Commodities Halftime Report: Silver, Oil And Gold Were The Top Performers

Frank Holmes

If you were in charge of feeding everyone this Fourth of July, you probably noticed a hike in prices. If you were in charge of feeding everyone this Fourth of July, you probably noticed a hike in prices.

According to the American Farm Bureau Federation, the cost of a typical Independence Day spread for 10 people jumped to $71.22 this year, up 5% from last year and a whopping 30% from five years ago.

That may not seem like much, but this inflation has a compounding effect on commodities. Research from Goldman Sachs shows that a 1 percentage point increase in U.S. inflation has historically led to a real return gain of 7 percentage points for commodities. Meanwhile, the same trigger caused stocks and bonds to decline by 3 and 4 percentage points, respectively.

This data supports the potential of commodities as an inflation hedge. In times of rising prices, having exposure to tangible assets like silver, oil and gold often retain their value better than paper assets.

The reason I mention silver, oil and gold is because they were the top performing commodities in the first half of 2024. Let’s dive into what’s driving these trends and what they might mean for investors.

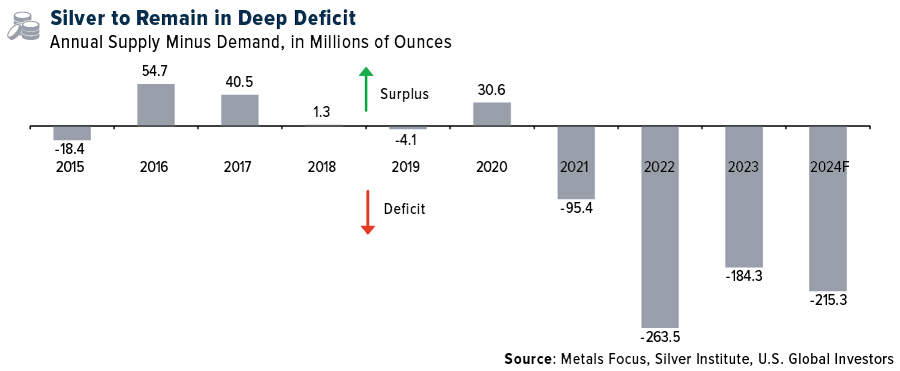

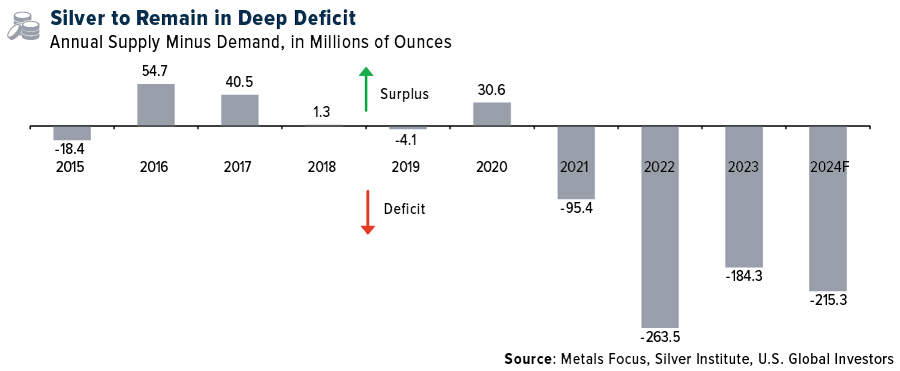

Silver’s Fourth Year Of Market Deficit Could Spell Opportunity

Leading the charge is silver, up close to 22.5% in the first half. The “poor man’s gold” is proving its worth, driven by a global supply deficit and increasing demand. Back in January, the Silver Institute forecasted that global silver demand will reach a near-record 1.2 billion ounces in 2024, up 1% from last year. This growth is primarily fueled by industrial applications, particularly in the booming solar energy sector.

We’re looking at the fourth consecutive year of a structural market deficit in silver. The deficit is expected to widen by 17%, reaching 215.3 million ounces. Loyal readers should be aware of what happens when demand outstrips supply—prices tend to rise.

The Coming Oil Glut?

