Send this article to a friend:

March

15

2023

Send this article to a friend: March |

What Will Irresponsible Governments Do to Precious Metals?

Remember silver? In one of Dominic Frisby’s analyses, he referred to platinum as “the other precious metal.” It feels like silver has filled that role in recent weeks and months. Everyone’s obviously watching gold as the global economy crumbles. There was the big correction in platinum to the upside and palladium to the downside. For as volatile as silver is supposed to be, it’s done surprisingly little in comparison. Rob McEwen, Executive Chairman of McEwen Mining, is here to remind us that silver isn’t to be ignored. In his recent interview with Kitco, the precious metals expert has a fresh and bullish take on silver. As opposed to merely touting the positive manufacturing demand picture, McEwen instead pointed out that silver is a hard asset in a period where people can’t get enough of the stability and security they offer:

Based on economic factors alone, McEwen expects silver to hit $250 by 2027, trailing gold’s own path towards $5,000 in that timeframe. If both projections materialize, silver’s gain would be much greater relative to current prices than gold’s. (Gold/silver ratio reversion to the mean, in other words.) Hardly a stranger to the manufacturing side of things, McEwen elaborated how the forceful application of green energy projects and electric vehicles is bound to continue being a prominent theme. McEwen spoke about electric cars (nearly every electrical connection in an EV uses silver), but I’ve seen mentions of demand from solar panel manufacturers rising recently. This forecast, for example, posits that the solar industry’s insatiable silver demand could consume the world’s silver supply by 2050. Extreme? Yes, it is. Unbelievable? Not at all. It’s important to note that forecasts usually fail to come true. Anyone who predicts an industry’s growth more than two decades in the future is guessing – hopefully, making a sound guess based on knowledge and experience, but guessing nonetheless. Currency debasement, though, is different. It’s already here, and precious metals prices rising as dollar declines accelerate is simple mathematics. You can watch the full interview here – it’s rather interesting: Investors are keeping the UK’s Royal Mint busy The UK is among the many nations where gold recently hit all-time highs in the local currency. Therefore, it should come as no surprise that British citizens are buying up as much bullion as possible. It’s what prudent savers often do when inflation blazes virtually unchecked, devouring the purchasing power of paper currency. Andrew Dickey, the director of Precious Metals Investment at the Royal Mint, expanded upon the consumption of physical gold on both the consumer side and that of the official sector. Dickey refers to the current pace of central bank gold purchases as a “big tectonic shift” for the precious metals market. Indeed it is, as we’d have to go back to 1967 to find a year when central banks bought this much gold. However, Dickey is just as interested in demand coming from smaller retail investors, which has risen exponentially over the past few years:

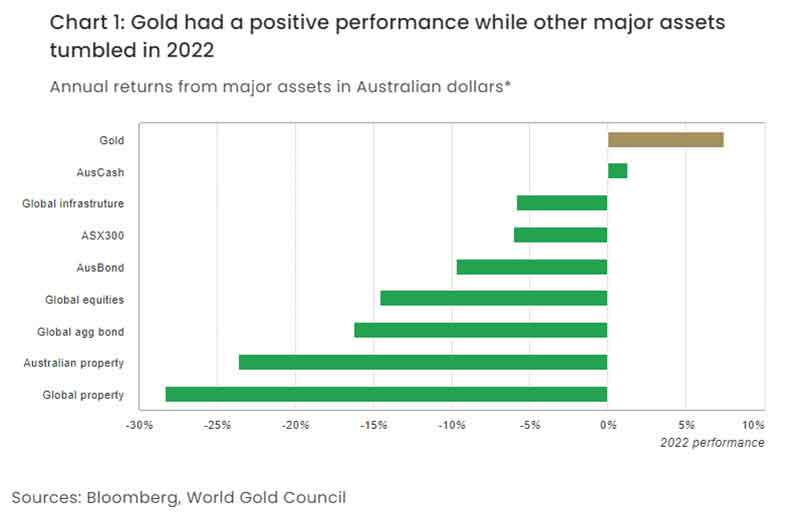

Perhaps to serve this massive increase in their customer base, the Royal Mint recently expanded its selection of products to include gold bullion bars as light as just one gram. Based on price alone, such fractional gold bullion appeals to a broader range of investors. Yes, Royal Mint also advertises a digital gold product that is “fully backed by physical gold” stored in their vaults. I can forgive them for that, so long as I consider this a gateway to acquiring real, tangible precious metals. As the Mint notes, the younger demographic often uses digital gold to ease into precious metals before going on to make an actual purchase in the form of a gold Britannia or the historic sovereign gold coin. The first time they hold their very own gold coin in their hands, I’m convinced they’ll delete their “digital gold” account. It’s just numbers on a screen. Absolutely nothing compares to owning tangible, physical precious metals. Australia’s doubling down on its investment in goldCentral banks everywhere are printing their currencies into oblivion (and buying gold to hedge their own purchasing power). It’s a well-established matter of record. Today we look at a specific case: Australia. Over the last year or so, gold beat the returns of most assets on the Australian market. When inflation rises, and speculative investments falter, that’s just gold doing its job. (For example, back in November, Perth Mint reported all-time record gold sales.) The Future Fund, Australia’s sovereign wealth fund, is there mostly to ensure the nation’s economic prosperity. And how has it been accomplishing that during these trying times? The same way as anyone else, from a central bank to a private investor – they buy gold. Now, wait just a second – doesn’t this break the “diversification” rule? After all, Australia is the world’s #2 gold miner, and mining already accounts for a hefty 8% of the nation’s GDP. In theory, Australia’s national wealth is already tied to gold. Nevertheless, the Future Fund is making gold a cornerstone investment. Gold’s performance compared to other assets and skyrocketing inflation (remember, it’s not just here in the U.S. – Australians are currently enduring 7.8% annual inflation) speak to the wisdom of this decision. Australia is looking at a volatile market where both stocks and bonds are tanking, property values are plummeting and the only thing going up seems to be prices. Here’s a chart that demonstrates the logic of the Future Fund’s decision:  Image via World Gold Council Sometimes, prominent investors say we should look to emerging market currencies as a safe haven from inflationary wealth erosion. I say, nonsense. Look at the top story again! Unbacked currencies are being devalued globally by reckless money-printing. If you’re concerned about declining purchasing power of the U.S. dollar, can anyone tell you, with a straight face, to trust the Malaysian ringgit instead? A safe haven from currency devaluation is not another currency! Personally, I’m confident that gold is a much safer and more prudent bet than any unbacked currency, whether I’ve heard of it or not.

|

Send this article to a friend:

|

|

|