Send this article to a friend:

July

29

2023

Send this article to a friend: July |

How the Fed Might Trigger Another Great Depression

That brings the Federal target funding rate to 5.25-5.5%, the highest rate in over two decades. (Granted, those were two decades of perpetual emergency, the lowest-for-longest rates in U.S. history.) Powell summarized the FOMC decision as follows:

The Fed’s continuing battle against inflation was started way too late under the mistaken idea it was “transitory.” Towards that end, the recent rate increase was justified by Powell in another statement:

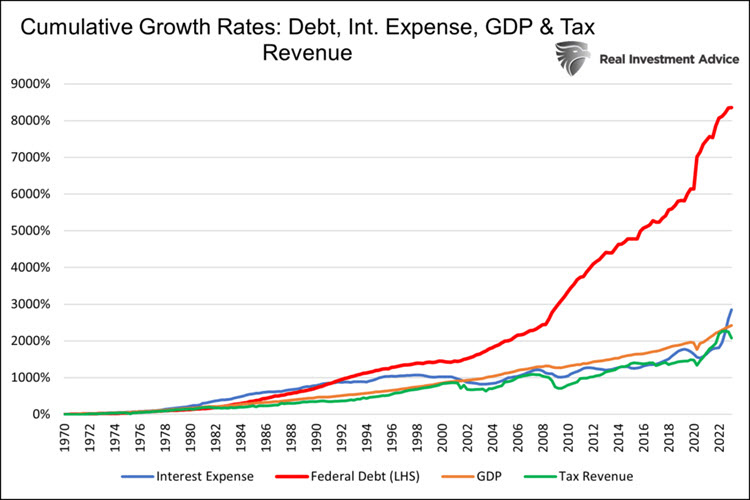

He’s right that price stability is a crucial part of a functioning economy. However, the Fed’s efforts to rein in inflation add stress to another part of the economy that’s already cracking under the strain… Higher interest rates are good for creditors, but terrible for debtors The truly wealthy, who have no debts at all – people like Warren Buffett and Bill Gates – don’t need to worry much about interest rates. Institutions and individuals who require credit, though, including the U.S. government, banks, many businesses and most American households, are running into trouble. Higher interest rates are pushing them to the brink of survival. Let’s take a look at how the world’s largest debtor, the U.S. government ,is doing. (Source). This graph compares the growth rate for four major economic indicators: GDP and tax revenue (“income”) on the one hand, total federal debt and debt service payments (interest expense) on the other:  Source Deficit spending increases government debt. Old debts aren’t paid off – instead, they’re rolled over into new loans. And when interest rates are higher, those new loans become more expensive. When interest rates were low (for those 20 prior years), the government borrowed massive amounts of money – cheaply. As though historically low interest rates would last forever. The borrowing continued – now surpassing $32 trillion. But now, thanks to 5% in rate increases the Fed has initiated since February 2022, the interest expense the government pays has skyrocketed. This is because, instead of paying off its debts, the government is simply writing new IOUs and paying higher interest rates, rolling over old debts into new:

That’s right. The vast majority, some 90% of federal debt, isn’t funding the military. It isn’t training new Immigrations & Customs Enforcement officers, or helping the Food and Drug Administration monitor food safety. It’s simply paying off old debts by taking on new, more expensive debt! And if you look at the chart again, you’ll see that debt service payments are rising much faster than tax revenue – faster than GDP (which, theoretically, if the government imposed a 100% tax, would represent the entire income of the U.S.) This looks like a debt trap. Governments, however, can draw out a bankruptcy for decades, because they have the power to print their own money (and force citizens to use that money). Businesses, however, can’t print their own money… A recent New York Times article summarized the potential for a new bankruptcy crisis:

Lending and banks are already suffering thanks to higher rates, and another banking crisis could ensue if they continue to rise. Business Insider reported on the contraction of credit:

It’s not just credit that’s contracting, though – liquidity is down some $500 billion across the banking system. Tighter credit is bad news for anyone counting on loans to survive. Such as the average American household, which has been borrowing heavily to afford higher prices. Consumer debt recently breached a historic record high. Of course, consumers will suffer consequences of higher interest rates on credit, which in some cases was being used to combat the inflation that the Fed is fighting. To summarize:

We can be pretty sure, from past experience, that the Fed will prioritize “financial stability” over its inflation fight. The real question is, which will happen first: a credit crisis bringing on a severe recession? Or a pre-emptive return to quantitative easing and money-printing, fueling another inflationary surge? One of the two looks extremely likely in the next six months… Finding stability in an unstable economy Consider everything we discussed above, it’s no wonder that global de-dollarization is all over the news these days. No one wants to pin their financial future on a bankrupt nation’s rapidly-devaluing currency… Maybe the only good news is that there’s an asset that can not only diversify your savings, but provide shelter from dollar devaluation: Physical precious metals like gold and silver. There’s a reason gold and silver are the historic safe-haven assets of choice. In addition to being some of the few inflation-resistant investments that are practical for individuals to own, they have a centuries-long track record of preserving purchasing power regardless of economic crisis. So right now, it might be a good idea to take a few minutes to help yourself by learning about them. You can get all the information you need about both gold and silver for free to make an informed decision right here.

|

Send this article to a friend:

|

|

|