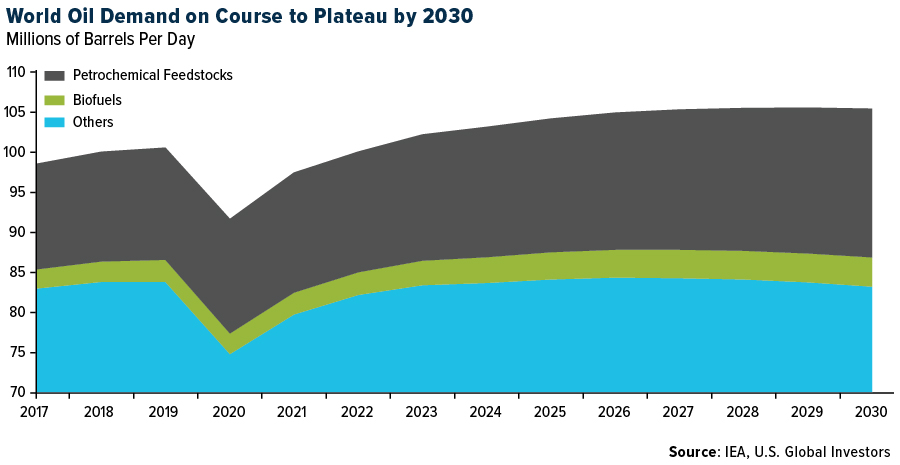

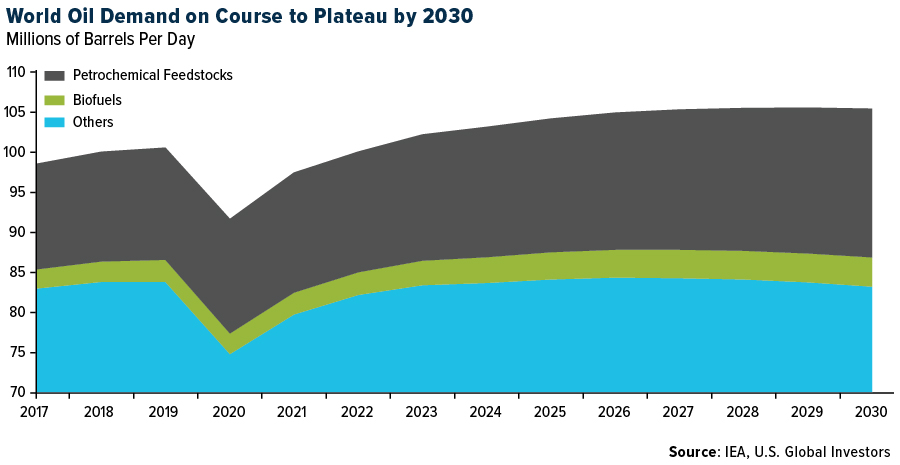

Oil, our second top performer with a gain of 13.8%, continues to demonstrate its staying power in the global economy. Despite the push for electrification, oil demand remains robust.

According to a new report by the International Energy Agency (IEA), we’re approaching a significant turning point. Global oil demand, which averaged just over 102 million barrels per day in 2023, is expected to level off near 106 million barrels per day towards the end of this decade. This plateau in demand coincides with a projected surge in global oil production, particularly from non-OPEC+ producers.

The implications of this forecast are profound. We’re looking at a future where oil supplies could reach levels of abundance unseen outside of the pandemic. This potential oversupply situation could exert downward pressure on oil prices.

It’s worth noting that the IEA’s outlook contrasts with some other forecasts. Goldman Sachs Research, for instance, expects oil demand to continue growing until 2034, potentially reaching 110 million barrels a day. They cite increasing demand from emerging Asian markets and the petrochemical industry as key drivers.

Goldman Sees $2,700 Gold On The Horizon

Last but certainly not least is gold. The yellow metal has shone brightly in 2024, rising 12.8% year-to-date and outperforming many major asset classes. This performance is particularly impressive given the high interest rates and strong U.S. dollar—conditions that ordinarily create a challenging environment for gold.

What’s behind the metal’s resilience? It’s a perfect storm of factors: continued central bank buying, strong Asian investment flows, steady consumer demand and persistent geopolitical uncertainties. In its midyear outlook, the World Gold Council (WGC) estimates that central bank demand alone contributed at least 10% to gold’s performance in 2023 and potentially around 5% so far this year.

Looking ahead, Goldman has set a bullish target of $2,700 per troy ounce for gold by year-end. That’s an increase of about 16% from current levels. They cite solid demand from emerging market central banks and Asian households as key drivers.

Many investors, myself included, appreciate gold’s potential as a hedge against both inflation and geopolitical risks. It could provide a buffer against potential stock market volatility, especially if trade tensions escalate. Additionally, gold might see further upside if concerns about the U.S. debt load increase or if there’s a shift in Federal Reserve policy under a new administration.

