Send this article to a friend:

October

03

2025

Send this article to a friend: October |

The Door is Open to a Year-End Melt Up… Here’s Why!

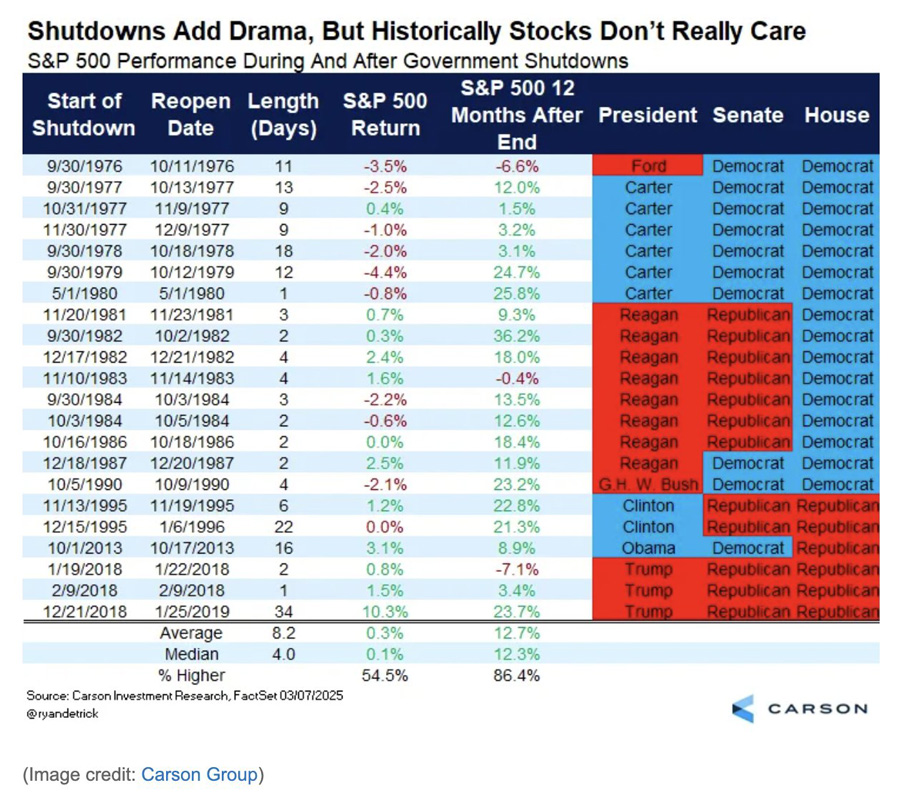

So far stocks are shrugging off this development for the simple reason that a shutdown opens the door to the Trump administration aggressively cutting the federal workforce, which would reduce government spending, which would reduce the deficit, potentially lower inflation, and stabilize the bond market. Put simply, this situation could in fact benefit the Trump administration, rather than hinder it. Moreover, as Ryan Detrick notes, historically government shutdowns have NOT led to bear markets. There have been 22 government shutdowns since 1970. Stocks actually rallied 54% of the time during this episodes. And 86% of the time, they were higher 12 months later with an average gain of 12%.

We also have to consider the fact that it is now the fourth quarter of 2025. Many hedge funds/ financial institutions/ wealth management firms have underperformed this year due to the tariff meltdown/ trade war. So the door is open to an end of the year melt-up as the people in charge of large pools of capital will do everything they can to end the year with the best possible results. I’m talking about the S&P 500 hitting 7,000 before year-end. It sounds ridiculous, but so did the S&P 500 hitting 6,500 which I predicted back in 2023 when the index was at 4,000… and here we are. Indeed, there is NOTHING bearish about the S&P 500’s monthly chart.

Again, the doors are open to a year-end melt up in stocks. And those investors who are properly positioned for this stand to make a killing. On that note, we just published a Special Investment Report concerning THREE investments poised to produce extraordinary gains during the Great Global Melt Up. And they’re already erupting higher! Heck, all three just hit new all-time highs in the last month! Normally I’d charge $499 for this report as a standalone item, but we are making just 100 copies available to the public. To grab one of the last remaining copies… Best Regards Graham Summers, MBA Chief Market Strategist Phoenix Capital Research

|

Send this article to a friend:

|

|

|