Send this article to a friend:

August

31

2023

Send this article to a friend: August |

Fed’s Favorite Inflation Indicator Jumps Higher In July (4.2% YoY),

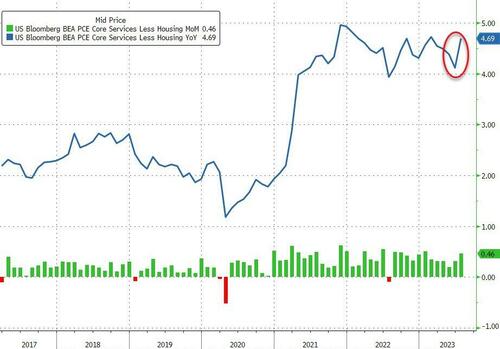

Source: Bloomberg Even more focused, is the Fed’s view on Services inflation ex-Shelter, and the PCE-equivalent shows that is very much stuck at high levels…

Source: Bloomberg Services inflation accelerated in July but Goods saw the biggest MoM deflation since 2022…

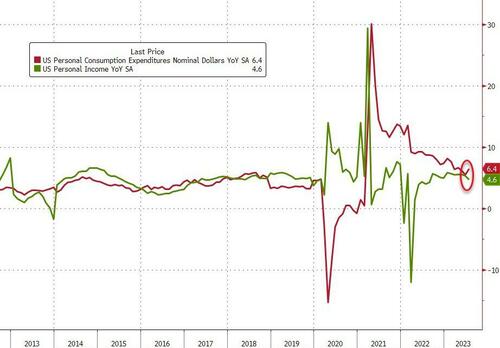

Source: Bloomberg Personal Income growth slowed for the 2nd month in a row as Spending accelerated for the 2nd month in a row…

Source: Bloomberg On a year-over-year basis, spending accelerated as income growth decelerated…

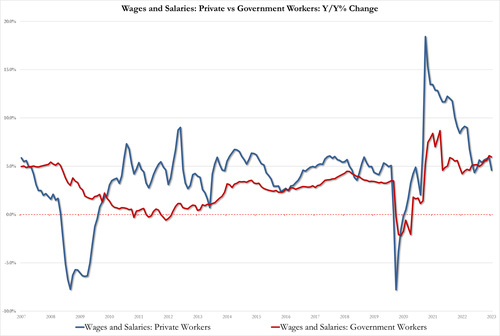

Source: Bloomberg Wage growth slowed:

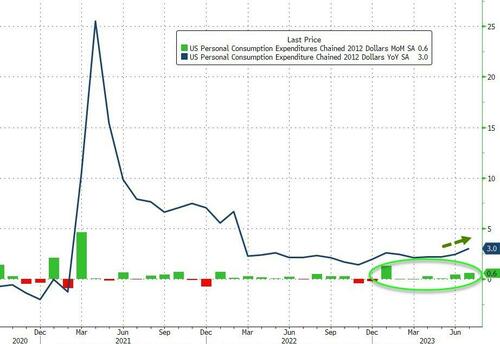

Adjusted for inflation, ‘real’ personal spending was higher in July (up 3.0% YoY)…

Source: Bloomberg But real disposable income fell 0.2% MoM – its biggest decline since June 2022…

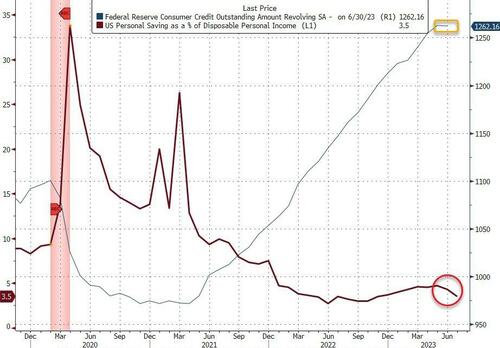

Putting all that together, we see that the savings rate plunged to 3.5% – the lowest since Oct 2022 – down from 4.3% – the biggest drop since Jan 2022….

It appears the American consumer is completely tapped out – consumer credit has flatlined (maxx’d out) and now savings are plunging again.

|

Send this article to a friend:

|

|

|