Gold Spikes To Record High Over $2,130, Bitcoin Soars Above $40,000

As Market Calls Powell's Bluff

Tyler Durden

On Friday, shortly after Powell failed to hammer the hawkish case in his “fireside” chat with stocks eager to take out 2023 highs, we said that Powell has a big problem on his hands not so much because if the market was indeed correct about imminent easing that only assures that inflation will come back with a vengeance and Powell would indeed be the “second coming” of a former Fed Chair – only Burns not Vlcker – but because the kneejerk surge higher in gold (and digital gold) meant that the once again deathwatch for the dollar – and fiat in general – had resumed. On Friday, shortly after Powell failed to hammer the hawkish case in his “fireside” chat with stocks eager to take out 2023 highs, we said that Powell has a big problem on his hands not so much because if the market was indeed correct about imminent easing that only assures that inflation will come back with a vengeance and Powell would indeed be the “second coming” of a former Fed Chair – only Burns not Vlcker – but because the kneejerk surge higher in gold (and digital gold) meant that the once again deathwatch for the dollar – and fiat in general – had resumed.

Well, with futures having opened for trading on Sunday night, what we joked about on Friday, namely that Powell – having seemingly once again lost control of the hawkish narrative – may be leaking emergency rate hikes though Nick Timiraos on Dec 12, ahead of the December FOMC (now that the Fed is in blackout mode)…

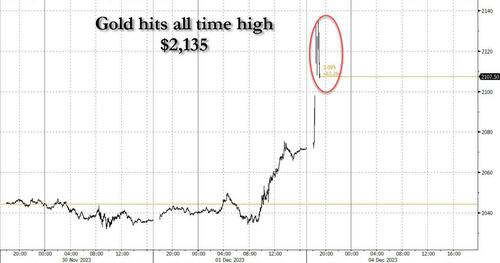

… is all too real because suddenly everything that is non printable is soaring, starting with gold, which has exploded as much as $60, spiking to a new all time high of $2,135…

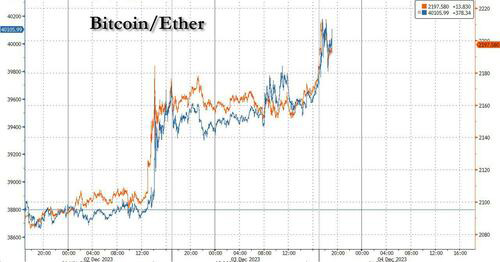

… while bitcoin, and the entire crypto sector following closely, spiking above $40,000 for the first time since May 2022.

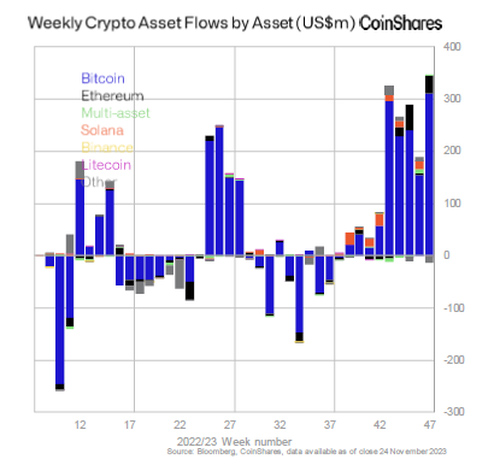

The bitcoin move was to be expected after what we reported yesterday, namely that cryptos had just seen their largest inflows in two years… and Friday’s comments by Powell only guaranteed even more capital would flow into the largely illiquid asset class.

"Bitcoin continues to be supported by optimism around SEC approval for an ETF and Fed rate cuts in 2024,” Tony Sycamore, a market analyst at IG Australia Pty, wrote in a note. Technical chart patterns point to $42,330 as the next level to watch for, he added.

As for gold, everything is suddenly going in its favor, and not only the violent resumption of the Israel-Hamas war (which now includes attacks on US warships in the Gulf)...

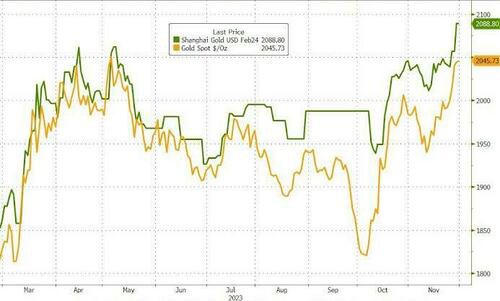

... as well as the relentless buying out of China which we discussed last week in "Behind The Mysterious Explosion In Gold Prices: China's "Massive Accumulation Of Gold" which noted the staggering divergence between Shanghai and London gold prices, a clear proxy for outsized demand for physical gold on the mainland...

... but also years of market reflexes which prompt algos to buy gold any time the Fed is set to ease, something which markets assigned 80% odds on Friday could happen as soon as March.

And so, going back to square one, Powell is once again boxed in: either he pushes back on the market's sudden dovish euphoria which could well send dollar sparling lower, and in turn send commodities exploding higher guaranteeing that all the worst aspects of Burns Fed make a triumphant return, or he does nothing, and we see gold go parabolic.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|