Send this article to a friend:

October

18

2023

Send this article to a friend: October |

Too Much Debt!

First, debt laden banks Paper losses on the most opaque part of US banks’ bond portfolios are now close to $400bn — an all-time high, and 10 per cent above the peak at the start of the year that caused the collapse of Silicon Valley Bank.

Rising interest rates are really causing havoc at banks, particularly small banks. The US 10-year Treasury yield rose again after a brief respite in rate increases.

iShares 20+ Treasury Bond ETF is getting crushed with inflation and Fed rate hikes.  And The Federal government is seeing interest payments on their massive $33 TRILLION debt load. Rising Treasury yields = higher US interest payments on debt … really fast.

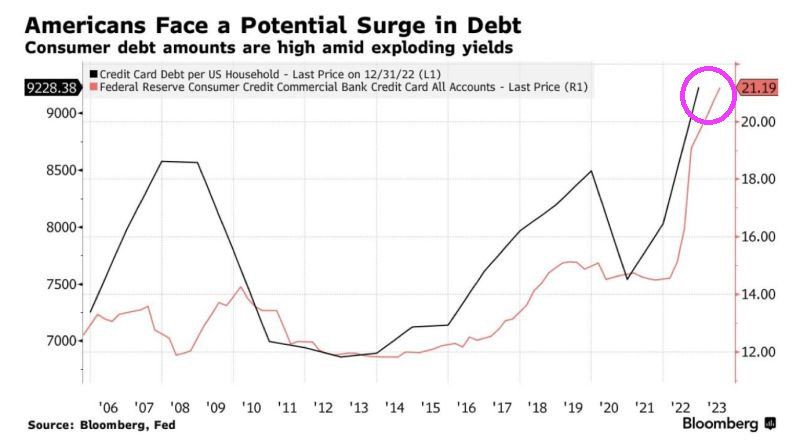

And with interest rates rising, Americans are seeing a surge in debt.  With rising Treasury yields, the 30-year conforming mortgage yield is up 173% under Biden’s Reign of Economic Error.

And then we have US Debt Clock, Federal debt is now above $33.56 TRILLION that is causing no consternation for Treasury Secretary Janet Yellen who said that the US economy is great and we can afford to fight wars in Ukraine AND Israel! Of course, Yellen believes in the foolish Modern Monetary Theory (aka, just keep printing money and hope nobody cares).

Multifamily rents turned negative in September, with the average U.S. rent declining $6 from August and $3 during the third quarter. It marked the first time since 2009 when national rents decreased in September.

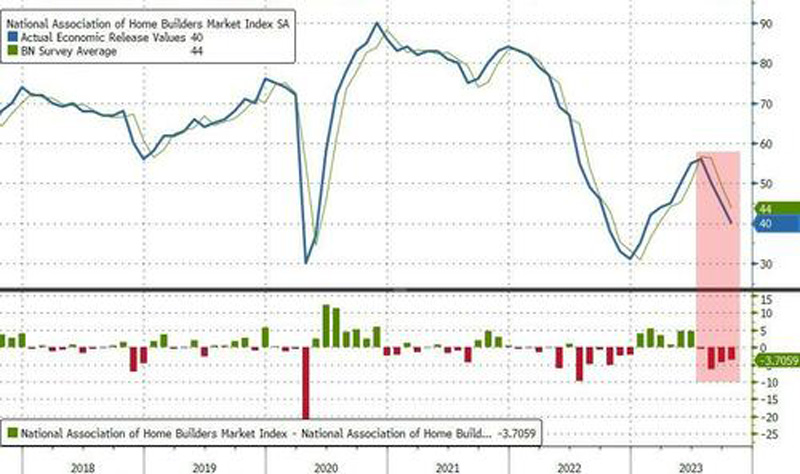

Hopefully a downturn in rent growth will let buying a home more affordable relative to rent in San Jose, San Francisco, Honolulu, Los Angeles and Seattle.  Headline NAHB confidence index printed at 9-month lows (down 5 to 45, vs 49 exp). That is the 4th straight monthly miss in a row (and 5 upside surprises).  I remember when economists used to say, “Inflation? No problem! Inflation allows us to devalue the massive debt!” Except that inflation crushes the middle class and low wage workers. Introducing Treasury Secretary Janet Yellen, the actual Nutty Professor who still thinks that the US can spend and borrow unlimited amounts without consequence.

|

Send this article to a friend:

|

|

|