Futures Flat As Attention Turns To Fed Rate Hikes

Tyler Durden

US futures are flat with bond yields reversing an overnight drop, lifted by the belly of the curve; the USD weaker for 8 of the past 9 days, and commodities mostly higher as investors shift their focus back to concerns about inflation and potential further monetary tightening from the recent banking-industry chaos; after all, a bank hasn't failed in at least a few days. WTI has soared 5.6% this week. US futures are flat with bond yields reversing an overnight drop, lifted by the belly of the curve; the USD weaker for 8 of the past 9 days, and commodities mostly higher as investors shift their focus back to concerns about inflation and potential further monetary tightening from the recent banking-industry chaos; after all, a bank hasn't failed in at least a few days. WTI has soared 5.6% this week.

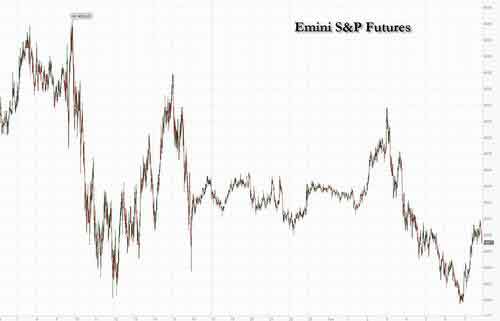

S&P 500 contracts were little changed as of 7:45 a.m. ET, after earlier gaining as much as 0.4% and closing 0.2% higher on Monday. Nasdaq 100 futures slid 0.2% after the tech-heavy benchmark lost 0.7% on Monday following strong gains over the previous two weeks. European stocks advanced along with Asian equities and the dollar traded lower as fears of broader contagion from the banking turmoil eased.

According to JPM, If bank contagion fears subside, we may see a resurgence in both bond yields and commodities as growth, before the banking crises, was stronger than expected led by the US and a reopened China. "However, banking crises typically have wide-ranging, and negative, impacts on growth and employment." Today’s macro data focus includes inventories, housing prices, regional mfg updates, and Consumer Confidence. Keep an eye on the confidence number as that can impact spending.

In premarket trading, Alibaba shares soared 9% after the Chinese e-commerce company planned to split into six units that will individually explore IPOs. Shares in fellow Chinese ADRs also rallied. First Republic Bank gained 3.1% adding to a 12% jump on Monday after First Citizens BancShares’s agreement to buy Silicon Valley Bank reassured investors in regional lenders. PVH climbed 12% in premarket as the owner of Calvin Klein and Tommy Hilfiger issued stronger-than-expected earnings forecasts. Lyft rose as much as 5.2% after the ridesharing company appointed David Risher as CEO. Here are some other notable premarket movers:

- Array Technologies gains 3.7% after Truist Securities raises the solar equipment manufacturer to buy from hold, saying it has made significant progress addressing past challenges related to its product portfolio, execution and margin structure.

- Carnival Corp. is raised to equal-weight from underweight at Wells Fargo as the cruise operator has low near-term refinancing risk, its business in Europe is holding up well, and its annual Ebitda forecast is reasonable. Its shares gain 1.7% after dropping 4.8% on Monday following its earnings report.

- Ciena Corp. shares are up 3.2% in premarket trading after Raymond James upgraded the communications equipment company to strong buy from outperform.

- Occidental Petroleum advances as much as 2.2% after being upgraded to outperform from market perform at Cowen, with the broker saying the oil and gas company stands out for its “superior” exposure to oil pricing, share support, capital structure and differentiated catalyst rich profile. .

- PVH shares surge 12% after the parent company of Calvin Klein and Tommy Hilfiger issued stronger-than-expected forecasts for revenue growth and reported fourth-quarter earnings per share that beat estimates. Analysts found the company’s performance to be strong, flagging the beat to EPS as well as the strong outlook. .

- Viking Therapeutics said it plans to initiate a Phase 2 study of VK2735 in patients with obesity in mid-2023 based on Phase 1 trial results. Shares gain 50%.

- Virgin Orbit fell more than 9.5% after the launch provider placed workers on furlough as it seeks rescue financing or bankruptcy.

"For now, it looks like the major stress around the banking crisis is calming down and markets can switch back to monitoring the inflation-recession dynamics," said Marija Veitmane, senior multi-asset strategist at State Street Global Markets in London.

As jitters in the banking sector subside, investors are again turning their attention to economic fundamentals and the outlook for Federal Reserve policy. Swaps have meanwhile priced in a more than 50% probability of a rate hike at the next meeting; they continue to expect sharp easing later however, with pricing suggesting the policy rate will slide to around 4.3% in December, down from around 4.95% in May.

