Why Warren Buffett is Wrong About Gold

Graham Summers

Warren Buffett once famously stated that gold doesn’t do anything but “look at you.” Warren Buffett once famously stated that gold doesn’t do anything but “look at you.”

What Buffett meant was that unlike corporations, gold doesn’t have earnings, pay a dividend, or grow revenues. It’s simply a hard asset. In this sense, its value is determined by circumstance (economic growth, inflation, etc.) as opposed to the future value of its cash flows.

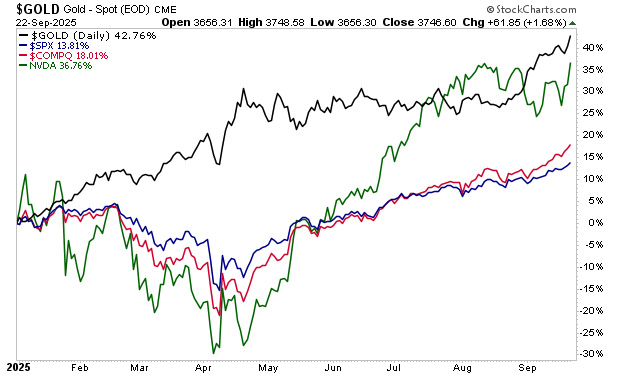

I was thinking a lot about Buffett’s quote yesterday as I watched gold rocket to new all-time highs yesterday. For those who aren’t paying attention, gold is now outperforming every major stock market index as well as every investing legend (including Buffett himself) this year.

Heck, it’s even outperforming Wall Street AI-darlings like Nvidia (NVDA)!

What is going on?

What’s going on is that Buffett is actually wrong, gold does do something: it hedges against currency devaluation. And globally, central banks are in the process of turning their currencies into confetti. Practically every other day, another central bank announces a new round of easing/ money printing.

Case in point, yesterday China’s central bank, the People’s Bank of China (PBoC) launched a new round of liquidity, pumping 260 billion worth of yuan into China’s financial system. Gold rocketed higher to new all-time highs on the news.

The PBoC joins the Fed, the European Central Bank (ECB), the Bank of England (BoE), Bank of Canada (BoC), the Reserve Bank of Australia, and the Swiss National Bank (SNB) in easing monetary conditions.

The fact that gold is now outperforming stocks indicates that this easing will be highly inflationary. Put another way, the financial system is telling us that it is more worried about future inflation than it is excited about future growth.

This is a MAJOR development.

Central banks are supposed to balance the risks/ benefits of prioritizing growth vs. inflation. Based on what gold is doing relative to stocks, we are getting clear signals that there will be a resurgence in inflation in the coming months.

This is THE theme for investors who want to make a killing in the markets. The BIG money is made by preparing for what’s about to happen, NOT focusing on what is already happening.

On that note, we just published a Special Investment Report concerning FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead. They’re already up 17%, 25%, 25%, 40% and 42%. And that’s just in the last few weeks!

The report is titled Survive the Inflationary Storm. And it explains my top five gold mining plays, including their names, their symbols, and the resources they own.

Normally I’d charge $499 for this report as a standalone item, but we are making just 100 copies available to the public.

To grab one of the last remaining copies…

CLICK HERE NOW!

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research

Graham Summers, MBA is Chief Market Strategist for Phoenix Capital Research, an investment research firm based in the Washington DC-metro area.

Graham’s sterling track record and history of major predictions has made him one of the most sought after investment analysts in the world. He is one of only 20 experts in the world who are on record as predicting the 2008 Crash. Since then he has accurately predicted the EU Meltdown of 2011-2012 (locking in 73 consecutive winners during this period), Gold’s rise to $2,000 per ounce (and subsequent collapse), China’s market crash and more.

His views on business and investing has been featured in RollingStone magazine, The New York Post, CNN Money, Crain’s New York Business, the National Review, Thomson Reuters, the Fox Business, and more. His commentary is regularly featured on ZeroHedge and other online investment outlets.

gainspainscapital.com

|