Send this article to a friend:

January

28

2026

Send this article to a friend: January |

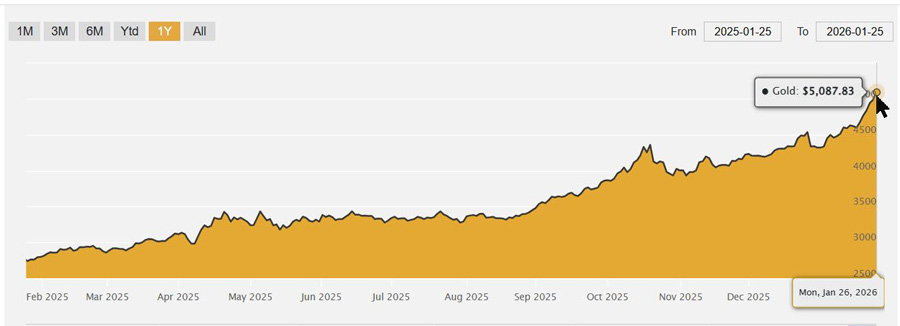

Gold Clears $5,000 as Economic Stress Builds

Gold surges 3x in 2 1/2 years – not bad for a non-yield bearing asset According to CNBC, gold briefly broke $4,800 last week, with coverage pointing to trade tensions involving Greenland. That explanation doesn’t survive even basic scrutiny. For two and a half years, we have watched a desperate scramble by the mainstream to come up with whatever reason for gold rising besides currency devaluation and supply and demand dynamics. Any narrative, no matter how ridiculous, can and will be stretched to accommodate that. And it is indeed getting more ridiculous with each passing week. As I'm writing this, gold stopped a few cents below $4,983. Early morning fixes for Monday have it around $4,950, so Monday will be a day to watch. Pullback or post-$5,000 havoc? It actually matters very little. Below, I'll go more into the details of this run and how Bitcoin can essentially be used to corroborate everything I've been saying for years. As it stands now, gold has finally tripled in price since the run began in mid-2023, when it was $1,650. There was absolutely nothing in terms of overt real drivers to jumpstart that run besides hints of a cessation of the rate hiking cycle. It flew off in the middle of 50-year high interest rates, and if you weren't reading this outlet, you might have been wondering why. If you have been, you have a pretty good idea, and you aren't surprised by anything happening in silver, either. What was that about Greenland? Right, right. Officially, gold reached $4,800 and then I suppose gained $180 more in a few days based on Greenland tariffs. Strangely, the piece doesn't cover what they are in the slightest, requiring you to look elsewhere to find out what's powering this incredible gold run. Don't waste time, as on the same day, January 21, President Trump said there will be no tariffs involving Greenland. So why is gold a few dollars away from $5,000? The headlines look to have malfunctioned, as there isn't even an attempt to find some other nonsensical driver. That's telling on its own. Anyways, the CNBC piece has plenty of interesting stuff nonetheless. I somewhat carefully entertained forecasts of $6,000 gold over the past year by well-established economists and analysts. Perhaps too carefully, as $7,000 gold is now being mentioned by the likes of Julia Du, a senior commodities strategist at ICBC Standard Bank. Her target is $7,150, to be precise. It makes sense for forecasts to move in accordance, since a recent LBMA survey returned a mostly unanimous vote that gold will climb past and likely loiter above $5,000 this year. And, by Monday morning, the LBMA survey was proven correct as spot gold surged beyond $5,000:

