Send this article to a friend:

June

16

2025

Send this article to a friend: June |

Implications Of The Impending Failure Of London’s Platinum Market

That was followed this past week by former metals trader and precious metals analyst Robb Gottlieb reporting that the 1-month London OTC platinum lease rate had increased to 24.5%. Figure 1 shows a mark-up (in yellow) of Bloomberg’s platinum lease graph showing the scale of Gottlieb’s reported spike in the London platinum lease rate.

Figure 1 – Graph Of 1-Month London Platinum Lease Rate 2019 to 2025 Marked To Show Lease Rate Surge Reported by Robb Gottlieb; original graph source: Bloomberg

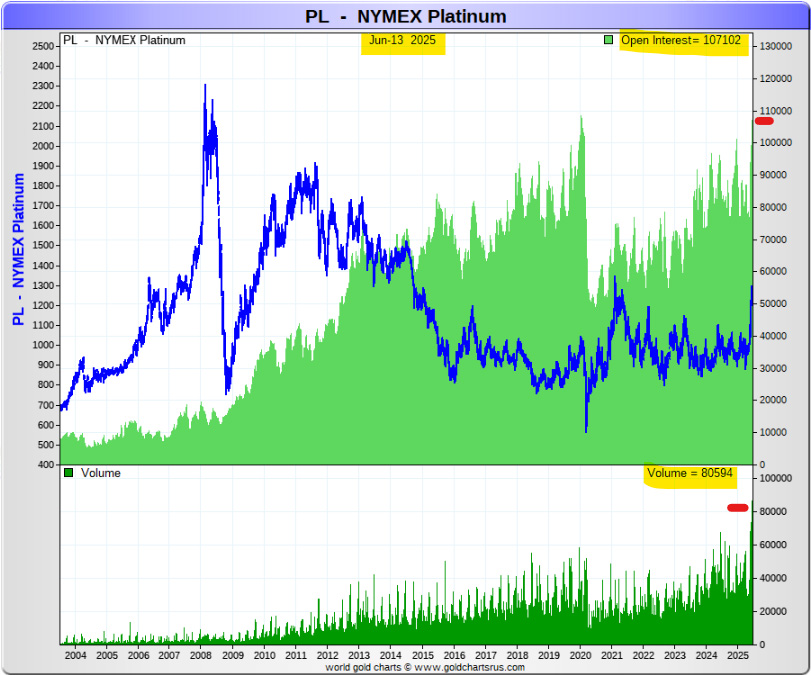

Extreme Paper Leverage Spells Doom For The Price Fixers The platinum market is tiny in comparison to gold and silver. The 8 million (M) oz. per year global platinum market now faces a third year running with an approximately 1M oz. per year supply deficit. While the London Platinum & Palladium Market publishes almost no market data, we can look to the New York CME-COMEX platinum futures market for a sense of how leveraged this paper market has become. It can be seen in Figure 2 below that the COMEX market’s open interest (paper claims for metal) and trading volumes are now surging to historic highs.

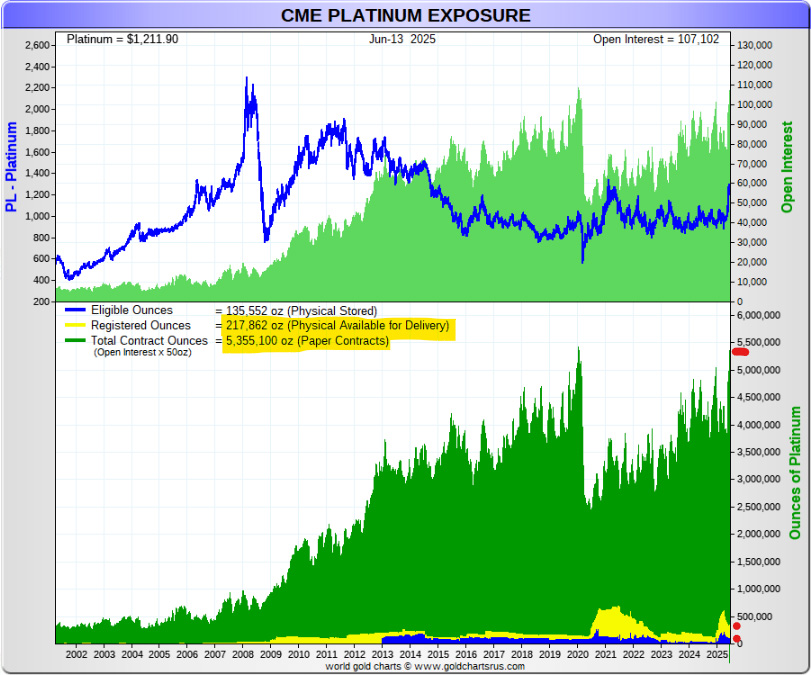

Figure 2 – CME-COMEX Platinum Trading Data 2003 -2025; source: GoldChartsRUs.com Even more disturbing is the scale of open interest or standing open claims in the COMEX.

Figure 3 – CME-COMEX Platinum Vault Holdings And Open Interest (Contract Claims) 2003 -2025; source: GoldChartsRUs.com The platinum market now stands at a critical juncture for platinum supply that can only be met by (much) higher prices. In the meantime, it is likely that default for physical delivery in the London and New York markets will occur.

The Consequences Of Precious Metals Markets Price Fixing FailurePrice fixing, especially in the London gold and silver market, was ultimately a system to artificially (fraudulently) lower global interest rates that leads us to the largest debt bubble in history with global debt now standing at over $300 trillion. Precious metals have always competed as safe havens against bonds and we can anticipate that, as investment continues to aggressively move into these metals to protect savings against the global debt and asset price bubbles created by our central bank central planners, metal availability will become negligible, metal prices will soar as will interest rates, and the whole sorry paper era will end. So war. Mistakes were made. Who could have known? Best regards, David Jensen This post is public so feel free to share it.

|

Send this article to a friend:

|

|

|