Just Another Hyperinflation Post - Part 3

FOFOA

|

Let's try this one more time. Let's look at it from a purely conceptual angle. Most of the following discussion will not be a proof of the inevitability of hyperinflation, but merely the proper way to view the flow of capital in a panic while analyzing the probability that it will be called "hyperinflation" in hindsight, after the fact. This is what seems to be most lacking in the descriptions I read from those who cannot accept that fiat currencies always end the same way, and that the dollar has reached the end of its timeline.

To get there, I will walk you through several visualized metaphors in an attempt to build a workable mental image of hyperinflation. Hopefully you will be able to use this mental imagery when analyzing the deflationists' claims that it simply cannot happen to the US dollar.

So first, I would like you to imagine two flat, parallel planes. Those that know M theory can envision two membranes, very close to each other but only touching at a single point:

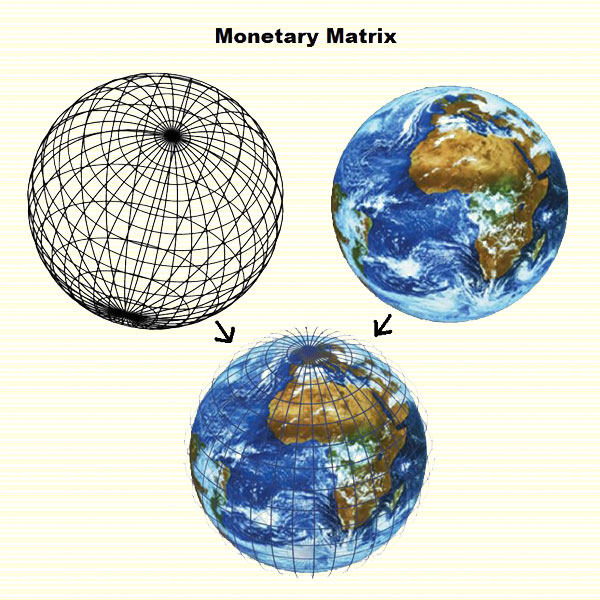

The top plane we'll call "the monetary plane" and the bottom one will be "the physical plane." And just so that we don't get confused with "the flat Earth society," those of you with advanced visualization skills can picture this same scheme as a globe with a membrane (or a Matrix of sorts) wrapped around it but not actually touching:

Now, for the purpose of this visualization exercise, I am going to challenge your definition of the word "money." In all likelihood you think of money as that which is substituted in the middle of a barter exchange. Something like this:

There is no right or wrong definition of the word "money," there are only poorly defined uses and clearly defined uses of the word. In the context of any single discussion, it is better to use a clear definition than to simply rely on everyone's common understanding.

In this discussion I will be talking about "the monetary plane," and in this context the word "money" refers to BOTH the medium of exchange and all forms of wealth reserves that exist in this "monetary plane." That is, "money" in this discussion is the medium of exchange PLUS any store of value that is not found in "the physical plane" of existence. Hopefully this is clear enough so that I don't have to add another three pages of descriptions.

In antiquity, the monetary plane didn't even exist. All wealth was held in the physical plane. In fact, even the medium of exchange was in the physical plane back then. So in that way, it was actually a barter exchange of one physical item for another, even if the other physical item was a chunk of gold. That chunk of gold existed in the physical plane. And for the purpose of this particular discussion, I hope this distinction is clear. In antiquity, the monetary plane didn't even exist. All wealth was held in the physical plane. In fact, even the medium of exchange was in the physical plane back then. So in that way, it was actually a barter exchange of one physical item for another, even if the other physical item was a chunk of gold. That chunk of gold existed in the physical plane. And for the purpose of this particular discussion, I hope this distinction is clear.

In today's monetary plane, enormous amounts of wealth are held as "someone else's thoughts of value" not value itself. And as ANOTHER once said, "time moves the minds of people to change, and with this, the thoughts of value also change. In this day, as not in the past, the loss of paper value as a concept will destroy the very foundation of wealth that this economic system is built on. This drama has started and is well underway!"