As we move into the second half of 2024, the commodities market continues to offer intriguing opportunities. Silver’s industrial demand, particularly in the green energy sector, presents a compelling growth story. Oil remains a critical resource, especially for emerging economies, despite the global push towards renewables. And gold, the eternal safe haven, continues to prove its worth in uncertain times.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.66%. The S&P 500 Stock Index rose 1.95%, while the Nasdaq Composite climbed 3.50%. The Russell 2000 small capitalization index fell 1.02% this week.

- The Hang Seng Composite gained 6.16% this week; while Taiwan was up 2.28% and the KOSPI rose 2.30%.

- The 10-year Treasury bond yield fell 12 basis points to 4.277%.

Airlines And Shipping

Strengths

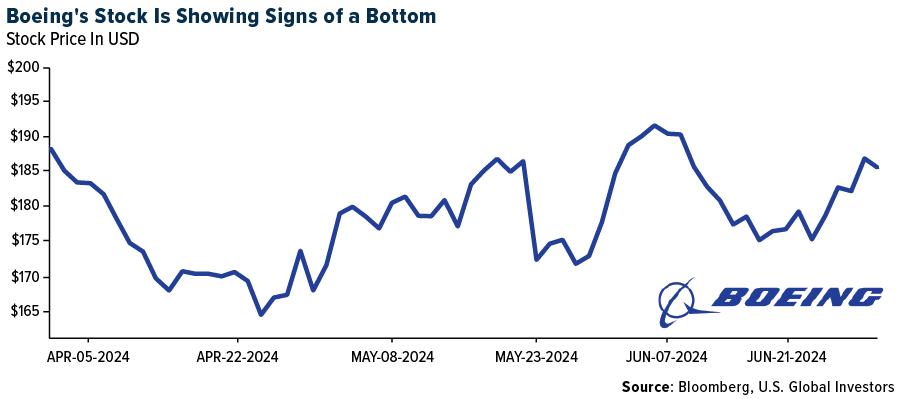

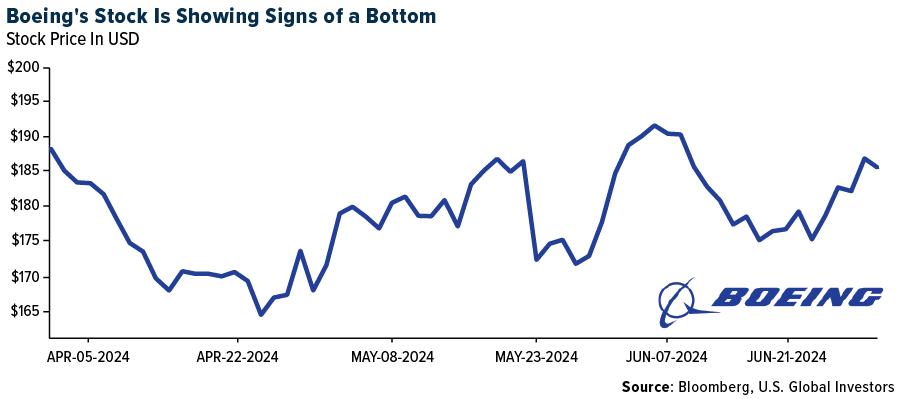

- The best performing airline stock for the week was El Al, up 9.0%. According to Goldman, Boeing is on track to make 43 deliveries for June, including 34 737 MAXs, three 787s and six others. Of the 34 MAX deliveries, 26 were new production deliveries, with eight from inventory. Both the total delivery number and implied underlying rate are improvements versus the trend through the first half of the year.

- The Panama Canal Authority announced further easing of restrictions and now allow 35 ships per day. This is just below typical daily levels of 36-37 but compares to a low of just 22 per day in January, according to Stifel.

- Air Canada announced an agreement with BOC Aviation for the placement of eight Boeing 737-8 aircraft, a positive sign as it highlights RBC’s view that Air Canada has better access into securing aircraft compared to peers.

Weaknesses

- The worst performing airline stock for the week was Norwegian Air Shuttle, down 13.3%. According to ISI, Frontier cut 13 percentage points from August capacity and 4 percentage points from September capacity. Last week, Frontier cut 3 percentage points from July.

- Tanker demand sequentially declined 8% through the second quarter 2024 on Asian refinery maintenance and fading U.S. exports. According to Bank of America, forward curves suggest VLCC rates below breakeven through the third quarter of this year.