Banks and similar institutions have upgraded their forecasts across the board. $5,400 is now the norm, but Bank of America sees gold hitting $6,000 this spring. With how things are going, people will end up criticizing me as a gold bear, saying I wasn't duly addressing gold's upside. The Greenland thing is part of a broader package of attributing this run to President Trump, and saying that there are concerns over the independency of the Federal Reserve. That's weird, because speculators were trying to sink gold after the Trump election, saying it won't be the inflationary run that Harris would have brought. Trump's second term has been mostly similar to the first, during which gold moved little. So we can probably safely say Trump isn't causing this. As for the Fed, independent from whom? Of the many interests that the Fed serves, America and its people probably clock in dead last. We have the privately-chartered Fed to thank for the U.S. dollar losing 99.9% of its purchasing power, a feat it has pretty much accomplished by itself. If anything, a "non-independent" Fed might bring some actual oversight and stop this derailed train or slow it down a bit, but that's really just wishful thinking. Now onto Bitcoin and the actual why of what's happening in the gold market. Bitcoin is quietly confirming gold’s messageAccording to Gizmodo, Bitcoin has largely ignored the same headlines that some outlets have tried to pin on gold’s surge – including trade tensions and tariff speculation.1 Instead of reacting violently, Bitcoin has spent much of the past year trading in a relatively narrow range, roughly between $90,000 and $100,000. That behavior matters. For most of its history, Bitcoin demanded a high tolerance for volatility. Sharp drawdowns and explosive rallies were part of the bargain. What we’re seeing now is different. Bitcoin has begun behaving less like a speculative instrument and more like a mature monetary asset – one that responds to broad liquidity conditions rather than daily news flow. Gold, meanwhile, has done the opposite. It has posted gains that look almost Bitcoin-like, confounding commentators who are still searching for a tidy narrative hook. When one asset calms down and another accelerates, it’s tempting to look for unrelated explanations. But viewed together, the message is simpler. Both assets are responding to the same underlying pressure: declining confidence in fiat currencies. Gold has long been described as a rough gauge of U.S. dollar value. That framing is incomplete, but it isn’t wrong. When gold rises steadily without a clear catalyst – and when the usual explanations fail to stick – history suggests the problem lies with currency itself, not with any single policy announcement. Think back to 2008 or the early months of the pandemic. Gold rose during those periods, but nothing like what we’re seeing now. The current move implies stress that is broader, more persistent, and less openly acknowledged. That’s uncomfortable to say, especially given the human cost of past crises. But economic damage doesn’t need to be sudden to be devastating. A slow erosion of purchasing power can dismantle livelihoods just as effectively. Anyone who regularly buys groceries, pays insurance premiums, or covers medical expenses can see the evidence firsthand. Official measures may suggest inflation is contained. Everyday experience suggests otherwise. This disconnect helps explain why gold has surged in every major currency –and why it was the last to fully break out in U.S. dollar terms. The dollar held up longer than most, but even that relative strength appears to be fading. There’s also a straightforward supply component at work. Under Basel III rules, financial institutions are required to hold more physical backing for certain gold exposures. That change didn’t make headlines, but it quietly reduced the amount of paper gold standing in for real metal. The result is a market discovering, in real time, that physical supply is tighter than previously assumed. Strip away the headlines and speculation, and the fundamentals aren’t mysterious. There is less physical gold available than many believed, and currencies are under more strain than officials are willing to admit. Those two forces are enough to explain both the magnitude and the persistence of this run. Is there any way to guess how high silver will go?Forbes tells us silver passed $100 for the first time in history last week, reaching $103 by the end of the week. The early morning fixes for Monday place it above $100, in line with gold ($112 at the moment as I’m writing this). As far as silver weeks go, this one wasn't as interesting as the previous, though some will no doubt take issue with that."But, it finally hit $100!" True, with caveats... Last week, silver had a great run, but it was brought on by gold's similarly forceful gain. That wasn't the case in the previous weeks, when silver would gain just as much while gold moved little. Those were the weeks I highlighted as evidence that silver isn't correctly valued, much more so than gold. The truth is that $100 silver with $5,000 gold doesn't quite feel right to me. It's a gold/silver ratio of around 50, which is about where it should be based on recent history. Even so, silver has supply dynamics nothing like gold’s – and silver’s industrial demand is nothing like gold’s. While gold has tripled in price since mid-2023, silver did so in considerably less time. Now, this is normal since silver outspeeds gold in runs like these. Nobody is talking much about a run towards $200 silver, which I find interesting. Gold is plenty well-positioned for a run towards $7,150. But it's difficult to convey how much better silver is positioned for a run towards $200. $7,150 gold would likely bring global panic and much wailing and gnashing of teeth. While $200 silver would mostly illicit an "eh, makes sense" reaction, with everyone coming to the conclusion it was undervalued without much issue. So it's strange, and somewhat revealing, to see analysts freely discuss or even forecast $6,000-$7,000 gold while steering clear of $200 silver. Silver could very easily be $200 with gold's current price, and arguably should. Whether it will is one of the big questions of the decade. As it tries to, silver investors need to be exceptionally sensitive to downplays or false interpretations of data. For example, I read today how China's 16-year high silver export figure cast doubt on fears of supply. But that figure accounts for all of 2025, and China only limited exports on the tail end of the year. Reading that, you're being urged to think that silver's supply is dandy, when the biggest exporter just curbed supply of a market with a structural deficit of 200 million ounces. This is the kind of wayward print to watch out for as we try and guess whether silver price can normalize towards $200, which would undoubtedly mean that price manipulators have slipped up. Closing perspectiveWhen gold and silver move this decisively – and when familiar narratives stop working – it’s usually a sign that something structural is shifting beneath the surface. I’m calling this shift The Great Repricing. Like all of history, these moments tend to be clearer in hindsight than in real time. For people thinking about how to diversify and hedge their savings against long-term currency stress, education matters more than timing. If you’d like to learn how physical precious metals can fit into a broader, tax-advantaged retirement strategy, Birch Gold Group offers a free information kit that explains the basics in plain English. There’s no obligation – just context you need to understand what’s happening when clarity is in short supply.

|

Send this article to a friend:

|

|

|