Investor Alert: the Biggest Opportunities Today Are NOT In Stocks…

Graham Summers

Stocks hit new all-time highs last week on news that the Trump administration has the basic outline of a trade deal with China.

There is NOTHING bearish about this chart.

Indeed, the move has been confirmed by High Yield Credit, which is much more sensitive to changes in risk/ the macro environment than stocks. The High Yield Credit ETF (HYG) has also hit new all-time highs indicating little to no duress in the financial system.

What is happening here? Weren’t stocks on the cusp of a serious correction with numerous subprime lending firms blowing up just a few weeks ago?

What’s going on is the financial system is in what I call the Great Global Melt Up: a process through which central banks devalue their currencies via money printing… forcing investors to move capital into risk assets like stocks, precious metals and the like.

The reality is this is the ONLY option central banks have to deal with the world’s egregious levels of debt. There is no way that countries like the U.S., France or others can grow their way out of their debt loads. And defaulting on their debt would trigger a crisis that would make 2008 look like a picnic.

Thus, the only path forward, as far as policymakers are concerned, is to devalue their currencies in an attempt to “inflate away” their debts. To that end, central banks have already cut rates 312 times in the last 24 months.

That is not a typo: central banks are averaging 13 rate cuts per month as they race to make money/ credit cheaper.

This is why stocks are bubbling up. It’s why gold has hit new all-time highs, erupting from $2,600 per ounce at the start of the year to over $4,000 per ounce today. And it’s why investors NEED to prepare for what’s coming to insure they maintain their wealth.

Take a look at the $USD and you’ll see what I mean… the greenback is on the verge of taking out a 15-year trendline. When this breaks, and it will, anyone who is storing their wealth in savings/ cash will get taken to the cleaners.

And while stocks will likely do well in this environment, precious metals, specifically precious metals miners will produce truly life changing gains.

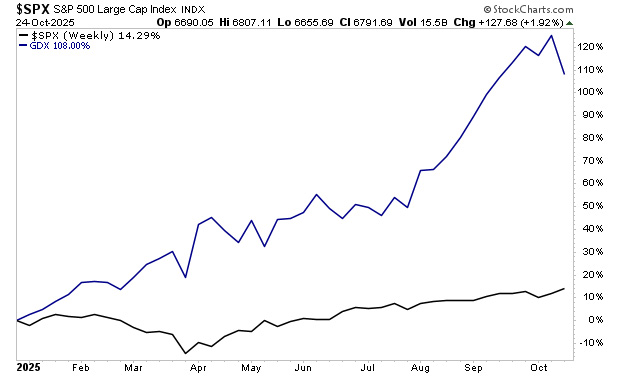

The S&P 500 is up 10% thus far in 2025. But the ENTIRE gold mining complex is up over TEN TIMES that at 110%.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm. And it explains my top five precious metals plays, including their names, their symbols, and the resources they own. These are HIGH OCTANE positions that are already up 40%, 120%, 120%, 140% and an incredible 450% this year alone!

Normally I’d charge $499 for this report as a standalone item, but we are making just 100 copies available to the public.

To grab one of the last remaining copies…

CLICK HERE NOW!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Graham Summers, MBA is Chief Market Strategist for Phoenix Capital Research, an investment research firm based in the Washington DC-metro area.

Graham’s sterling track record and history of major predictions has made him one of the most sought after investment analysts in the world. He is one of only 20 experts in the world who are on record as predicting the 2008 Crash. Since then he has accurately predicted the EU Meltdown of 2011-2012 (locking in 73 consecutive winners during this period), Gold’s rise to $2,000 per ounce (and subsequent collapse), China’s market crash and more.

His views on business and investing has been featured in RollingStone magazine, The New York Post, CNN Money, Crain’s New York Business, the National Review, Thomson Reuters, the Fox Business, and more. His commentary is regularly featured on ZeroHedge and other online investment outlets.

gainspainscapital.com

|