Government Shutdown Distracts from the Bigger Financial Crisis

Peter Reagan

Shutdowns make for political theater, but the true risk isn’t missed paychecks – it’s the mounting debt, weakened confidence and rising mistrust they reveal. Here’s why the Congressional “budget drama” points to a deeper crisis… Shutdowns make for political theater, but the true risk isn’t missed paychecks – it’s the mounting debt, weakened confidence and rising mistrust they reveal. Here’s why the Congressional “budget drama” points to a deeper crisis…

Well, it’s time for another government shutdown.

While the news media wants you to focus on the political conflicts that led to the shutdown (which we won’t be getting into here), there’s a bigger, more important angle that almost no one is talking about.

Despite all the attention, the shutdown itself is just a sideshow. This week, I’ll explain the main event – because it has the biggest potential to affect you personally.

The shutdown situation

Now, it’s worth noting that the government shutdown this week is the first one since 2019 (which was from December 22, 2018, to January 25, 2019).

Shutdowns occur when Congress cannot pass an annual budget bill. (Sometimes, they’re able to pass a “stopgap spending bill” instead, which guarantees business as usual.) This time around, they couldn’t even do that.

One side wanted to spend more.

The other side didn’t want to spend more.

Once again, neither party has any intention of spending less.

So the argument really boils down to whether we should rack up new debt at the current rate – $1.97 trillion in 2025 so far, per the Treasury Department?

Or whether we should rack up debt faster?

So the national debt explosion is only being held back by partisan bickering (fun fact: Congress was designed to be inefficient – the Founding Fathers were deliberately attempting to prevent the kind of government bloat that we have today).

With that out of the way, let me explain…

The government shutdown doesn’t do what most people think it does

First of all, even with less federal money being spent during the shutdown, overall it’s not a cost-saving measure.

I know, that doesn’t make any sense, does it? So let’s run the numbers.

Lost GDP: Newsweek cites Mark Zandi, chief economist at Moody’s Analytics, that every week of government shutdown trims about 0.1% from quarterly GDP.

A separate Goldman Sachs analysis of the 2019 shutdown set lost GDP at 0.15% – in other words, that 7-week shutdown cost us nearly a full percentage point of GDP! When you consider that typical annual GDP growth is just 2%, that’s a significant loss.

The Newsweek article goes on to cite Congressional Budget Office (CBO) estimates of lost growth. The 2013 shutdown under Obama cost the U.S. not only our AAA credit rating, but $20 billion in GDP per the Joint Economic Committee report.

As you can see, shutdowns have a very real impact on the economy. (Even if you’re not a federal employee, or a federal contractor – their personal experiences are significantly more challenging.)

Lost revenue: A slower economy means less tax revenue for the government to collect. There are direct revenue losses, too. Fee-based programs like licensing, permit issuance and regulatory reviews are suspended. Federal parks don’t collect entrance fees (ditto museums and national monuments).

But the biggest revenue machine, the Treasury Department’s regular weekly debt auctions, that keeps humming right along.

Increased project costs: You know how frustrating it can be to start and stop a project. Well, federal contractors are all too familiar with that frustration, especially the defense and healthcare sectors, according to Forbes. Data analytics company LexisNexis actually advises government contractors to factor a “government shutdown risk factor” directly into their contracts! Shutdowns trigger clauses that raise contract costs. So the frustration is at least somewhat offset by a bigger check.

Furloughed workers don’t get paid: While thousands of federal workers are sent home, members of Congress will still be paid. Though, to be fair, the Washington Examiner tells us that a few asked to have their pay withheld until the shutdown is over. Some particularly unfortunate folks who work for the FBI, the Armed Forces, the CIA, ICE and Customs and Border Protection agents must stay on duty – even when their paychecks stop.

Now, that obviously saves money, right?

Well, no, it doesn’t. Because, once shutdowns are over, the CBO tells us that furloughed workers receive back pay. Yes, they get paid for not working.

Recently, the President and the head of the Office of Management and Budget have declared they intend to terminate a significant number of federal employees during this shutdown. Well, that would at least save some money, right?

Oh, definitely. But not as much as you’d think. Marketplace recently reported that total federal payroll is just 5% of overall government spending! If we add in contractors, who work for another company on a federal contract, the CBO tells us we get closer to 15% of total federal spending. About $750 billion in total.

Now, that’s not nothing! But it’s also just a drop in the bucket of the overall federal budget. The vast majority of federal dollars goes toward Social Security, Medicare, defense and (of course) interest payments on the national debt.

