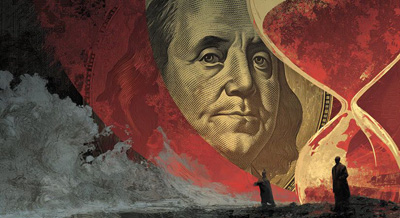

The Debt Crisis Has No Escape

Peter Reagan

The world’s richest nations are out of fiscal options. Even The Economist now admits debt can’t be repaid and growth won’t fix it. When governments inevitably inflate away currencies, where does that leave their citizens? The world’s richest nations are out of fiscal options. Even The Economist now admits debt can’t be repaid and growth won’t fix it. When governments inevitably inflate away currencies, where does that leave their citizens?

For years, we’ve said the global financial system was running out of exits. Now even The Economist – pretty much the definition of globalist’s daily financial reading – is saying it out loud.

On October 18, the world's most respected financial newspaper published a special report with the stark title Governments going broke.That week's regular issue ran with the headline The coming debt emergency. Both are well worth reading if you're fortunate enough to have a subscription.

I'm assuming you don't. So, today I'll briefly explain the three most important points from the key articles in both issues.

In brief, The Economist quietly admitted that what sound-money advocates have been warning for decades has come true:

- The world’s richest governments are heading toward a slow-motion debt disaster.

- Sovereign debt rarely gets repaid honestly – it’s inflated away, or quietly defaulted.

- And no, economic growth can’t save us this time.

That’s a stunning confession. And it changes how we think about risk, trust, and gold.

“Across the rich world, fiscal crises loom”

In The Economist’s words, rich countries are sliding into “third-world financial situations.”

Average government debt now exceeds 110% of GDP, and the supposed “safe” borrowers – America, Japan, France, Britain – are adding debt faster than ever.

Long-term lenders have noticed. Debt costs remain stubbornly high even after central banks started lowering interest rates. That’s not a mystery – it’s a vote of no confidence. Creditors no longer trust governments to manage their budgets, so they’re demanding higher payments to keep lending.

We’re not likely to see formal defaults. Instead, inflation and higher borrowing costs will do the work – an invisible tax on savers that “solves” the debt problem by eroding purchasing power.

The next global crisis, The Economist warns, won’t come from banks or housing. It’ll come from governments themselves.

“Sovereigns don’t repay their debts”

The textbook answer to sovereign debt is “Outgrow it or slash spending.”

History says otherwise, The Economist reports.

Since 1913, rich nations have almost never paid down debt through honest surpluses – through spending cuts or real economic growth. Only one G7 country – Canada in the 1990s – managed to reduce debt through real austerity.

Everyone else chose the politically painless path: inflation dressed up as policy success. More often, they’ve inflated it away.

Postwar “success stories” in the West weren’t about fiscal virtue – they were about letting inflation quietly destroy the real value of old debts.

In plain English: Governments taxed savers by printing money. Worse still, they call this a policy success! Even Nixon’s 1971 decision to abandon gold convertibility – a default in all but name – was celebrated as “modernization.”

But the result was 50 years of relentless dollar debasement.

“Growth won’t work again”

Politicians love to say “We’ll grow our way out of it.”

But with aging populations, shrinking productivity, and record-high debt, The Economist warns that growth now makes the math worse.

When productivity rises, wages and interest rates tend to rise together. Lenders demand higher yields on government debt, neutralizing any fiscal benefit. In other words, prosperity itself accelerates the debt spiral.

As The Economist puts it: “AI could solve the fiscal problem – by making it bigger.”

That’s the paradox of our time. Every fix fuels the inflation fire.

The quiet admission

Put those three insights together and the picture is stark:

- We can’t borrow cheaply anymore.

- We won’t pay it back honestly.

- We can’t grow fast enough to escape it.

And by “we” in this case, I mean the entire developed world. I mean NATO and its allies. I mean the U.S. and the UK, France and Italy, Japan and Australia.

This is a straight-up admission that our governments' debts have us all in checkmate.

And it’s exactly what I have been telling you since 2020 (at least). The math is in charge now, not the politicians or the central bank bureaucrats.

The end of “faith-based finance”

This week’s slide in gold prices rattled a few people. I want you to look past the two-day price dip.

Physical demand has never been stronger. COMEX deliveries of physical gold are on track to hit an all-time record this month. China’s gold ownership has surged 25-fold this year.

Central banks worldwide have been setting gold-buying records for 3 ½ years now.

Gold doesn’t depend on policy, promises, or the next election cycle.

Why gold? It doesn’t need Congress to balance a budget or the Fed to regain credibility.

It just needs the world to keep doing what The Economist finally admits it’s been doing for decades: printing, borrowing, and hoping. The printing and borrowing are ongoing; it's the hope that's fading. And that’s why physical gold still matters. Maybe more than it ever has.

Because when trust itself is at risk, only one asset has held both global trust and value for five thousand years.

Peter Reagan is a financial market strategist at Birch Gold Group. As the Precious Metal IRA Specialists, Birch Gold helps Americans protect their retirement savings with physical gold and silver.

www.birchgold.com

|