Send this article to a friend:

August

30

2024

Send this article to a friend: August |

The Long, Slow Goodbye (to the USD)

“There is no trap so deadly as the trap you set for yourself.” ― Raymond Chandler, Long Goodbye Topics:

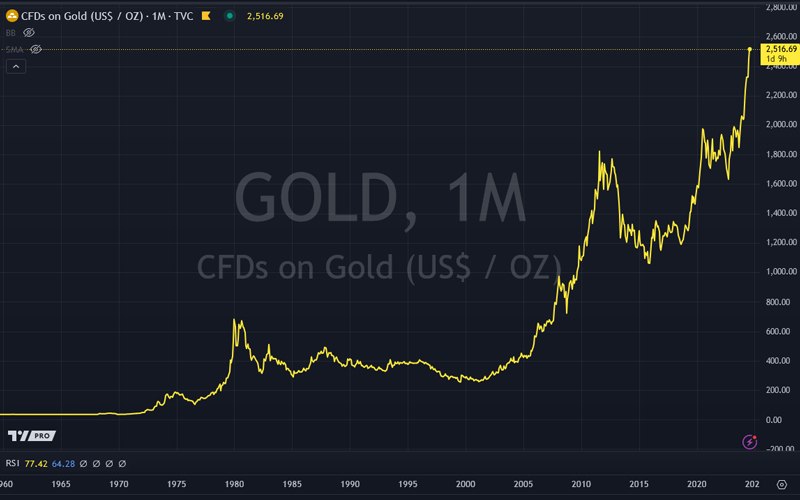

Intro: Inside James Grant’s latest Interest Rate Observer there is a nice piece on Gold in it titled Long goodbye to the dollar standard fromwhich some important comments should be shared. As always his writing is part history, part observation, and part dry humor. Here is a summary and analysis of that article. Gold is making new highs, or to put it differently, the dollar is making new lows. The dominance of the dollar has been the unchanging backdrop of the global monetary system. But could there be an alternative?

Shift Happens It's not far-fetched. The world doesn’t change its monetary preferences often, but when it does, the shift is significant.

If monetary standards never changed, the British pound would still dominate. The idea that the dollar would surpass sterling was evident to some as early as 1776. The paper dollar replacing gold seemed improbable, but it happened. Economists call it progress, but each generation defines that term in its own way. What do 1971 and 2024 Have in Common? Today, the dollar faces new competition from an unexpected source. Central banks in Asia and emerging markets are buying gold, an asset that seemed outdated in the 21st century. European central banks—like those in Switzerland, the Netherlands, and Germany—are relieved by the gold they bought and retained; the rising gold price is offsetting their bond losses. Gold now offers diversification not only from the dollar but also from the overactive digital printing of central banks. But this is not new. Concerned countries in 1971 thought the temptation to cheat and monetize the ballooning US debt was too big a risk. In 1971 Great Britain and France wanted their Gold back to hedge against fears of debasement.

via Grant’s Interest Rate Observer Fast forward 50 years and it is happening all over again. Countries are once again worried about our ability to maintain the buying power of the USD in light of an increasingly unmanageable debt burden. Germany began repatriating its gold as far back as 2016. Most recently nations like India are repatriating their own Gold as well. Most countries are buying more gold outright. It is therefore quite possible this year’s BRICS summit in October will be a reversal of sorts to what Nixon did in ending the Bretton Woods agreement in 1971. From: Why Brics 2024 and Nixon 1971 are the Same Thing