The current deficit for 2025 is $1.97 trillion. Terminating every single federal employee (yes, if we stop paying Congress, too) the government could lower that number to $1.22 trillion.

It’s a lot, but it’s nowhere near enough to even come close to balancing the budget!

If nothing else, I hope this discussion demonstrates just how critical the Treasury Department’s daily debt auctions are. Which leads us to the next issue…

“The full faith and credit of the federal government”

At current spending levels, the federal government borrows somewhere between $20-$30 billion every single day.

What do lenders get in exchange for making that loan? Well, they get a promise. A promise they’ll get paid back (in dollars). On the one hand, that’s an easy promise to keep! The dollar is the sovereign currency of the U.S. Nobody else can make new dollars – every dollar in the world has to come from the Federal Reserve.

But what’s a dollar worth? Well, that changes day to day. Like all other modern currencies, the dollar has no intrinsic value. Its value comes from “the full faith and credit of the federal government.”

Yes, that same U.S. government that can’t agree on a budget. That has no plan to slow the borrowing and spending.

I just can’t wrap my head around this. Would you loan money to someone who wouldn’t tell you when (or how) they planned to spend it? Especially if they already had the largest debt in world history?

It’s like calling up a bank and asking for a mortgage. The real estate market here in Los Angeles is crazy, so even a basic 2-bedroom 2-bathroom “starter home” is going to cost you at least $1 million. More likely $2 million – so you ask the bank for $3 million, just to be sure. “What’s the address of the home?” the loan officer asks.

You say, “Oh, I haven’t picked the property yet.” What’s your deposit? “I don’t have a deposit.” Okay, how about collateral? “You have my full faith and credit as collateral – what more do you need?”

What are the odds you’re going to get a mortgage like that? Pretty close to zero, based on a poll (I asked a couple of my friends who are Realtors).

Yet that’s exactly how the federal government is behaving. They haven’t written a budget, so they aren’t sure where the money will go – they just know they’re going to spend it.

And the Treasury Department keeps asking for loans. Almost every single day.

Listen, “the full faith and credit of the federal government” has been enough to convince the world to lend us $37 trillion (so far). On no security and no collateral! To a Congress that can’t pass a budget!

When lenders start to worry about whether the U.S. will make good on its debts, they demand a higher premium on loans. In other words, when faith declines, credit follows.

Since the government has no plan (and no intention) to balance the budget, the borrowing will continue. It has to continue. Higher debt costs means selling more debt – which means higher debt costs…

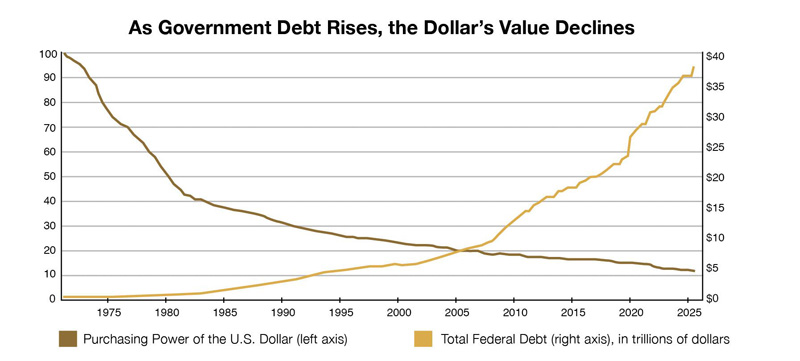

And all this has a negative effect on our spending power. It’s what economists call a “negative correlation” – as debt goes up, our purchasing power declines.

Sliding down the slippery slope

When you’re already on the slippery slope, the only way out is down. We can expect a weaker economy, bigger federal budgets and a mountain of debt growing faster than ever.

It’s a recipe for disaster, and it looks like we’re seeing the beginnings of it in real-time.

There is something that you can do to at least protect yourself and your family, though, and that is to build a hedge around your financial wealth by diversifying into inflation-resistant stores of wealth.

In my mind, the best option for that is diversifying into precious metals, and I’m not the only one who thinks that. There’s a reason that banks are stockpiling gold and that Trump has said that there will be no tariffs on gold.

It’s because gold and other precious metals retain value compared to fiat monies regardless of what is going on in the economy.

So, the fact of the matter is that gold and other precious metals may be the saving grace for the people wise enough to diversify into them now.

You can start your due diligence into precious metals now by getting our free Precious Metals Information Kit.

Peter Reagan is a financial market strategist at Birch Gold Group. As the Precious Metal IRA Specialists, Birch Gold helps Americans protect their retirement savings with physical gold and silver.

www.birchgold.com

|