Extreme Heat Exposes Fragile U.S. Energy Grid

Tyler Durden

For the third consecutive day, extreme heat across the eastern half of the U.S. has triggered power grid alerts and emergency warnings, highlighting the fragility of current energy infrastructure. Extremely tight power grids reinforce a core part of our energy thesis: the urgent need for clean, reliable baseload power, and there is no better option than nuclear. For the third consecutive day, extreme heat across the eastern half of the U.S. has triggered power grid alerts and emergency warnings, highlighting the fragility of current energy infrastructure. Extremely tight power grids reinforce a core part of our energy thesis: the urgent need for clean, reliable baseload power, and there is no better option than nuclear.

The current environment strengthens our conviction as long-term 'atomic bulls', a stance we've maintained since our original call in December 2020 (read here). Nuclear energy remains the only scalable, carbon-free solution capable of delivering 24/7 generation for powering up America in the 2030s (more here).

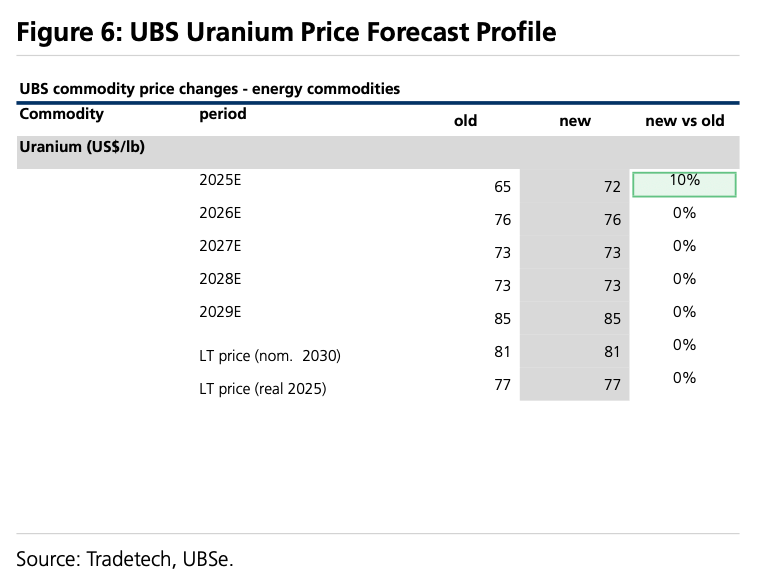

On Wednesday, a team of UBS analysts, led by Dim Ariyasinghe, upgraded their near-term uranium price forecast by ~10% (to $72/lb for 2025) due to improved policy sentiment, bipartisan support, and tighter supply from global disruptions.

The analysts recently hosted a call with the Atlantic Council, noting that U.S. nuclear capacity could grow from approximately 100 GW to 400 GW by 2050—surpassing the Biden administration's current targets. News earlier this week of New York's plan to develop a 1GW plant provided additional tailwinds for the industry.

"We upgrade our near-term U prices ~10% on an improved US policy backdrop, which has buoyed broader market sentiment," Ariyasinghe penned in a note to clients.

UBS maintains a long-term price forecast of $77/lb (real 2025) and $81/lb nominal from 2030.

Uranium spot prices...

Ariyasinghe's stock views within the industry:

- Paladin Energy (PDN): Maintains a BUY rating with price target lifted 3% to A$9.40/share. Restart at the Langer Heinrich mine is ahead of schedule; FY26 production revised slightly down to 4.5Mlb due to blending lower-grade ore, but this is offset by higher prices and improved costs.

- Boss Energy (BOE): Downgraded to SELL despite production success at Honeymoon mine and a 6% price target increase to A$3.50/share. UBS views the stock as overvalued after an 81% YTD rally and cites risks in long-term growth clarity, wellfield geology, and expansion capex.

Separately, long-time readers will recognize familiar ZeroHedge favorites like Cameco (CCJ) and Oklo, both of which continue to log fresh record highs week after week. We've consistently laid out the investment framework over the years—and most recently provided additional, comprehensive guides (read here & here) on how to profit as an 'atomic bull' in this unfolding nuclear era.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|