Send this article to a friend:

July

26

2023

Send this article to a friend: July |

Why was The US Treasury's Silver Eagle Mandate Not Honored?

Summary

A simple question … Why would the Mint’s production of American Silver Eagles be at a 5 year low during a period where coin premiums have been the highest ever? The US Mint is a Bureau of the Treasury Department. The US Constitution defines the dollar as 371.25 grains of pure silver. Millions of small investors are now forced to bid against each other to purchase American Silver Eagle coins. Both parties in Congress called the CEO of a private corporation, Robinhood, to testify to congress. It was believed that Robinhood restricted trading of shares of a video game retailer for a few days. A US Government institution violating federal law by restricting production and depriving small investors of their preferred investment is much more important. I look forward to hearing answers to that simple question by Janet Yellen and Ventris Gibson, under oath. Background The US Mint has been producing the American Silver Eagle (ASE) 1 troy oz silver coin since 1986. Production commenced after the Liberty Coin Act (99-61) was signed into law on July 9, 1985. Over the nearly 4 decades since the first coin was struck, the ASE has become the primary vehicle for many investors to participate in the precious metals market. Some mint products are produced in limited quantities specifically for the collector market. While some may purchase ASEs as a collectible, for most, it is an investment in precious metals. Some investors often choose the “monster box”, a 500 coin container. Obviously, buying 500 identical coins is an investment and not collecting coins for their scarcity. Small bullion investors are drawn to the ASE because, in part, gold coins are much more expensive. The smallest gold coin produced by the Mint, the 1/10 oz American Gold Eagle, is smaller than a penny and is typically 10 times more costly than an ASE coin. Other silver investment alternatives such as the pre-1965 silver coins have a fixed supply. There are other sovereign coins such as Canada’s Silver Maple Leaf coin and Australia’s Kangaroo coin, and coins issued by private companies often called rounds. However, the point of acquiring silver coins is to have a liquid investment in precious metals. The ASE is preferred by American investors because it is a highly recognizable coin with an active resale market. The fact that it is produced by the US Mint increases the coins desirability. Over 619 million ASE coins have been bought by investors and many are resold in an active secondary market. American Silver Eagles, legislated by the US Congress The Mint is bound by law to meet market demand. The specific language of the Liberty Coin Act is as follows:

The key word is “shall”, which combined with “sufficient to meet public demand”, means that production volumes are not up to the discretion of Secretary of the Treasury or the Director of the Mint. The Mint must meet public demand. That same law specifies other coins produced by the Mint. However, this specific language regarding the Mint’s obligation to meet public demand is only used for the ASE and the American Gold Eagle coins. Other coins, such as the gold Buffalo, the 5 oz silver coin, platinum and palladium coins have less restrictive language and give the Secretary discretion on production. Below is a summary of the language prescribing the production volume for each product:

The mint is also bound by law to sell the ASE at the cost of silver plus manufacturing costs. The specific language is as follows:

According to the Mint’s web page and the Federal Register, production cost increased in from $1.25 per coin in 2008 to $2.00 per coin in late 2010. The rapid increase at that time was likely due to the vastly increased production volume which was triggered by the fiscal response to the global financial crisis. The current production cost is currently stated as $2.00 per coin. The plot below summarizes the history of the production cost on a per coin basis and as a percentage of silver cost:

Marketing and Distribution The mint does not sell ASEs directly to the public instead relying on private sector distribution channels. ASEs can only be purchased by “Authorized Purchasers” which are pre-approved by the Mint. The mint only sells ASEs in bulk quantities of 25,000 oz or larger. The approved buyers often distribute to other dealers and/or sell directly to retail buyers. According to the Mint’s web page there are currently 10 Authorized Purchasers of silver products in the USA and 2 in Europe:

Purchasing newly produced ASE’s in the retail marketplace typically involves a price markup beyond the Mint’s production cost. The distribution chain is also compensated for their value added services and requisite profit incentive. The retail price as a percentage of the silver price is the Total Premium. ASE buyers are typically presented either the total coin cost or the Total Premium. Some retailers prefer to quote the Total Premium because silver prices fluctuate constantly. The Total Premium is market driven and also fluctuates. During periods of increased demand, Total Premiums may increase significantly. I obtained historic ASE market Total Premiums from various sources including the web site listed below which is compiled daily by one of the participants at Reddit’s WallStreetSilver group, U/ExploringFinance who also has written finance commentary for SchiffGold. He has compiled historic Total Premium data for many silver products including the ASE. Retail buyers are typically not shown the components of the Total Premium such as the Mint’s Premium or Dealer Premium. The apparent Dealer Premium can be calculated by subtracting the Mint Premium, a known value, from the Total Premium. The Total Premium, the Mint Premium and the Dealer Premium at the start of each calendar month are plotted below:

