|

Forward Guidance: The Fed Sounds Like A Wizard Reading Chicken Bones

Mike Shedlock

Stanley Druckenmiller says the Fed should get rid of forward guidance and just do their job. Stanley Druckenmiller says the Fed should get rid of forward guidance and just do their job.

I totally endorse a view by Stan Druckenmiller, the Fed Should Stop Forward Guidance.

Squawk Box:

I’ve been perplexed about the unwavering focus the Fed has had on cuts for a six month period. … Did cuts make sense the whole time?

Druckenmiller:

I was perplexed with the December pivot. …

To some extent it seems they fumbled on the 5-yard line with the game on the line. I remember saying to some of my partners, that’s the speech I thought we might hear in March.

… Instead they set financial conditions on fire. …

And once financial conditions took off, it became very clear this thing could go either way. More curiously, why they and others continued to talk about, well, it’s not going to be six cuts it’s only going to be three cuts or four cuts.

I’m going, why are we even talking about cuts?

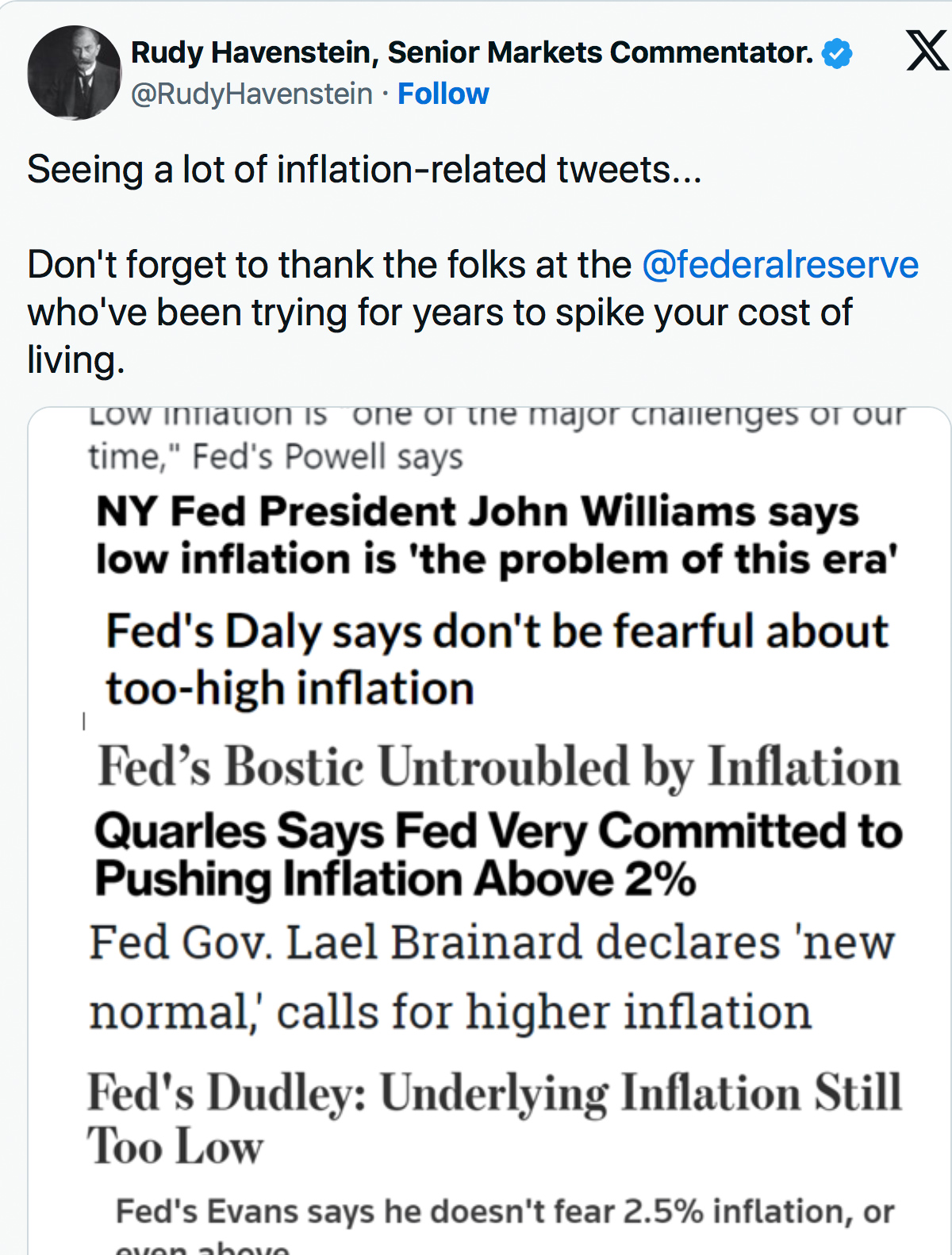

Because inflation, if you remember, we did trillions of dollars of QE because it was 1.7 percent instead of 2! But somehow now that we are at 3 vs 2 we’ve got to start cutting rates to bring in a smooth landing. Huge mistake. It goes back to Kevin Warsh, when he was in the running for the Fed job, used to talk about reforming the Fed.

