02

2013

February 02 2013 |

Buy Silver – the War Against the China Bears Begins

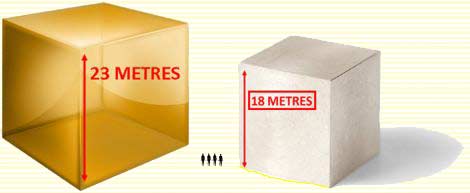

Watch out! Silver is finally looking ready for action. And this is as much to do with what my mate and regular Money Morning editor, Kris Sayce, now calls ‘The Doc’s war against the China Bears’. In case you missed it, I’ve kicked off the year by saying the China bears are about to get smoked. But sounding my China-Bull ‘battle-cry’ doesn’t just mean that industrial metals are on the menu. Because a resurgent Chinese economy is also good for precious metals, including a long-time favourite of mine: silver. Really it comes down to just two things. Firstly, China recently became a net importer of silver. Secondly, as I’ll now show you, silver is much, much rarer than anyone thinks… Which Precious Metal is Actually Rarer – Silver or Gold?Now you’ll sometimes hear that if you took all the gold bullion in the world, and melted it into a single cube, this would measure just 23 metres on each side. To use a timely illustration, it means that all of the world’s gold would fit on two tennis courts. That shows you very nicely just how rare gold actually is. A big part of why gold is so valuable is due to this level of scarcity. So…how does silver stack up in these terms? The answer is surprising. Because the world’s silver bullion would fit in a cube measuring just 17.9 metres on each side. In other words the silver cube would be significantly smaller than the gold cube. And I’m being generous here, using the largest estimate of the total investible silver bullion I would trust. According to CPM Group, the total global inventory for silver bullion is 1.9 billion ounces. This includes 711moz in futures exchanges, 38moz government stocks, 941moz in coin form and the rest in inferred & unreported private holdings. Many analysts are less generous, and most work on the basis of just one billion ounces of silver. That would equate to a cube just 14.4 metres on each side! But I’ll stick to the CPM figure for now. You don’t need to cherry pick to show just how rare silver bullion really is. Here’s a representation of that 17.9 metres cube for you (using the 1.9 billion ounces of silver number), stacked up against the world’s gold cube. ‘Global gold cube’ Vs ‘Global silver cube’ – SILVER IS MUCH RARER Source: Diggers and Drillers

As you can clearly see – there’s not much silver kicking around. So here’s a thought: When there is clearly far less silver bullion in circulation than gold… then why is silver 53 times cheaper than gold? I admit this is comparing apples and oranges to a degree. They are different markets and have different fundamentals. But the core reason for the different price is that gold is primarily an investors metal, be it punter, hedge fund or central bank – they are buying for its investment qualities. Whereas silver has long been an industrial metal, with a few investors making up a portion of purchases. But this is changing. As recently as 2007, investment demand was just 5% of the market. By 2012 investment demand was 30% of the market. And this is where China comes in. Chinese precious metals demand has exploded recently. All the press focus on the gold side of the story, as China’s hunger for gold means it’s now the main player in the market. That’s what happens when an economy grows in size five-fold in a decade, and gold ownership becomes legal (and encouraged) along the way! But the silver story is just as bullish. The Chinese Passion for Silver and GoldThe key point here is that China has only recently switched from being a silver exporter, to a silver IMPORTER. In 2012, the tide quietly turned in earnest. The silver stopped flowing from Chinese ports to Hong Kong, and started flowing from Hong Kong ports to China. You can see how clear this trend of Chinese silver imports is in this chart I provided recently. Investors often wish that someone would ring a bell to signal the turning point in a market. Well this is just about as close as you’ll get. Whenever China’s hunger for any particular commodity has forced them to import the commodity, it has been a watershed moment. Although Chinese gold imports have soared to record levels recently, China actually became a significant net importer of gold (5 tonnes/month) as far back as 2007. And since then the gold price has climbed from $600/oz, to $1650/oz. China is still there now, buying all the dips with their ears pinned back. Today silver is looking at a similar transformative event in its market as China is now a net importer here too. What’s great for investors today is that this has only just happened, which means you have time to act. So it’s no coincidence that silver’s technical chart is looking interesting again. Over the last six months it has bounced off the 200-week moving average, to find support around the 50-week average more recently. This is very bullish, and the last time we saw this pattern was back in 2010. And it was the prelude to the mother of all silver rallies, which saw the silver price more than double in just nine months. Australian Dollar Silver Brewing for its Next Monster Rally? Source: stockcharts

I can’t tell you when exactly silver’s next move will begin. It could be a month, it could be six months. It doesn’t really matter. Silver is an investment to hold for many years – so waiting half a year for the move is immaterial. All that matters is buying it cheaply, before the rally happens. But here’s something to think about. Chinese silver demand was a big factor in that nine month rally that saw silver more than double. So with China now making a clear move into the silver market today, we could well see more of the same. With such a small amount of silver bullion available today, it really won’t take much Chinese demand to make a big difference to the silver price! Dr Alex Cowie

Alex holds a graduate degree in finance and investment from the Financial Services Institute of Australia and is trained in Industrial Equity Analysis and Applied Portfolio Management. He is also the editor and chief analyst for Diggers and Drillers — Australia's premier resource stock advisory service. Don't expect Alex to tip BHP and RIO. You can find broker analysis on these two giant firms anywhere. Alex looks a lot further and deeper into the resource markets to find genuinely good Australian-listed companies on the verge of huge discoveries in often overlooked commodity markets. As Alex says: Even in a boom, you will not make extraordinary profits by buying the same big-name mining firms everyone else does. Last year Alex travelled over 100,000 miles across six continents, driving for days across barren deserts, witnessing fatal police shootouts and even being threatened by one mining executive, to bring his readers the very best resource investment opportunities. His goal is to identify under-reported Australian resource stocks that are not being covered by mainstream analysts, while there's still heaps of potential upside in their stock. These companies can operate anywhere in the world, but they're all listed here on the ASX. To have Alex's insights on the resources, mining and commodities sector delivered straight to your inbox, take out a free subscription to Money Morning here. And to see how you can start making big money from Aussie junior mining stocks, then you can take out a 30 day trial of his paid subscription service Diggers and Drillers here. |

|

|

|