Kraft Heinz's Top Shareholder Berkshire Plots Exit

Tyler Durden

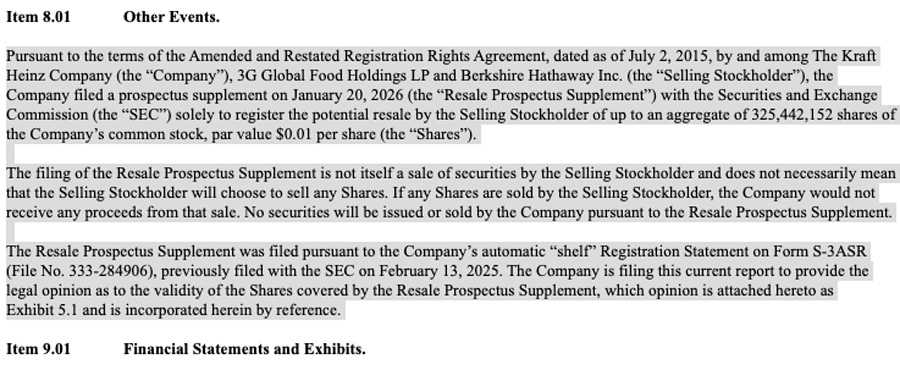

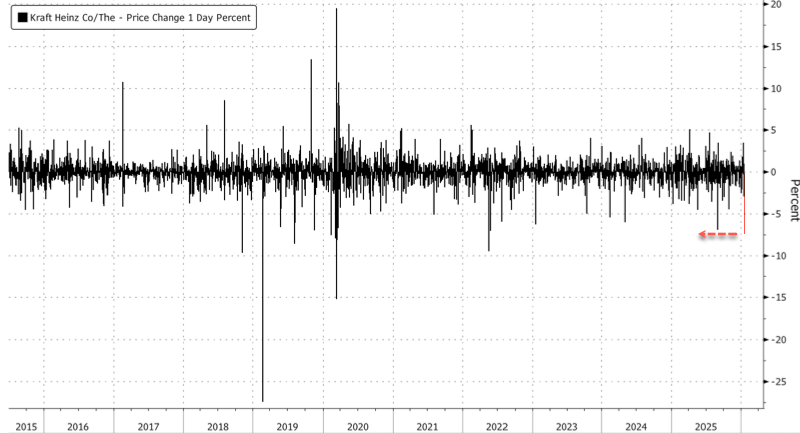

Kraft Heinz shares are down about 7.5% in New York premarket trading, the biggest drop in just under four years, after the company filed an 8K allowing Berkshire Hathaway to sell up to 325.4 million shares of stock if it chooses to do so. Kraft Heinz shares are down about 7.5% in New York premarket trading, the biggest drop in just under four years, after the company filed an 8K allowing Berkshire Hathaway to sell up to 325.4 million shares of stock if it chooses to do so.

Kraft Heinz's permission to sell is not an actual sale. No shares have been sold as a result of this filing, and Berkshire is not obligated to sell anything.

The proposed sale of the 325.4 million shares by Berkshire represents about 28% of the packaged-food company. This comes as the company recently announced plans to split into two.

Berkshire's Warren Buffett expressed disappointment last year about the potential split of the two companies. Berkshire played a critical role in the 2015 merger, partnering with 3G Capital as a financial backer.

As a result of the 8K filing, Kraft Heinz shares were down 7.5% in premarket trading on Wednesday. If losses extend and hold through the cash session, this would mark the largest daily decline since May 18, 2022, of -9.5%.

Kraft Heinz shares have tumbled 76% since peaking at around $100 per share in early 2017.

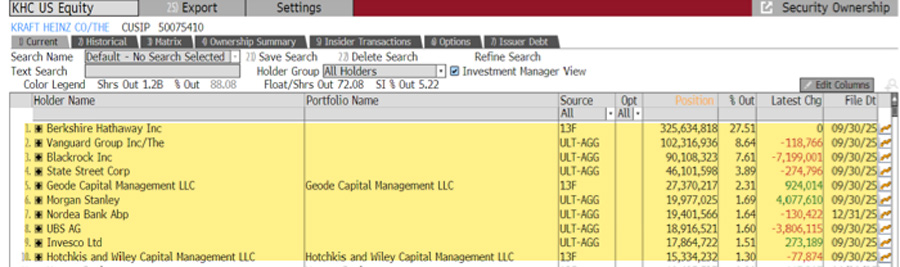

Berkshire, Vanguard, BlackRock, State Street, Geode Capital, Morgan Stanley, Nordea Bank, and UBS are the top shareholders of Kraft Heinz.

Bloomberg noted, "After years of underperformance, Kraft Heinz announced in September that it would separate into two public companies, essentially undoing its $46 billion mega-merger from a decade ago. Its chairman has blamed the company's poor performance on an overly complex corporate structure and the inability to focus on capital allocation and the right projects to prioritize. Kraft Heinz also replaced its chief executive officer at the start of this month."

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|