Note the following:

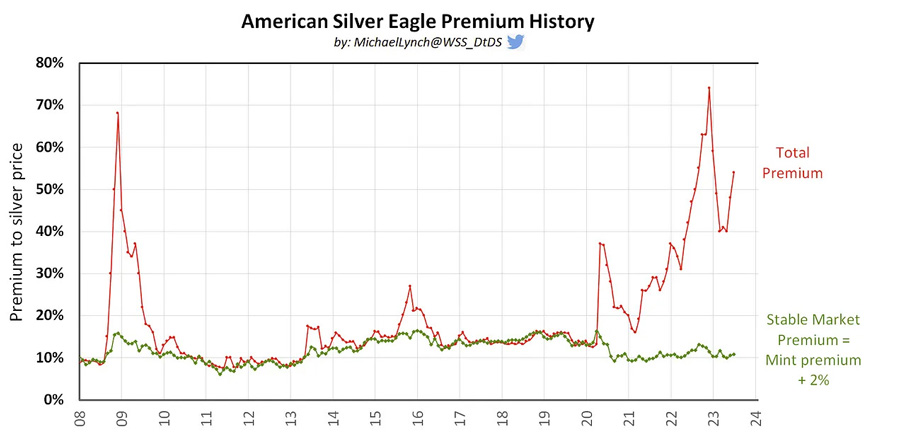

If a 2% Dealer Premium is assumed to cover cost and provide sufficient profit incentive for the private sector distribution channel, then the Total Premium in a market with supply-demand equilibrium would be the Mint Premium plus 2%. This could be called a “Stable Market Premium” and that is posted on the plot below along with the Total Premium:

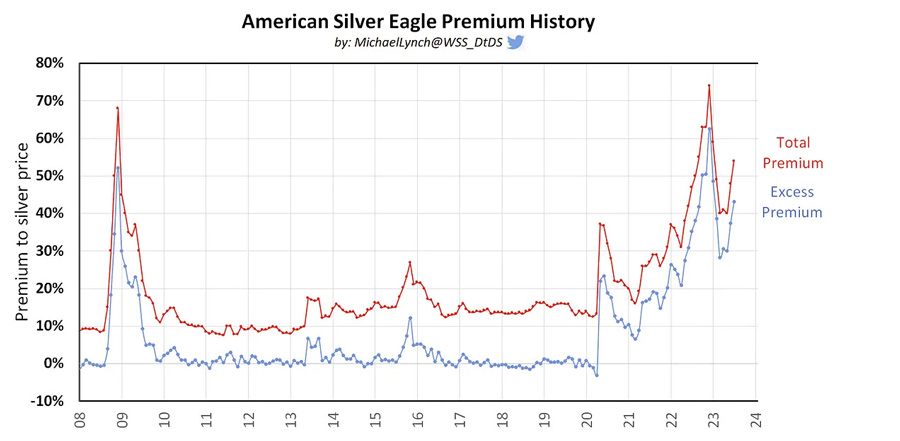

Note that the Stable Market Premium is often nearly the same as the Total Premium. In those situations, the market is in supply-demand equilibrium. During periods where the Total Premium is greater than the Stable Market premium, market demand is exceeding supply. During those periods ASE buyers are bidding against each other to purchase the restricted supply. This Excess Premium can be calculated by subtracting the Stable Market premium from the Total Premium. Excess Premium is plotted below along with the Total Premium:

Note that the Excess Premium of 0% serves as a baseline. During periods of supply-demand equilibrium the excess premium is near 0%. During periods where supply is less than demand, the Excess Premium increases above 0%. The Excess Premium is a quantitative indicator of demand exceeding supply. It is a better supply-demand indicator than Total Premium because:

ASE Sales and Production The mint publishes monthly sales figures on its web site. A plot of that data is shown below along with the trailing 12 month average production. Excess Premium is also shown for the period after 2007.