And I go Kevin, what is the major reform that we do? He says we’ve got to get rid of forward guidance.

When you put forward guidance out, unlike me when I am wrong, I tend to change my mind very rapidly, they get trapped in the forward guidance, stuck in it. … Bizarrely, at the last press conference, the Fed seems to still be hanging on to this asymmetric directive of we are not going to hike and we expect to cut but we are going to wait for the data.

… I don’t know where inflation is going to be in a year, Powell doesn’t know. I don’t think anybody knows.

Squawk Box:

You think a hike is off the table? Definitely?

Druckenmiller:

No, because there’s not a zero percent chance inflation has bottomed. I don’t know. What I would do is just say nothing, and do what a Fed chair used to do: When you need to raise rates, raise them; when you need to cut rates, cut them.

Don’t go on 60 Minutes.

You are not a rock star. You’re the Fed chair.

You are supposed to be running monetary policy.

Bernanke did a lot of things I don’t feel good about. One of the worst was forward guidance.

You have a bunch of academics talking about sending a message to the markets.

I would rather they get rid of forward guidance and just do their job.

The Fed is Uncertain About Uncertainty, So Why the Forward Guidance?

On September 22, 2023, shortly before the Fed’s pivot, I asked The Fed is Uncertain About Uncertainty, So Why the Forward Guidance?

The key words at the FOMC press conference is “uncertain” for good reason. The Fed doesn’t know what it’s doing.

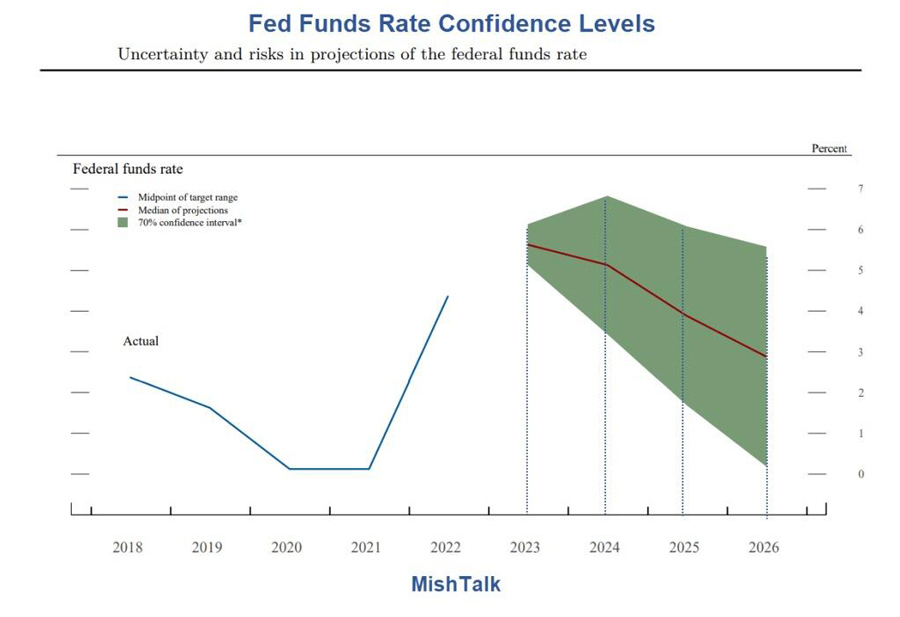

Here is the image I posted then.

Image from the Fed FOMC projection materials.

Hoot of the Day

Actually, it’s good that the Fed is uncertain because their expectations have not been close to the mark for a decade.

The above chart is particularly amusing. The Fed has only a 70 percent confidence level that interest rates three years from now will be in the range of of 0 to 5.5 percent.

That means the Fed expects that 30 percent of the time, rates will be outside that range.

From 2012 to 2019 the Fed kept producing interest rate charts showing hikes that never happened.

Then the Fed decided it was necessary to make up for lack of inflation.

Need to Make Up For Lack of Inflation

I’ve been discussing this for going on two decades.

Fed Uncertainty Principle

Flashback April 3, 2008 before the collapse of Lehman and Bear Stearns, to one of my all time favorite posts: Fed Uncertainty Principle

Most think the Fed follows market expectations.