Credibility Inflation

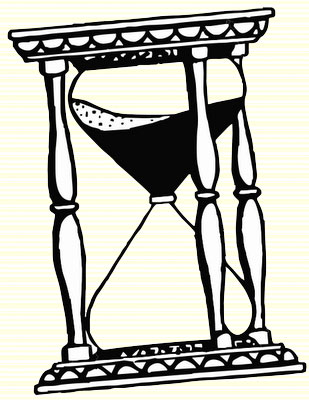

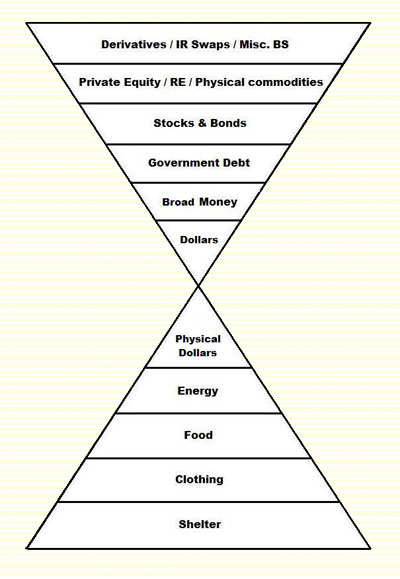

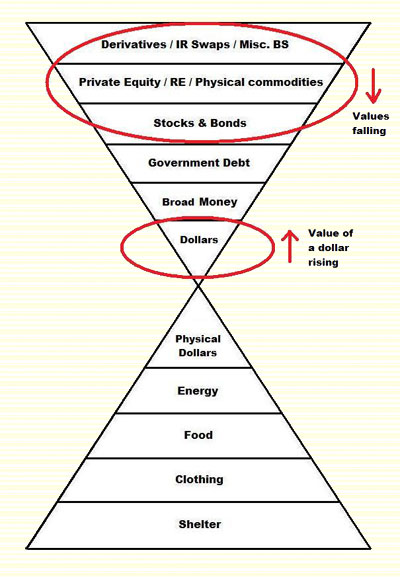

Referring to my post, during times of credibility inflation the monetary plane swells large along with its credibility. One way to picture this is an hourglass, as I did in Gold is Wealth:

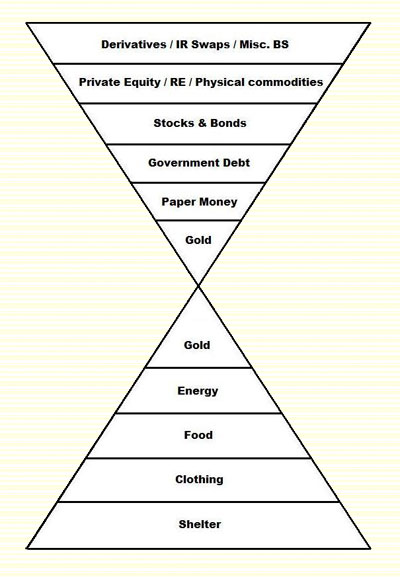

The top of the hourglass is the monetary plane and the bottom is the physical plane. And during times of credibility inflation, sand accumulates in great quantities in the top. Here are my pyramids representing the two planes from that same post, stacked on top of each other in a visual similar to the hourglass:

As I said in my Credibility Inflation post, the latest period of credibility inflation ran from 1980 until 2007. Since then, the credibility of the monetary plane has been deflating against the protestations of the Fed and CNBC. That doesn't necessarily mean the sand has gone down the hourglass yet, but its desire to cross the "bottleneck" is growing as the credibility of the top part deflates.

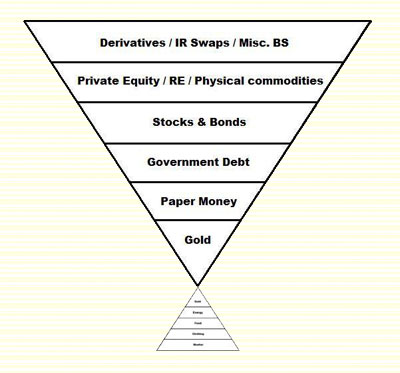

The stage for this was already set when the top swelled too large for the bottom to handle over the past 30 years:

Gravity alone would have brought it down gradually but for the managed perception of credibility that was holding it up, even as pressure built. But with credibility now deflating (that's the REAL deflation) it's anybody's guess when the pressure of over-inflation will bring it exploding downward with a force much greater than gravity alone. It's overdue at this point, kinda like The Big One in LA.

Some of you may have already figured out that hyperinflation, in my visualization, will be the great flood under pressure from the monetary plane back down to the physical plane of existence. And you may have noticed that this great flood must pass through a "bottleneck" of sorts to get where it's going. And perhaps you surmised that, if under enough pressure, this hyper-flow could actually BREAK the fragile neck in the middle of the hourglass.

