows some of the classic economic controls imposed in wars and which of the World War II combatants applied them. It shows that in times of war all economies become command economies de facto run by their governments rather than run independently in pursuit of profits. That is because the profit-making system doesn’t get the resources directed to where they are needed most in order to fight the war. As you can see in the table, the governments exerted control over nearly every major part of the economy: what you could buy, what you could produce and sell, what you could charge, and how monetary policy was set.

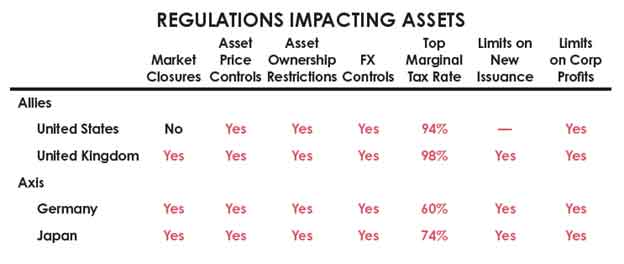

Beyond significant controls on transactions and profits, some countries greatly restricted the ability to buy and sell assets, access savings abroad, and flat out confiscated earnings/profits above a certain level. For instance, many countries simply closed their stock markets, meaning many people couldn’t access their savings held in equities at all.

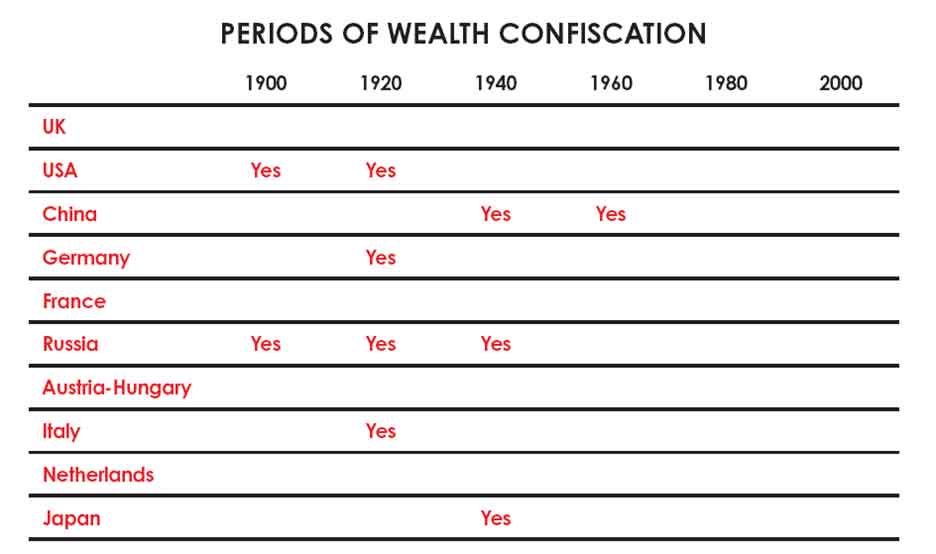

As shown in the next table, wealth confiscations are relatively common in history, ranging from forced selling of gold to wholesale confiscations of real and financial assets.

Also, as shown here, severe capital controls were commonplace (until relatively recently). It was common for rising geopolitical tensions to usher in these sorts of controls, making it harder for investors to access their savings. These actions put sand in the gears of international trade, as we are seeing now via supply chain disruptions.

