US Consumers Are Facing A Crushing Debt Servicing Problem

Tyler Durden

US econowatchers have been stumped by a bizarre divergence in the US economy in recent months. On one hand, the aftermath of the March bank crisis which destroyed two of the largest California banks, led to a crippling tightening in credit standards at least according to the SLOOS survey. US econowatchers have been stumped by a bizarre divergence in the US economy in recent months. On one hand, the aftermath of the March bank crisis which destroyed two of the largest California banks, led to a crippling tightening in credit standards at least according to the SLOOS survey.

On the other hand, after a brief airpocket three months ago when credit card debt saw its lowest increase in over two years, revolving consumer credit has exploded higher and the last two months have seen a near-record increase...

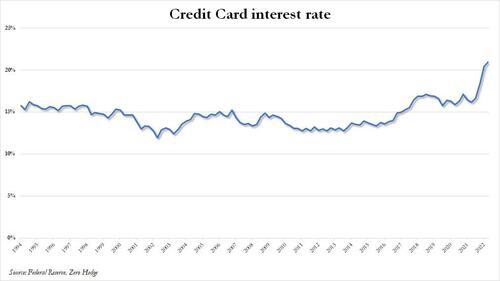

... even as the interest rate on credit cards has jumped to the highest on record.

How is it possible that despite the surge in total credit card debt, and the surge in interest rate on credit card debt, that consumers would continue to spend with the same reckless abandon they exhibited in the aftermath of the covid crash when trillions in new stimmies were flooding bank accounts and rates were at zero? This is a question even veteran Goldman traders are struggling with, to wit:

I continue to scratch my head as one hand all rational information points to harder days ahead as cost of capital debt increases which in turn means cost of living increases and we go through a period of muted growth, rising unemployment and possible stagflation. Yet…..hotels remain full, all restaurants booked out, flights are expensive and it feels like the music plays on.

Maybe the answer is that despite all the gloom and doom, consumer credit is not (yet) a problem, as banks a re clearly willing to supply it, while demand to spend money (on credit) is clearly there. So what is the problem?

According to TS Lombard's Steven Blitz, it's not so much the credit as its servicing that is rapidly becoming the biggest household problem.

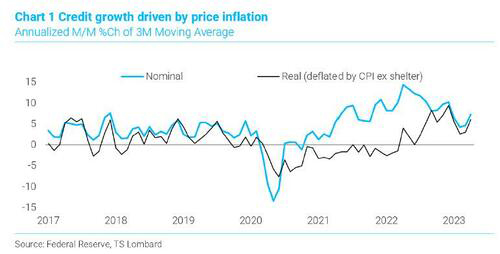

As Blitz notes, while nominal revolving and non-revolving credit (w/o student debt) increased 8.1% M/M SAAR in April, it rose "only" 3% when debt is deflated by CPI ex-shelter; furthermore, when looked at on a three-month moving average basis, much of the borrowing growth since 2020 has reflected prices not a real expansion of credit growth relative to the pre-Covid pace, its about the same. As for the acceleration in real credit growth in late 2022, that according to Blitz reflects a drop in energy prices, which is included because people buy gas with credit cards, most of the time.

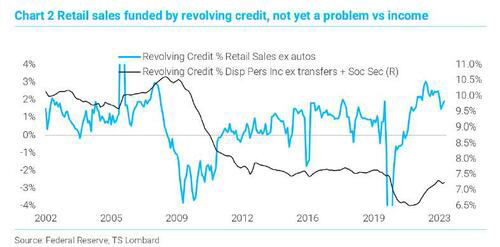

Another way of looking at the debt stock data reveals that revolving credit as a percent of retail sales ex autos peaked at 3% in May last year and is now down to 1.9% – which of course is still higher than it has been since before the 08-09 recession.

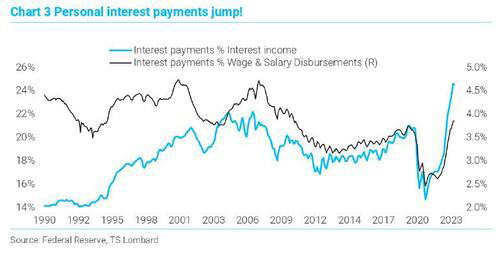

So while it is debatable whether nominal credit usage is a major risk on a stock-to-income basis, one thing that is undisputable is that since interest rates are a lot higher than they have been, interest payments on said debt have soared -- both relative to interest earned and as percent of total wages; in fact, they are now the highest since before 08-09 recession. This, according to Blitz, "will limit growth, just as the Fed planned when it started hiking rates."

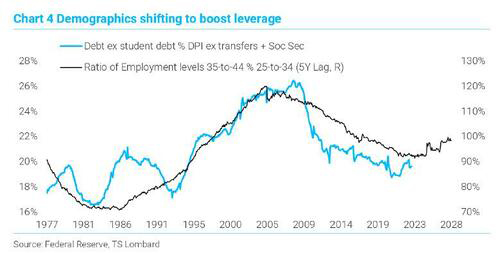

Looking beyond the current cycle, the TS Lombard strategist says that a key question for the economy is whether the appetite for leverage returns after a decade of deleveraging. Based on one demographic measure, the answer is yes

In summary, while it is debatable whether what is already a record credit card debt load had led to consumer overleverage, interest payments on credit cards have exploded higher and this, according to Blitz, is "how consumers experience their debt burden first. The borrowing that has underpinned retail spending will reverse quickly once there are sustained signs of labor market weakening."

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

| ![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_gold.gif)

![[Most Recent USD from www.kitco.com]](http://www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/live/s_silv.gif)