Jamie Dimon Warns QT Will Lead To More Bank Failures

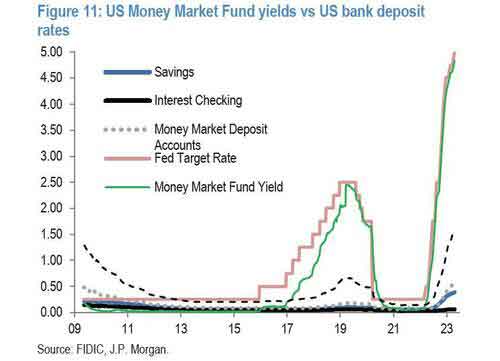

Tyler Durden

At the start of May we explained that it's not just the Fed's rate hikes that are behind the nascent regional bank crisis (because with Fed Funds rate at 5.25% and both T-Bills and money market funds offering similar yields, there is no way small banks can compete with these returns, prompting a bank jog (which periodically turns to a sprint) and deposit flight from both checking and saving accounts). At the start of May we explained that it's not just the Fed's rate hikes that are behind the nascent regional bank crisis (because with Fed Funds rate at 5.25% and both T-Bills and money market funds offering similar yields, there is no way small banks can compete with these returns, prompting a bank jog (which periodically turns to a sprint) and deposit flight from both checking and saving accounts).

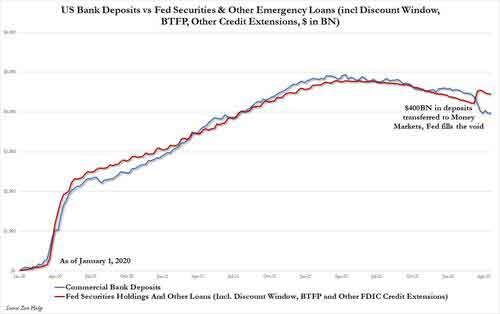

We said that the Fed's ongoing QT is a just as pernicious threat to the viability of small/regional banks because with every dollar drained from the system as part of the Fed's quantitative tightening, a matching deposit dollar is also destroyed, to wit:

Under an ample reserves framework, virtually all deposits are created by the Fed.

That's why banks were forced to load up on low-yielding securities during 2000-2001 and are now getting crushed as yields soar and fixed income/loan prices plunge.

It also means that under QT as Fed reserves shrink, deposits must follow: as such deposits are either forced to shift into Bills/TSYs or are destroyed (bank failures).

Thus, the bank crisis is an inevitable side effect of Fed tightening.

Now, by now everyone knows that when it comes to banks failing (and capitalizing on it) few are as experienced as JP Morgan, aka JP Mega...

... aka JP More-gain, which now has more than 13% of the nation's deposits and 21% of all credit card spending: in other words, there has never been a bank that is more systematically important than JPMore-gain... and with every small bank failure, Jamie Dimon's goliath is only getting bigger. Which is why we found it curious that none other than Jamie Dimon confirmed what we said three weeks ago during JPM's Investor Day on Monday.

This is what the billionaire CEO said:

We haven't been through Quantitative Tightening. So we really don't know what's going to happen to deposits at all [ZH; actually we do: deposits will shrink dollar for dollar alongside reserves]. And that's why I've been quite concerned about that. I'm probably more concerned about quantitative tightening with anybody in this room.

We've never had QT before. It just started, okay? And you see huge distortions in the marketplace already. We've never had the Fed in the market like this with that RRP program that Jeremy mentioned ever. They have $2.3 trillion basically lent out to money funds. And I don't know the full effect of that. And obviously, that's a direct deduction from deposits are rolling out it made sense to do.

So I think people should build into their mindset that they may have to move deposit beta more than they think and manage that. So I mean, if I was any bank or any company, I'd be saying, can you handle higher interest rates and surprise in deposits, etc?

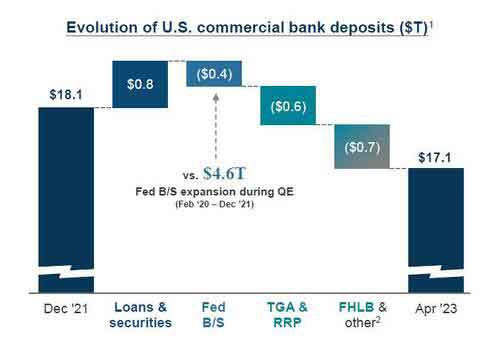

And this is how JPM itself shows the impact of the shrinking Fed balance sheet and TGA/RRP liquidity drains soak up commercial bank deposits.

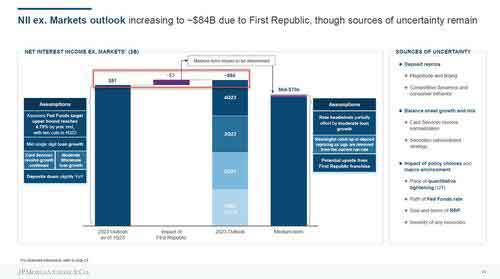

By the way, "deposit beta", as Jamie calls it, for those unfamilliar is a polite way of saying bank run, which is a less polite way of saying bank failure. As for Dimon's rhetorical last question, the answer is a resounding no, or so JPM's shareholders would like because for the second time in a month, JPM hiked its Net Interest Margin forecast, this time courtesy of the bank's FDIC/taxpayer-funded gift in the form of First Republic Bank.

According to a slide in the bank's Investor Day presentation, JPMorgan will gain an even bigger benefit from rising interest rates because of its "purchase" of First Republic Bank. We put purchase in quotes because in reality it was a gift by the FDIC, which gave JPM all the good parts of the collapsed California bank, while taxpayers were left holding the nuclear waste.

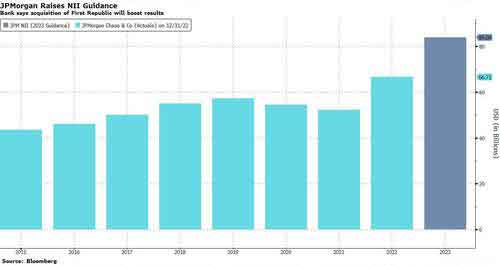

The biggest US bank raised its guidance for net interest income this year to $84 billion up from a previous forecast of $81 billion, according to an Investor Day presentation. The reason: the failure of First Republic which directly boosted JPM's top line by billions!

In other words, as other banks fail, JPM prospers: here is a history of JPM's Net Interest Income courtesy of Bloomberg. It will only keep rising...

... as more banks fail.

It is no surprise then that it is Jamie's sincerest wish for rates to keep rising...

... after all that's the surest way for John Pierpont's bank - which still pays 0.01% interest on most of its deposits - to once again become bigger than the US and to finally fulfill the reason behind creation of the Federal Reserves.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|