These Charts Show More Currency Creation is Guaranteed...

and 3 Guesses How Gold Responds

Jeff Clark

It’s not very often you get to use the word ‘guarantee’ and be right about it. But this just might be one of those times. It’s not very often you get to use the word ‘guarantee’ and be right about it. But this just might be one of those times.

Question: what do you get when you combine a debt-based monetary system with soaring interest rates?

If debt levels are rising, and the federal government has to pay interest on that debt, and they’re hiking the rate that affects how much they pay on that debt…

Well, you end up with a toxic monetary cocktail that virtually guarantees more and more currency will have to be created to meet that obligation.

And you can probably guess how gold is likely to respond to greater and greater currency dilution.

Here’s some new research you may not have seen elsewhere…

How Do You Spell Debt? U-N-S-U-S-T-A-I-N-A-B-L-E!

You’ve seen debt charts before, but we need to set the stage. And, even I was surprised when I saw the latest total public debt figure from the Fed’s website.

As you can see, the increase in federal public debt since 2000 has been unrelenting. It’s nothing short of a parabolic rise.

Since just 2008, total public debt owed by the federal government of the United States has grown a whopping 224%. That means it’s more than tripled in 14 years. Heck, it’s up 15.5% just since Covid hit in March 2020.

It doesn’t take much mathematical insight to understand that this isn’t sustainable.

And unless you think deficits will be zero going forward—deficits get automatically added to the debt—this figure is only going further north.

Now, some economists try to claim that “we owe it to ourselves,” implying large debts are not a big problem. Sometimes it even “feels” like they might be right.

But that statement is not entirely accurate; when you have to pay bond holders interest on that debt, that’s more than just paying ourselves. And with rates going up, that payment is getting bigger and bigger.

Here’s what that looks like…

The Big Debt Squeeeeeze

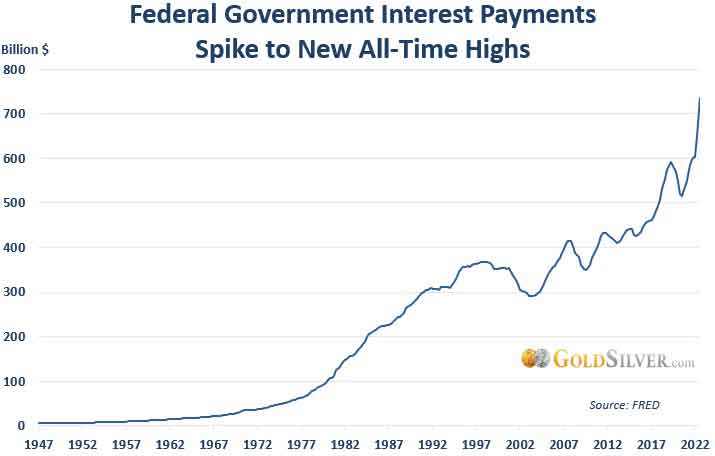

The federal government tracks the amount of interest they pay on their debt.

The latest update is sobering.

As you can see, the amount of interest paid on US debt has spiked to new all-time highs. That spike on the far right of the chart is a direct result of higher interest rates.

- In just the past 12 months, interest paid on federal debt has jumped 22.7%.

And this excludes the last Fed rate hike. And any hikes going forward.

This raises a natural question. Considering just interest payments on the debt…

- How long can the central bank of the US afford to continue to raise rates?

To help answer that question, this study from the US House Committee on the Budget titled The Consequences of Higher Interest Rates to the Federal Budget came to the following shocking conclusion:

- “The 50-year average for interest rates on the Federal debt is 5.7%. If rates meet the 50-year average, interest payments on US debt would be $11 trillion per year, more than 100% of annual tax revenues.”

That $11 trillion figure is not a misprint.

How big is that?

Well, the Congressional Budget Office (CBO) projects that federal tax revenues will be approximately $6 trillion by 2045. Tax revenue is the government’s primary source of income.