However, this creates what would appear at first glance to be a major paradox: If the Fed is simply following market expectations, can the Fed be to blame for the consequences? More pointedly, why isn’t the market to blame if the Fed is simply following market expectations?

This is a very interesting theoretical question. While it’s true the Fed typically only does what is expected, those expectations become distorted over time by observations of Fed actions.

For example: If market participants are expecting the Fed to cut on weakness and the Fed does, market participants get into a psychology of expecting more cuts on more weakness. Here is another example: If market participants expect the Fed to cut rates when economic stress occurs, they will take positions based on those expectations. These expectation cycles can be self-reinforcing.

The Observer Affects The Observed

The Fed, in conjunction with all the players watching the Fed, distorts the economic picture. I liken this to Heisenberg’s Uncertainty Principle where observation of a subatomic particle changes the ability to measure it accurately.

The Fed, by its very existence, alters the economic horizon. Compounding the problem are all the eyes on the Fed attempting to game the system.

Fed Uncertainty Principle Recap

Fed Uncertainty Basis Principle:

The fed, by its very existence, has completely distorted the market via self-reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed’s actions. There would not be a Fed in a free market, and by implication, there would not be observer/participant feedback loops either.

Corollary Number One:

The Fed has no idea where interest rates should be. Only a free market does. The Fed will be disingenuous about what it knows (nothing of use) and doesn’t know (much more than it wants to admit), particularly in times of economic stress.

Corollary Number Two: The government/quasi-government body most responsible for creating this mess (the Fed), will attempt a big power grab, purportedly to fix whatever problems it creates. The bigger the mess it creates, the more power it will attempt to grab. Over time this leads to dangerously concentrated power into the hands of those who have already proven they do not know what they are doing.

Corollary Number Three:

Don’t expect the Fed to learn from past mistakes. Instead, expect the Fed to repeat them with bigger and bigger doses of exactly what created the initial problem.

Corollary Number Four:

The Fed simply does not care whether its actions are illegal or not. The Fed is operating under the principle that it’s easier to get forgiveness than permission. And forgiveness is just another means to the desired power grab it is seeking.

And so here we are. Still discussing the same things, with the Fed making the same mistakes.

The Fed’s Big Problem

On average, the economy looks OK. But averages are misleading. Several large groups of people are struggling. They all have one thing in common.

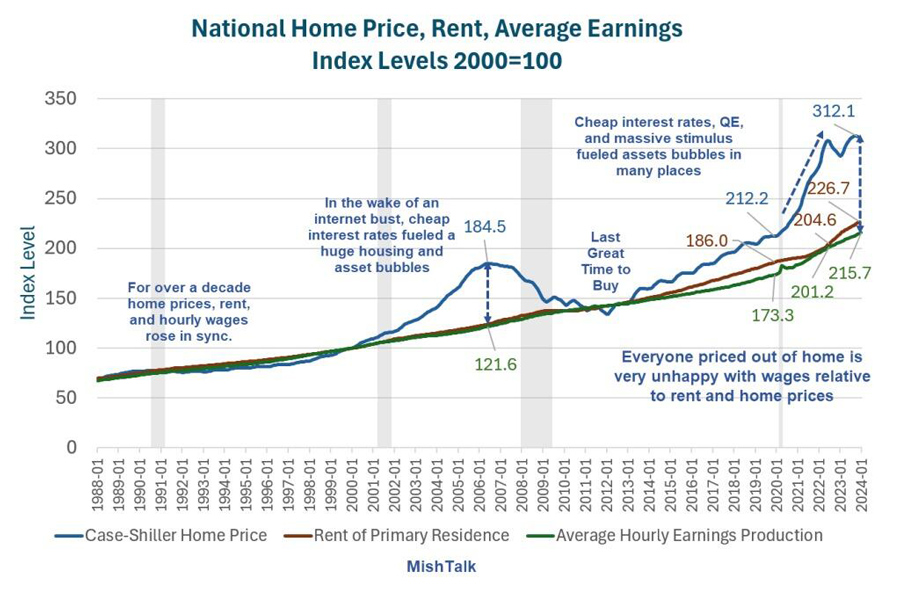

Case-Shiller home price index, CPI rent index, and the index of hourly earnings for production and nonsupervisory workers.

The Fed is now trapped in a box of its own making. Everyone who is priced out of a home is very unhappy with soaring rent, soaring home prices.

If the Fed cuts rates prematurely, what does that do to housing prices?

For discussion, please see The Fed’s Big Problem, There Are Two Economies But Only One Interest Rate

Meanwhile, Powell sounds like a wizard reading chicken bones because that’s really all he is.

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management.

Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

You are currently viewing my global economics blog which typically has commentary every day of the week.

mishtalk.com

|