In my pyramid above, taken from my Gold is Wealth post, I have that "neck" represented by gold. That's because that particular post was more about my #1 topic, Freegold, while this post is about my #2 (of 2) topic, hyperinflation. So for the purpose of this post, I will change that "bridge" between the monetary plane and the physical plane to dollars. For the bottom I'll use physical dollars, since they do actually exist in the physical plane. And I'll change the second layer on the top to "broad money," representing "balance sheet money," M1, M2, M3, MZM, TMS etc...

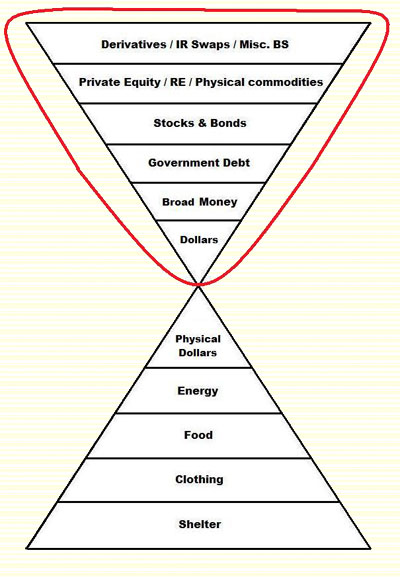

Now when I say we have already hyperinflated the $IMFS (the Dollar International Monetary and Financial System) over the last 30 years, I am referring to this whole top pyramid:

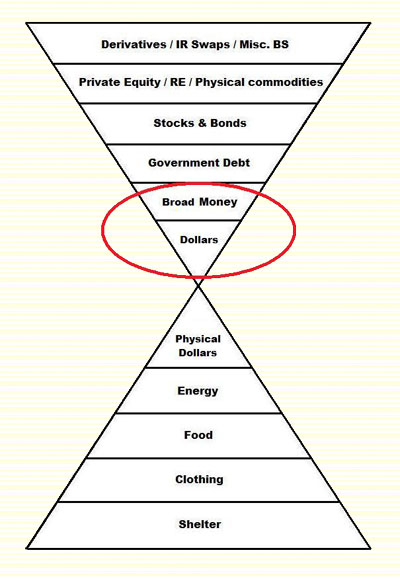

When deflationists see monetary deflation, they are looking at this part, and they see the value of the dollar in this circle rising:

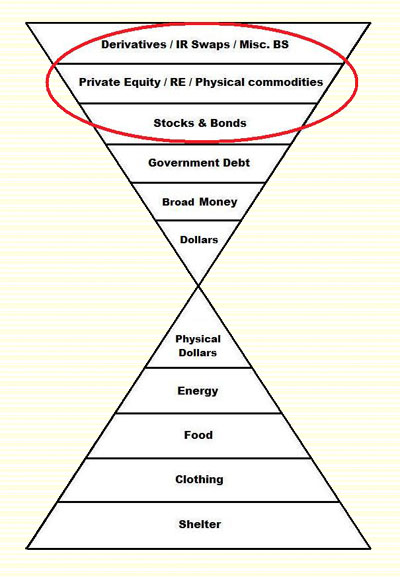

When they see price deflation, they are looking primarily at this part, and they see the value of real estate and other things in there falling:

But they are missing the significance of the bigger picture; that the credibility of the entire top of the pyramid is deflating. And it was this credibility that was holding all that sand up there in the first place. With the value of the top red circle falling and the value of the bottom red circle rising, the deflationists see "deflation."

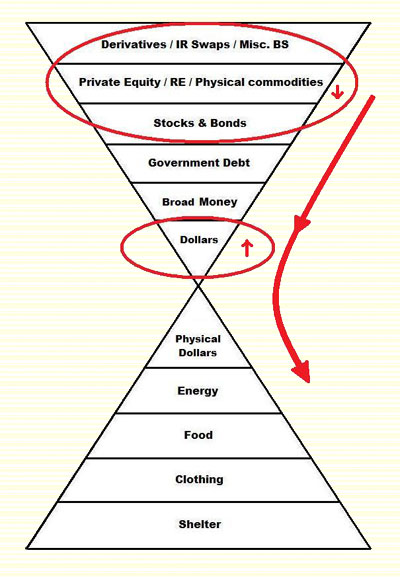

But what I see is the beginning of a capital flow, in one particular (and significant) direction:

Legal tender laws mandate the medium of exchange, but they do not and cannot name the store of value. For that they rely on credibility management by institutions like the Fed and CNBC. Jim Sinclair calls this MOPE. And it is the monetary store of value that is on the move, not the medium of exchange. But thanks to legal tender laws the monetary store of value must pass through (and be priced in) the medium of exchange, dollars, whenever it is on the move. Legal tender laws mandate the medium of exchange, but they do not and cannot name the store of value. For that they rely on credibility management by institutions like the Fed and CNBC. Jim Sinclair calls this MOPE. And it is the monetary store of value that is on the move, not the medium of exchange. But thanks to legal tender laws the monetary store of value must pass through (and be priced in) the medium of exchange, dollars, whenever it is on the move.