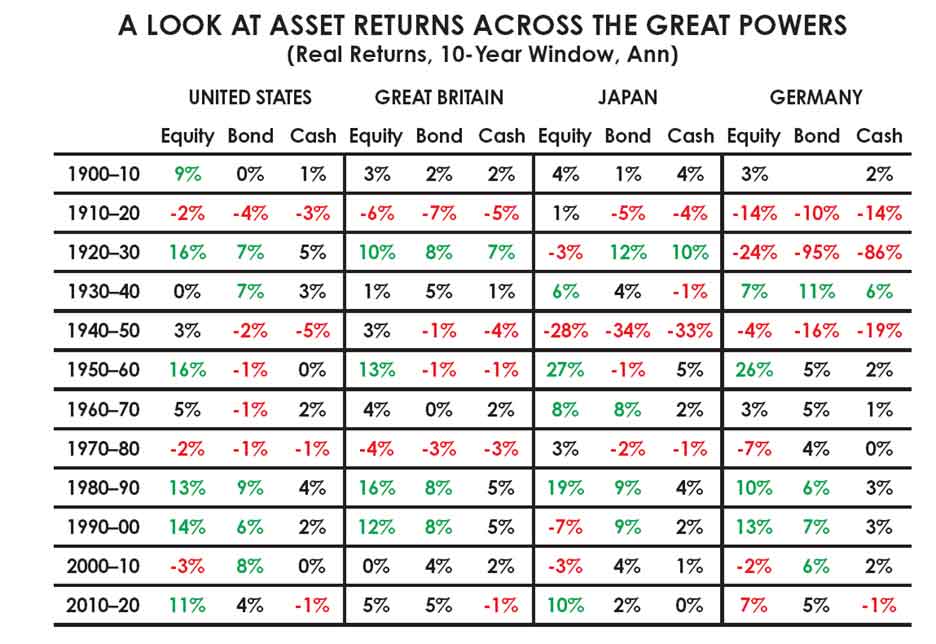

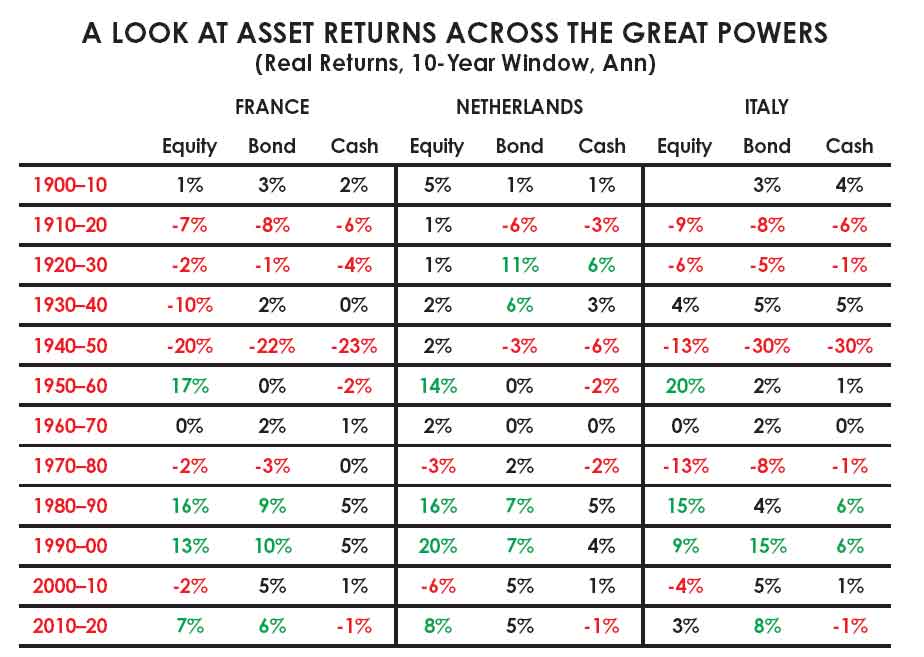

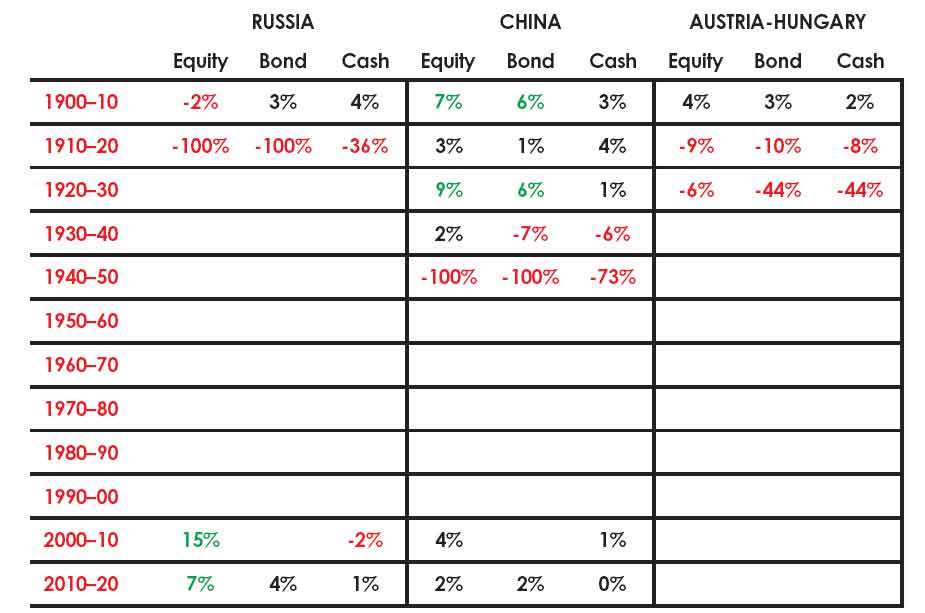

How did investors fair through this turmoil? To answer that question, I chose to look at the real returns of the assets in the 10 greatest powers, starting in 1900. All of these countries were powerful, and any one or group of them that constituted a side in the war could have become the winner. They were all reasonable places for one to invest, especially if one wanted to have a diversified portfolio. What happened? Seven of these 10 countries saw wealth virtually wiped out at least once, and even the countries that didn’t see wealth wiped out had a handful of terrible decades for asset returns that essentially destroyed them financially. Two of the great developed countries—Germany and Japan, which at times one easily could have bet on to be the winners—had nearly all their wealth and many lives destroyed in war. Most other countries had similar results, even the winners. The numbers shown in this table are annualized real returns for each decade, which means that for the decade as a whole the losses and gains are much larger than shown.

While I of course hope that we will not slip into Stage 6 and all-out war, I think it is my responsibility to make you aware of where I believe we are in these cycles (i.e., in late Stage 5, close to Stage 6) and what Stage 6 has typically looked like. If we should start to enter Stage 6, I will review it more comprehensively in another post.

I am also working on a new post that will convey my thinking on China and will follow shortly.

A global macro investor for more than 50 years, Ray Dalio founded Bridgewater Associates out of his two-bedroom apartment in NYC and ran it for most of its 47 years, building it into the largest hedge fund in the world. Ray remains an investor and mentor at Bridgewater and serves on its board. He is also the #1 New York Times bestselling author of Principles: Life and Work, Principles for Dealing with the Changing World Order, and Principles for Navigating Big Debt Crises. He graduated with a B.S. in Finance from C.W. Post College in 1971 and received an MBA degree from Harvard Business School in 1973. He has been married to his wife, Barbara, for more than 40 years and has three grown sons and five grandchildren. He is an active philanthropist with special interests in ocean exploration and helping to rectify the absence of equal opportunity in education, healthcare, and finance.

www.linkedin.com

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)