Send this article to a friend:

June

22

2024

Send this article to a friend: June |

The Federal Reserve’s Cure May Actually Be Worse Than the Disease

Like I explained in my last article, the miraculous Bidenomic economy has been dominated by first historic and now merely persistent inflation. Since his swearing in, our purchasing power has officially declined about 19%. The cost of living has risen even more… Data from the Labor Department confirms that housing expenses, energy and vehicle maintenance costs have all increased by double digits since January 2021. It also costs more to buy a car (+20.4%), maintain it (+30.5%) and insure it (+51.3%) than it did just a few years ago. It all boils down to this phrase I saw on X a few days ago:

Inflation has remained so hot for so long that I’m forced to consider whether the Fed is really as concerned with it as Powell lets on. Put simply, the Federal Reserve appears like it is actually choosing higher inflation. I hope I’m wrong, but I’m afraid I’m right. First, let’s consider just how that decision would be a truly diabolical deal with the devil – then, I’ll present my evidence… Inflation is wealth destruction: “Stealing our heartbeats” Investing legend Jim Grant (of Grant’s Interest Rate Observer) just wrote an absolute banger of a column. In the context of a book review, he points out the sociopathic immorality of allowing inflation to exist at all:

This is brutal. We spend so much time talking about concepts like GDP and money supply that it’s really easy to forget what those things actually mean. Grant continues – and by the way when he says “King” he’s referring to British economist Stephen D. King, author of the book We Need to Talk About Inflation, the subject of this article:

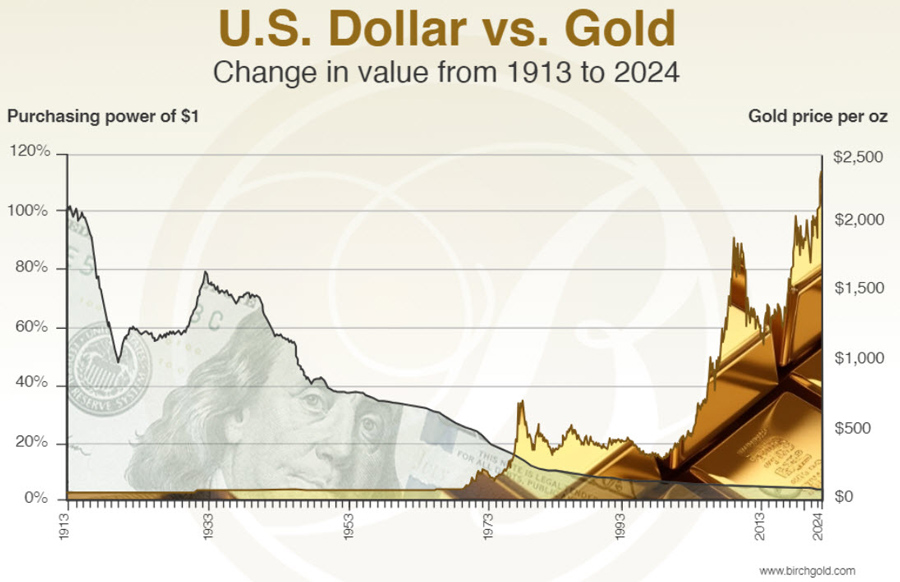

Ron Paul wrote about those “clipped Roman coins” previously. The point here is that inflation as a policy destroys the savings we’ve worked so hard for. The Fed’s in the business of exchanging your purchasing power, stealing your heartbeats, to prop up overall economic growth. They argue that economic growth benefits everyone. Besides, if they didn’t engage in an ongoing campaign of purchasing power destruction, something much worse would happen. They tell us that a 2% loss of heartbeats is the lesser of two evils. And their job is to make sure we never find out what the “something much worse” really is. It’s the economic version of the old gangster protection racket: "That’s a real nice nest egg you got there. Be a shame if something happens to it." This threat works because it’s so vague. Most people’s imaginations can create a much more frightening scenario than even the most inspired central banker. This plan of deliberate purchasing power destruction is going well, from the Fed’s perspective. So far, since the Fed was launched in 1913, they’ve successfully destroyed 96.9% of the dollar’s purchasing power:

They’ve done such a great job that there’s only 3.1% of the dollar’s purchasing power left to destroy. Mission (almost) accomplished! Where does that leave us? Some recent survey data shows us just how successful the Fed has been:

All of this is happening right now, in what is supposed to be the “wealthiest” economy. That’s Bidenomics in action! Of course, if you’re reading this, you aren’t likely to be wondering where your next meal is coming from. Count your blessings! Then watch them evaporate. The Fed creates economic problems it cannot fix Returning to Grant’s article, I found another gem.

There’s this thing called “interest rate risk” that most of the world seems to have forgotten about over the last two decades. It works like this:

The bottom line is this: The Federal Reserve has created an enormous problem that it cannot fix by tinkering with interest rates. Higher interest rates are supposed to work like chemotherapy: It’s doctor-administered poison that’s just toxic enough to eliminate the unhealthiest parts of the patient. The rest of the patient feels terrible, granted, but should survive. Higher interest rates should be able to eliminate the unhealthiest parts of the economy – the malinvestments, the overleveraged businesses and irresponsible borrowers. This is exactly the “strong medicine” Paul Volcker used to crush the stagflationary episode of the 1970s, for example. Make no mistake, it wasn’t fun – the patient felt terrible – but the treatment worked. The U.S. economy went on to grow at an unprecedented rate for nearly 20 years. But what if the patient’s just too sick for the Fed’s chemotherapy to work? Well, if we extend our metaphor, here’s what happens next:

You already know how the story ends. Keeping your savings healthy when the economy is terminalYou can't opt out of the entire U.S. economy even if you wanted to. However, you can diversify your savings so your personal financial health isn’t entirely dependent on the ailing economy, the dysfunctional government or the Fed’s ham-handed chemotherapy. Consider diversifying with physical precious metals. Their value isn’t determined by interest rates or inflation – but based on global supply and demand. You can get an idea of just how resistant gold specifically is to the Fed’s economic intervention from the following chart. Since its founding in 1913, even as the Fed destroyed the dollar, the price of gold has soared:

We can’t get back our stolen heartbeats by owning gold or silver. The best we can do is protect those heartbeats we have left. Please take a moment to learn about the benefits of owning precious metals like gold and silver. They both could provide some stability and a firm foundation for your savings, no matter how sick the patient really is.

|

Send this article to a friend:

|

|

|