Not all agree. “We see major central banks moving away from a ‘whatever it takes’ approach, stopping their hikes and entering a more nuanced phase that’s less about a relentless fight against inflation but still one where they can’t cut rates,” strategists at BlackRock Investment Institute, including Wei Li and Alex Brazier, wrote in a note.

Hugh Gimber, global market strategist at JPMorgan Asset Management, also doesn’t foresee rate cuts anytime soon, even if hikes pause, and cautions against stock-market optimism on it. “I think the market is right to price a Fed pause,” he said in an interview on Bloomberg TV. “The question here is how big the feed through from a deterioration in lending standards is to really get inflation lower towards target, and I’m not that convinced we will see that very quickly. I think we would need a pretty significant economic shock to get there in 2H. Rate cuts are more of a 2024 story.”

European stocks are in the green although they’ve pared gains since the open as investors remain cautious amid risks to the global financial system. The Stoxx 600 has trims gains to 0.2% while Deutsche Bank swings to a ~2% fall from from ~2% rise. Energy, miners and autos are the strongest-performing sectors. Here are the most notable European movers:

- GSK gains as much as 0.9% after it announced positive results from an endometrial cancer drug trial. Shore Capital describes the published data as “promising”

- Ocado shares rise as much as 5.7% after the online grocer’s retail joint venture with Marks & Spencer beat sales expectations in the first quarter

- Zalando shares rise as much as 3.2% as HSBC upgrades the online fashion retailer to buy from hold, saying its momentum is moving in the right direction

- Marks & Spencer shares gain as much as 3.1% as Credit Suisse hikes its price target, saying the UK retailer’s recovery momentum is building

- Eurocash jumps as much as 11% after the retailer posted record 4Q Ebitda of 308m zloty and cut debt ratios, seen by analysts as a soothing signal

- Telecom Italia shares rise as much as 3.4% after Bloomberg reported that Italian state-backed lender CDP plans to raise its offer for the carrier’s landline network

- Diageo shares slip as much as 0.9% after the British distiller said Ivan Menezes plans to retire as chief executive officer, which analysts say is a loss

- Embracer shares slump as much as 15%, after the video-game maker said licensing deals with several industry partners are unlikely to be completed before the month ends

- Norma shares fall as much as 15% as Baader highlights the tech hardware firm’s conservative FY23 margin outlook due to ongoing burdens from efforts to restructure

- CMC Markets falls as much as 6.3%, adding to a 21% drop Monday when the online trading company released a downbeat earnings update late in the session

- Schibsted shares drop as much as 9.6% as a weaker short-term guidance for the Norwegian media and classified advertising group offsets higher longer-term targets

- Synthomer shares drop as much as 19% with Morgan Stanley saying it sees further consensus downgrades ahead for the UK chemicals firm following its FY results

Elsewhere in markets, Asian stocks gained as a lull in new developments in the banking sector gave investors a chance to adjust positions and assess whether the Federal Reserve will lower rates to buttress the US economy. The MSCI Asia Pacific Index rose as much as 0.9%, halting a two-day losing streak. A sub-gauge of financial shares jumped more than 1% as they followed US peers higher. Australia, Japan and South Korea advanced. Hong Kong’s Hang Seng Index gained about 1%, while China’s mainland indexes fluctuated. “Asia still remains relatively well insulated from the latest round of US/European bank turmoil,” Citigroup analysts including Johanna Chua wrote in a note. “Direct exposure of Asia to the affected financial institutions is very limited.” Asia’s regional equity gauge has climbed more than 2% over the past week as US bank shares regained their footing after tumbling last week and fanning fears of a looming economic slowdown. Doubleline Capital’s Jeffrey Gundlach said on CNBC that he expects a US recession to start in a few months, and that the Federal Reserve will need to respond “very dramatically.”

Japanese stocks rose for a second day as concerns around financial institutions cooled after First Citizens BancShares Inc. agreed to buy failed Silicon Valley Bank. The Topix rose 0.2% to close at 1,966.67, while the Nikkei advanced 0.2% to 27,518.25. Sumitomo Mitsui Financial Group contributed the most to the Topix gain, increasing 2.7%. Out of 2,159 stocks in the index, 799 rose and 1,232 fell, while 128 were unchanged. “Overall risk tolerance has increased now that the Silicon Valley Bank situation appears to have calmed down,” said Ryuta Otsuka, strategist at Toyo Securities. “However, it is hard to expect large market moves in Japan as we are approaching the end of the fiscal year.”

