23

2013

January 23 2013 |

The Hidden Inflation

Back in 1980 the US experienced high inflation, close to 20% and with

interest rates in excess of 18%, before the Fed finally got things under

control. Companies had to raise prices and sales suffered as a result. In

today’s world we are experiencing inflation, but it’s a lot harder to see.

The government has changed the weighting of its inflationary indexes so the

true effects aren’t reported. We also have more subtle ways of hiding

inflation. Companies have learned not to raise prices since everyone can see

that. Instead they’ve learned to quietly cut back on content while

maintaining prices at previous levels.

Demand in the US and Europe have been on the decline for two years and that

is evident in the preceding chart of the Reuters CRB Index. You can see the

series of lower highs and lower lows that have developed, but if you look

closely you can see that the 50-dma has crossed back up above the 200-dma

and the index has moved and closed above both. Can the CRB Index move up to

post a higher high? Now look at the Baltic Dry Index and we can see the same kind of deterioration over a long period of time. Then look at the far

right of chart and you can see two higher lows. If prices are going to

finally turn higher we’ll see the BDI move and close above the 50-dma as a

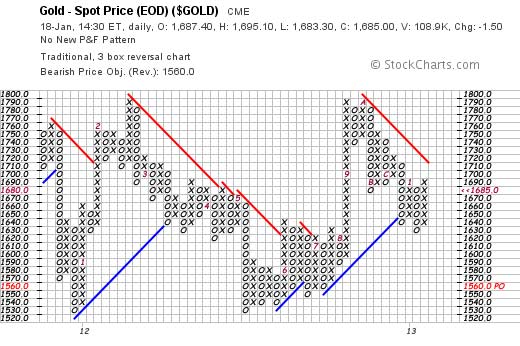

first step.  One of the best warning signs of a coming inflation is gold so I want to take a fresh look and see if there are any new developments:  You can see that gold enjoyed a nice long run from its March 2009 low to the September 2011 all-time high. Then came the correction, shallow by past standards, and less than commodities like oil and copper. The correction lasted eight months and now gold is undergoing a process of accumulation. The difference between this accumulation and past accumulations is that this is the one that will push the gold bull market into its third and most profitable phase. How close is gold to moving up and out of the accumulation stage? Take a look at this:  The spot gold has been headed higher for two weeks after making a significant higher low at the 1,630.00 support level. This move is taking us toward the higher end of a “flag formation” that has developed over the last three months. Once it breaks out of this formation with consecutive closes above 1,705.00, it will be a strong buy signal. Since gold is a long way from being overbought, it could easily run up to the next level of good resistance at 1,746.20. Now look at the Point & Figure chart below:  Robert M. Williams (I very seldom write for public consumption, content to talk to myself when I feel I have made some worthwhile observations. I do however feel that we are at a critical stage, and since so little is known about gold, some comment is necessary. Should you have any questions, you can reach me at robmwilliams@hotmail.com and I will do my best to respond in a timely manner.) |

|

|

|