Send this article to a friend:

September

15

2023

Send this article to a friend: September |

The Biggest Con Job in Banking: The Savings Account

Today, let’s take a break from exploring the downsides of higher interest rates. Let’s focus on the positive. If you’re prudent, you undoubtedly have some extra money tucked away in a savings account at a bank or credit union. Savings accounts are typically used for household emergency funds, cash set aside for short-term expenses like a big vacation, a significant home improvement (or downpayment on a home) – that sort of thing. Recently, setting aside cash in a savings account got a lot more attractive:

Just one year ago, Dr. Ron Paul calculated exactly how much the Fed’s interest rate repression was costing us. For example:

What a difference a year makes! At 5% APY (annual percentage yield, or “yield”), the most generous savings accounts are actually outperforming inflation – most recently reported at 3.7% year-over-year. A positive after-inflation return on your cash? Liquidity on demand? Insured by the FDIC? What’s not to like? If only we could take these benefits at face value… The drawbacks of savings accounts Unfortunately, offering 5% APY on your savings isn’t something banks are just offering you for free. If you have an existing savings account, don’t expect a complimentary upgrade to your APY. For example, here’s the current yield on my personal savings account:

You’ll probably have to shop around, but if you do you can find an account offering 4.75%-5.25% APY. But should you? Switching banks (even opening a new savings account online) can be a hassle. Is it worth it? Well, there are two reasons banks offer high yields on savings accounts:

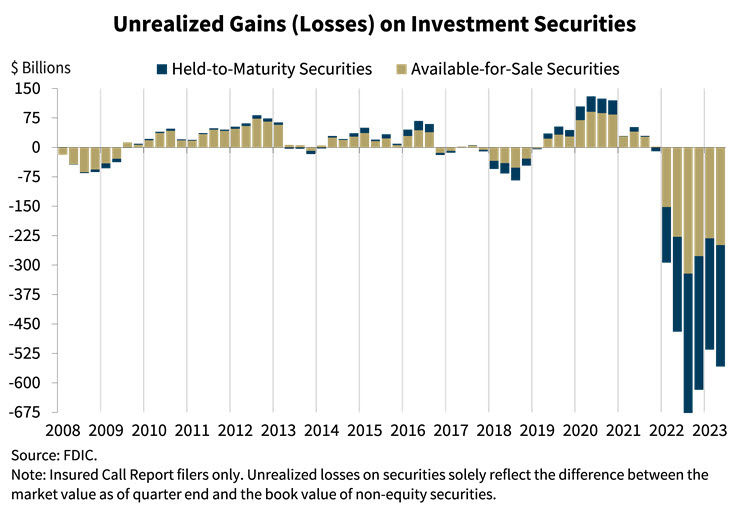

Don’t forget, the entire banking sector is still dealing with unrealized losses on their reserves – more today than in March, when SVB and Signature banks suddenly failed:  via FDIC Chairman Martin Gruenberg, September 7, 2023 Banks can borrow money from the Federal Reserve BTFP fund, which costs them 5.55% today. Why wouldn’t they offer savers a bit less to fill a hole on their balance sheets? From that perspective, a 5% APY savings account rate doesn’t look quite so attractive… Even if the worst occurred – you opened a savings account with a bank that promptly collapsed – your deposit would be insured by the FDIC. Right?

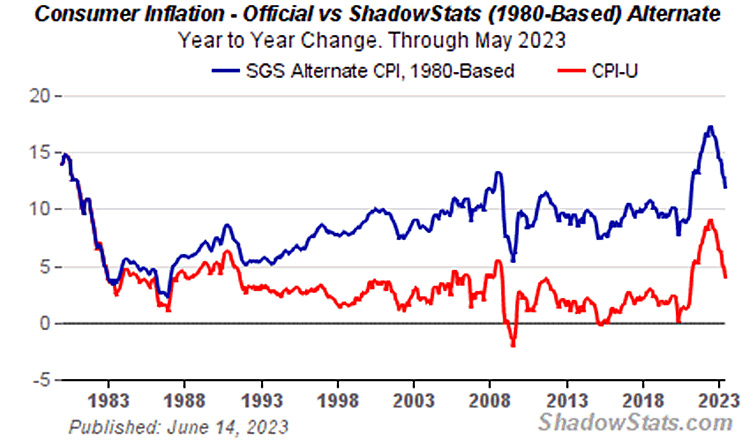

Stay under those FDIC insurance limits, folks! Fortunately, the FDIC maintains a significant deposit insurance fund (DIF). Unfortunately, the DIF has only $116 billion on-hand. That sounds like a lot, until we compare it to the $17.2 trillion currently on deposit in banks nationwide (about 40% or $7 trillion of that total is uninsured). If the deposit insurance fund is depleted, the Federal Reserve can always print more money to make up the difference. Which would cause inflation, naturally… Even in a worst-case scenario, you’d get your money back eventually, but you might need to wait on an act of Congress to make it happen. But we’ve been starved for yield on our savings for so long, a 5% APY might be enough to encourage even the most skeptical to open up a savings account. One more point to ponder – if we factor inflation into our calculations, how much after-inflation yield are we earning? Less than you’d think… “Real” returns or a mirage?The number one enemy of cash is inflation. The phrase “real return” means what’s left over after subtracting the corrosive effects of inflation on your cash. As I said earlier, the official CPI is currently 3.7% per year. Pause for just a moment and ask yourself whether that 3.7% increase in the cost of living accurately reflects your own expenses? For most Americans, the answer is a resounding No. That’s because CPI or “headline inflation” isn’t terribly accurate. Absent a deeper dive into the politics of inflation calculations, consider this. If we were to use the Federal Reserve’s own price index procedures from the 1980s (before substitution hocus-pocus were allowed to corrupt the data), inflation would measure about 12.5%.  via John Williams of ShadowStats That would also mean any cash stashed in a 5% APY savings account would actually cost you 7.5% of your purchasing power… Listen: Liquidity is great. Insurance on up to $250,000 in savings? Outstanding. Even when a bank collapses, the FDIC generally figures out a way to make insured deposits available within a day or two. Are those privileges worth a -7.5% return on investment? Maybe it’s time to consider a more inflation-resistant form of saving… Inflation burns up dollars, but it can’t touch this Whether you put your hard-earned cash in a savings account is totally up to you. So long as you’re aware of how much you’re really paying for liquidity and deposit insurance. Savings accounts aren’t the only solution, though. Consider the benefits of physical gold and silver. They’re not only resistant to inflation, they’re also historical safe-haven assets. Instead of a misleading APY, physical precious metals offer you long-term stability that can’t be inflated away. Gold and silver are almost as liquid as cash in the bank. And your physical precious metals are your property (unlike a bank deposit, which is a bank liability or IOU to you, the customer). Gold and silver cannot default, cannot go bankrupt. Ever. Savings accounts are supposed to offer low risk and low reward. Right now, it seems to me they offer a combination of low risk and guaranteed loss of purchasing power instead. There are two ways to own gold and silver. You can purchase them and have them delivered to your home. Or, you can use the retirement savings funds you’ve already set aside for your future to open a Precious Metals IRA. To learn more about either of these options, request a copy of this free kit. Knowledge is power – so whatever you choose, educate yourself and make an informed decision that’s right for you.

|

Send this article to a friend:

|

|

|