Send this article to a friend:

November

17

2022

Send this article to a friend: November |

Polyamorous geeks, psychopaths and perhaps the greatest fraud in history

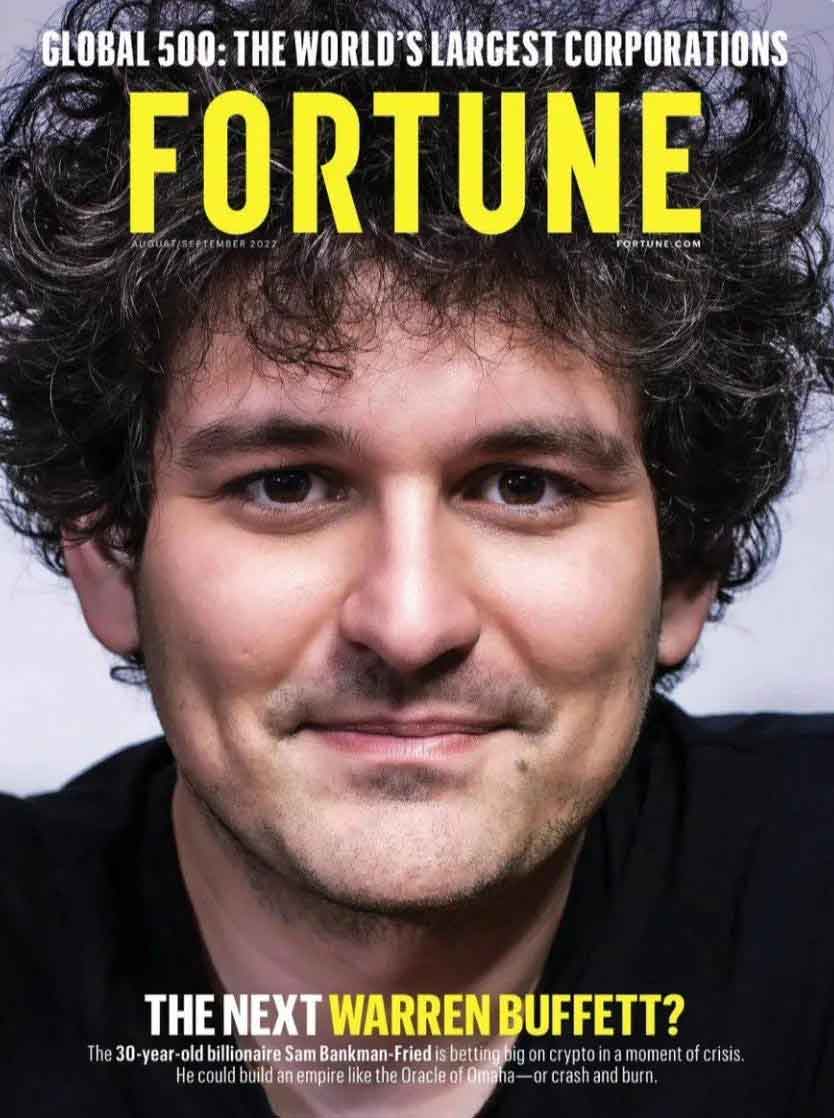

By popular demand, today we consider bitcoin - and the amazing story that is FTX. Gosh, this is some story - it’s difficult to know where to start. The more you dig in, the more that comes out. It’s a cautionary tale of the madness that engulfs crowds during investment manias and bubbles, of greed, delusion, risk, and more besides. I’m sure many of you already know the story, even though there are new developments every day, so I’ll recap it quickly, before moving on to what it means for bitcoin. The story of FTX Sam Bankman-Fried was a geeky young crypto “entrepreneur”, born to an upper-middle-class Jewish family in California. His parents were both professors at Stanford Law School. Ironic. In 2017 he set up the quantitative trading firm (that would be trading based on mathematical models) Alameda Research . Then, in 2019, came FTX, a crypto exchange that became phenomenally successful, phenomenally quickly. In July 2021, barely two years into its existence, FTX raised $900m at an $18bn valuation. That was Series A. Three months later came Series B - $420m at a $25bn valuation. Three months after that, in January of this year, it raised another $400m. This time the company was valued at some $32bn. To put those numbers in some kind of context, the likes of Barclays, Soc Gen and Deutsche Bank - banks that have been around forever - all have smaller market caps in the $20-30bn range. $32bn would be more than the UK collects in stamp duty in a year. Or fuel duty or alcohol and tobacco duties. It’s roughly five times what it collects in inheritance tax. Bankman-Fried himself was worth $16bn, and at the age of 30, was on the front cover of Fortune Magazine, along with a headline asking if he was “The Next Warren Buffett?”

