Amazing Top Silver Producing Countries Short Reserve Life Remaining

Steve St Angelo

Yes, it’s true. The largest silver-producing countries in the world have the lowest reserve life remaining. And, when I say… LOW, it isn’t decades’ worth of silver reserves; rather, it’s a matter of years. This may sound quite unbelievable, but that is exactly what we find when we look at the data.

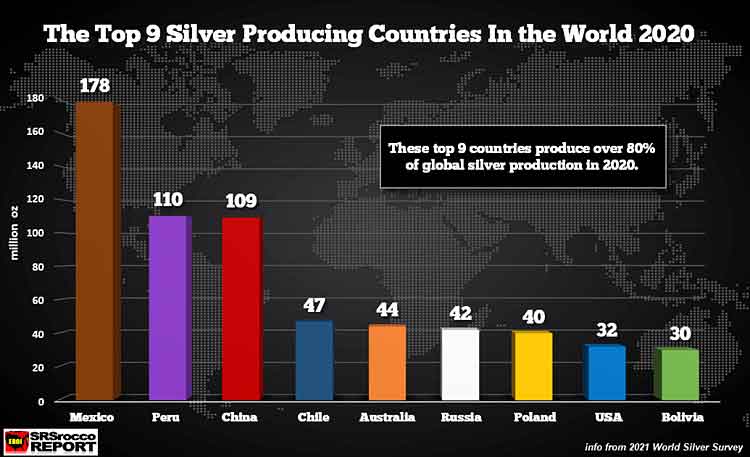

The chart below shows a breakdown of the top nine silver-producing countries globally. The top three are Mexico (178 Moz), followed by Peru (110 Moz) and China (109 Moz).

Both Mexico and Peru will likely see a rebound in silver production in 2021 as they recover from the pandemic shutdowns in 2020.

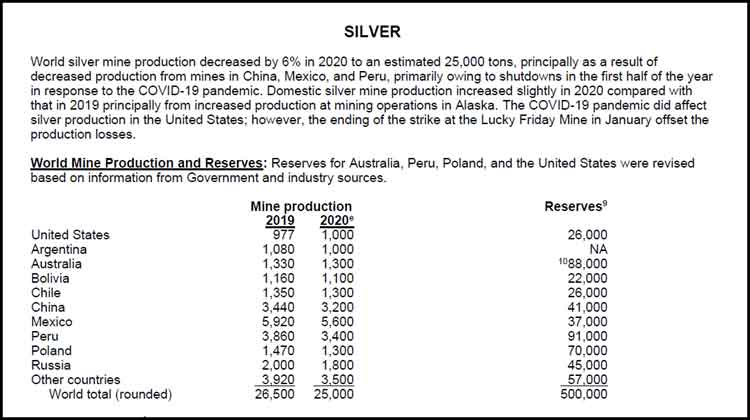

These nine countries produce over 80% of the global silver mine supply. Now, if we look at the chart below from the USGS, it shows the remaining silver reserves for these countries.

The USGS reports its data in metric tons and rounds off the figures. For example, Mexico’s 178 Moz is 5,535 metric tons (mt). So, it’s close enough. If we divide the current 2020 production for each country by its Silver Reserves, we end up with a “Reserve Life” remaining based on the current annual output.

As we can see, Mexico, the world’s largest silver producer has the lowest Reserve Life remaining at only seven years at the current production level. Third-ranked China only has 13 years of silver reserves remaining.

Interestingly, Australia has the longest Reserve Life remaining at 68 years followed by Poland at 54 years. So, according to the USGS silver reserves, Mexico will run out in seven years while China will do so in 13 years. Of course, these countries could add more reserves, but I highly doubt it when we include the coming ENERGY CLIFF and how that will impact the mining industry.

So, with two of the largest silver producers in the world showing the least amount of Reserve Life remaining, this is just another reason to own physical silver metal.

Independent researcher Steve St. Angelo (SRSrocco) started to invest in precious metals in 2002. Later on in 2008, he began researching areas of the gold and silver market that, curiously, the majority of the precious metal analyst community have left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy. Independent researcher Steve St. Angelo (SRSrocco) started to invest in precious metals in 2002. Later on in 2008, he began researching areas of the gold and silver market that, curiously, the majority of the precious metal analyst community have left unexplored. These areas include how energy and the falling EROI – Energy Returned On Invested – stand to impact the mining industry, precious metals, paper assets, and the overall economy.

Steve considers studying the impacts of EROI one of the most important aspects of his energy research. For the past several years, he has written scholarly articles in some of the top precious metals and financial websites.

You can find many of Steve’s articles on noteworthy sites, such as GoldSeek-SilverSeek, Market Oracle, Financial Sense, GoldSilver.com, SilverDoctors, TFMetals Report, Outsiderclub, SGTreport, BrotherJohnF, Hartgeld, Der-klare-blick, PeakProsperity, SilverStrategies, DollarCollapse, FurtureMoneyTrends, Sharpspixley, FinancialSurvivalNetwork, Pmbull, Deviantinvestor, PmBug, Wealthwire, and ZeroHedge.

srsroccoreport.com

|