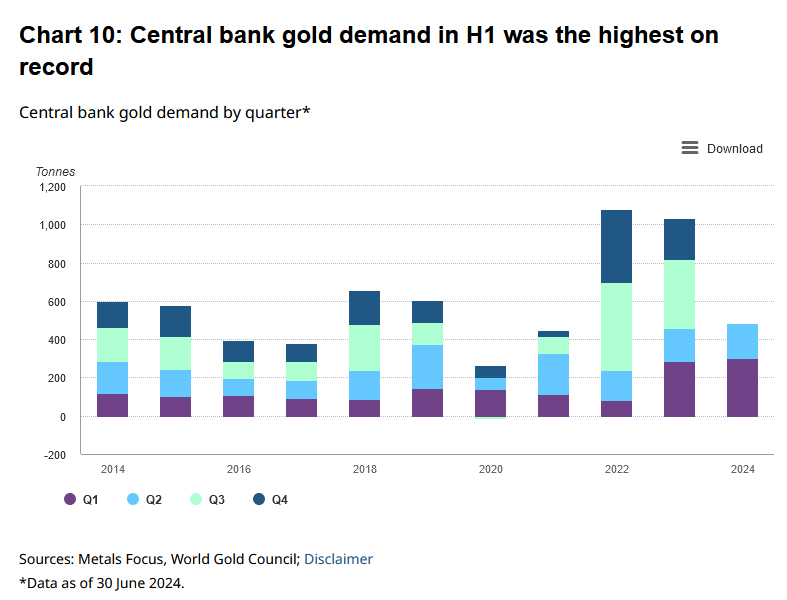

This time, there is no “monetary” Gold to sever deliver-ability of. Thus Gold is again being “freely” movedfrom the West to reside in Eastern vaults as discussed (broken) here discussed in November 2023. Let’s take a look at just how much Gold they want this time. Historical Perspective Markets shape opinions, and central-bank gold buying today might not mean much. A generation ago, the same central banks were selling gold, causing a historic low in gold prices in 1999. Have they learned anything about market timing since then?

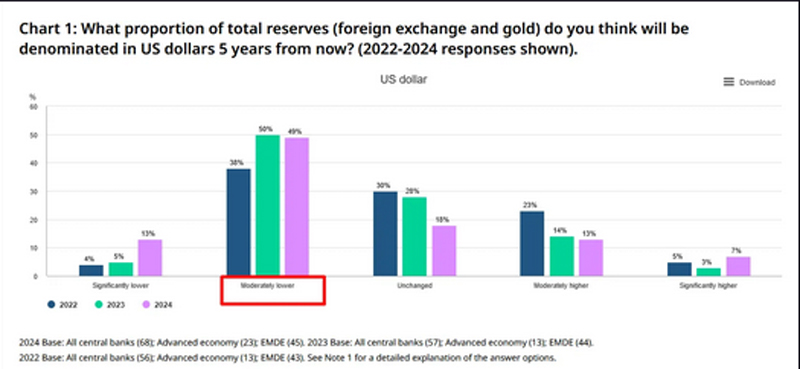

Maybe they’ve just rediscovered that gold is the best currency. It’s scarce, has no national allegiance, and will never trade at zero. Gold is universally accepted, visually appealing, and isn’t anyone’s liability. Its physical properties are almost magical, as evidenced by a medieval Florentine goldsmith who could hammer an ounce into a surface area of over 140 square feet. No Imminent Return to Gold Standard We're not holding our breath for a return to the classical gold standard. Its principles—simplicity, monetary freedom, and price stability—seem ill-suited for the 21st century. The gold standard thrived from 1815 to 1914, with central bankers focused mainly on maintaining the exchange rate. Inflation was a wartime issue, neutralized by peacetime deflation, keeping average prices stable over time. The gold standard may be gone, but gold is back in the monetary spotlight. Central Bank Trends According to the 2024 Central Bank Gold Reserves Survey, 29% of the World Gold Council’s respondents plan to increase their gold holdings within the next 12 months, the highest since the survey began in 2018.

Furthermore, 62% of respondents believe the dollar’s share of total reserve assets will decrease within five years, up from 55% in 2023.

Dollar's Hegemony Understanding the dollar’s global dominance requires knowing how it gained that position, which can’t be understood without explaining the collapse of the Bretton Woods system from 1944 to 1971. Free Posts To Your Mailbox

|

Send this article to a friend:

|

|

|