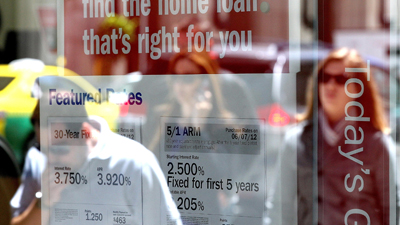

The Fed Is Cutting Rates Soon. Should I Wait to Get a Loan?

Kelly Shue

The Federal Reserve is expected to lower interest rates at its meeting on September 17–18. Many homebuyers and other borrowers incorrectly believe that they get a lower rate by waiting until a cut becomes official, according to Prof. Kelly Shue. This misconception is so widespread that it can undercut the effectiveness of Fed monetary policy. The Federal Reserve is expected to lower interest rates at its meeting on September 17–18. Many homebuyers and other borrowers incorrectly believe that they get a lower rate by waiting until a cut becomes official, according to Prof. Kelly Shue. This misconception is so widespread that it can undercut the effectiveness of Fed monetary policy.

The Fed is expected to cut interest rates in September. What does your research say about whether borrowers should wait to take out a loan?

Our research shows that many people make the mistake of waiting to take out a mortgage or other long-term loan if the Fed is expected to lower interest rates in the future. By waiting, people hope to secure a lower interest rate on a long-term loan after the Fed lowers interest rates. Using a long historical data sample, we show that there is actually no reason to wait. The current interest rate on long-term loans has already dropped to reflect information about future anticipated cuts to short-term rates.

Similarly, when the Fed announces that it is likely to gradually raise interest rates over the next year, people rush to lock in long-term loans before interest rates rise further. This is again a mistake. Knowledge that the Fed plans to gradually increase short rates does not mean that long rates will gradually increase in tandem. Instead, the long rate jumps immediately in response to such an announcement, and there is no reason to rush to lock in long-term debt before the Fed raises short rates.

In both cases, people fail to recognize that the current long-term interest rate already reflects the average of expected short term-interest rates over the life of the long-term loan. In other words, long rates have already priced in all public information about Fed policy with respect to short rates. In the data, expected future changes in the short rate do not positively predict corresponding future changes in the long rate.

Households are not alone in making this mistake. We find that corporate managers and bond investors make a similar mistake in thinking they can predict future changes in long-term interest rates based on expected changes in short rates. Even professional forecasters make a mistake of forecasting similar shapes for the paths of long and short rates over the next four quarters; in reality, there is no positive relationship between these paths.

What causes the confusion between short-term and long-term interest rates?

This confusion occurs because people lump short- and long-term interest rates into the same coarse category of “interest rates.” Categorical thinking is a cognitive shortcut in which people organize similar concepts, objects, and events into a category, and apply the same rule or judgment to all items within the category. (Common examples of categories used to simplify our thinking include Ivy League universities, S & P 500 firms, and Morningstar investment styles.) Research in behavioral economics has shown that categorical thinking can cause people to overlook differences within categories, leading to errors in reasoning.

“Categorical Thinking about Interest Rates”

In the case of interest rates, it is natural to think about short- and long-term interest rates in the same category because they indeed share many characteristics. The contemporaneous levels of short- and long-term rates are positively correlated. It is also true that Fed announcements of surprise changes to the federal funds rate simultaneously affect short and long rates in the same direction. However, people may fail to recognize that long and short rates are correlated precisely because long rates are an average of expected future short rates. Thus, long rates should not be expected to move with expected future changes in short rates.

Does this misconception have larger effects on the economy?

Yes, this misconception can reduce the effectiveness of Fed monetary policy. When the Fed announces that it plans to gradually increase interest rates over the next year, the long-term interest rate rises immediately on this announcement, and the Fed hopes that the immediate increase in long-term rates will reduce borrowing, slow the economy, and fight inflation. We show that instead of a reduction in borrowing, households and firms rush to borrow to lock in long-term rates before they rise further. This rush to borrow and buy homes can add to inflation in home prices—the opposite of what the Fed intended.

Surprisingly, we find that categorical thinking about interest rates increases with education and income. This occurs because a high degree of sophistication is necessary for one to make this mistake. In particular, one needs to have at least some knowledge about anticipated Fed policy regarding short-term interest rates in order to conflate short-term interest rate expectations with long-term interest rate expectations. Because sophisticated actors tend to make this mistake, and because these sophisticated actors control the bulk of investment dollars, their behavior really matters for the macroeconomy.

Kelly Shue is a Professor (Adjunct) of Law at Yale Law School and a Professor of Finance at the Yale School of Management. Her research focuses on behavioral finance, with applications to CEO pay, non-proportional thinking in financial markets, and the gender promotion gap.

insights.som.yale.edu

|