Fed Chair Powell Does Not Comment On Outlook Or Policy

In Prepared Remarks

Tyler Durden

Update (9:18am ET). As is usually the case, Powell's prepared remarks which were just released, did not comment on the outlook for Fed policy or economy so soon after the FOMC meeting. Instead, the Fed chair focused on the Fed's forecasting voodoo and said the central bank must be willing to think beyond the complex mathematical simulations it traditionally uses to forecast the economy. Update (9:18am ET). As is usually the case, Powell's prepared remarks which were just released, did not comment on the outlook for Fed policy or economy so soon after the FOMC meeting. Instead, the Fed chair focused on the Fed's forecasting voodoo and said the central bank must be willing to think beyond the complex mathematical simulations it traditionally uses to forecast the economy.

“Intellectual rigor has to be combined with flexibility and agility,” Powell said in opening remarks at a conference celebrating the 100th anniversary of the Fed board’s Division of Research and Statistics.

“Even with state-of-the-art models and even in relatively calm times, the economy frequently surprises us,” Powell said. “But our economy is flexible and dynamic, and subject at times to unpredictable shocks, such as a global financial crisis or a pandemic. At those times, forecasters have to think outside the models.”

R&S, as the division is known, provides the Federal Open Market Committee — the Fed panel that sets interest rates — with an economic forecast eight times a year, as well as updates on current data and research on policy and economic topics. The division is currently headed by Stacey Tevlin, the first woman to lead the unit, which employs dozens of PhDs.

Forecasting has been a difficult exercise for the Fed in the post-pandemic economy. Fed staff continued to call the burst of inflation “transitory” for most of 2021, before it kept accelerating in 2022 and reached a peak annual rate of 7.1% in June of that year.

In general, the Fed has been dead wrong about pretty much everything in its 110 year history, and that will never change since it is the crises that allow the Fed to inject trillions into the economy and make the rich richer.

Below is his full prepared speech:

Thank you, Stacey, for the chance to be part of this celebration. It is great to be here to honor the Division of Research and Statistics (R&S) and humbling to see so many Fed people who served the institution over long and distinguished careers and have returned for this great occasion. The Fed is one of those places where you can work for a decade or so and still feel like a newbie.

For those listening outside this room, I will briefly outline R&S's responsibilities. A large part of the division, along with other divisions at the Board, is engaged in producing the Tealbook, which contains the staff's forecast for the U.S. economy, as well as a great deal of data and analysis on financial and economic issues, and which is delivered to the Federal Open Market Committee (FOMC) before our meetings.

Outside of the FOMC meeting cycle, R&S deploys its experts wherever they are needed across the Board, providing crucial inputs to work on financial stability, bank merger analysis, and many other topics. R&S is also an ongoing source of specialized information for policymakers. If Board members have questions about even the most arcane workings of some aspect of the economy, they can send an email and, in no time, be sitting down with some of the best-informed experts on that subject. Much of the time, these are R&S economists. During the pandemic, when questions arose about how the computer chip shortage was affecting auto production or how businesses were responding to the backlog at U.S. ports, R&S gave detailed briefings on these topics. Among its other activities, the Board of Governors is one of the world's most productive economic research institutions, and a large share of that work takes place inside R&S, supporting our mission of promoting a healthy economy and a strong and stable financial system.

I've spoken about research—now let me turn to statistics. In addition to the gathering of data from many sources outside the Federal Reserve, R&S is itself the source for some of the most important data on the economy and the financial system. Our consumer credit data provide financial markets and the public with a vital indicator of the strength of household spending and balance sheets. Each month, the Industrial Production report gives us insights into how well certain sectors of the economy, especially in the manufacturing realm, are operating. R&S is also responsible for the Financial Accounts of the United States, a quarterly compendium of assets, liabilities, and transactions for different segments of the economy. And every three years, R&S conducts the Survey of Consumer Finances, a premier source of detail and insights about how households are faring in the economy. The latest survey was published just last month. These and other data series produced by R&S are a significant public service.

I want to focus in more detail on the forecast, perhaps the most important of R&S's roles. The U.S. economy baseline forecast produced by R&S, along with the simulation of a half-dozen plausible alternative paths, constitutes the largest part of the essential bedrock that enables our pursuit of our dual-mandate goals.

Some people are attracted to extremely challenging tasks. The people of R&S are those people, having chosen such a task in forecasting the path of the U.S. economy, eight times a year for FOMC meetings, with ongoing updates between meetings. They do this work on the biggest stage and with the highest stakes, knowing that the economy very often surprises us.

Several qualities are required to do this work well.