- Morgan Stanley says that Air France and Transavia France are currently experiencing pressure on projected unit revenues for the summer season due to the upcoming Olympic Games in Paris, with traffic to and from the French capital lagging behind other major European cities. They have quantified this negative impact on unit revenues in the region of 160-180MM EUR for the period June until August, with no impact on guided capacity at this stage.

Opportunities

- The TSA forecasts a record-setting July 4 holiday and expects to screen over 32 million passengers between Friday, June 28 and Monday, July 8, which is almost a 5.5% year-over-year increase for the holiday, reports CNBC.

- Air cargo demand continues to surprise, tracking at 13.2% year-over-year growth with June demand also tracking double digits higher year-over-year. June saw unseasonally strong demand supported by rising tech shipments and strong eCommerce demand combined with shifts from ocean, given surging ocean freight rates and longer shipping times, according to Bank of America.

- Boeing agreed to acquire Spirit AeroSystems for $37.25 per share, valuing Spirit AeroSystems (SPR) at $4.7B, in an all-stock deal, reports RBC. SPR shareholders will receive a number of shares of Boeing between 0.18 and 0.25 shares for each SPR share, depending on the price of Boeing stock at the time of the acquisition. The total enterprise value of the transaction is $8.3B, considering the SPR debt.

Threats

- Lufthansa is introducing an Environmental Cost Surcharge. The surcharge (ranging from EUR1-EUR72) applies to all for departure in 2025+ and to departures from the 27 EU countries/U.K./Norway/Switzerland, according to Raymond James.

- Car carrier demand growth is tracking at up 5.4%, reports Bank of America, with Chinese seaborne exports hitting record levels in April 2024. But car carrier time charter rates trended lower month-over-month again in June 2024, showing further signs of a peak, while the car carrier orderbook continues to build, hitting 39% in June 2024.

- Southwest Airlines initiated a Rights Plan that will expire in one year. Pursuant to the Rights Plan, the company is issuing one right for each share of common stock. The rights will initially trade with Southwest Airlines common stock and will generally become exercisable only if any person or group acquires 12.5% or more of the company’s outstanding common stock.

Luxury Goods And International Markets

Strengths

- Constellation Brands, an alcoholic beverage company, reported a profit for the quarter that exceeded expectations and affirmed its guidance; however, sales fell slightly short of estimates. Sales increased by 6% to $2.662 billion, compared to estimated sales of $2.669 billion. The company anticipates sales growth of between 6% and 7% in the coming year.

- In the United States, June nonfarm payrolls increased by 206,000 month-over-month, surpassing the consensus estimate of 190,000 and a downwardly revised May figure of 218,000 (previously 272,000). According to FactSet, job gains were most notable in healthcare, construction, and government sectors, while retail and professional/business services experienced declines

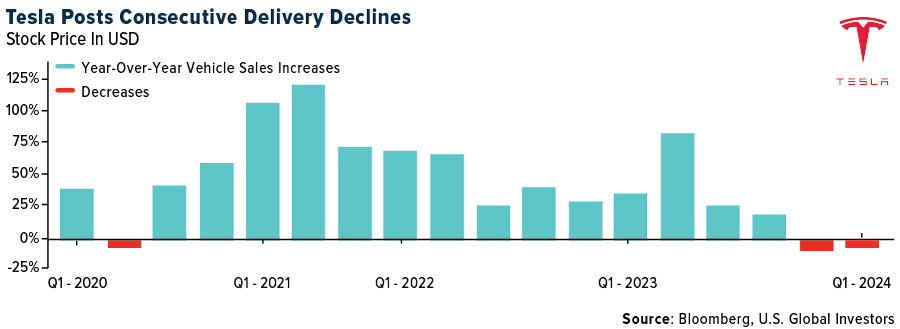

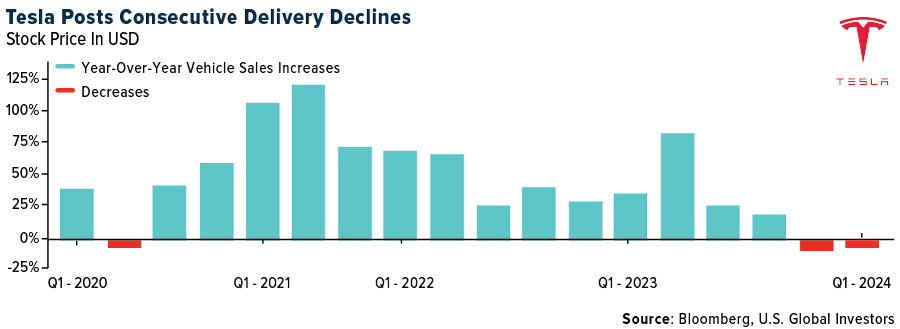

- Electric vehicle maker Tesla was the top-performing S&P Global Luxury stock, rising 27.1% over the past five days. The company’s shares gained after it reported sales data for the latest financial quarter.