I decided to put those two projections to a chart. While this scenario is 23 years away, it doesn’t paint a pretty picture.

If this projection played out, the federal government would be paying 85% MORE in interest payments than their income.

Yes, it is a projection, and yes maybe interest rates don’t get back to the 50-year average. But the direction is frightening because it’s obviously not remotely feasible.

In fact, it’s not feasible now! We can’t balance the budget as it is. And of course this is only one of many payments the federal government has to make, the other big ones being healthcare, social security, education, welfare and defense.

How will the government meet its financial obligations?

Fed, Phone Home

The pressure on the financial system will increasingly grow. How will the federal government and politicians deal with this shortfall?

- Will they default on the debt?

- Would they consider a debt jubilee?

- How about a bailout by the IMF?

No American President would allow any of these options. And certainly, a total systemic collapse is not an option either.

The easiest and most expedient “solution” is to just print more currency.

Indeed, the track record of the US central bank certainly shows this is the choice they will make—they’ve done it numerous times in the past.

And what asset can’t be printed or digitized on a whim?

Gold supply grows roughly 1.5% per year. Imagine politicians being limited to spending increases of just 1.5% annually… that’s what a gold standard would do (which is why they’d fight it), and it’s why the gold price would respond to currency dilution. Gold can’t be diluted.

- Gold is the standard against which all currency values are measured—not the other way around.

Yes, the gold price has been stagnant, but this cannot last. Especially once the Fed is forced to pause interest rate hikes and needs to start creating more and more currency again.

In my opinion these things are highly likely to start next year. Which will probably kickstart the next bull run—maybe the big one we’ve all been waiting for. Which is why I’m not worried about the gold price in the short term (one year).

It’s also why I’m not worried about gold in the long-term. Until the monetary system is restructured, we must own it. We can reconsider how much to own once we have a more sound, honest, responsible financial system.

More currency creation is guaranteed to come. That signals to investors to buy the one asset that can’t be diluted, debased, or destroyed.

Jeff Clark utilizes his knowledge of the gold mining industry, a family legacy, from prospecting and exploration to the financial and capital markets to produce Casey Research's BIG GOLD investment newsletter. Jeff Clark utilizes his knowledge of the gold mining industry, a family legacy, from prospecting and exploration to the financial and capital markets to produce Casey Research's BIG GOLD investment newsletter.

Working the family placer and hardrock claims in California, Nevada, and Arizona taught Jeff what to look for when investigating the merits of a prospective property. Learning from his father, an award-winning panner with a history of successful stakes, Jeff regularly visits gold and silver projects to assess their economic and geological potential, examine drill core, tour operations and drill targets, and meet with the management team and even workers to dig deep into their operations and potential.

Making money in the precious metals industry—for both himself and his subscribers—is what drives Jeff. He's constantly researching companies to recommend, analyzing the big trends in precious metals, and looking for safe and profitable ways to capitalize on the gold and silver bull market. He puts his money where his mouth is, and is completely committed to making BIG GOLD the best precious metals advisory for the prudent investor.

Jeff is a regular speaker at the industry's top investment conferences, such as the Vancouver Resource Investment Conference, the Silver Summit, and the Sprott Natural Resource Symposium. Jeff is also regularly quoted in notable business press, including MarketWatch, TheStreet, Kitco, Hard Assets Investor, and the Washington Post. He's sought after for his big-picture view of the gold and silver markets, as well as the implications of daily market moves on the underlying fundamentals. He focuses on mid- to large-cap precious metals, ETFs, mutual funds, and of course various forms of bullion. A well-rounded expert commentator with a very approachable and entertaining style, Jeff is known for helping readers make sense of the frequent changes in the price of gold and silver, the direction of metals and mining equities, and what place precious metals of all types have in an investor's portfolio.

Jeff's publication, BIG GOLD, is ideal for subscribers who are new to the world of precious metals investing, or who are looking for independent analysis of the many options out there for gold, silver, and other precious metals investments.

goldsilver.com

|