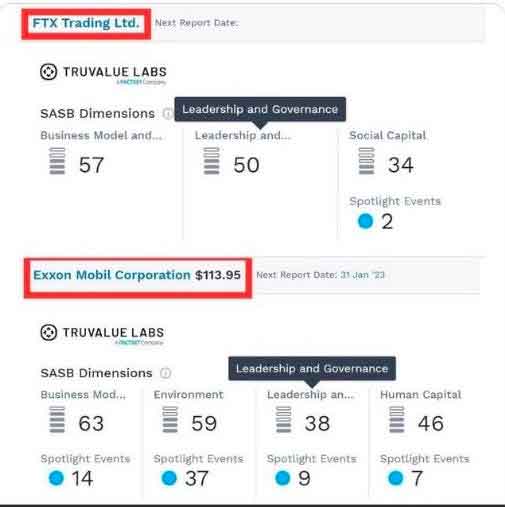

FTX’s blue-chip and “smart money” investors included Japan’s SoftBank, venture capital firm Sequoia Capital and hedge fund Tiger Global. Even the Ontario Teachers’ Pension Plan put in $95mn. (What has your pension fund manager been doing with your money?) There were rumours of another $1bn raise in September. However, that didn’t materialise and the bitcoin bear market meant the tide was going out in the crypto industry. We would soon learn who had been swimming naked. FTX suffers in the bitcoin bear market Some started asking questions about FTX’s accounting and other practices. Short sellers also started taking notice - they expose frauds more quickly than anyone. Negative coverage started to appear. On November 6 an article at Coindesk raised doubts about the balance sheet of Bankman-Fried’s sister company, Alameda. Then things started to unravel quickly. Changpeng Zhao, CEO of Binance (the world’s biggest crypto exchange), which had been an early investor in FTX, announced that Binance was selling all its FTT coins - as much as $2bn worth. (FTT coins are part of the plumbing of the FTX exchange). The value of FTT started to fall. Suddenly there was a scramble to withdraw assets from the exchange. It was thought to have had the assets to back the liabilities, Bankman-Fried tried assure everyone that client funds were safe, but it seemed this was no full reserve exchange and FTX didn’t have the funds to meet the run. In fact, it seems FTX had been using some of the funds - as much as $10bn - to shore up sister company Alameda, which had suffered significant trading losses over the past year. (Watch the interviews with 28-year-old Alameda CEO Caroline Ellison - said to be in a polyamorous relationship with Bankman-Fried - describing how she “doesn’t like stop losses”. Turns out she had barely any risk management at all). Chain analysts noted that FTX didn’t have the funds to cover withdrawals. On November 8th Bankman-Fried said he had “enough to cover all client holdings” and that “he doesn’t invest client assets”, but the run continued. That evening withdrawals were halted. In an attempt to restore confidence, Zhao and Bankman-Fried announced that Binance would be acquiring FTX soon after. However, the following day, Zhao said that having done his due diligence, Binance would not be acquiring FTX. A day later, FTX filed for bankruptcy. Easy come, easy go: Bankman-Fried’s net worth went from $16bn to zero in barely 72 hours. Reports are FTX had $900m in assets against $9bn in liabilities. And then, the day after that, some $600m in crypto was hacked from FTX’s wallets and syphoned lord knows where - Panama, Bermuda and Cayman, presumably. Apparently the hacker isn’t even that sophisticated and numerous Twitter feeds are now following the stolen crypto. As FTX unravels stories start to emerge Since then all sorts of stories have emerged. Weird sexual goings on at the companies HQ - Alameda’s employees lived together in a luxury apartment the Bahamas and polyamory reigned. Bankman-Fried sharing the stage with Bill Clinton and Tony Blair. A key employee had run an online poker company and been convicted for cheating. Flight tracker apps showing private jets fleeing to jurisdictions where they can’t be arrested. The contagion has spread to other crypto operators such as BlockFi which have halted withdrawals. Author Michael Lewis of Big Short fame has apparently already signed a film deal - he had been tracking Bankman-Fried for six months. (Surely he must have been aware of what was going on). Bankman-Fried was the US Democrat party’s second-largest donor in 2020, donating around $37m, and pledged upwards of $1bn if Trump were to run in 2024. Given these proceeds might effectively be stolen capital, should the Democrats return the money? Heck, it’s even emerged that Ukraine had money with the business, that it has links to the WEF and that Bankman-Fried took advice from Gary Gensler of the SEC. All the while the fraud was being perpetrated, Bankman-Fried donated to what he considered good causes - and talked up his giving even more. He spoke endlessly about charity, philanthropy, altruism and utilitarianism. His talks were peppered with motivational catchphrases, all delivered with geeky, beta-male sincerity. The double standards are breathtaking, given the magnitude of this fraud and the lives he has ruined. Even now his apologies are those of an errant rich kid - he seems oblivious to the magnitude of what has happened. Illustrating the uselessness of rating agencies (as if 2008 were not enough), and ESG, FTX was given a higher leadership and governance rating than Exxon Mobil.  