Send this article to a friend:

December

30

2023

Send this article to a friend: December |

2024 Economic Prediction: The Repocalypse Redux is Coming!

Well, it blew up far beyond that even, though it got some help from the Covid lockdowns. In other words, it was only resolved by the TRILLIONS of dollars the Fed found excuse to create out of thin air when the Covidcrisis hit. That little event that blew up in November was something I predicted based on an event exactly like what happened today, which also happened on the last business day of the year. Based on that final day of 2018, I predicted the Repo Crisis of 2019 in that January, as something that would blow up in the latter part of that year. This year, on December 20th, I warned something similar this way comes, giving the following warning and prediction about interbank lending (repos), which is what just came true today. It’s a bit technical, but it is as important today as it was back on the last day of 2018 because it is happening all over again: (See “The Market Runs Red, So Does the Sea, So Do Bank Repo Loans!”)

Well, the end of the month just arrived, and, as I anticipated, that strain in the system broke out today in the largest differential between that interbank lending rate and the Fed Funds Rate, which is the Fed’s bottom-dollar lending rate, since the huge meltdown in this subterranean market back at the start of the Covidcrisis. That historic meltdown was part of what sent the Fed screaming back into the biggest all-out quantitative easing in the Fed’s longer-than-human lifetime back in 2020. Zero Hedge, today, showed the following graph of what happened with last night’s overnight loans:

At the right end, you can see the first spike this month that caused me to write the warning above and then the higher spike that hit last night and today (in progress) as banks and businesses all make their end-of-the-year rush to balance and clear all the year’s transactions as necessary. You can also see that most years end quietly, but this one is ending with noise as I anticipated because liquidity in the financial system is starting to dry up as I warned it likely would. Finally, you can see that, prior to December, the only spike that came close to the two this month was the panic that hit banks during the mega crash back in March, but even that didn’t go this high. These kinds of spikes are caused by the fear banks have in lending to each other, being unsure they will get their money back, which causes them to demand suddenly high interest for these interbank loans. While the spread between interbank repo loans and the cost of the world’s cheapest emergency loan at the Fed’s discount window (The Fed Funds Rate) was the worst since the Covidcrisis broke out in a panic, the news today is actually more dramatic because the actual repo rate hit its highest level in recorded history today — 5.40%: Here is why this slog of terminology is important: these end-of-the-year repos (world’s safest, cheapest loans that keep banks running on a daily basis) reveal that banks are clearly starting to feel stress as cash gets tighter. On top of that, the Fed says it has an indefinite amount of QT to continue with (which is creating the stress by sucking money out of bank reserves) even after it starts to lower interest rates. That is the same thing the Fed said and did when a blip like this appeared at the end of 2018, which it ignored, which triggered my prediction for 2019, claiming we’d see a severe repo crisis in the latter part of the year because the Fed clearly had no intention of stopping QT, though signs of tightness were already showing. When that did happen, I referred to it as “The Repocalypse” and stated assuredly that the only way out would be for the Fed to go back to full-on QE (massive money printing as the article quoted at the top describes). After the Fed tried endless overnight loans in massive amounts to end that crisis, pretending those loans were “not QE,” it eventually went to full-on QE (and called it that), and the crisis ended due to the biggest money printing in history wiping it out. (You right before that point, at the very beginning of the graph above, that the crisis was still looking quite spiky as late as February, 2020. Then that settles completely down after all the Fed’s massive injections of new money in the spring of 2020 due to the covid lockdowns.) That is the danger up ahead now, too. If the rate runs up, banks stop lending to each other, and the financial system freezes over unless the Fed rushes in to bail it out — not so easy when you already have inflation you have to fight. That’s why I also warned in an earlier article this month,

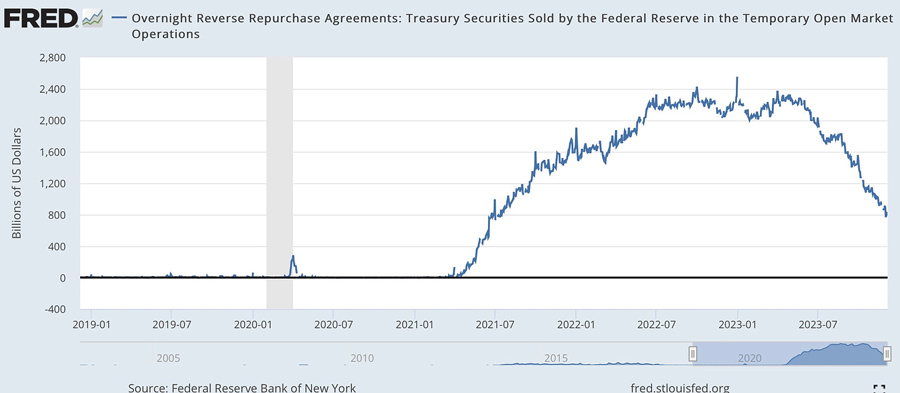

(The Fed asks for “loans” from the bank (which it doesn’t need at all) and promises the interest as a way to remove excess liquidity from the financial system, which the banks can take back when they need the cash.) That little sea monster suddenly emerge today from down below. I pointed out the following graph of how the huge reverse-repo market at the Fed, set up to store away the banks’ money for times like these, is rapidly tightening back toward normal:

