Send this article to a friend:

May

28

2025

Send this article to a friend: May |

Believe It or Not, Gold is Still Out of Favor

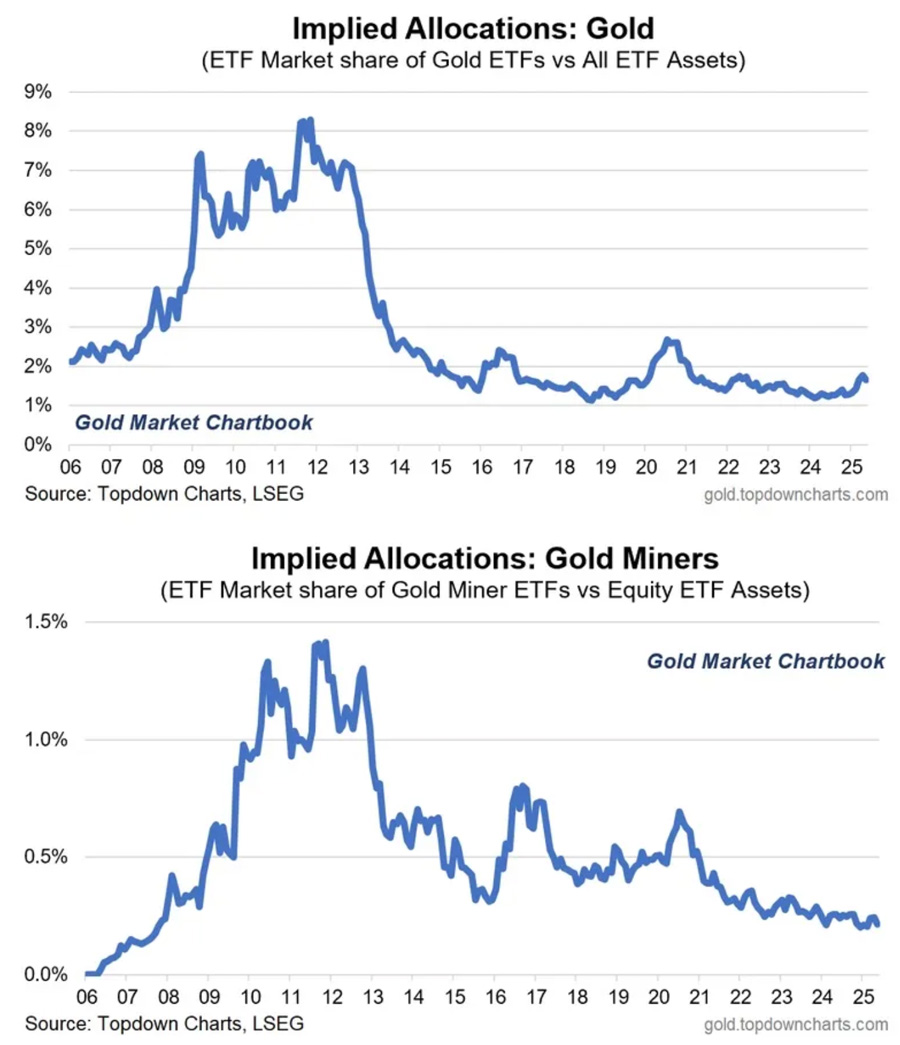

After the past year’s epic run, you’d think gold would have displaced at least some other assets in mainstream investors’ portfolios. But apparently not. These two charts have been making the rounds on X, showing that during the previous decade’s gold bull market, gold-related ETFs saw their share of “implied allocations” rise dramatically. But that hasn’t yet happened in the current bull market, as both gold and gold miner ETFs seem to be an afterthought for the average investor.

That Might Be Changing. In China…

…While Costco Gold Buyers Have To Be Restrained

Still Early In The GameThe above implies three things:

The conclusion? Momentum is building, but this bull market has a long way to run before generalist money is fully on board. Keep stacking. Subscribe to John Rubino's SubstackThousands of paid subscribers

Survive and Thrive in the Coming Crisis

DollarCollapse.com is managed by John Rubino, co-author, with James Turk, of The Money Bubble(DollarCollapse Press, 2014) and The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He currently writes for CFA Magazine.

|

Send this article to a friend:

|

|

|