I will start with an intense commitment. The work requires everything you have to give. You have to love this work to do it well.

The job also requires integrity—policymakers count on R&S to give us their best thinking, not shading the results for any reason.

Regular forecasting also demands a systematic approach and a high degree of intellectual rigor. Ask Stacey and her colleagues to explain a certain aspect of the forecast, and you will find that they have a clear explanation grounded in a rigorous framework.

That intellectual rigor has to be combined with flexibility and agility. Economic models can do a reasonably good job of capturing the working of the economy over past decades. Of course, even with state-of-the-art models and even in relatively calm times, the economy frequently surprises us. But our economy is flexible and dynamic, and subject at times to unpredictable shocks, such as a global financial crisis or a pandemic. At those times, forecasters have to think outside the models.

This work also takes large doses of courage and humility. And, finally, judgment. To complement this rigorous process, there has to be good judgment, based on knowledge and experience.

Perhaps the most important legacy of the past century for the Division of Research and Statistics is the resilience, the creativity, the energy, the rigor, and the commitment with which R&S has risen to the many challenges it and our country have faced in that span of history. On behalf of the Board and the FOMC, thank you for that, and hearty congratulations on your first 100 years of service to the public.

* * *

Fed Chair Powell is due to deliver opening remarks at The Fed's Division of Research and Statistics Centennial Conference this morning.

His 'FedSpeak' follows Cook this morning, who warned that "persistent inflationary pressures... are among risks to the global financial system", and six 'hawkish' Fed speakers yesterday who all toed the same line: data-dependent, job not done, inflation still too high, rates high(er) for long(er), no cuts on the agenda.

Williams, Barr, & Jefferson are also due to speak later on today.

So, it should be clear by the time all that is done exactly what The Fed's path forward is.

The question is - will Powell inch back his rhetoric having seen stocks soaring higher since the FOMC statement (and press conference), since financial conditions are now loosening extremely fast... just as The Fed crowd about how 'the market was doing their tightening job for them'...

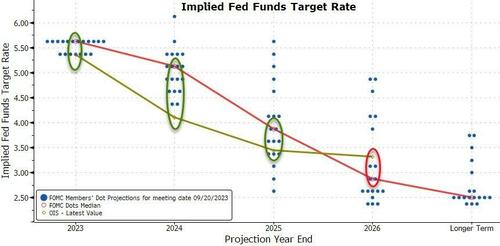

The market remains dramatically more dovish than The Fed's "dots" - more so since the FOMC meeting...

“Fed speakers will attempt to jawbone and cool market expectations for rate cuts,” said Todd Schubert, a Dubai-based senior fixed-income strategist at Bank of Singapore.

“The market is underestimating the Fed’s resolve in bringing down inflation to 2% and we would not expect a sustained rally in risk assets until there is clearer evidence of a pronounced downward trajectory in inflation.”

Simply put, Powell is widely expected to follow other policymakers in downplaying the likelihood of policy easing. Additionally, given that recent US labor market stats signaled a softer labor market environment, Powell could indicate whether labor market conditions weakened enough for the Fed to end its rate hike cycle.

our mission: our mission:

to widen the scope of financial, economic and political information available to the professional investing public.

to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become.

to liberate oppressed knowledge.

to provide analysis uninhibited by political constraint.

to facilitate information's unending quest for freedom.

our method: pseudonymous speech...

Anonymity is a shield from the tyranny of the majority. it thus exemplifies the purpose behind the bill of rights, and of the first amendment in particular: to protect unpopular individuals from retaliation-- and their ideas from suppression-- at the hand of an intolerant society.

...responsibly used.

The right to remain anonymous may be abused when it shields fraudulent conduct. but political speech by its nature will sometimes have unpalatable consequences, and, in general, our society accords greater weight to the value of free speech than to the dangers of its misuse.

Though often maligned (typically by those frustrated by an inability to engage in ad hominem attacks) anonymous speech has a long and storied history in the united states. used by the likes of mark twain (aka samuel langhorne clemens) to criticize common ignorance, and perhaps most famously by alexander hamilton, james madison and john jay (aka publius) to write the federalist papers, we think ourselves in good company in using one or another nom de plume. particularly in light of an emerging trend against vocalizing public dissent in the united states, we believe in the critical importance of anonymity and its role in dissident speech. like the economist magazine, we also believe that keeping authorship anonymous moves the focus of discussion to the content of speech and away from the speaker- as it should be. we believe not only that you should be comfortable with anonymous speech in such an environment, but that you should be suspicious of any speech that isn't.

www.zerohedge.com

|