You Own Stocks, But….

Karl Denninger

..... you don't really own them. ..... you don't really own them.

Let me explain.

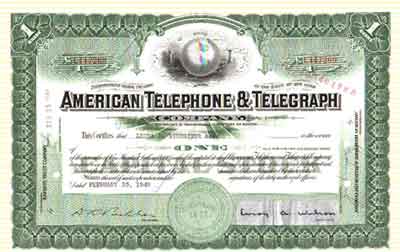

Let's say I own shares of Boeing or GE. This gives me the right to vote my shares. That is, if I own shares in a public (or private for that matter) company, I have a right to representation -- I can vote at the annual meeting for, as an example, the board of directors. I can also vote on shareholder proposals, which may include things like "DIE" (or DEI), ESG and similar.

That's how it should be. If I own the stock via a brokerage account then I get notices before the meeting from the brokerage (this is part of what they're required to send to me) and can vote as I wish.

Except.... this has been corrupted.

How could it be otherwise? A very large percentage of the people in this nation disagree, for example, with "social promotion" -- for any reason. Whether due to sex, age, color, religion, ethnicity or otherwise, a large percentage of the population of this nation, perhaps even the majority, think that only merit should determine whether you get a job, get promoted, hired for the board and similar.

Similarly many people think that a company should act to provide products and services at the best quality and lowest cost within the limits of the law rather than deliberately damaging cost and profitability by, for example, committing to use only "green" energy.

What percentage of the actual shareholders think this way? Nobody knows.

Why don't we know?

Because today many people own stocks in what is called an "ETF".

And, under current law, when you buy an ETF you delegate your vote to the manager of the ETF who may or may not agree with your position on any of these issues.

A huge percentage of the people who own the "S&P 500", for example, own it via a mutual fund or an ETF. Said are run by firms such as Vanguard and Blackrock, to name two. If you buy such a fund you lose the right to vote on the 500 company proxies contained in that ETF, and Vanguard, Blackrock, or the other management firm has the right to vote those shares -- and does.

Do their views align with yours? Doesn't matter.

Do you even know, or have a right to control, how they will or do vote the shares you own via that ETF? Nope.

How do you think all these "ESG" and "DEI" proposals and policies got to be in place? You didn't vote for them!

Do you agree with them? Do you agree with higher energy prices, higher gas prices and putting people into management positions not due to their individual merit but because of their sex, skin color or other non-job-related characteristics?

We would all like to "save the planet." Is it ok if it doubles the cost of your electricity, heating fuel and gasoline to get to work?

Well?

If you're an owner of the company, and if you own common stock you are, then exactly how do you square being an owner with losing all representation before said firm? Because you have.

How do we fix this?

I'm not entirely sure. But what I do know is that what used to be has been perverted, and that perversion means that a very small number of people now speak for tens of millions despite never being elected to do so -- they have simply arrogated that power to themselves and used it, and the result is a more than doubling of gas prices along with wild acceleration in health care, energy and food costs, among others.

I very much doubt you actually support any of that, nor would you vote for it.

They did.

Mr. Denninger, recent author of the book Leverage: How Cheap Money Will Destroy the World, is the former CEO of MCSNet, a regional Chicago area networking and Internet company that operated from 1987 to 1998. MCSNet was proud to offer several "firsts" in the Internet Service space, including integral customer-specified spam filtering for all customers and the first virtual web server available to the general public. Mr. Denninger's other accomplishments include the design and construction of regional and national IP-based networks and development of electronic conferencing software reaching back to the 1980s. Mr. Denninger, recent author of the book Leverage: How Cheap Money Will Destroy the World, is the former CEO of MCSNet, a regional Chicago area networking and Internet company that operated from 1987 to 1998. MCSNet was proud to offer several "firsts" in the Internet Service space, including integral customer-specified spam filtering for all customers and the first virtual web server available to the general public. Mr. Denninger's other accomplishments include the design and construction of regional and national IP-based networks and development of electronic conferencing software reaching back to the 1980s.

He has been a full-time trader since 1998, author of The Market Ticker, a daily market commentary, and operator of TickerForum, an online trading community, both since 2007.

Mr. Denninger received the 2008 Reed Irvine Accuracy In Media Award for Grassroots Journalism for his coverage of the 2008 market meltdown.

market-ticker.org

|