On several occasions ASE investors increased demand resulting in a rapid increase in Excess Premiums. Excess Premiums increase when demand spikes because in the short term the total supply of coins is nearly fixed. The only increase in supply can be due to production from the Mint. Mint Reaction to Change in Demand It is apparent from the plot above that the Mint has always reacted to periods of changes in demand as quantified by the Excess Premium … until recently. The plot below zooms into the post 2007 period and shows the trailing 12 months average coin production to filter out the seasonal sales spikes:

2008 through 2011 A spike in demand at the onset of the global financial crisis started in 2007. Excess Premiums rose sharply eventually peaking at 52% in late 2008. The Mint dutifully adhered to the Liberty Coin Act and rapidly expanded production. Sales soared throughout 2008 despite the high premiums paid by the public. Total 2008 production was double 2007 and 70% greater than any period in the mint’s history. At the end of 2008 Excess Premiums had declined somewhat to 26% signaling the increased supply had not yet caught up with demand. The mint continued ramping production through 2009, 2010 and 2011. The total increase in production from the start of the premium spike until early 2012 was 260%. The Excess Premium in late 2011 approached zero indicating the coin supply had caught up to demand. Total 2011 ASE sales were 39.9 million oz. That ASE demand from small investors was nearly as significant as the total physical silver transacted on the comex exchange. ASE’s bought by the public in 2011 were 81% of the 49.1 million oz of physical silver bought on comex that year. ASE sales exceed silver transacted on comex for 5 calendar months. Comex transacts physical silver in 5,000 oz tranches which is beyond the means of most small investors. ASEs are the vehicle the average American buys bullion. At times of high demand, ASE investment can exceed comex if the Mint meets the demand with appropriate supply. 2013 through 2016 Through most of 2012 and early 2013 the market was in equilibrium as indicated by Excess Premiums being near 0%. A premium spike occurred in May 2013 induced by a silver price decline. Excess Premiums rose to 6%. Elevated demand and Excess Premiums continued through mid-2016 and the mint reacted by increasing production by 32% over the 3 year period through May 2016. Over the final 12 months of that period production was 53.5 million oz. To this day that is the highest 12 month production in the Mint’s history even though Excess Premiums have since gone far higher. 2020 Between mid-2016 through 2019 supply-demand were near balanced as indicated by Excess Premiums being near 0%. The Mint reacted to the reduced demand with a production decline. The fiscal reaction to covid in March 2020 increased ASE demand as Excess Premiums spiked to 22%. The plot below further zooms into the period from 2019 onward:

Credit is given to James J. Ryder, the Director of the Mint, and his team for increasing supply given the associated supply chain challenges. The Mint increased production from an average of 1.7 million oz per month prior to the onset of covid to an average of 2.8 million oz per month through early 2021. Through that period Excess Premium drifted lower however remained at 8% in early 2021 indicating the supply had not yet caught up with demand. 2021 through Current In February 2021 a grass roots community self-organized on a social media group on Reddit’s “WallStreetSilver”. The group’s members bought many silver products including ASEs. The increased demand caused the Excess Premium to increase further from 8% to 18% at the end of September 2021. This time, the mint did not increase production. Sales during the 8 months from the start of the social media movement through September 2021 averaged 2.6 million oz per month down from 2.8 million oz. Mint Director David Ryder resigned on September 24, 2021. His replacement was Ventris Gibson. Following the leadership change, ASE production immediately and sharply declined by 50%. ASE production over the 21 months since the leadership change has continued at the highly restricted production rate averaging only 1.3 million oz per month. That is one of the lowest sustained production rates since the production expansion in 2008. Excess Premiums soared to over 60% as small investors have bid against each other due to supply restrictions by the Mint. ASE Supply Deficit It is obvious that Mint production is far from meeting public demand as legislated by law. It has been nearly 3-1/2 years since ASE premiums initially spiked higher in March 2020. That is the longest period of elevated premiums in ASE history. American ASE investors have paid $345 million in excess cost above typical market premiums. However that doesn’t capture the most significant damage. The biggest impact is that many small investors have forgone buying silver bullion due to the excess cost of ASEs. The total supply of ASE’s through July 2023 is 619 million oz. Obviously market demand is substantially greater. Market demand can be estimated based on the Excess Premium which quantifies the under supply. The estimated market demand is shown below along with the actual supply and the supply deficit”:

Note the following:

I certainly hope that lawmakers can address this supply deficit. Millions of small investors would like to exercise their freedom of choice and allocate savings to silver bullion in the form of the American Silver Eagle.

Petroleum engineer who experienced a 90% currency collapse. That'll lead a guy to gold and silver. I do analytics on monetary metals. #Silver #SilverSqueeze

|

Send this article to a friend:

|

|

|