Thanks to our legal tender laws, in order for all that "wealth" at the top of the upper pyramid to escape to the bottom pyramid it must pass through the dollar. But as this occurs, the dollar swells in value. It becomes "more expensive." It'll cost you more derivatives to buy a dollar in order to pass through the neck of the hourglass. The dollar becomes a little bit harder to get, and this starts to look like deflation to the deflationists.

Now I'm really not trying to gross you out in this next little bit. But in order to pass through my next explanation I am going to have to carefully and delicately shift metaphors... without visual aids this time. ;)

As escape pressure builds in the upper regions of the upper pyramid, the legal tender dollar constricts its escape route like a clinching sphincter muscle as its (the dollar's) price rises. And then all that value that escaped the upper region starts collecting and compacting in the large intestine of Treasury Bonds, held in place only by the swollen sphincter that is the swelling dollar.

Not that I hope you can relate to this metaphor - I'm sure some of you can - but what do you think happens when that "flow restrictor" lets go, just a tad? Do you think "just a tad" escapes? Perhaps... at first. But with the Fed shoveling Ex-Lax (QE) into the system like there's no tomorrow, what do you think the end result will be? Will it be a journey back up into the stomach?

I know I haven't proven anything in this post. But I warned you at the beginning that was not the goal. The goal here, as I stated at the top of this post, was to give you the proper way to view the flow of capital during a panic when analyzing the probability that it will be called "hyperinflation" after the fact.

Notice that there is nothing in this view about the addition of new dollars. There is nothing about printing wheelbarrows full of money. All that stuff is secondary to the initial blast that explosively exits through a very small opening.

The lesson I hope you'll take from this story is simple. The next time a deflationist tells you there is no possible mechanism for hyperinflation in the dollar, just show him your sphincter and say, "oh yeah?" ;)

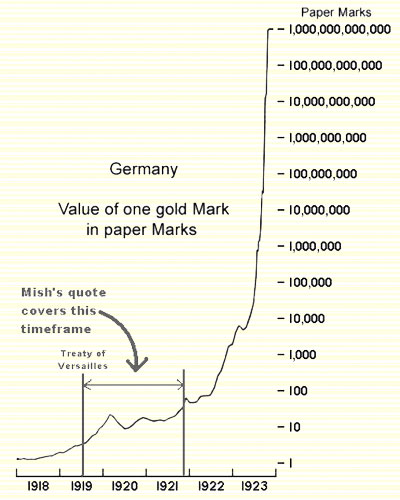

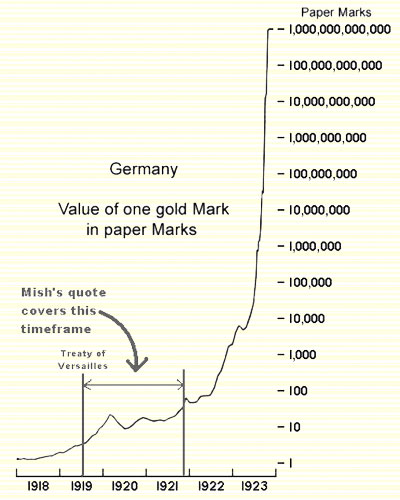

This metaphor even holds for the Weimar hyperinflation. If we think about our 30 years of credibility inflation as "packing the musket" for hyperinflation, then we can view the first year and a half of the Weimar three-year experience in the same light: "packing the musket." From Wikipedia:

It is sometimes argued that Germany had to inflate its currency to pay the war reparations required under the Treaty of Versailles, but this is misleading, because the treaty did not allow payment in German currency. The German currency was relatively stable at about 60 Marks per US Dollar during the first half of 1921.[1]

But the "London ultimatum" in May 1921 demanded reparations in gold or foreign currency to be paid in annual installments of 2,000,000,000 (2 billion) goldmarks plus 26 percent of the value of Germany's exports. The first payment was paid when due in August 1921.[2] That was the beginning of an increasingly rapid devaluation of the Mark which fell to less than one third of a cent by November 1921 (approx. 330 Marks per US Dollar).