Its brand has sponsored sporting event after sporting event - baseball, basketball, F1 - star athletes such as Tom Brady (who appears to have lost hundreds of millions). Rather like JP Morgan bailing out the markets in the Panic of 1907, Changpeng Zhao is now forming forming “an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis”. It’s all just extraordinary. What does FTX’s collapse mean for bitcoin? It’s worth remembering that in the wild west that is this new financial technology we have been here before. Many times, in fact, most famously with Mt Gox. It’s hard to emphasise just what a big deal that bankruptcy was back then. In 2014 Mt Gox was the biggest bitcoin exchange in the world, handling over 70% of bitcoin transactions, according to Wikipedia. When news broke that it had been hacked and it suspended trading, stopped withdrawals and filed for bankruptcy, the news precipitated an immediate 50% fall in bitcoin (from over $800 to $400). It would then fall by a further 50% to $200 in the ensuing bear market. This time around bitcoin has “only” fallen by 20-25%, though other coins, Solana especially (FTX held a lot), have fallen by a lot more. The beneficiaries have been coins of which FTX did not hold vast quantities (so there hasn’t been the selling pressure). These are the kinds of frauds that get perpetrated in bull markets with all the accompanying euphoria. I’d say it was very likely Alameda’s poor risk management was due to the fact that it was founded almost at the bottom of the previous bear market cycle and so they only knew bull market conditions, and that guided their behaviour. But then the bear market exposed the fraud. Bottom line: it seems FTX was doing what banks have been doing (and shouldn’t be doing) ever since there have been banks, regulated or not. It was taking client money and using it for other purposes. Fortunes have been decimated. Lives have been ruined. Many of the previous cycle’s crypto darlings are now headed for the scrap heap, if they are not already there. The list of the top ten coins by market cap is already very different to what it was a year ago. It’s completely unrecognisable from the previous cycle. But bitcoin carries on. There will be many who cannot distinguish between the sound, censorship-resistant money that is bitcoin, other dodgy cryptocurrencies and psychopathic fraudsters, tainting one with the other. There are many who will declare this the end of bitcoin. It won’t be. It’s a blow to bitcoin and crypto more generally. The optics are terrible. This is a fraud of Bernie Madoff proportions and more (estimates suggest FTX has more than one million creditors all of whom will be fighting over the scraps in the bankruptcy process). But remember just because criminals use the US dollar or cars does not mean all US dollar or car users are criminals. Bitcoin will survive and grow. Don’t keep your money on third-party exchanges. “Not your keys, not your coins” as the saying goes. And if you are one of the people who wished they got in, but never did, now is probably not a bad time to dip in your toe. There is blood on the streets. As somebody richer than you or I once said, that is the time to buy. Will this story mark the low? Nobody knows the answer to that, but let’s just say there is a lot more bad news priced in than good. The next big line of support is around $12,500. If you want to play it safe and buy gold, my preferred dealer is the Pure Gold Company, with whom I have an affiliation deal. There are still a handful of tickets left for my gig with the Gilet Jaunes in Piccadilly on November 24. Otherwise it’s the Christmas Knees Up with Comedy Unleashed in Camden on December 16. This article first appeared at Moneyweek.

|

Send this article to a friend:

|

|

|