Weaknesses

- China’s Manufacturing PMI was reported below 50, indicating contraction rather than expansion. The official index released over the weekend was 49.5. In contrast, the Caixin China Manufacturing PMI, which focuses on smaller privately-owned companies, was reported above the 50-mark at 51.8. The China Manufacturing PMI tracks production among larger, government-owned conglomerates.

- Eurozone inflation slowed as expected from 2.6% to 2.5%. However, core inflation, which excludes volatile items like food and energy, remained unchanged at 2.9%, surpassing expectations of 2.8%

- Faraday Future Intelligence was the worst-performing S&P Global Luxury stock, losing 21.0% in the past five days. This remains a highly volatile stock, after the company’s share price dropped by 99% in a single year.

Opportunities

- Tesla reported weaker year-over-year sales, but the numbers exceeded analysts’ expectations, indicating signs of recovery. The company delivered 443,956 cars in the second quarter, surpassing the expected 439,302. Despite a 4.8% decline from a year ago, Tesla showed sequential improvement from the 386,810 cars delivered in the first quarter of the year.

- UBS’s global equity strategist recommends investing in European consumer stocks over those in the United States. The firm highlights accelerating real wage growth in Europe and the United Kingdom, improving employment trends, increasing consumer confidence, and significantly higher excess savings compared to the U.S. In Europe, excess savings amount to 8% of GDP, while in the UK, it’s 16% of GDP, compared to just 2% in the U.S.

- Uber Technologies is launching luxury yacht and boat rides across European destinations. Users can book exclusive yacht day trips around Ibiza for 1,600 Euros, which includes a personal skipper, a complimentary bottle of champagne, and a snack, with transfer services available across the island. Additionally, Uber will introduce a “limo boat” service in Venice, allowing users to navigate the Venetian Lagoon for 120 Euros per trip through the Uber application.

Threats

- An investigation in Italy into local factories revealed workshops producing handbags and other leather goods for Dior and Armani are using foreign labor to manufacture high-end products at a fraction of their retail price. According to a Bloomberg article, Dior paid a supplier EUR 53 apiece to make a handbag it sells in stores for EUR 2,600. Following the investigation, judges in June placed Manufacturer Dior SLR, a unit of Dior, under court administration.

- According to Bryan Garnier’s research, luxury goods companies are expected to face profit pressure in the first half of the year due to weakness in China. This cautious outlook on the sector led to a downgrade of Swatch from a buy rating to neutral. The research suggests there may be a notable performance difference between soft luxury brands and top picks like Hermes, LVMH and Richemont.

- Americans are projected to spend less on food for Independence Day celebrations this year compared to 2023, according to a survey by the National Retail Federation. The survey indicates that consumers plan to spend $9.4 billion on food and related goods for the holiday, down from $9.5 billion last year. This equates to an expected per-person spending of $90.42 this year, a decrease from over $93 per person last year, as reported by the group.

Frank Holmes is the CEO and chief investment officer of U.S. Global Investors (NASDAQ: GROW). Mr. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. He is the co-author of The Goldwatcher: Demystifying Gold Investing. Over 100,000 subscribers follow his weekly commentary in the award-winning Investor Alert newsletter, across social channels and in his Frank Talk blog, which is read in over 180 countries.

Under his guidance, the company’s mutual funds have received recognition from Lipper and Morningstar over the years. In 2015, Mr. Holmes led the company into the exchange-traded fund (ETF) business with the launch of the U.S. Global Jets ETF (NYSE: JETS), which invests in the global airline sector. In 2017, the firm launched its second ETF, the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU), focusing on gold royalty companies.

In 2017, U.S. Global Investors made a strategic investment in HIVE Blockchain Technologies (TSX.V: HIVE, NASDAQ: HIVE). Mr. Holmes serves as Executive Chairman of HIVE, which is the first cryptocurrency mining company to go public, mining Bitcoin.

Mr. Holmes is a much-sought-after keynote speaker at national and international investment conferences. He is a regular commentator on popular financial networks and has been profiled by Fortune as well as The Financial Times.

https://www.usfunds.com

|