Because banks get interest when they finally take their “loaned” money back from the Fed, they should generally prefer to eat up the cash they deposited on loan to the Fed before going to the interbank repo market to borrow needed overnight funds. So a run to repos indicates tightness. As that cash banked in the Fed’s Reverse Repo facility is coming down, I said it is likely some banks had a lot less banked than others, so we would start to see only a few running to the repo market first (along with hedge funds that also operate from that market less directly through clearing houses). All of this means we are entering that critical zone, folks. Today even had the effect of jogging bond yields up to start waking the lazy bond market. This tightness in the system shows up first on a Friday like this one, because the last Friday of December stresses the system by far the hardest (just as it did at the end of 2018). So, today’s move doesn’t mean the system is going to crumble tomorrow since this is the hardest day to get through; but it does mean what it meant back at the end of 2018. It caused me to say in January 2019 that we would see this agitation break out late in the year as cash got tighter until it busted apart in lest stressful times than the very end of a year. It did that when the final day of the third quarter hit, which has similar stresses, but not as big. The first big crack did show “near the end of the month” today as I said was likely to happen. It should settle down quickly as all those transactions clear, but it will rise again in a much worse way when banks get tight enough that they can’t even handle normal daily transactions because the Fed plans to continue QT even after it does eventually start lowering interest rates.

Speaking of lowering interest rates: While one of Zero Hedge’s own articles referred today to “the Fed’s ‘shocking’ dovish pivot,” another one of the articles they carry that are written by others (in this case the Mises Institute) asked “When Will the Fed Pivot?” They ask that because--contrary to ZH, which keeps trying to sound victorious in its nearly two-year-long prediction of an imminent Fed pivot—the Fed has not pivoted at all. Hence, my prediction for the Repocalypse Redux if the Fed doesn't actually change course soon. While ZH continues to push the misconception that they were finally right, the rest of us wait for the actual change in Fed policy to happen months from now with no certainty that it will, given everything in the world that will tend to crowd inflation back upward. A change whispered by Fedheads now but not actually made for months won’t qualify as a “pivot” even when it happens. That time span is more like a slow, heavily listing turn of the Queen Mary, taking months between the first hints that a change will eventually come and the actual implementation of the change. For now, policy holds rock steady. However, Powell still clearly screwed up on his communications, unless he wanted the markets to undo half of his tightening for him. He screwed up by not clubbing the notion of an interest change on the head before the market seized it and used it as the foundation of its new narrative for a new bull market. That premature ejaculation by the markets (sadly, I can think of no more apt description of the market’s response to fantasy Fed stimulus) is, in the end, just one more reason to think a change in Fed policy has actually been pushed further away, because the market’s sudden rise could, all by itself, push inflation back up via the “wealth effect”that the Fed has said it tries to get from the market when stimulating the financial system. Inflation was already starting to turn back up, and spreading wars will create more upward pressure. An upcoming “Deeper Dive” will dig into the intense wars that spread across the oil-producing regions and major shipping lanes as part of my 2024 economic prediction regarding inflation. For now, I’ll just briefly note from today’s stories alone, that wheat is rising directly due to the war with Ukraine in the Black Sea, and numerous other goods face price pressures as half of all container-ship traffic has abandoned the critical Red Sea route and is heading around South Africa, while half has abandoned Panama for other reasons and is heading around South America. While oil has held pretty steady through all of this so far, due to enormous increases in US oil and gas production offsetting some of the risks, Doug Casey writes a good article in the headlines today that says we are one shot away from the most devastating oil crisis in history. Even those fighting wars cannot ever predict what will happen. Look at how many were wrong in thinking that Putin would rapidly walk right over Ukraine, but the war keeps pounding on with neither side looking ready to back off. What one can do, though, is look at how serious the risks are and how many there are coming out of the war, and if you see a huge cliff of risks stacking up, know the risks of rising inflation also become high. I’ll dig deeper into all of that in my upcoming “Deeper Dive.” Finally, as a curiosity that means nothing for events happening in 2024, which I’ve called “The Year of Chaos,” how apropos that one headline today says that NASA is sending out a probe to investigate the asteroid Apophis, which means “God of Chaos,” and which is scheduled to just miss earth in 2029 in one of the closest passes ever by the kind of asteroid that can end history as we know it. They forecast we’ll be able to see it zing by with the naked eye. IN THE MEANTIME, with all this talk about inflation, if you have been sitting on the fence about supporting the writing here on The Daily Doom and benefitting from all the “Deeper Dives” where I’ll be laying out my remaining predictions for 2024 as well as gaining access to all the headlines, you can counter inflation some by subscribing before the end of the year at the following sale price: (Headlines referred to above appear in boldface below.) Keep reading with a 7-day free trialSubscribe to The Daily Doom to keep reading this post and get 7 days of free access to the full post archives.

|

Send this article to a friend:

|

|

|