Australian stocks extended rose with the S&P/ASX 200 index rising 1% to close at 7,034.10, extending gains for a second session, boosted by mining shares and banks. Lithium miners, some of the benchmark’s most shorted names, rallied after Liontown rebuffed a takeover bid from Albemarle. Equities across Asia climbed, US stock futures edged higher and the dollar declined as fears of broader contagion from the banking turmoil eased. Investors await Australia’s CPI print due Wednesday. In New Zealand, the S&P/NZX 50 index rose 1.4% to 11,771.27

Stocks in India were mostly lower on Tuesday as key gauges headed for their fourth consecutive monthly decline amid tepid sentiment for global equities. The S&P BSE Sensex fell 0.1% to 57,613.72 in Mumbai, while the NSE Nifty 50 Index declined 0.2%. The benchmark gauge has slipped about 2.1% this month and is on course for its longest losing monthly streak since Feb. 2016. Software major Infosys contributed the most to the Sensex’s decline, decreasing 0.8%. Out of 30 shares in the Sensex index, 11 rose, while 19 fell. All 10 companies related to the Adani Group fell, led by a 7% plunge in flagship firm Adani Enterprises after a newspaper report said the conglomerate will probably seek more time to repay a $4 billion loan it took out last year. Foreign investors have been buyers of $1.3b of local shares this month through March 24, mainly on back of GQG Partners’ stake purchase in Adani companies. “Barring gains in select banking and metal stocks, other sectors witnessed profit-taking as caution prevailed ahead of the F&O expiry on Wednesday,” Kotak Securities analyst Shrikant Chouhan said.

In FX, the Bloomberg Dollar Spot Index slipped 0.1%, marking its eighth day of declines in the past nine sessions, weighed by a jump in the yen on domestic demand ahead of the fiscal year-end in Japan. Exporters in Japan and Australia added to the selling of the dollar as they increased hedging to cover prior long positions in the greenback, Asia- based FX traders said. The New Zealand dollar and Japanese yen are the best performers among the G-10s while the Swiss franc is the weakest.

In rates, the five-year Treasury yield rises as much as 7 basis points to 3.67%, while the two-year yield climbs 4 basis points to 4.04% after sliding as low as 3.89% earlier in the session; a selloff in Treasuries since the start of the week has lifted most yields from six-month lows reached on Friday. 10-year yields around 3.55%, cheaper by 2bps on the day with bunds lagging by additional 5bp in the sector; 2-year yields cheaper by around 7bp on the day, remain above 4% level vs. Monday’s 3.954% auction stop. As BBG's Beth Stanton notes, Monday's poorly-bid 2Y auction is now under water vs its 3.954% stop with May rate hike back in favor. Auction cycle continues with $43b 5Y at 1pm. WI yield 3.65% is between last two 5Y stops. The US auction cycle resumes with $43b 5-year note sale at 1pm, follows Monday’s poor 2-year result; WI 5-year at 3.63% is ~48bp richer than February’s stop-out. German two-year borrowing costs are up 12bps.

Traders are now betting on a roughly 50/50 chance that the Fed will deliver a final quarter-point hike in May, followed by a similar-sized cut in September; market pricing reflects a diminishing outlook for a series of cuts in the coming months, and a growing view that the Fed may keep rates on hold for longer. BlackRock sees the Fed continuing to raise interest rates despite traders betting otherwise as fears of a banking crisis convulse markets. “We don’t see rate cuts this year – that’s the old playbook when central banks would rush to rescue the economy as recession hit,” its strategists write in a note. “We see a new, more nuanced phase of curbing inflation ahead: less fighting but still no rate cuts.”

In commodities, crude futures advance with WTI up 0.5% to trade near $73.15. Spot gold falls 0.3% to around $1,951. European and US gas benchmarks diverge slightly in European trade; Morgan Stanley writes that “prices likely still need to move lower to incentivize an adequate supply response, but we may be approaching the bottom”.

Looking to the day ahead, we will have a number of data releases from the US including the Conference Board consumer confidence, the Richmond Fed manufacturing index and business conditions, the Dallas Fed services activity, the January FHFA house price index, and February’s wholesale and retail inventories and advance goods trade balance. We will also have Italy’s March manufacturing and consumer confidence as well as economic sentiment data, and from France the March manufacturing and consumer confidence data. The BoE’s Bailey will testify today on the Silicon Valley Bank crisis, and we will also hear from ECB’s Muller. Finally, we will have earnings releases from Micron, Walgreens Boots Alliance and Lululemon.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|