The total reparations demanded was 132,000,000,000 (132 billion) goldmarks which was far more than the total German gold or foreign exchange. An attempt was made by Germany to buy foreign exchange with Marks backed by treasury bills and commercial debts, but that only increased the speed of devaluation. The monetary policy at this time was highly influenced by the Chartalism, and was notably criticized at the time from economists ranging from John Maynard Keynes to Ludwig von Mises.[3]

Yes, this is the same quote Mish used. Sounds pretty bad when you read that from August to November, in 1921, the Mark fell to less than one third of a cent! But it sounds less bad when you realize that it fell from only one and two thirds of a cent. That's like saying he fell to the bottom of the Grand Canyon without mentioning he was standing on an applebox at the bottom of the Grand Canyon. To restate: during this period the German Mark fell from 1.67 cents to .33 cents. Only an 80% fall. This was Germany's "packing the musket" phase, similar to our 30 years of credibility inflation.

At this point the Mark looked the same, and it actually stabilized for the next 6 months! But the musket was already packed, just waiting for the collapse of confidence. And the collapse of confidence is what brought hyperinflation to Germany. It came halfway through 1922 after a conference with U.S. investment banker J. P. Morgan produced no workable solution to Germany's problems. Here's the next part of the Wikipedia article that Mish didn't include: At this point the Mark looked the same, and it actually stabilized for the next 6 months! But the musket was already packed, just waiting for the collapse of confidence. And the collapse of confidence is what brought hyperinflation to Germany. It came halfway through 1922 after a conference with U.S. investment banker J. P. Morgan produced no workable solution to Germany's problems. Here's the next part of the Wikipedia article that Mish didn't include:

During the first half of 1922 the Mark stabilized at about 320 Marks per Dollar accompanied by international reparations conferences including one in June 1922 organized by U.S. investment banker J. P. Morgan, Jr.[4] When these meetings produced no workable solution, the inflation changed to hyperinflation and the Mark fell to 8000 Marks per Dollar by December 1922.

This came later, as a reflex to the collapse of confidence

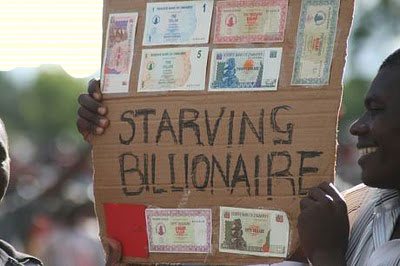

Hyperinflation was the result of the collapse of confidence after the conferences failed. The wheelbarrows that soon followed were the effect of this collapse of confidence, not the cause. The initial printing in 1921 "packed the musket." The loss of confidence in mid-1922 fired the musket. And then the real printing began out of necessity! By November of 1923 wheelbarrows were no longer big enough. The banks were counting their money by the ton.

An Afterthought

I realize that some of you are going to complain about "physical commodities" being on the top pyramid of my visuals. They are there as a class of speculative investments with its value anchored in the industrial use of those commodities which fluctuates along with the health of the economy. This industrial use value will disappear, at least temporarily, during a hyperinflation. And the actual commodities will retain an appropriate value through the hyperinflation out to the other side. But if they are bid up by speculation prior to the hyperinflationary event, their final value on the other side may actually be lower in real terms, even if it is much higher in nominal terms.

A monetary commodity, on the other hand, like gold, will rise because its value is anchored in the MONETARY use of the metal, as seen on the ECB balance sheet. So as you are deciding on a metal in which to ride this thing out, ask yourself in which function, monetary or industrial, is its value anchored. And you might just want to follow in the footsteps of the Giants, because they are clear and large, and easy to follow.

Sincerely,

FOFOA

For more on the gold angle in the above discussion, please read:

All Paper is STILL a short position on gold 3/23/09

Gold is Wealth 11/21/09

and Gold: The Ultimate Wealth Reserve 12/29/09

|

At this point the Mark looked the same, and it actually stabilized for the next 6 months! But the musket was already packed, just waiting for the collapse of confidence. And the collapse of confidence is what brought hyperinflation to Germany. It came halfway through 1922 after a conference with U.S. investment banker J. P. Morgan produced no workable solution to Germany's problems. Here's the next part of the Wikipedia article that Mish didn't include:

At this point the Mark looked the same, and it actually stabilized for the next 6 months! But the musket was already packed, just waiting for the collapse of confidence. And the collapse of confidence is what brought hyperinflation to Germany. It came halfway through 1922 after a conference with U.S. investment banker J. P. Morgan produced no workable solution to Germany's problems. Here's the next part of the Wikipedia article that Mish didn't include: